Navigating The Calm Before Earnings in NFLX

Beneath the surface #2

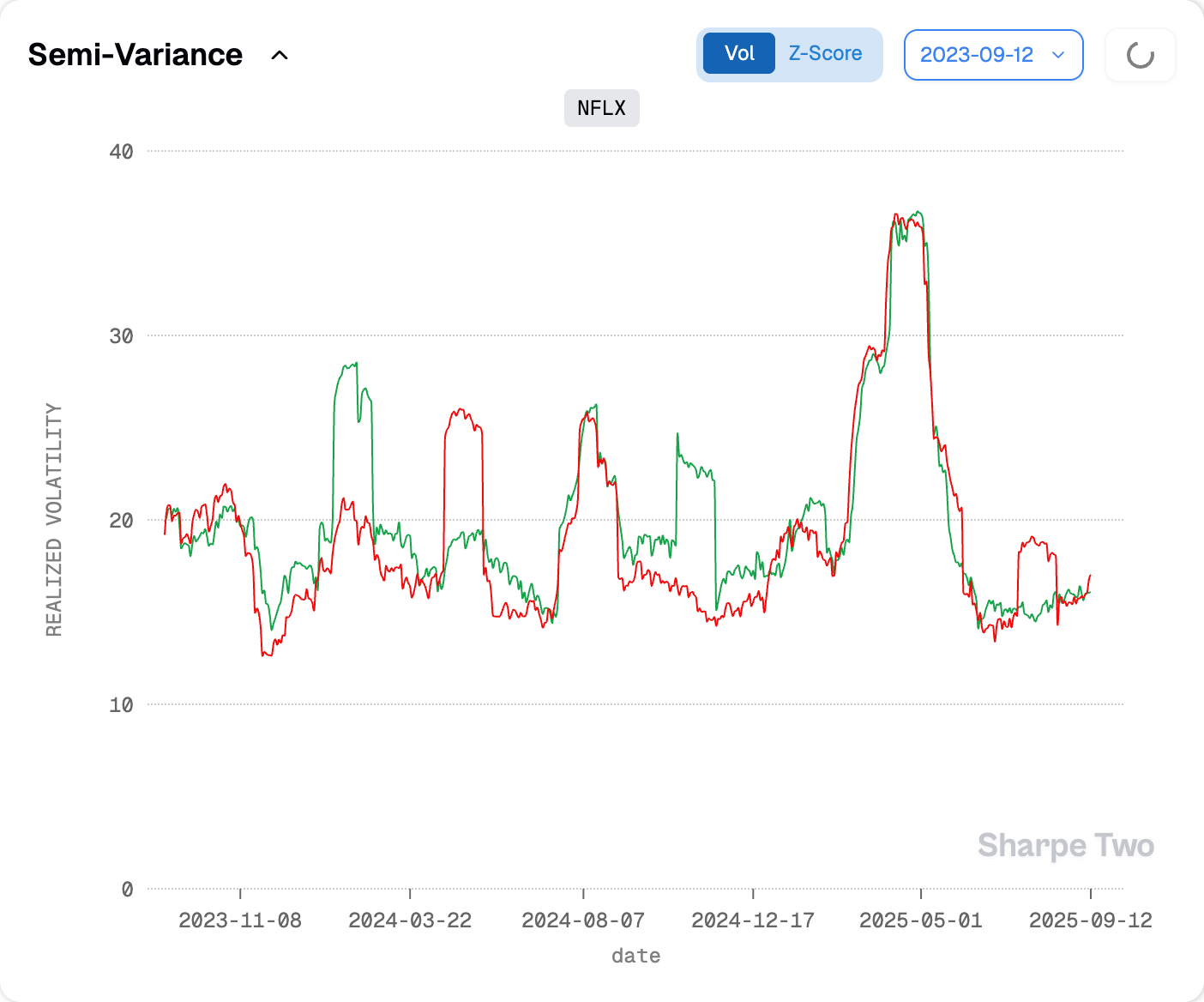

Netflix volatility looks like a calm sea. Realized vol has collapsed from its spring storm into a late-summer drift. Skew is soft, vol-of-vol is neutral, and the 9-day window offers little urgency. On the surface, it looks like a short vol gift: implied still trades above realized, variance risk premium is positive, and the tape feels quiet. That is exactly where traders get trapped.

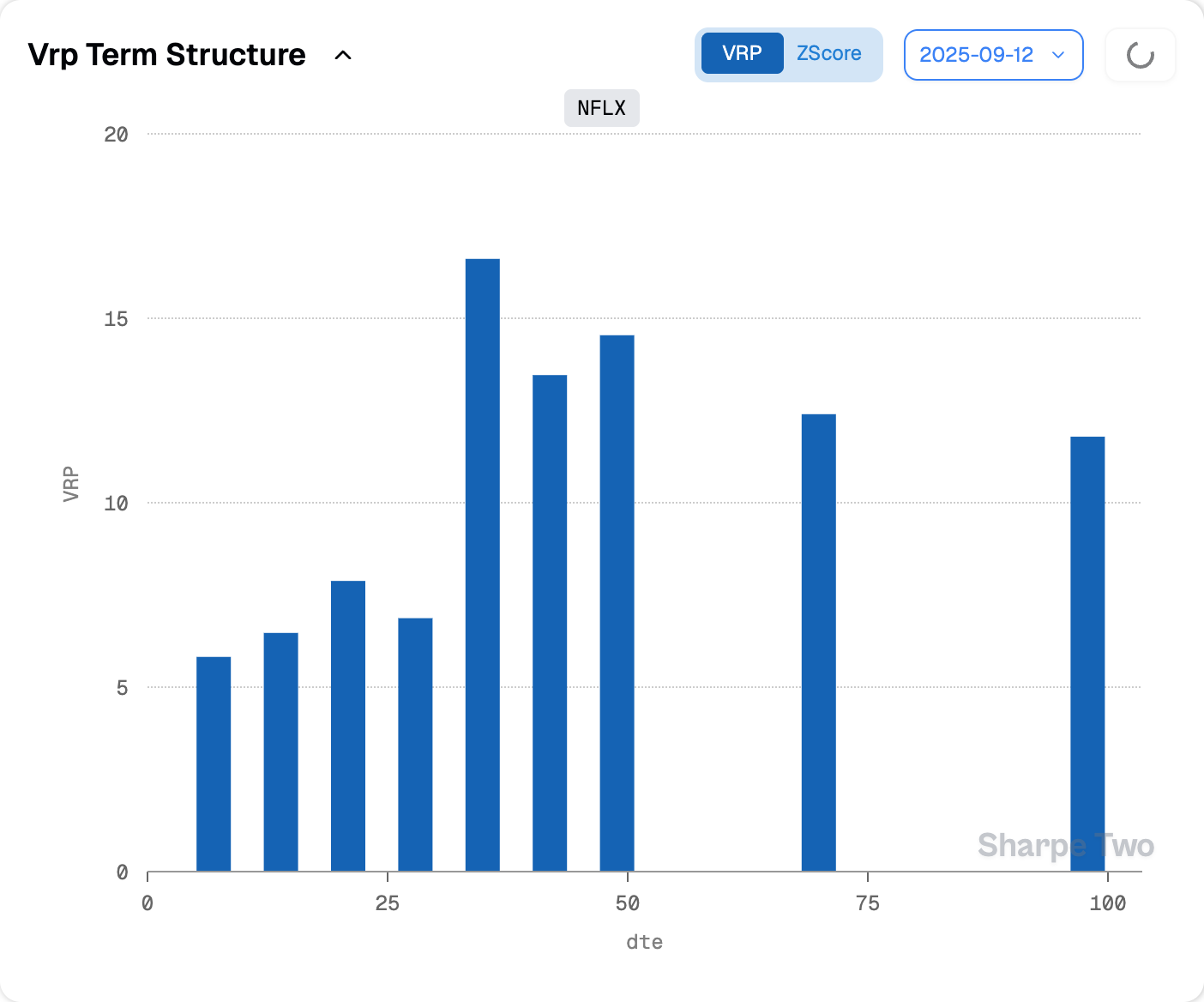

The real story is not in the front. Beneath the calm, the 30–40-day bucket is already starting to inflate as earnings approach. Convexity is being bid up well before the announcement, with option buyers quietly migrating premium into the expiries that capture the event. What feels like easy carry in the short-dated options is really a mirage, while the true battle is taking shape in the medium-tenor contracts.

This setup is a classic example of how short vol edges can seduce you with front-end decay, only to reverse as earnings premium creeps closer. NFLX today is less about the calm in front and more about the storm building just behind it.

Let’s have a look.

The short-term VRP trap

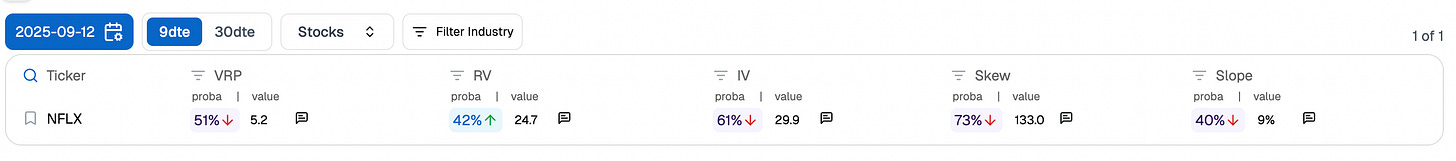

At first glance, the front part of the VRP term structure on NFLX screams “short me.” Variance risk premium is positive at +5 points, implied is holding near 30 while realized drifts around 25, and skew is hardly pressing higher.

For the surface-level trader, it looks like an easy paycheck: sell some decay, lean on the quiet tape, and pocket the spread. But look closer at the probabilities and conviction evaporates. VRP down only 51%, IV down 61%, RV up 42% — essentially a coin flip dressed up as edge.

This is the mirage of short vol. It happens when realized collapses more quickly than implied. On paper, the gap between IV and RV generates a positive VRP, but the signal is fragile. Without realized volatility grinding lower still, the “edge” is less clear and is more a carry illusion. Traders fall into this trap when they confuse temporary quiet with structural mispricing. Selling premium here is not arbitrage; it’s warehousing risk with no catalyst. Just to be clear - we are not saying the trade won’t work. We are saying that while the premium is here, everything is not aligned to be a perfect slam dunk. It can work, it can flop - 50/50.

The semi-variance profile tells the same story. Both upside and downside realized vol are muted after the spring spike, leaving no directional imbalance to exploit. Yes, you can short some front-end straddle premium and clip theta, but you are not harvesting durable mispricing — you are just renting exposure in a low-conviction zone.