Signal du Jour - Long vol in EWT

Tactical hedges ahead of the busy end of the week.

The equity markets enjoyed a nice rebound yesterday, giving them a breather before the week's meaty part. The action starts tonight with Tesla's earnings results, followed by Meta on Wednesday and Microsoft and Google on Thursday. On the macroeconomic front, we'll receive some durable goods data, a GDP reading, and more inflation data before the next FOMC meeting in just eight days.

It's a busy, busy week. And in this context, it doesn't seem too far-fetched to add a tactical hedge, just in case. We've seen both realized and implied volatility picking up over the past few weeks. Unless we finally get much better clarity on the rate cut trajectory, it's probably here to stay.

Today, we're considering a tactical hedge in EWT, the ETF tracking Taiwan. We picked this one after a long hesitation, but to be honest, there were a couple of others. We'll mention them later in the trading methodology section.

The context

EWT is an interesting ETF to track. It's impacted by a few key risks: geopolitical risk and, to a certain extent and the tech sector risk.

Even though tensions with China have been downhill recently, we all understand that the country is always on high alert.

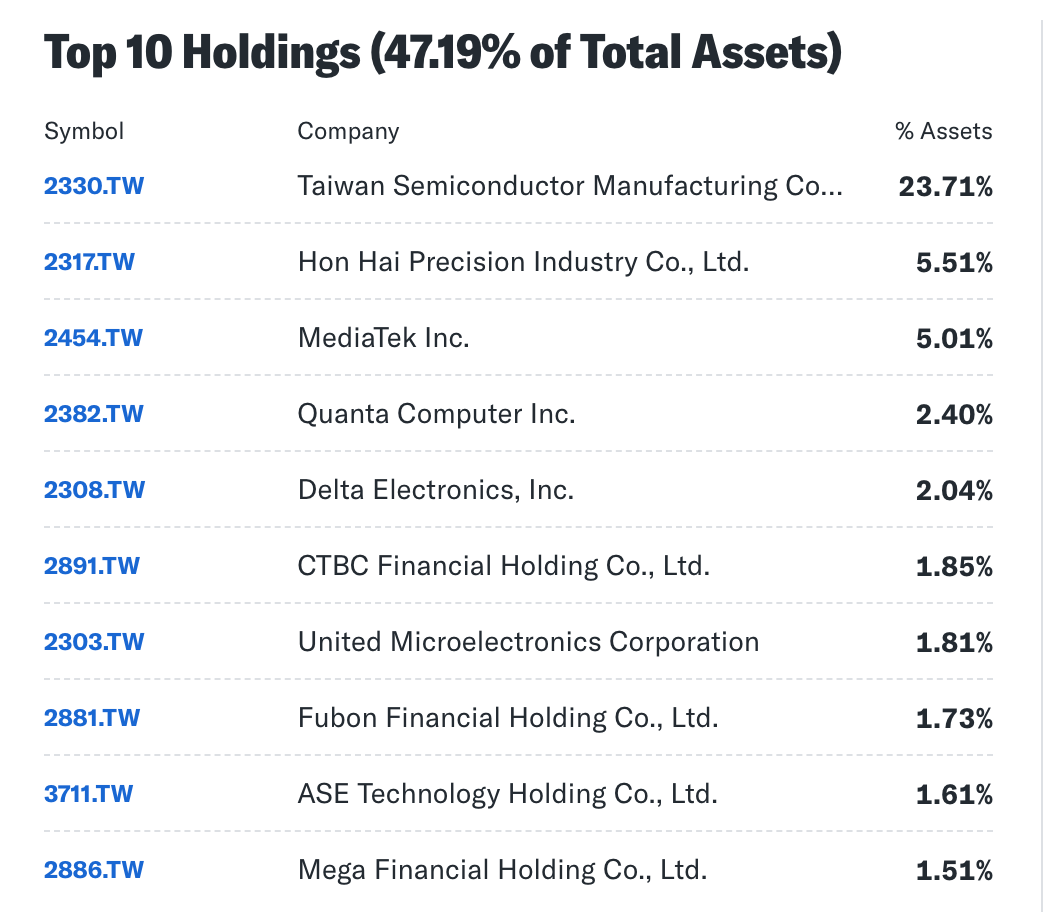

EWT is also quite heavy on the tech front, with a few important semiconductor companies leading its top holding positions.

As you can see, TSMC accounts for almost a fourth of the index's composition. If you add all the other technology companies in the top 10 holdings, they would represent about a third, with most of them being semiconductor companies.

As a result, EWT was not very immune to the downtrend in US equities observed over the past two weeks, and the index lost about 10% as investors braced for some important results in the tech sector.

After a quiet end to Q1, realized volatility has picked up. While we're far from the highs observed in Q3/Q4 2024, some bad news stories in the US equity market could translate well into EWT.

In this context, let's identify the cheapest options in the expiration cycle.

The data and the trade methodology

First, let's take a look at the volatility term structure for EWT.

As of the end of last week, the backwardation in EWT was extremely pronounced, signaling the market's uneasiness about the upcoming events in the short term. As usual, at Sharpe Two, we're less focused on trying to find an explanation for why the markets would be right or wrong. Instead, we tend to follow the events most anticipated by the marketplace: if some risk term is expected, it must be for a good reason, and we won't bet against that.