Signal du jour - Long volatility in VTI

Looking for cheap gamma

What a weird quarter it has been. From VIX kissing 60 to closing at all-time highs by the end of the period—via the bombing of Tehran and strikes on nuclear facilities—none of that was exactly on our bingo card. But markets have their own logic, rarely obvious to us mere mortals. If it were, we’d all be rich by now.

Still, as we pointed out on Sunday, it was unlikely the market would overreact to the latest geopolitical shock. And now that a truce has been signed, the whole episode is fading fast into the rearview mirror. Dwelling on it won’t help your forward P&L.

So why the long signal, then? Do we think markets are on the verge of a crash? Absolutely not. The catalysts for a proper rout just do not seem to be there anymore. But there are a few events on the horizon that could jolt things enough to make VIX 16 look a bit too complacent. We are not betting on panic—just a touch more movement than the market currently expects.

To explore that, we are turning to VTI, the Vanguard Total Market ETF, and seeing how we can structure a trade to lean into it.

Let’s have a look.

The context

As you would expect, VTI has been through some rough waters over the past six months. Like SPY, it took a hit around Liberation Day but has since clawed back and now trades just a few points off its all-time highs.

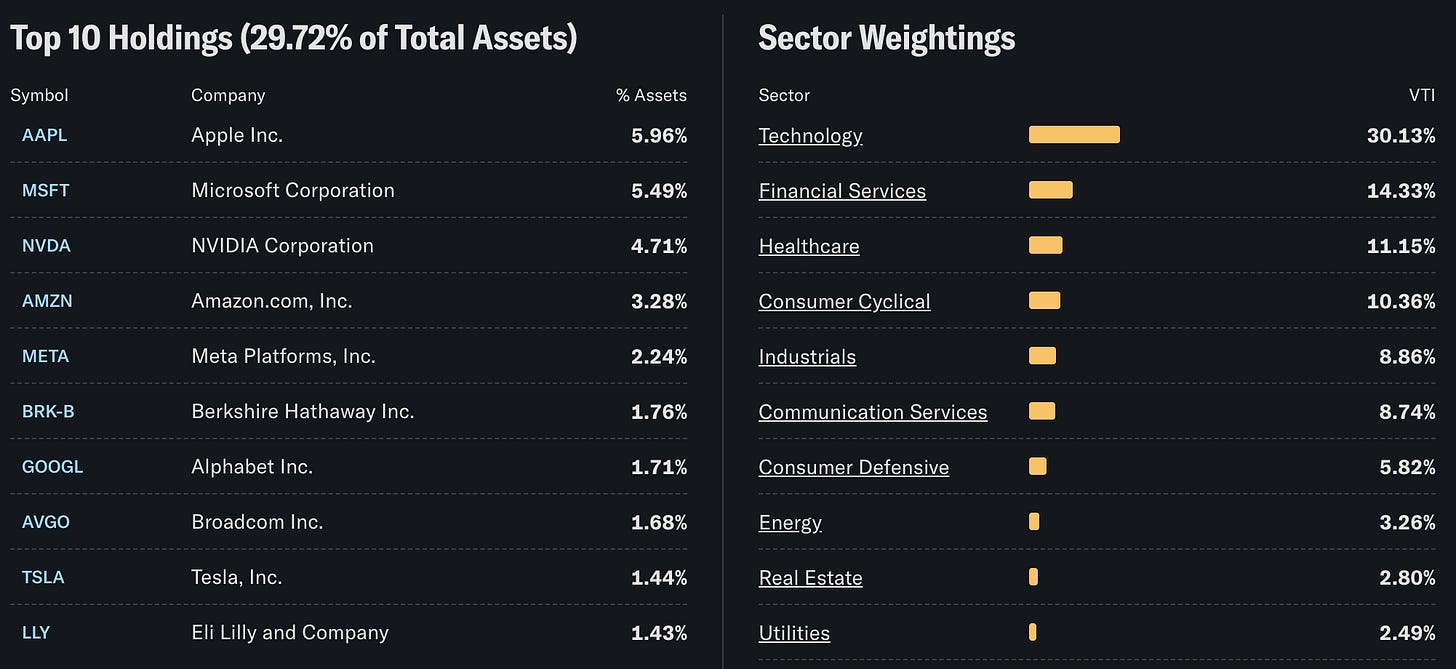

Side note: the correlation between VTI and SPY has been so tight lately, it’s hard to tell them apart. That checks out—VTI is a well-balanced ETF, fully exposed to U.S. equities across large, mid, and small caps. Let’s pull up the table of its biggest holdings.

Roughly 30% of the performance comes from the usual blue-chip suspects, with a heavy tech tilt—so yes, structurally not far from the S&P 500.

Now, let’s shift the lens back to volatility and take a look at how realized vol has evolved over the past six months.

The big spike observed in April has now been completely resorbed, and we are in what has been the calmest stretch of the year—realizing around 12.5% over the last 30 days. And considering we are entering the summer season, traditionally a quieter one, betting on a major reversal right now does not seem like the wisest decision.

Yet, while we certainly do not expect realized volatility to break above 15 in the coming weeks, the gap between our forecast and current implieds is wide enough to warrant a look at the options market for short-term opportunity.

We know that significant portfolio rotations often happen around quarter-end. And next week—albeit a short one—comes with an NFP print and, inevitably, renewed speculation about rate cuts.

Let’s dig in.