NFP week and potential bump ahead

How to structure a hedge and be ready for whatever comes in the next two weeks.

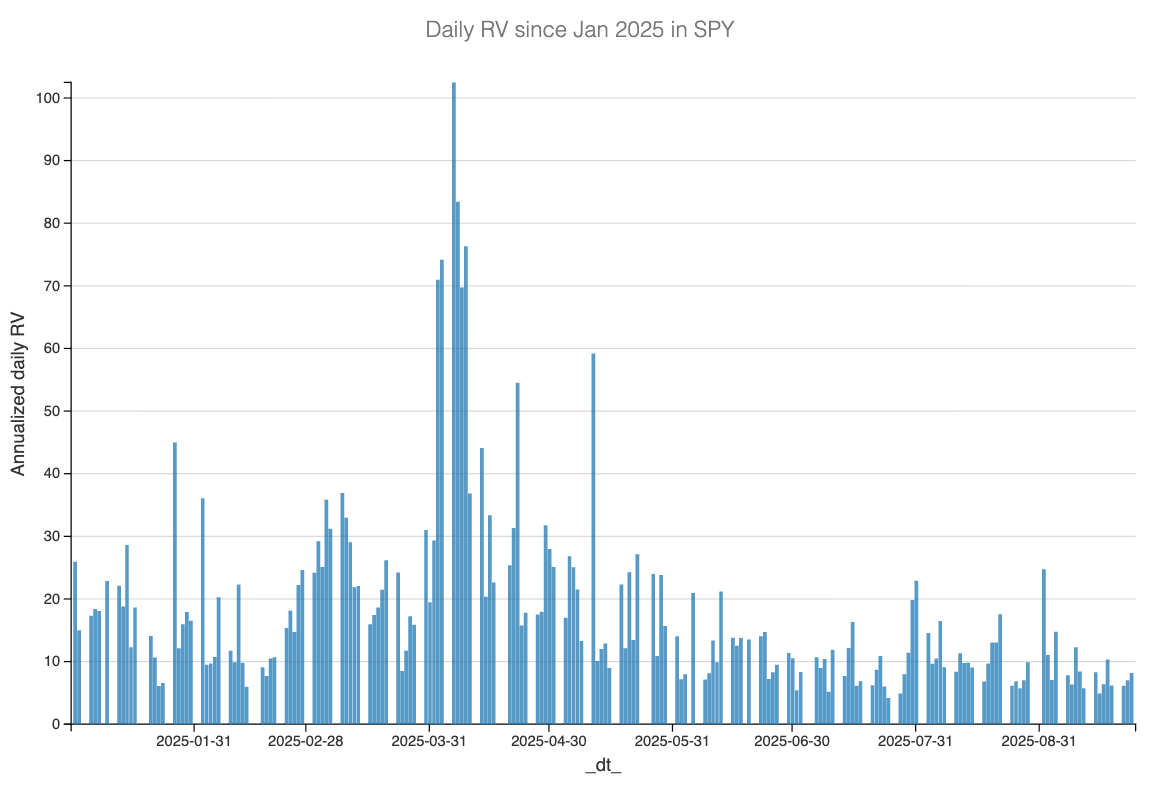

Quiz time: what do the last four NFP weeks have in common? Either on the day or at least on the week, realized volatility ran above 20%. In isolation, a nothingburger and you would be right to shrug.

But here is an interesting follow-up question: since June 1, how many sessions cleared 20% realized? Four. Out of 82 trading sessions, that is not a lot. And you see where this goes: one of those spikes landed on an FOMC day (June 13); the other three were NFP weeks — June, August, and September.

And which week is it today? Bingo, first week of October and NFP week.

We are not saying something will necessarily happen this week. But markets are not completely random, and recent history tends to repeat, especially now that the macro focus has quietly but surely shifted from inflation to the health of the job market.

So what does that mean for our short-volatility positioning in US equities? Do we step aside, or get long? Good questions. Let us dig beneath the surface.

It’s quiet for a reason. But maybe a little too quiet.

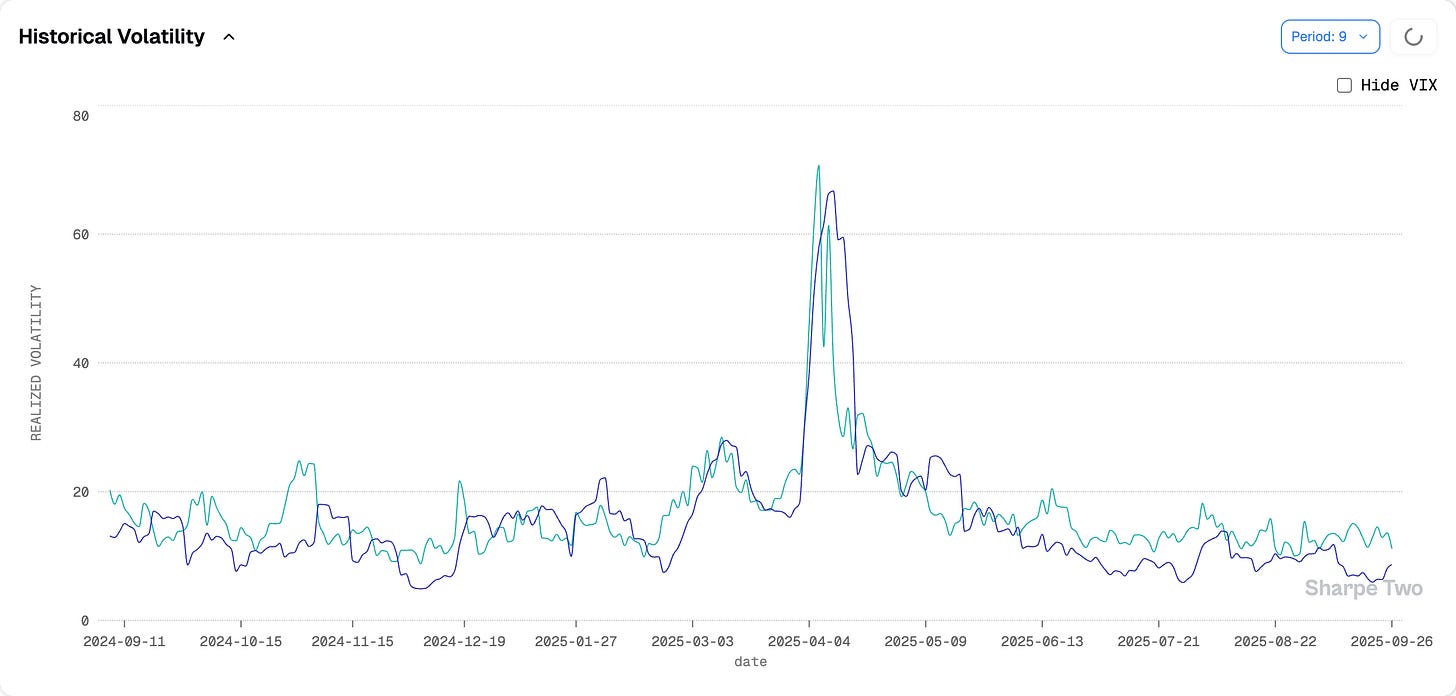

Everything has been said about the low-vol regime in US equities these past few months. Only on rare occasions have we seen real bursts of daily realized volatility, and selling options — particularly puts — has been broadly profitable.

Harvesting risk premium is fine, but that does not mean you ignore the bumps in the road, especially when they repeat. As noted earlier, three of the last four sessions with realized volatility above 20% landed on NFP weeks.

The most recent was early September, just after Labor Day, when the market caught everyone off guard with a sharp downside move. It was contained and quickly absorbed, but it would still have paid to hedge a little ahead of the week and better yet, to keep dry powder for that dip.

This time is no different.

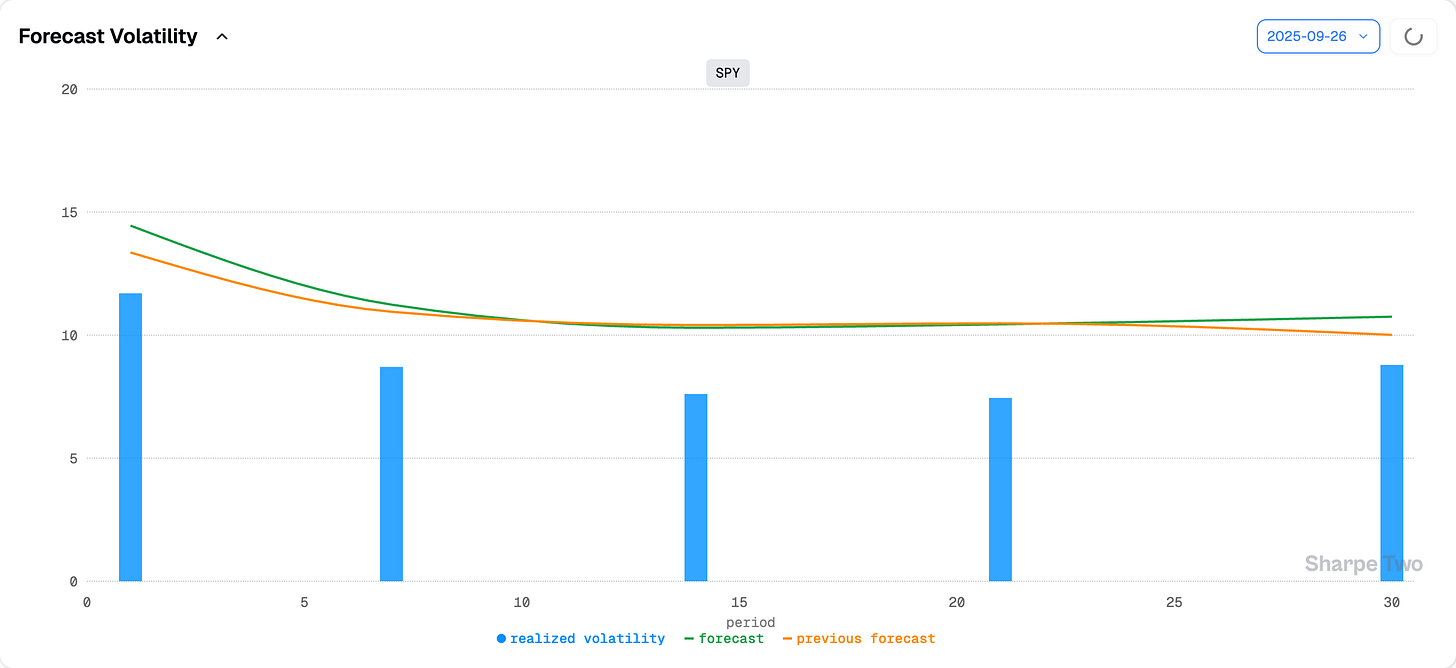

First of all, our models still flash that current levels of realized volatility are running a little too low compared to the long-term average. Take one-week RV: it sits at 8.7, while we would expect it to be at least three points higher. A weaker NFP could easily act as the catalyst for a repricing of longer-term expectations, with the market pulling back a couple of points.

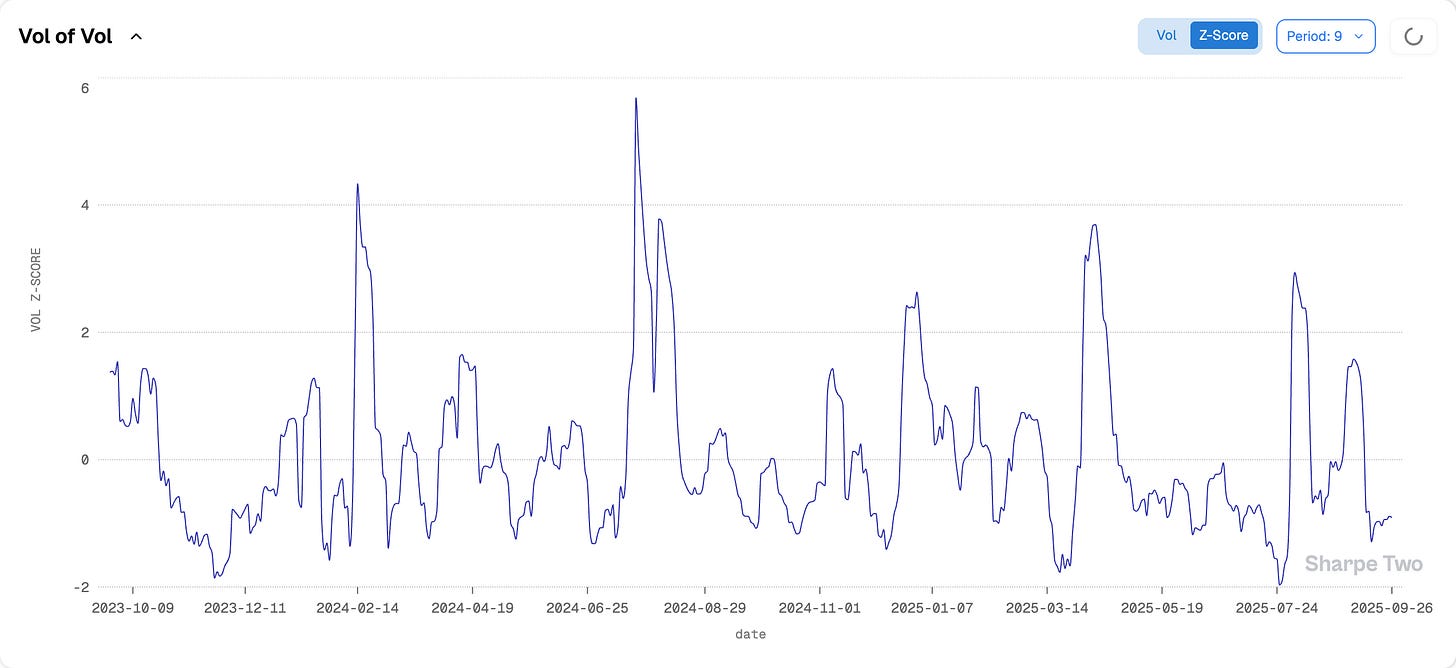

Another sign comes from the volatility of implied volatility — the one we track at nine days. It is usually more sensitive to headlines and catalysts, and like any normal measure of volatility, it tends to mean revert, especially when sitting at abnormally low levels. Right now, the z-score on vol-of-vol is hovering near -2. That alone is a good reason for us to lean more cautious in the short term.

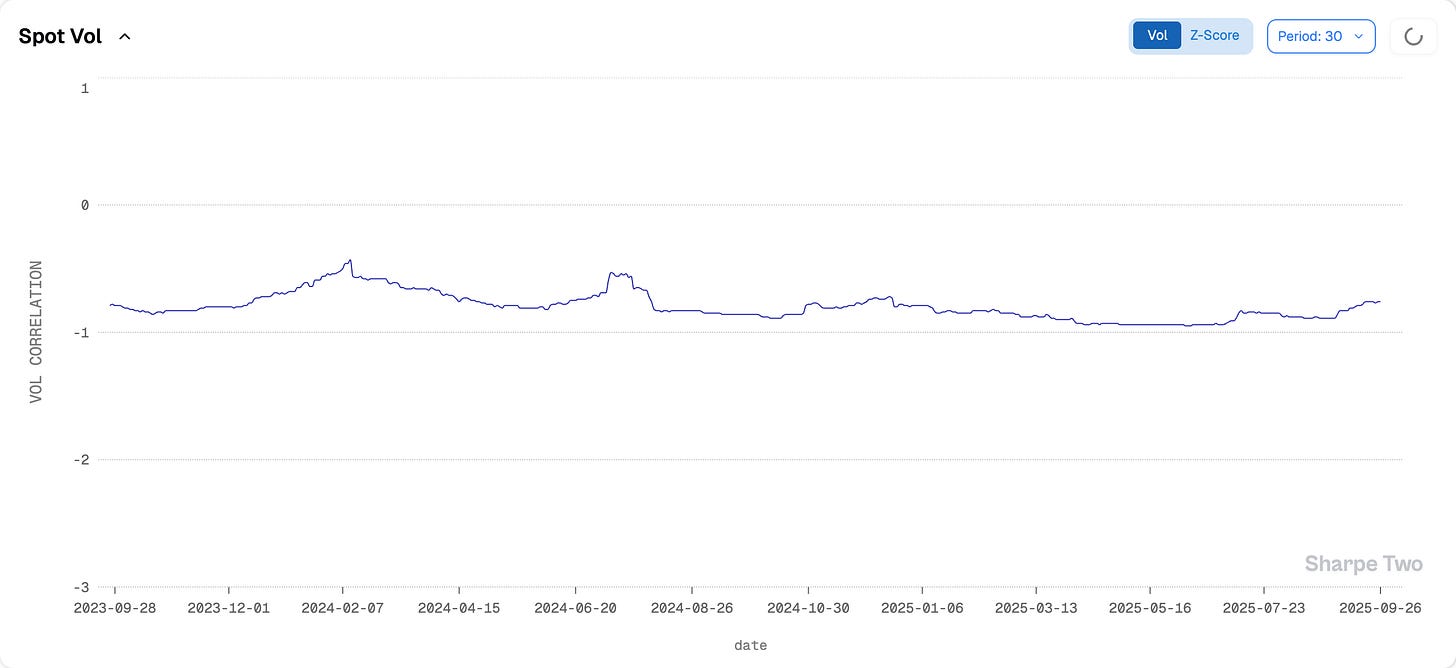

Once again, we do not expect anything to be fundamentally broken in the coming days or weeks — unless, of course, the health of the job market is seriously called into question by the latest data. And that is exactly what the current trend in spot/vol correlation is hinting at.

At -0.76, it is the highest level in the past 12 months and signals a shift in mindset: downside is less hedged, pointing once again to a market that does not fear the kind of pain and prolonged downturns seen earlier in the year. We are still far from the -0.43 observed during the deep low-volatility regime of February 2024, or even the -0.56 of June 2024 before uncertainty came roaring back and pushed these numbers closer to -0.9.

But still, implied volatility a little more agitated than it has been over the last three months would not be a hard no, given the focus now on the jobs report. Keep in mind that earnings season is about to kick off, and with it the usual hedging flows that can disturb the quiet we have seen in recent months.

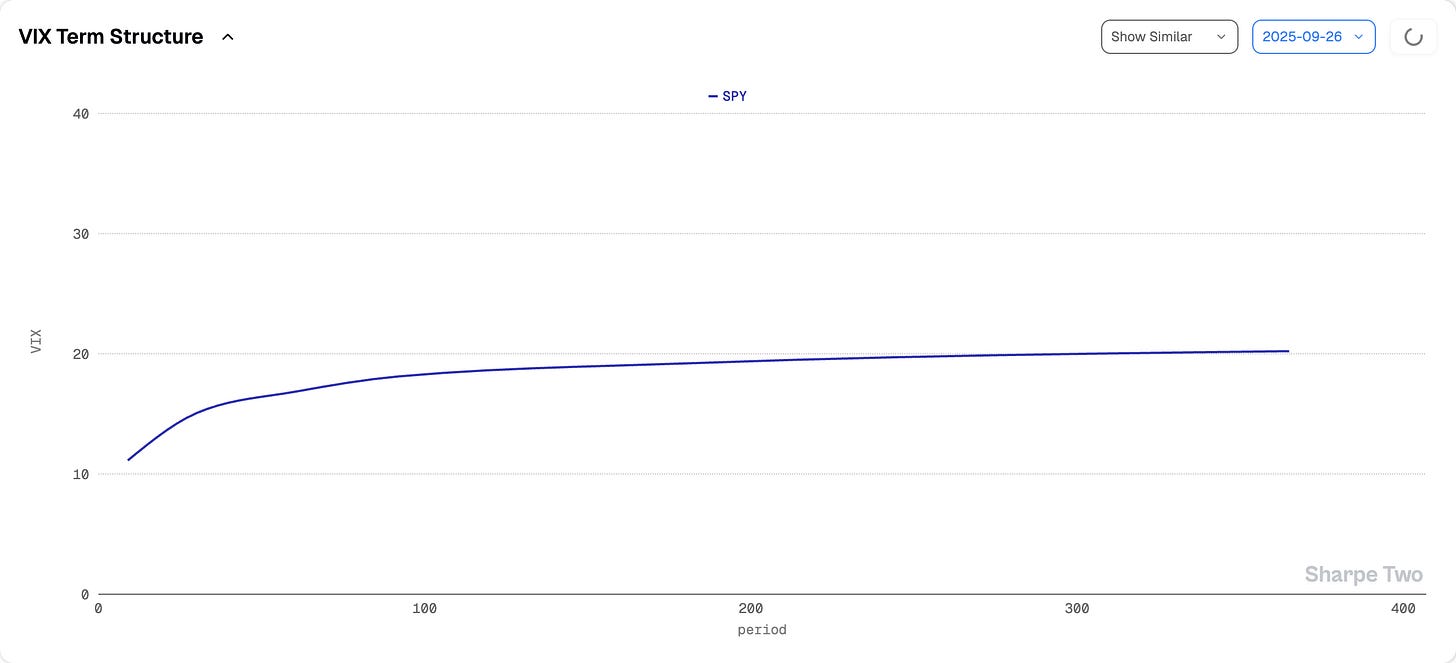

The contango is strong and healthy; that does not mean the curve cannot flatten a bit over the next few days. Being short volatility too close to the expiration cycle may not be a great idea.

With all that in mind, let us look at what our predictions say for the next few days and dig beneath the surface to structure a trade.