Signal Du Jour - EWZ Sharpe 1.64 Win Rate 88%

Brazil wins again: 14-2 on the Volatility Pitch

We hope you had a relaxing weekend. If you missed it, check out our Sunday Note to gear up for the exciting week ahead.

Today is December 11th, and although it's not technically winter yet, the growing chill and gloom are starting to affect our spirits. Thankfully, the End of Year festivities offer some cheer.

How about a virtual trip to sunny and warm Brazil to brighten things up? Our focus is on EWZ - one of our favorite ETFs in 2023, by the way - which offers exposure to Brazilian equities.

And to make things better, 14 out of the last 16 signals observed in the last 12 months ended up winners.

Got your plane ticket yet?

The context

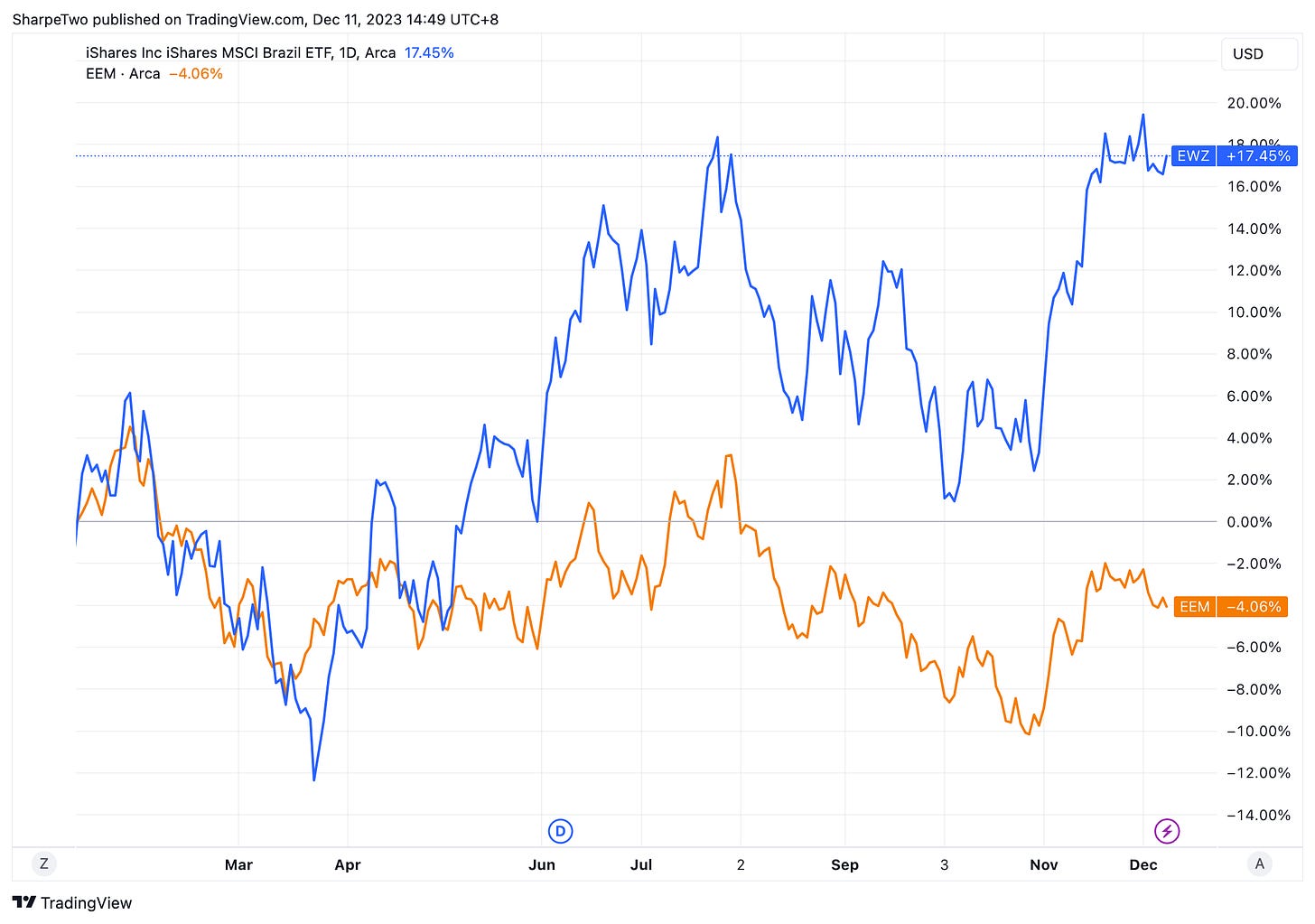

Until the end of last year, EWZ lacked a clear direction. However, it has surged over 100% since hitting a low in March this year.

So, what's behind this impressive performance? One factor is a broader shift from ASEAN to LATAM equities, driven by escalating tensions between the U.S. and China.

Another significant development was the return of Lula as President of Brazil, ending Bolsonaro's controversial tenure, especially in the context of the COVID crisis management. This political change was viewed positively by many analysts.

Furthermore, with the pandemic receding and global supply chains normalizing, Brazil's export-heavy economy started to breathe easier.

All these factors are plausible justifications for the remarkable outperformance of EWZ compared to EEM, a basket of emerging market stocks worldwide.

But what about volatility?

As you might have inferred from the overall relaxed macro/geopolitical context, volatility in EWZ has significantly decreased. It plummeted from a whopping 50% just before Lula's election in October 2022 to a record low of 19% last week.

Yet, even in these calmer times, we're still talking about Brazil—a dynamic emerging market where unforeseen events can swiftly disrupt the status quo.

Could another corruption trial involving the president emerge? Might a resurgence of hyperinflation impact domestic consumption? Or perhaps a slowdown in the global economy?

While realized volatility is low, traders are likely pricing options at a premium, keenly aware of the inherent risks associated with this robust but still developing economy.

This scenario presents attractive opportunities for volatility sellers. Let's delve into that.

The signal and the trade methodology

We examine a VIX-like indicator for EWZ, following the CBOE's methodology to derive this crucial metric. It's evident that similar to realized volatility, the implied volatility derived from option prices has significantly decreased from last year's peaks.

Interestingly, the profile of Implied Volatility itself is noteworthy. On average, it hovers around 30, with occasional rapid spikes that tend to normalize just as quickly.