Navigating the Top-Performing Tickers in High IV and Expanding HV Regimes

And finding the structural reasons why some may keep performing well.

The market is patiently waiting for the next FOMC meeting, and it seems unfazed by the whole thing. With the VIX closing below 14 yesterday and VVIX retreating to 85 below its natural mean of 90, we're still in a very low volatility regime, whether you're a fan of it or not.

So, what shouldn't you be doing right now? Don't go shorting the market and expect a 10% drop without any serious new catalyst. Sure, there's always a chance that Jay Powell might drop a bombshell in a couple of hours, which could trigger a regime change and make this introduction look silly. But until that bomb drops, it's best to hold your horses and wait. And if it does happen, go ahead and take that well-deserved victory lap.

It's also not recommended to go long on volatility, hoping for a black swan event. These low-volatility regimes can last quite some time, and people don't often brag about decimating their fortunes while trying to predict when they'll end.

The last thing you shouldn’t do? Spend too much time looking at prices and charts. We are in a low-vol regime, remember? Things are slow, boring, and tend to drift up.

So, what should you be doing instead? Selling volatility, of course. Even if it might seem cheap in dollar terms, it's likely to overstate the realized volatility significantly. Essentially, you're selling expensive insurance relative to the actual risk in this calm market, and as long as we remain in this regime, you should be able to profit from it.

Another thing to remember is to look for markets with higher volatility and less correlated with what is happening in the US equities. One of the most significant advantages of retail trading is the flexibility and ability to be relatively agnostic about the markets you consider. This gives you a serious edge over institutional traders, often limited to a single class of products.

If you're looking for ideas, why not check out our API? It's an excellent resource for helping you identify potential opportunities. It lays out all the regimes we frequently discuss for more than 60+ ETFs.

After two weeks of exploring the theory behind how we've built these regimes across implied and realized volatility to establish Sharpe 2+ strategies, we'll tackle the question of what exactly we should be selling. Are there any specific tickers or asset classes that deserve more attention when implied volatility is high?

If you haven't already, it might be helpful to read the previous articles before diving into the rest of this one. They provide valuable context and background information to enhance your understanding of the concepts discussed here.

However, past performance doesn't guarantee future success. While knowing what has been performing well lately has some predictive power, it's only valid if we can identify structural reasons likely to highlight a fundamental market feature rather than the outcome of a temporary market outlook.

Let's take a closer look.

A quick refresher on the methodology

Over the last two weeks, we've studied five different regimes across implied and historical volatility. This has given us a five-by-five matrix where we analyzed the performance of selling straddles on a universe of 60+ ETFs, covering most asset classes and geographies, over the past two years.

We then used this matrix to identify the most promising combinations based on the average return per straddle sold and the number of trades available during the period.

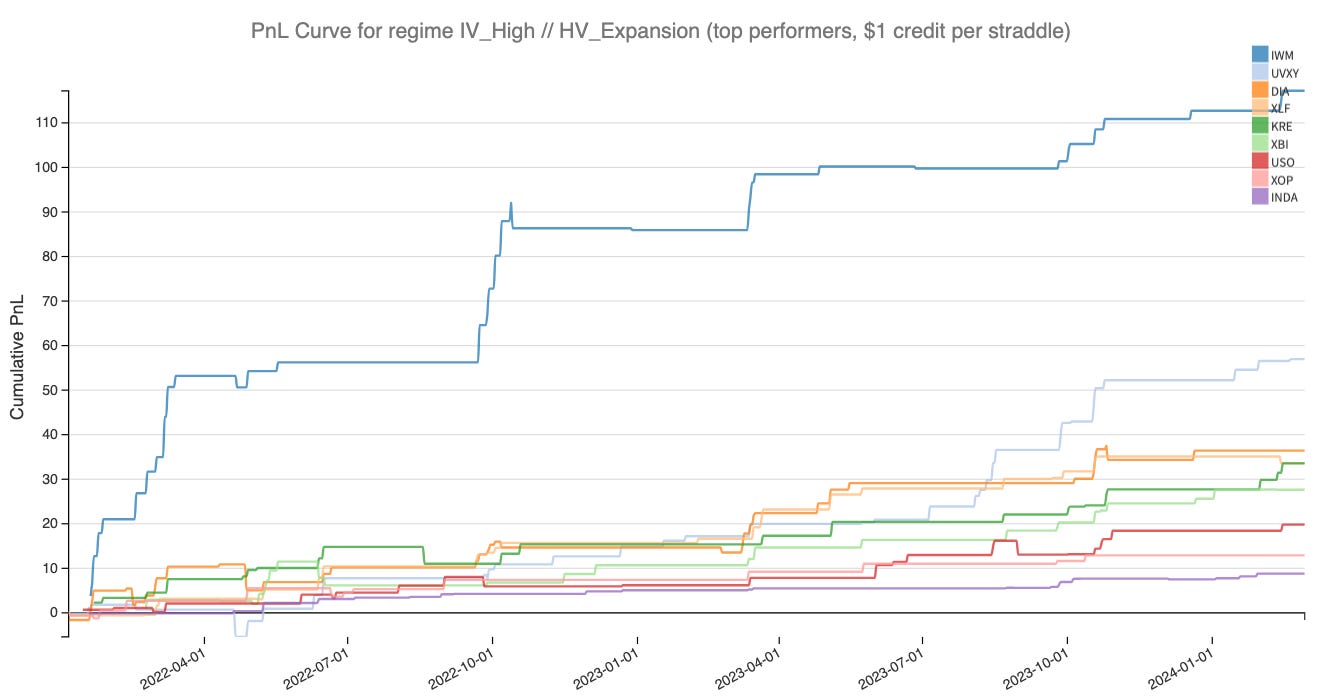

From there, we've focused on one of the best setups in the mix, characterized by IV_High and HV_Expansion. This setup yields an average of 7% per trade without any extra work, and the PnL looks pretty solid.

Let's understand which tickers in this combination of regimes performed the best over that period.

Among the top 20, we see a solid representation of equities, baskets, and commodities. However, while the average for the full segment is about 7%, we're only interested in finding the cases that significantly outperform that benchmark. The top 10 is very interesting with this approach, as it almost exceeds the benchmark by 2x.

Some of these have fewer trades than others, but the performance is consistent and the win rate is relatively high. Even though we're a data-driven publication, we like to find reasons for past performance and gauge the likelihood of it continuing in the future. Ideally, we want to distinguish between structural reasons likely to last a long time and market conditions tied to the overall environment observed over the past two years.

The ones we really like — UVXY and IWM

Let's start with the simplest of them all—UVXY. We were surprised not to see VXX on the list, but they offer investors exposure to slightly different things.

The main difference between UVXY and VXX lies in their structure and leverage. UVXY offers leveraged exposure (1.5x) to the VIX futures, aiming to amplify the underlying index's returns. In contrast, VXX provides non-leveraged exposure to a similar index of VIX futures, making it less volatile and risky than UVXY. As a result, UVXY tends to experience greater price swings. And because the risks are greater, it's very likely that in a regime where implied volatility is high and historical volatility is expanding, the market will demand a very high premium, which usually won't be realized.

We also find IWM and DIA in the list of top performers - often the two forgotten indices of the US equities market. IWM, in particular, comprises mid and small-cap stocks that are riskier than their larger index counterparts. As a result, the risk perception is higher, and the insurance premium skyrockets when things are up in the air. What's particularly interesting about IWM is how it performed exceptionally well during recent periods of stress, such as in Q1 and Q2 2022, as well as in March 2023 during the brief regional bank crisis and at the end of 2023.

So, when things get tense, keep IWM and UVXY in mind. Due to their inherent nature, market prices tend to be structurally less irrational and offer great opportunities for volatility sellers.

The ones we consider but do not trust too much

We then see two asset classes that, despite performing well over the past few years, present less compelling reasons to continue performing- the financial and the oil and gas sectors.

XLF and KRE performed well overall because the current risk perception in the market for financial equities is high. The tightening conditions due to the Fed's rate hike cycle, coupled with the regional bank crisis in Q1 2023, have spooked investors, and the prices of options in the sector have outperformed the actual market risk when things get tense. Why don't we like this? Because this is not a structural effect like UVXY and IWM.

It's very likely that when financial conditions normalize and people forget about the SVB Bank incident, options prices will return to normal, and the current edge will slowly fade away. Does that mean we shouldn't take the trade? No. However, we would be much more cautious about the size of our position in these assets.

The same goes for XOP and USO. First of all, there haven't been many trades between these two names, and when there were, it was mainly during heightened geopolitical tensions. The problem with geopolitical tension is that, most of the time, nothing is as bad as it seems, and options prices tend to overestimate the risk in the underlying asset.

However, one day, something completely out of your control happens, and things worsen. Shorting straddles in XOP and USO when implied volatility is high and historical volatility is expanding, which can be scary, with a lesser guarantee that things won't escalate to another level.

Therefore, more than ever, sizing your positions in these products is critical.

Bonus — XBI

XBI is an interesting case. There's an evident reason why options are overpriced, considering this index tracks the biotechnology sector. This sector is well-known for being hit-or-miss, with companies often experiencing 50% gains or cratering to zero. The risks are significant and difficult to estimate for any active investor in this sector. As a result, implied volatility is high because things tend to be mispriced in favor of the insurance seller.

This is also due to XBI's equal-weight structure: most holdings represent an average of about 1.75% of the index, with around 75 names. This means that if the index experiences extreme upward or downward movement, it's unlikely to disrupt the ETF completely. Needless to say, we really like this setup and consider trading in this ETF a good strategy.

It is crucial for retail traders to go beyond the data to understand the underlying reasons behind a trade's performance. This prevents us from becoming overly attached to specific names and continuing to trade them even when the factors that initially led to their success may no longer exist. This doesn't necessarily mean that these opportunities have vanished forever, but as retail traders, we face high opportunity costs and must allocate our capital to the most promising trades rather than those that might start performing again.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.