Signal du Jour - an exploration of IYR

And a primer on Sharpe Two vol surfaces capabilities.

In case you missed it, yesterday we officially launched the app. If you like the way we approach trading, you will find all the same insights—and much more—in a self-service format. Join now and lock in your price forever. How is that called in option terms? A call or a swap?

The market threw itself a panic attack on Tuesday, only to pop a couple of Xannies the day after. We took a few trades when VIX was at 19, but nothing crazy—the main events are still ahead. Part of us thinks it was the smarter move not to press harder. Another part cannot help but smirk and whisper over our shoulder: “VIX 16 tells you all you need to know.”

So, as a preamble, here is a trade we will obviously take tonight: sell the fat VRP premium overnight in the 1-DTE, ahead of tomorrow’s jobs report. It is not a sure bet—absolutely not. And trading on “good feelings” has never been a great strategy. But with all the chatter, opinions, and disagreement about the US economy, plus the growing challenge from the eastern bloc (too early to call it that?), we can see why premium is inflated. Once again, the better decision is not to go online. Trading does not have to be a casino. You do not have to behave like a degen.

With that said, let’s move into today’s signal—closely tied to Fed policy and something we discussed in the Discord last night (yes, access to the platform includes automatic access to Discord).

The context

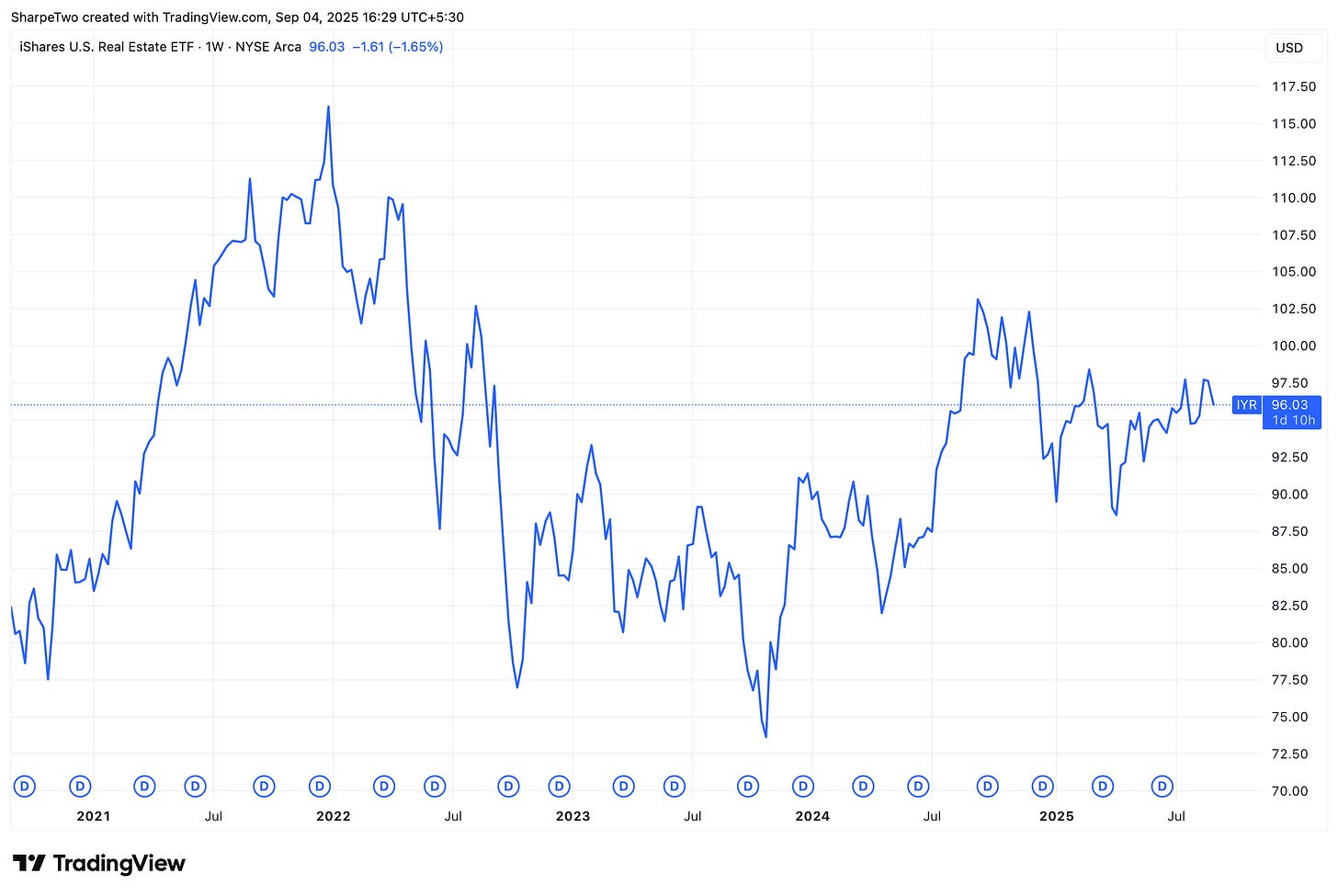

IYR has had a very quiet 2025 compared to the fireworks of the prior years. A quick recap: in 2022, rates climbing at record pace sent its volatility soaring and dropped the ETF to levels it had not seen in a long while. In 2023, after the regional bank crisis was digested and markets were reassured the Fed was done hiking, IYR stabilized and began to recover. Then, as rates started drifting lower—and expectations grew they would fall further—it accelerated higher, pushing into fresh highs.

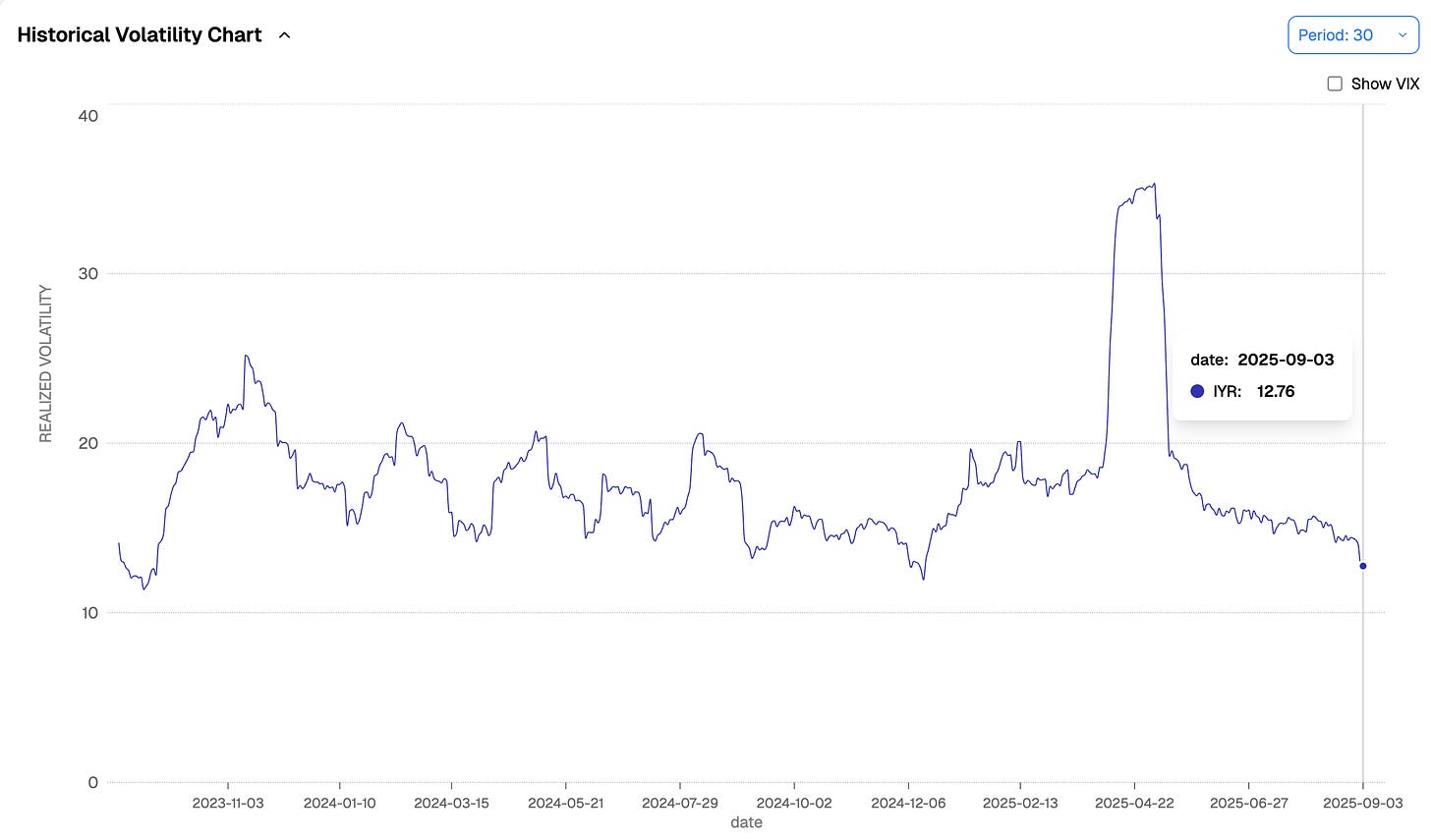

But in 2025, all the sparkle is gone. The Fed’s next move, understandably, will not appear until the second half of the year, and realized volatility has collapsed to its lowest in years—miles away from the spike seen in April when Trump shocked markets with his tariff list.

12.76% is on the low end of recent readings, and the obvious question is: what are the odds it stays there? From a macro lens, with key decisions set to shape the rate trajectory in the next 24 hours, the answer is: very slim. CPI lands later today, followed by NFP tomorrow. The worst-case scenario, as we outlined Sunday, would be inflation ticking sharply higher while employment shows job destruction. It is important context to keep in mind. Yet with VIX at 16, the market is telling you it thinks that scenario is unlikely.

What else could stir volatility in IYR? The actual rate cut. While one cut is already priced, the market will be looking for any hint of a second before year-end, and for a broader read on the 2025 trajectory. Needless to say, that 12.76% print is likely to look quaint soon enough.

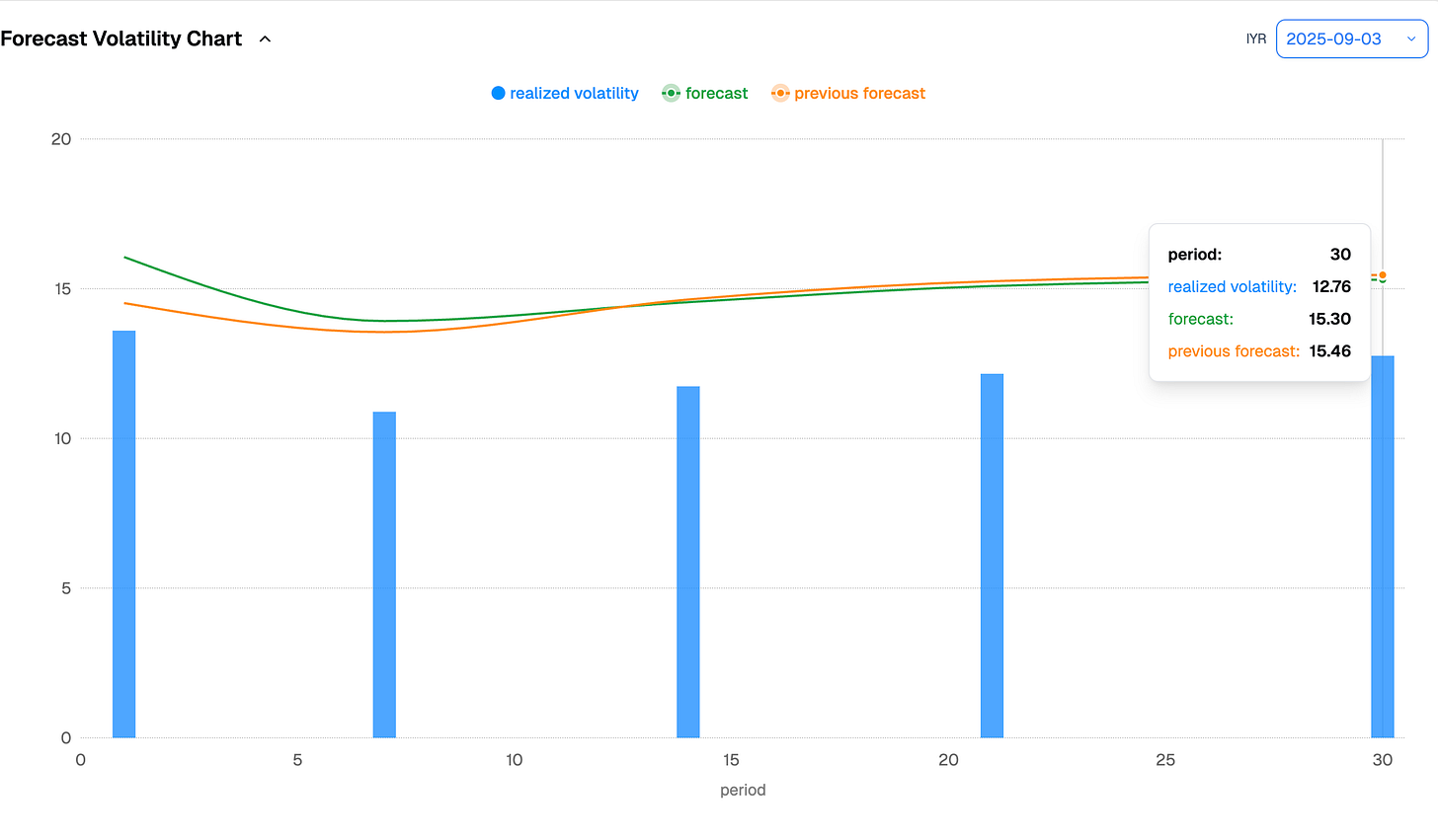

Of course, the market has its own sense of humor, and maybe we are completely wrong. Still, when structuring this trade, we need to assume the possibility of a rising realized vol environment. So let’s turn to what the option market is actually pricing.

Beyond this point, we switch to vol surfaces—a tool retail traders rarely have, but one that gives a spectacular advantage in structuring trades. Do not miss it.