The anticipation of Chinese New Year and the start of the year of the Dragon in 2024 offers a unique lens through which to view the Chinese economy. The significance of this period, deeply rooted in cultural and economic symbolism, can't be overstated, especially for us at Sharpe Two, who have experienced it firsthand during our 5 years stint in Asia.

However, we understand the skepticism; relying solely on zodiac signs for market confidence isn't our style either.

Fund managers and institutional players are also treading carefully, especially after the poor performance over the past two years, and are willing to pay extra when it comes to insuring Chinese stocks.

As a result, FXI, an ETF tracking Chinese equities, has seen its insurance costs spike, highlighting market apprehensions. But where there's caution, there's also opportunity—particularly for those looking to sell volatility.

Let's dive deeper.

The context

2023 was heralded as a turning point when China abruptly abandoned its stringent COVID-19 policies. The world's second-largest economy was poised to revitalize commodity demand and provide a much-needed boost, especially as Western economies, plagued by high inflation, braced for a slowdown.

However, the anticipated revival fell short. While global inflation rates began to ease, troubling signs emerged from China. Despite an optimistic start to 2023, the situation deteriorated over the year, with the FXI ETF—a barometer for Chinese stocks—plummeting 33% from its position a year ago.

The onset of 2024 has presented further hurdles for Chinese equities. A decline exceeding 5% since the year's start underscores the challenges ahead. Efforts by Chinese authorities to stabilize the market—through measures like banning short selling and pledging direct financial injections into the stock market—have yet to quash the heightened volatility.

The volatility levels we're observing now aren't reaching the dizzying heights seen during the early stages of COVID or the speculation period before China's reopening at the end of 2022. Excluding those exceptional periods, realized volatility for Chinese equities remains on the higher end of its usual spectrum.

This sustained volatility likely means that the premiums demanded by volatility sellers to provide coverage for fund managers are on the rise.

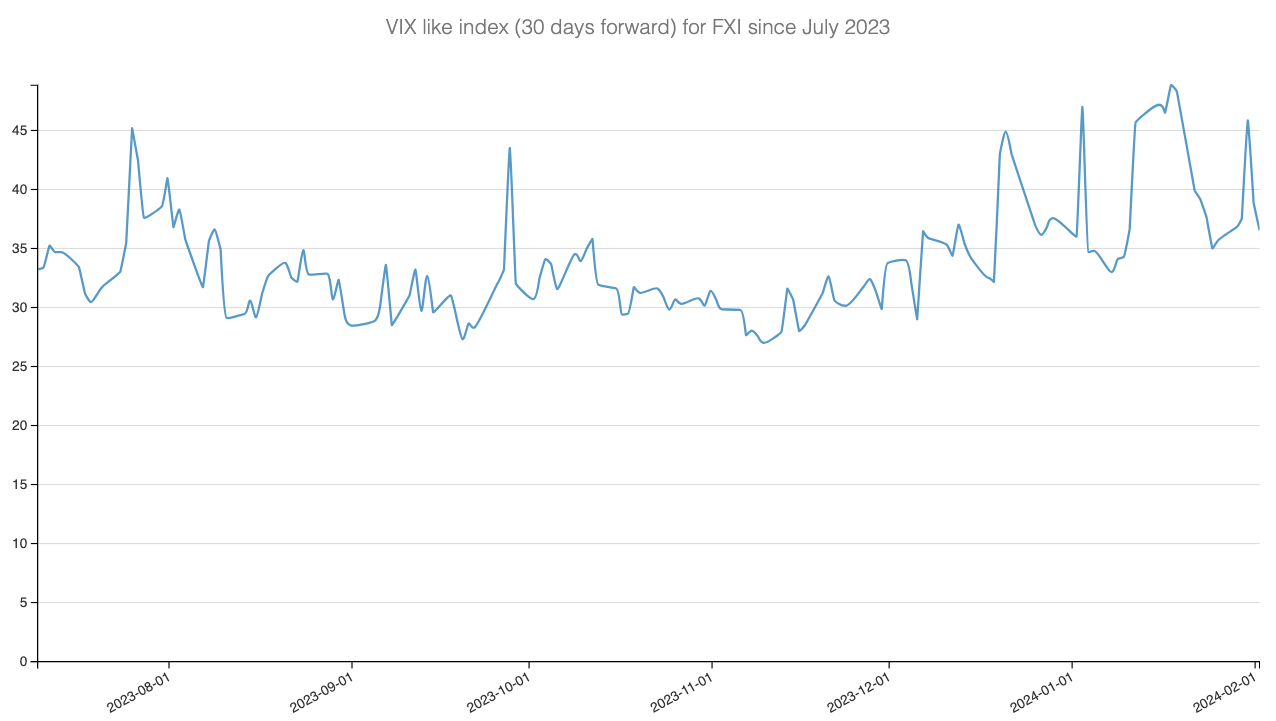

A look at a VIX-like index specifically constructed for FXI indicates a gradual decline from earlier peaks this year. Nevertheless, the cost of volatility remains relatively elevated, suggesting that opportunities for profitable trades might still be within reach.

Now, let's explore potential strategies to take advantage of the current volatility landscape in FXI.

The Signals and the Trade Methodology

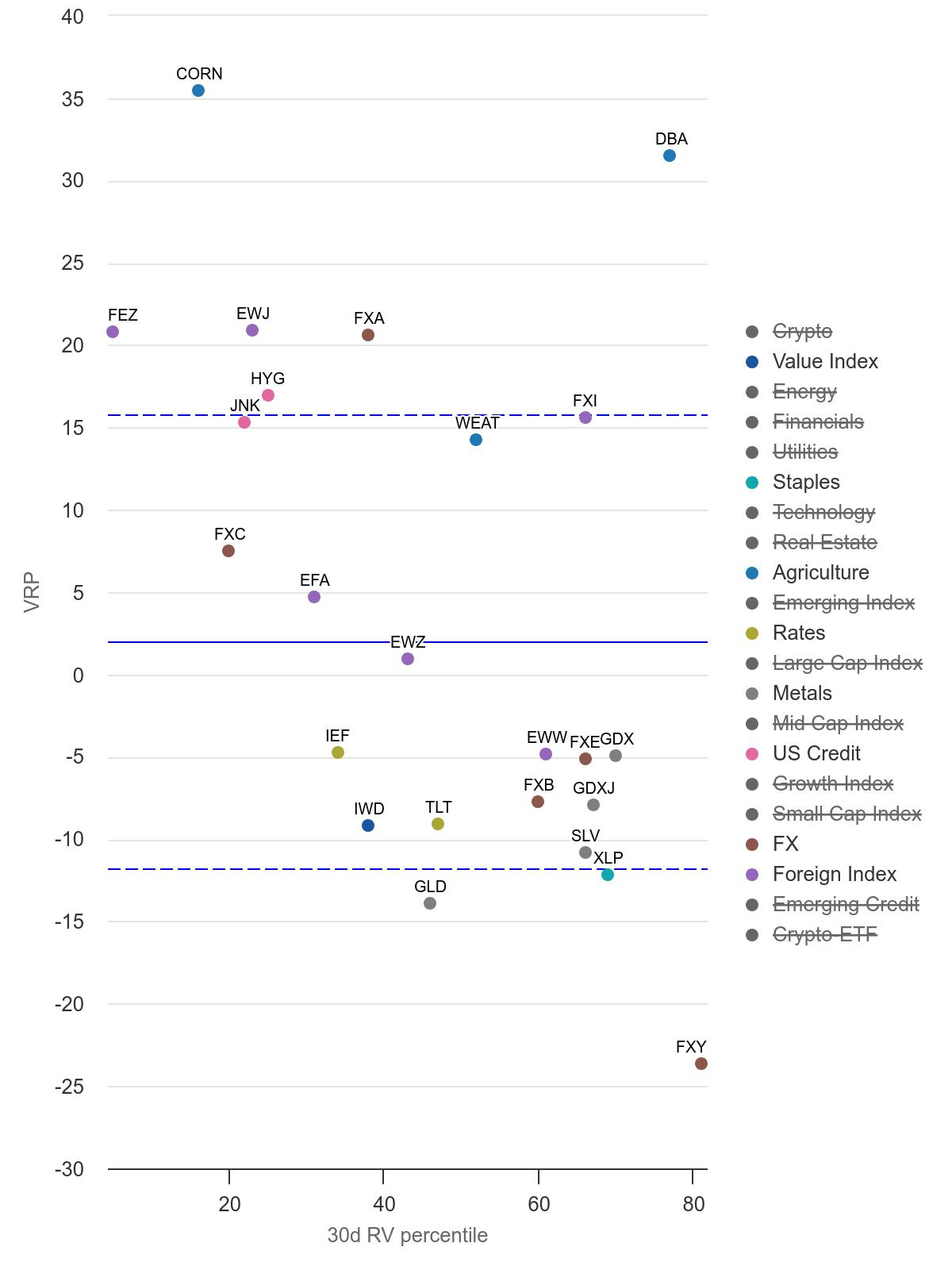

As we dive into the analysis, a key focus will be on the Variance Risk Premium (VRP) for FXI, defined as the ratio between the 1-month implied volatility and the actual movement in the underlying. A high VRP typically signals lucrative opportunities for option sellers.

Data from Moontower.ai illustrates that both the VRP and realized volatility in FXI are currently elevated. This context suggests that we might anticipate a reduction in realized volatility, given its tendency to mean-revert. Such a scenario could present favorable conditions for those looking to sell options.

Keep reading with a 7-day free trial

Subscribe to Sharpe Two to keep reading this post and get 7 days of free access to the full post archives.