Signal du Jour - long short XLF/XLK

Riding the earnings cycle.

The days pass and resemble themselves. SP500 is still edging higher while the VIX tries to dig deeper. We saw numbers below 16 yesterday: one week ahead of the next FOMC meeting, that may be a little presumptious. But who are we to know? As we wrote about over the weekend, this won’t stop us from looking for short volatility trade in US equities. Yet, if you have to roll some position or trying to add some, we are more in the camp of wait for better prices. And we are not saying 20, but just a 17/18 will do.

In the meantime, how do we stay busy? The entire vol complex in the ETF sector is quite depressed, and we are not keen in adding anything to the long side. We said it multiple times right now - we do not see the catalyst just yet to add positions there. If you feel differently, do not hesitate, but beware, options are not cheap however you want to look at them.

Instead, we’ll dabble in the long/short space today. One sector has just wrapped the bulk of its earnings, while another is just getting started—creating some intriguing setups for those paying attention.

Let’s take a look.

The context

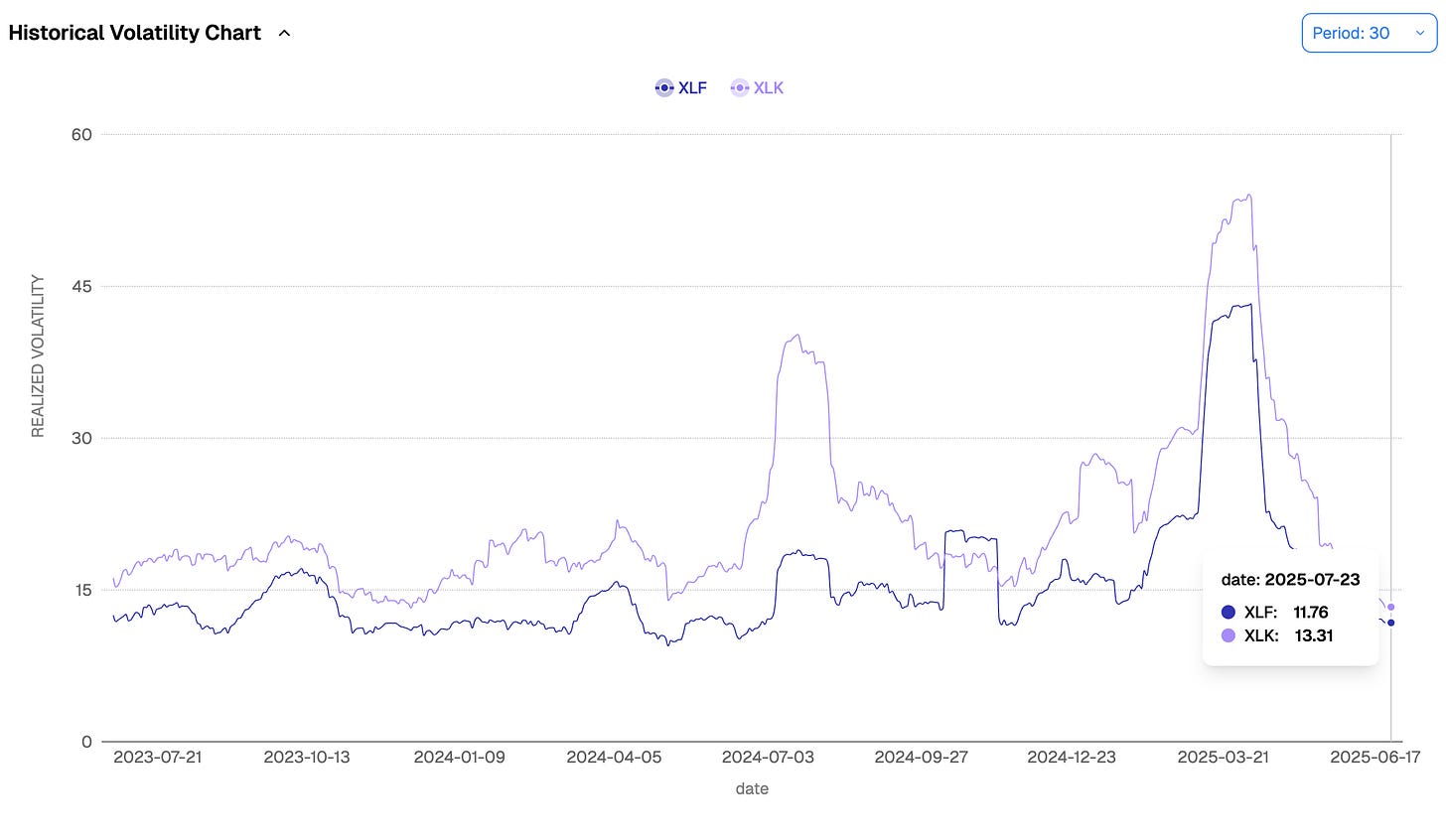

When the S&P sleeps, its sector ETFs rarely throw a party. Since Q3, realized volatility in XLF and XLK has quietly drifted to new lows—even as the financials wrapped up their earnings season in early July.

Currently sitting at 11.76 (XLF) and 13.31 (XLK), both are floating in regimes eerily similar to late Q4 2023—when most of the volatility had been wrung out of the market. Back then, something interesting happened: the two sectors began to part ways. Tech (XLK) broke out and never looked back, posting a wild +21% over six months, while financials (XLF) delivered a more restrained—but still respectable—+9%.

We do not drop those return numbers by accident. Vol trading is fun—sure—but it helps to have parts of your portfolio quietly doing the heavy lifting in the background. Stocks matter. Carry matters. Structure matters.

Back to today’s focus: with realized vol this low, it’s easy to see why some might hesitate to sell implied. After all, isn’t this where things should be cheap? But wouldn’t it be nice to sell something still bid, while hedging with something that’s already been drained?

Let’s see how that might look.