Signal Du Jour - long vol in XLK

While waiting for NVDA.

A side note - we are releasing something very exciting in a few weeks, and we hope it will transform your trading experience. Get in touch with us if you want to try it.

Exit the tariff rhetoric (for at least another 90 days), and just like that, April is already sealed in the history books — another forgettable chapter. Down 22% in five weeks — the kind of treatment usually reserved for meme stocks. But then again, what else should one expect when your favorite stock index... has its own coin?

Just kidding. Mostly.

But we still have to trade. Last week’s GLD setup did not age particularly well. With a truce between the U.S. and China hitting the wires, gold gave back nearly 9%. Even a calendar would not have saved you unless you were disciplined enough to delta hedge on the retrace.

Let’s hope we get another dose of explosive movement this week — we’re eyeing a long volatility setup in XLK. NVDA came up briefly over the weekend, with earnings fast approaching. And as usual, nothing is ever priced in when the regime changes more often than we change jackets. Who knows what the next few days — or hours — have in store.

And if the market feels like handing out free lottery tickets again, why not pocket a few? Let’s take a look.

The context

XLK has had, as you might guess, a turbulent four months. From down 25% in early April — as the Mag 7 were dumped indiscriminately — to slightly green just a month later, it is a recovery for the ages.

Plenty are now debating whether it is “healthy.” We will not partake. If April was not a loud enough reminder to stay humble in the face of what often amounts to a coin toss — one that, over the long run, drifts up and to the right — then honestly, what is?

Still, this eternal tug-of-war is valuable for volatility traders. Diverging views on future direction can create price discrepancies — and that is something we can work with. Just remember: it is a variance game. Even with the best data, outcomes are outside your control.

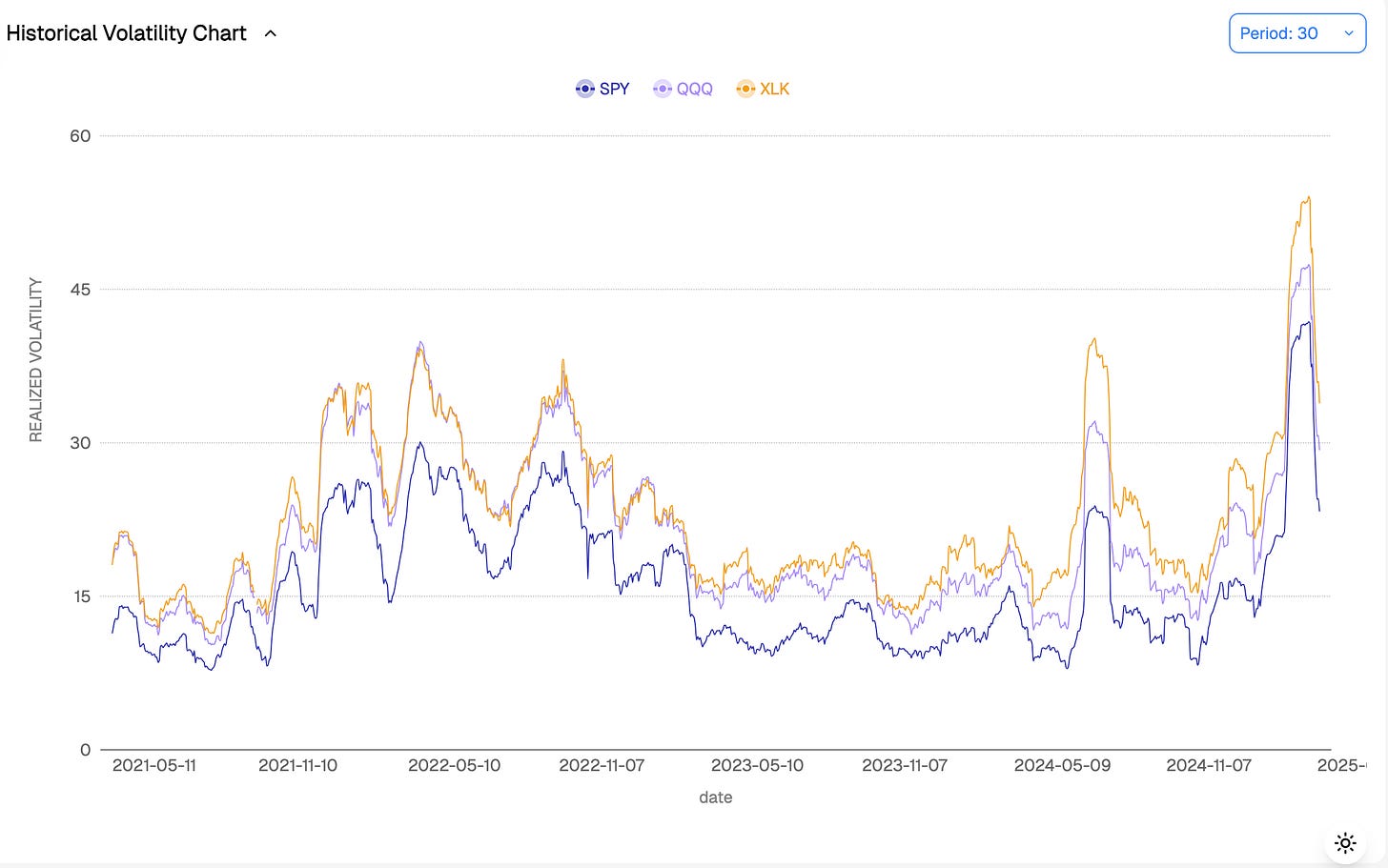

Speaking of data, let’s take a look at realized volatility in XLK. As expected — after spiking to levels not seen since the COVID era — it is now melting like butter under the sun. Like much of the market, it is pointing to a regime shift that is getting harder to ignore.

Still, with 30-day realized vol at 33% and the 9-day closer to 35%, it is hard to claim calm has fully returned. And, as you might also expect, most of that realized variance has come with positive returns.

The divergence between the two has now reached slightly extreme territory. Realized vol on its own is no crystal ball, but it does tend to mean revert. And that opens the door to both outcomes: either downside realized volatility picks up again… or the current rally cools, dragging upside-driven vol down with it.

Let us be clear — do not read into this what we are not saying: this is not necessarily a bearish signal. There is a perfectly plausible world where the market continues to grind higher and realized metrics converge, as they often do.

Still, if we turn to more traditional forecasts, something interesting shows up:

We do not expect realized volatility to collapse much further from here. Unlike a few weeks — or even days — ago, when forecasted vol was well below observed levels, the two have now largely aligned. Behavior, for once, followed the script.

Quick aside: from our seat, this temporarily invalidates the “regime change” thesis. Yes, we are no longer in panic mode, but we also do not see the return of a sustained low-volatility environment like in 2023. Once again: it is a variance game. The real question is how eager the market is to sell vol here — and at what price.