Signal du Jour - Long Vol IEF

All eyes on Jay

The first week packed with catalysts is about to unfold, and market momentum is decidedly positive. Investors are adjusting their portfolios in anticipation of a soft landing; after a year of unpredictability, the bond and equity markets are realigning, signaling a return to normalcy.

As equity markets reach new all-time highs, the absence of significant catalysts makes justifying short volatility positions challenging.

With an eventful week ahead, featuring GDP data release this morning and the year's first FOMC decision next week, alongside the job report, strategically adding a bit of long volatility to the portfolio seems prudent.

Given that monetary policy decisions are likely to dominate discussions, the bond sector appears to be a prime focus.

Today, our spotlight is on IEF, an ETF providing exposure to US Treasury bonds with maturities between 7 and 10 years.

Let's dive in.

The Context

Jay Powell has the most commented job in the market place, yet understanding his current mindset is a challenge for many.

Let's take a step back - within just a year, inflation has decreased from over 6% to just under 4%. Despite this decline and the Fed's hints at potential rate cuts through 2024, the consistent message has been clear: with inflation still hovering around 4%, the battle is far from over.

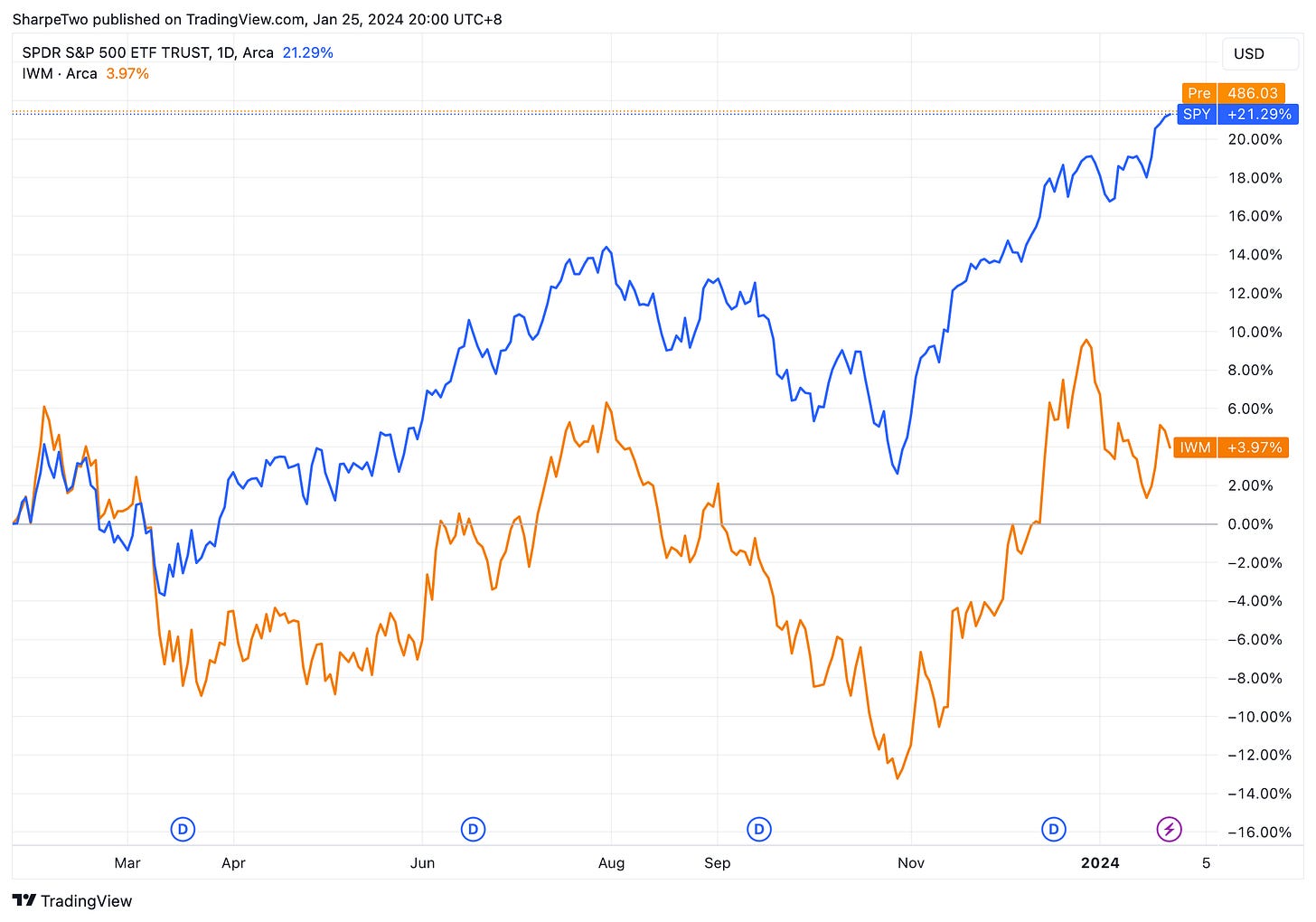

Meanwhile, the terminal interest rates are perched at 5.25%, a level that poses significant challenges for small businesses grappling with liquidity constraints. This is starkly evident when comparing the performance of large market cap entities (represented by SPY), which benefit from ample cash reserves and favorable credit conditions, against smaller companies (represented by IWM). This divergence highlights the contrasting economic realities faced by different segments of the market.

The market, ever anticipatory, recognizes that the current economic situation isn't sustainable. Consequently, the focus has shifted to potential rate cuts and a return to economic normalcy. A key indicator of this shift? The re-emergence of the inverse correlation between bonds and stocks following a year where both asset classes moved almost in sync.

This renewed anticipation of normalization opens the door for opportunities in volatility trading. As realized volatility in IEF has retreated from its peaks, there's a possibility that implied volatility has followed and as a result, overly contracted, potentially underestimating the Fed's forthcoming decisions.

Evidence supporting our hypothesis comes from a Moontower chart - while the 30-day realized volatility remains elevated, the negative variance risk premium suggests that options in the market are currently undervalued.

Now, let's get deeper into the data for more insights.

The data and the trade methodology.

With the context now clear – realized volatility hovering in the mid-range and a negative Variance Risk Premium (VRP) – the next crucial aspect to consider is the optimal part of the expiration cycle to focus on.