Signal du Jour - Sharpe 1.85 Win Rate 82%

Yet, how to position ahead of earning cycles?

The markets are closed now as the people in the United States of America are honoring Martin Luther King. This Signal du Jour is free for the occasion.

Let’s also take a moment to recognize his impact on the world and remember his message of hope and harmony among us human beings.

The Q4 earnings cycle kicked off last week, starting with the banking sector. Citigroup's recent quarterly report stands out, not for its strength, but for its notable weakness—it was their worst quarter since 2010.

Interestingly, the market's reaction was somewhat counterintuitive: Citigroup's stock rose by 1%. This response serves as a reminder that the market is less concerned with immediate past performance and more focused on future potential. In essence, stock prices often reflect the anticipated value of a company over the next six months rather than its most recent quarterly results.

This principle holds true in reverse as well: just like the standard disclaimer suggests, stellar recent performance is no guarantee of future success, particularly when we change regimes. And entering a new earnings cycle is definitely a regime change.

Therefore, it's crucial to conduct thorough research and analysis before committing to any trade during that period. At Sharpe Two, our approach is all about meticulous scrutiny before entering a position—or deciding to hold off.

Today, our focus is on XLP, an ETF that offers investors exposure to the consumer staples sector. Think of the everyday essentials that contribute to our daily stability and comfort, from food and beverages to household products.

Selling straddles in the front month of XLP has yielded significant profits over the past three months. As the earnings cycle gains momentum and volatility spikes in some key names, there's a growing temptation among social media circles to jump into trades with XLP. But the critical question remains: Is it truly a worthwhile move?

Let's dive in.

The Context

XLP is characterized by its significant concentration (67.6%) in ten major holdings, each a household name. Brands like Procter & Gamble, Coca-Cola, and Johnson & Johnson dominate this fund.

Known as a defensive sector, consumer staples are essential products that remain in demand, even during economic downturns. This consistent demand lends a degree of predictability to these companies' valuations, as they are less prone to unexpected shifts compared to other sectors.

The accompanying chart illustrates this stability: while the tech sector (shown in various shades of orange) often presents surprises to investors, consumer staples (in shades of blue) tend to offer more consistency.

That predictability makes XLP a prime candidate in social media for selling straddles ahead of the earning cycle and collecting premiums.

That is an interesting proposition; let’s start by looking at how implied volatility has behaved recently in the consumer staples sector.

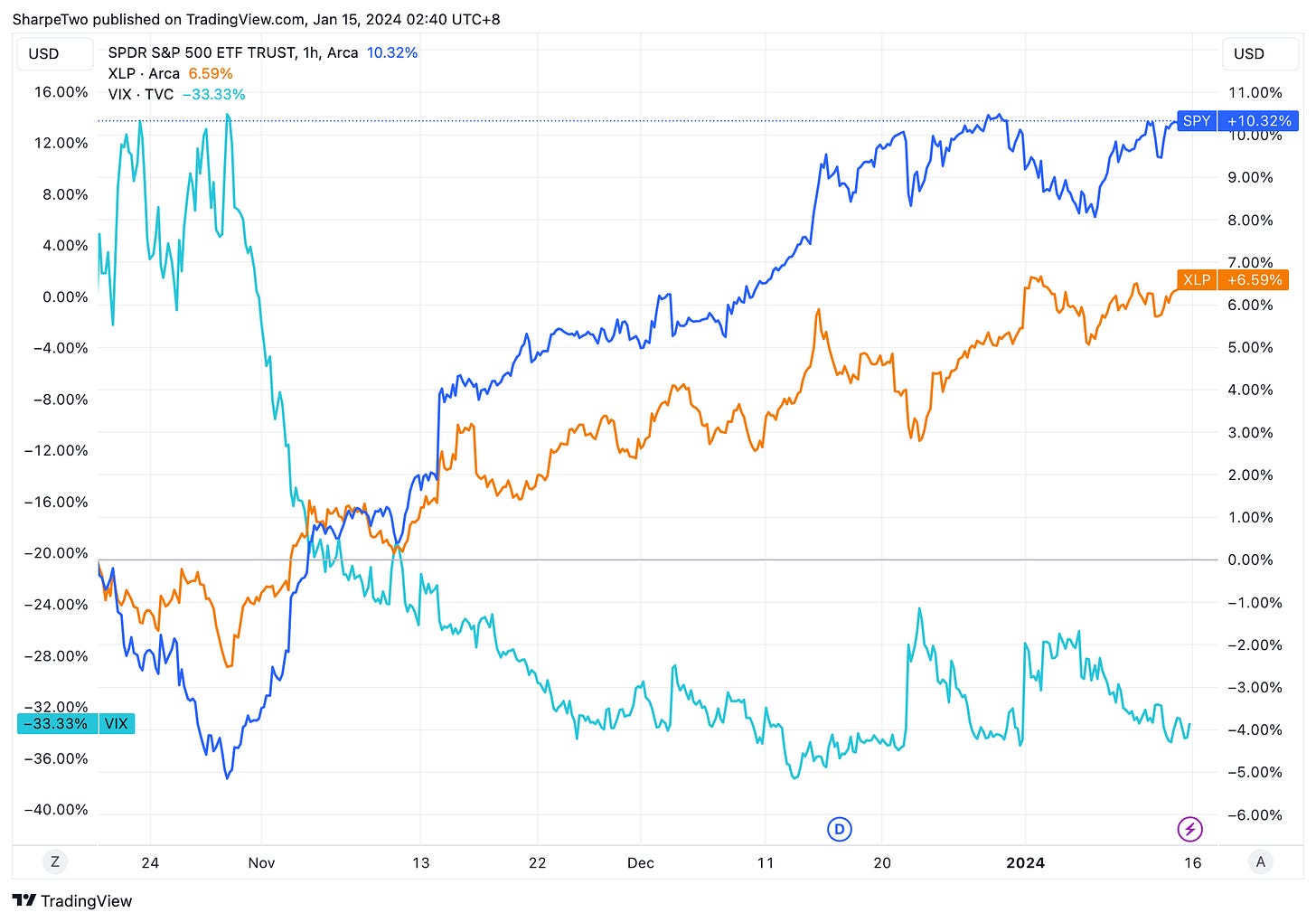

As many of you are aware, the last significant surge in the VIX, approaching 20, occurred about three months ago. This spike was driven by market uncertainties surrounding the Federal Reserve's interest rate decisions.

In the time since, we've seen the VIX retreat to much lower levels, with the markets now teasing all-time highs.

This fluctuation in the VIX created numerous short-volatility trading opportunities across various stocks, including those in the consumer staples sector.

The graph above represents a VIX-like index for XLP. It shows that following the market's Q3 turbulence, the index for XLP spiked alongside the broader market volatility, only to gradually decline in November and December to some of its lowest levels.

This pattern of high volatility reverting to the norm is precisely why selling straddles in XLP has been particularly effective recently.

Now, let's take a look at some performance metrics.

The Performance

As mentioned in our introduction, selling straddles in XLP has proven to be quite successful over the past three months.

A glance at the cumulative return curve, based on a standard assumption of $1 credit collected per straddle, is bolstered by some commendable statistics. These include an average expectancy of 0.32 per trade and an impressive 82% win rate across 11 trades.

With a Sharpe Ratio of 1.85, one might typically be tempted to jump into this trade. However, this situation exemplifies why we shouldn't blindly rely on past performance as a predictor of future success.

A critical observation that warrants caution is the performance of the last five trades. Since December, we’ve noticed a leveling off in the PnL curve, suggesting that the straddles might no longer be overpriced relative to the actual movement in the underlying asset. It appears the market has adjusted, and the previously lucrative edge may have diminished.

That is something we can easily check in the data.

The data and why we stay on the sideline

As our regular SharpeTwo readers know, we often look at the Variance Risk Premium (VRP), particularly focusing on how the price of straddles compares to subsequent movements in the underlying assets. For XLP, we've been examining the 17 DTE straddles and their corresponding price movements.

Even without applying our usual z-score analysis, the initial impression isn't striking. The spread is hovering around the median of its range, marked at 0.68. The picture becomes even clearer when we rank this spread against its performance over the past two years.

Currently, it's situated in the lower 22th percentile. This aligns with our instincts: now is not the time to engage, especially as we are about to change regimes and enter a new earning cycle.

Instead, we should keep our eyes open for a more suitable time.

As for when that might be, it's hard to say. However, it's conceivable that volatility within the index could increase as key companies begin to report their earnings. This could lead to some market surprises—or it might not. The key is to stay vigilant and responsive to any significant shifts that emerge.

Some thoughts on the next earnings cycle.

Understanding options trading, particularly using the Variance Risk Premium as a guide, is crucial. Yet, often, the real challenge lies in the wait, especially when volatility begins to climb in the lead-up to earnings announcements.

Consider XLP as a case study. While it's an ETF and not an individual stock, it exemplifies why preemptively selling volatility before earnings might not always be wise, even when volatility appears high. Elevated volatility alone isn't a sufficient signal for action when the market is adjusting to changes in regime.

We see some people on social media comparing the straddle’s price to recent move after earnings. It’s already a better approach, but still one we wouldn’t recommend. We find that straddle prices ahead of binary events are a good predictor for move magnitude but not a strong guarantee that the underlying won’t exceed the expected move like in a normal regime - who sold the overly expensive premium in NVDA May 2023 will never forget the 25% move the next day.

If you do decide to enter a short volatility trade before earnings, be prepared to delta hedge, and as we talked about a few months back, remember that this is expensive and often prone to mistakes.

Our recommended approach? Just wait for the announcement to pass and the initial market reaction. Once the dust settles, you will still find plenty of opportunities in a declining implied volatility environment.

Why?

Because often, the prices of straddles don’t go down as fast as the realized movements in the underlying. You now have a normal market regime and a stretched VRP. Put a z-score on it …

Well, you kind of know the mechanics now, don’t you?