Our 3 winners in Q1 2024

The last one shouldn't be a surprise anymore.

Q1 is now officially behind us, characterized by a super-low volatility regime. Things were unusually easy if you were on the short side of volatility. However, like stocks, there are big winners and big losers. The debate over whether or not Tesla should keep its status in the Mag7 is a good example of one company's different fortunes compared to another, despite the overall market performance.

Today, we will look at the best-performing combination of ticker and DTE for short volatility throughout Q1—the names where you just had to put a straddle on, rinse, and repeat with no other plan than being mechanical.

But why would such inefficiencies exist? The answer lies in the risk premium.

Stocks go up because fund managers like some names and dislike others. They are willing to pay a premium for the names they like, and the imbalance of demand drives the prices up. That is called the equity risk premium.

The same goes for options—fund managers are willing to pay a premium for protection in some names and sleep better at night knowing they are hedged. The imbalance of demand drives the prices up, often overstating the actual risk, characterized by the realized movement in the underlying. Short volatility sellers make a profit just for taking the position.

Past performance is never a guarantee of future success. However, it is useful to know what strategies worked in the recent past.

First of all, because of the nature of the variance risk premium—if the market has been overpaying for something, it will likely continue to do so in the short term, especially if nothing changes.

And second of all, well, we are human beings, and we like to torture ourselves by looking at the past and thinking, "If only I had put these on."

The trading methodology

If you are a SharpeTwo subscriber, you will know that we always conclude our Signal du Jour analysis by reviewing the naive strategy — the strategy where we would have sold all straddles for a given DTE over a certain period. Consider a concrete example: SPY has daily contracts up to 14 DTE. The naive strategy, defined as SPY/14DTE, would be selling a new 14 DTE contract daily.

EWZ, however, is a weekly contract. Therefore, a 14 DTE straddle can only be sold every week on Fridays.

How do we manage the exit? We don’t. We keep the trade on for 14 days. So, in the case of 14 DTE, that means keeping it until expiration, but if it were a 21 DTE trade, we would have kept it until 7 DTE. At that moment, you exit the trade.

All our research is done at mid-price and assumes no costs.

All positions are normalized and assume $1 of credit received.

Finally, we consider 67 ETFs, covering every asset class and geography. There is no magic here; just consider the most liquid ones. If you want an exhaustive list, check out our API.

General Statistics

Before we examine the results for individual names, let's review a few interesting statistics. First, we will see which part of the expiration cycle was the most profitable on average for Q1 2024.

We don't like to argue on social media, but sometimes we do. Once again, this quarter demonstrates that selling super long-dated options has no edge, despite popular beliefs reinforced by "selling options for income" schemes.

Oh boy—we can already hear the objections. "It did work for me" is the equivalent of buying a meme coin or an obscure penny stock and seeing it mooning. Another example — it’s like making drawings on a chart and saying that is the reason why you made money.

The only contributing factor? Luck. If you keep doing that over and over again, you are going to blow up your account.

Bonus points if not only are you selling the long part of the curve AND buying the front part as a "hedge" in case something goes bad. As this chart clearly shows, buying the front month is exactly what you shouldn't do. This is where the edge is.

We explained why that is in one simple sentence: the immediate present is much harder to predict than the superlong term. Therefore, fund managers are willing to pay a premium for the short term and much more price-sensitive for the long term.

Isn't this chart appealing? This is the P&L curve if you could have sold every straddle between 14 and 30 DTE in Q1 2024. Now, operationally, this would have been difficult for retail traders. However, this research shows that the data seriously challenges the narrative around selling at 45 days, managing at 21, or selling at 200 days.

We've talked a lot about regimes lately, and this curve perfectly highlights the low volatility regime that has characterized the overall market since the beginning of the year. Is this going to stay like this? It's hard to tell. However, as long as volatility is low, selling the front month on many ETFs is profitable.

For those interested in some details, the dip in February is characterized by the only moment in the quarter when things were uncertain.

Let's now review some of the best names where you could sell volatility and go away.

QQQ 14 DTE

"QQQ? Are you insane, bruv? With the Mag7 going full swings, that stuff can blow up in your face anytime."

That is precisely why you observed a strong variance risk premium. The market is well aware of the high-stakes musical chairs game on some Nasdaq names. Some valuations are so explosive that the music may get very ugly when it stops.

Yet, what are fund managers supposed to do? Stay on the sideline and protect capital? That is the sure way to lose business and, most likely, your job at the end of 2024. Instead, they buy the QQQ and, with it, many insurance policies to ensure their capital doesn't explode.

Despite a complicated beginning of the year, when flows pushed stocks higher and challenged the call side (another proof that you shouldn't sell calls on indices...), it's been smooth sailing since then. How long will it last? It's hard to tell, but let's enjoy it as long as it's there.

IWM 14 DTE

If it worked for the Nasdaq, you wouldn't be surprised to see it also working on IWM. IWM is the ticker tracking the performance of the Russell 2000, an index composed of mid- and small-caps, which are the soft bellies of the economy and, therefore, the riskiest part. Between an obscure furniture seller in Ohio and Microsoft, where would you put your money? Exactly.

The consequence is that the premium in options has been high compared to the actual risk observed in IWM. While putting this trade on could have given a few cold sweats at times, the low volatility regime made it a calm and profitable quarter. It is again a testament to two things: the variance risk premium is usually at its highest when things are calm. Even if the VIX spent most of the past six months below 16, and this could look cheap on paper, options sellers are not oblivious to the risk, and they still baked in a healthy margin of error, just in case things go all over the place again, particularly on riskier asset classes like IWM.

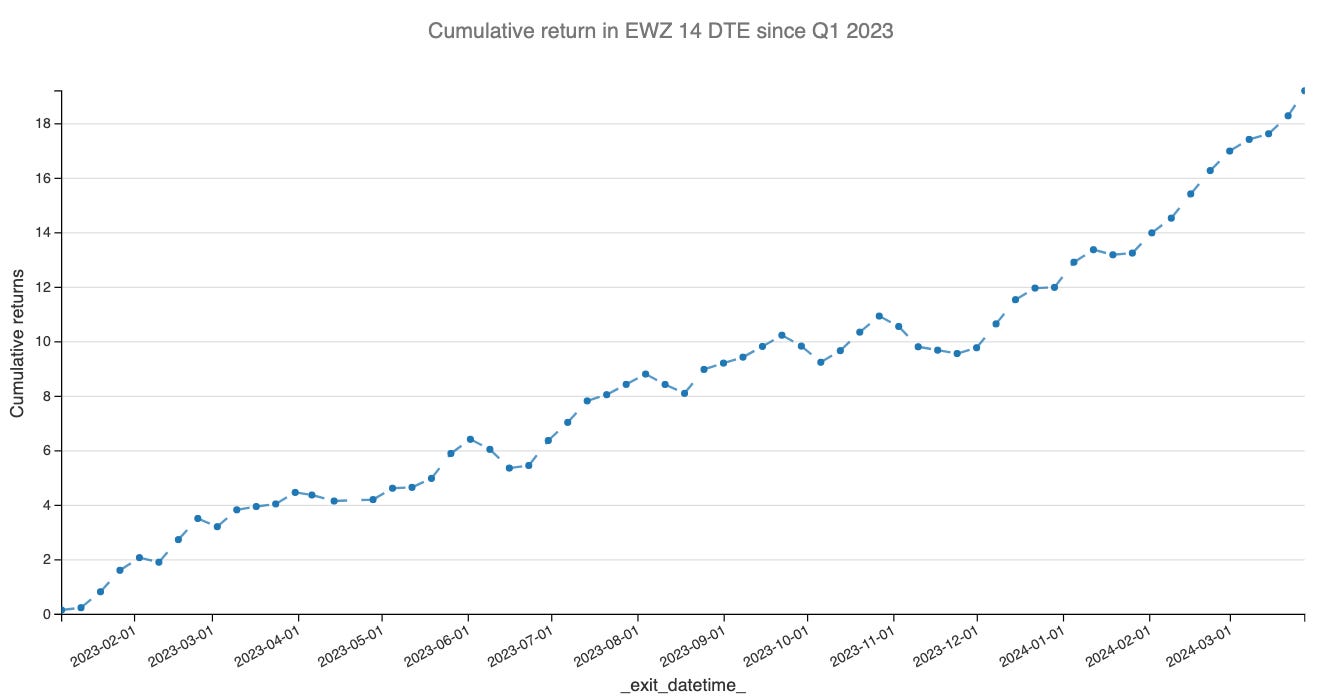

EWZ 14 DTE

We have been talking about this trade for some time, and it has once again delivered a fantastic quarter. To put things in context, we have included the entire year 2023.

The variance risk premium on the Brazil ETF is fairly easy to understand — things can go south quickly in that wonderful and powerful country in South America. And when they go south, well, they really go south. Two of their last presidents ended up in jail, and Bolsonaro had to leave the countries to avoid a similar fate.

Investors can’t build a diversified portfolio of international equities without considering Brazil. This would be silly and frowned upon. Therefore, like for the other two indexes, you buy the ETF and some protection. This leaves some very generous profit at the end of the day for anyone willing to sell the insurance and deal with the risk that one day … well, things will go south again.

In conclusion, selling premiums at the short end of the expiration curve was quite profitable in Q1 2024, particularly on asset classes where there is a natural explanation for why fund managers would overpay for insurance. That is how we always approach our trades: a fundamental reason why something is expensive and some data analysis.

If you want to receive more, consider subscribing to the paid content or contact us to join our Discord.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.