Mastering Market Regimes: A Sharpe 2+ Strategy for Short Volatility Trading

When too much stress is hurting your performance.

“Trade the regime you are in, not the regime you may see tomorrow” is the most valuable lesson I got as a young trader making his first steps on the trading floor during the onset of the European Debt crisis.

A common misconception about trading is that it's all about predicting the future. In reality, this approach is more typical of investing, where you spot value in an asset class or geography and wait for the market to correct its current valuation over time.

In contrast, volatility traders seek out price discrepancies caused by shifts in supply and demand within the options market. It's far more challenging to predict future demand imbalances than to identify and act on existing ones.

The time frame for these trades is usually shorter, focusing mainly on positions nearing expiration. Hence, immediate market conditions typically outweigh speculative future scenarios: trade the regime you are in, not the regime that might be.

That is why it is so important to have a clear picture of the current regime. Then, you can choose the strategy that best suits the market conditions and maximize your return on capital.

We’ve been in a low volatility regime for a few months now, and the mistake many retail traders make is trying to immitate the pro tail fund managers and anticipate the next regime: keeping a perpetual long volatility position will eventually pay off, but at what cost? Sure, you can structure this position so that it doesn’t lose too much money, but that is still a poor use of capital. When you are waiting for the storm to pick up, your fellow traders are harvesting real hard cash.

Trade the regime you are in, not the one that may be, and repeat the same winning trades over and over and over again. When the market landscape shifts, pivot and use the full arsenal of trading tools to seize emerging opportunities directly before us.

In today’s article, we explore how selling volatility performs as a function of (five) different regimes in realized and implied volatility - you can find them in our API. This creates a matrix of 25 regimes, offering us a comprehensive framework to analyze recent performance for short volatility trades.

Let’s dive in.

Let’s define our regimes

First, let's outline how we've established these regimes and the key characteristics we aim to capture.

Volatility, whether implied or realized, exhibits specific behaviors:

It clusters, indicating that the volatility of one day often serves as a reliable predictor for the next day's volatility.

It exhibits mean reversion, gradually returning to its average level over time.

When volatility spikes, it does so with significant intensity.

To effectively capture these volatility behaviors, our goal was to construct regimes that allow traders to interpret market conditions without getting bogged down in extensive data analysis. To achieve this, we incorporated various momentum indicators, such as smoothing techniques and lag features, for both realized and implied volatility. We then applied clustering methods to identify five distinct regimes, simplifying traders' decision-making process.

Realized (or Historical) and implied volatility differ significantly in their perspectives: one looks back, while the other anticipates the future. This distinction led us to develop two slightly different models. For implied volatility, our focus is on gauging market risk perception, leading to regimes that reflect varying levels of implied volatility. Below is an example for KRE:

The model effectively identified periods of heightened stress, such as the regional debt crisis, before illustrating a gradual return to normalcy.

Realized volatility, being backward-looking, helps us gauge whether volatility is expanding or contracting, acting like the market's pulse. It signals whether we're in a turbulent phase (expanding) or settling down as realized volatility contracts. Below is an illustration of the five distinct regimes, again using KRE as an example:

In the ascending phase, we observe more yellow, orange, and red, which indicate expanding volatility. Conversely, the descending phase features more green and blue, signaling a contraction in volatility.

With our regimes now clearly defined, let's examine the performance of a short volatility strategy. We've utilized data from the past 18 months across a diverse range of over 60 ETFs covering various asset classes and geographies. For the complete list, please refer to our API.

Data analysis

We'll begin by validating a fundamental characteristic of implied volatility: it is often overpriced compared to what happens in the market, and on average, should result in profitability across various market conditions.

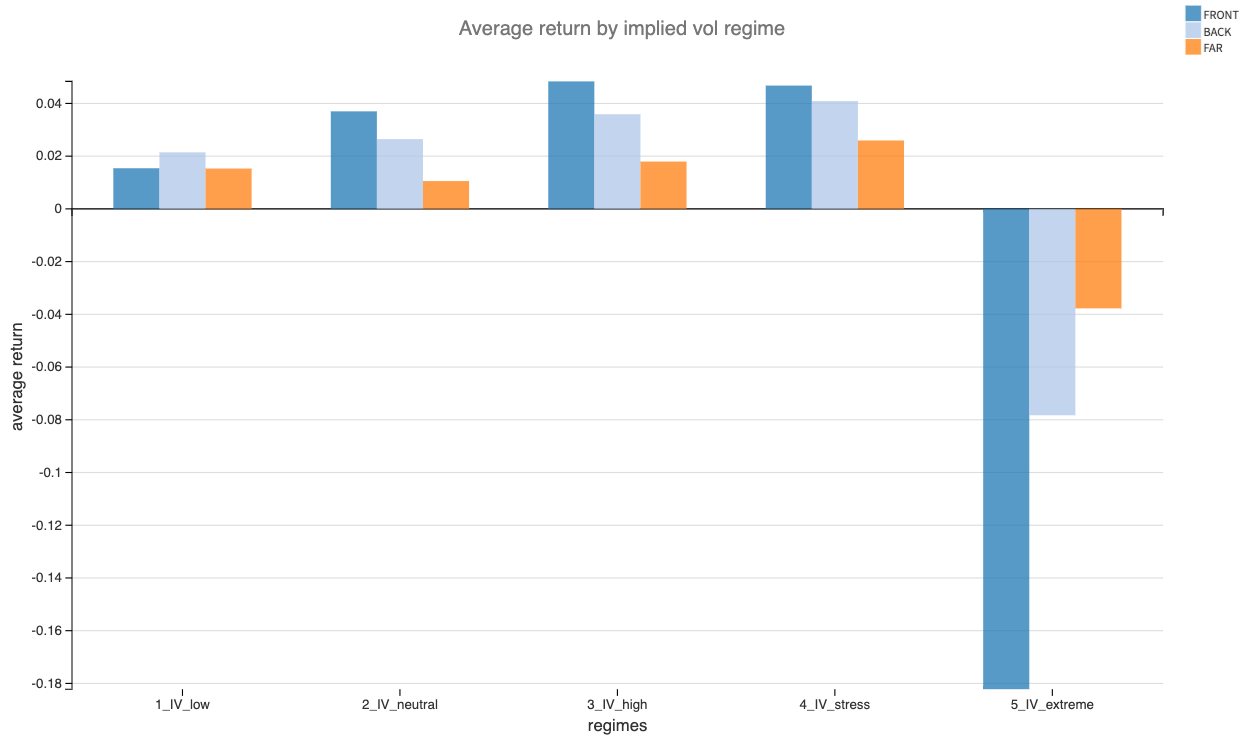

Our analysis will compare the performance of selling straddles in three distinct periods: the front month (less than 30 days to expiration), the back month (up to 60 days to expiration), and beyond the back month (more than 60 days to expiration). We'll observe how these strategies fare across different implied and realized volatility regimes.

For this analysis, we standardize the test by assuming a $1 credit received per straddle sold, holding the position for two weeks without applying delta hedging.

This approach generally yields positive results consistent with expectations, except during phases of extreme expansion in realized volatility. Such a scenario logically indicates significant market movements, either upward or downward, posing a high risk of breaching our straddle boundaries. It's precisely during these times that we should steer clear of selling volatility. Considering buying volatility instead? That's a possibility, but it would necessitate further analysis before taking a stance.

Next, let's examine this strategy's performance across various implied volatility regimes.

A similar pattern emerges with the implied volatility regimes: as volatility increases, so does the premium we're able to retain across the different expiration periods. However, selling volatility when it reaches extreme levels, despite the lure of high premiums, is generally not advisable. This might seem counterintuitive at first, but there's a logical explanation. Extreme implied volatility doesn't spike without cause—it's a market signal anticipating significant events. And such events, with their outcomes being notoriously unpredictable, could swing -10%, -20%, or beyond. Our analysis shows that the risk of our straddles getting breached under these conditions is substantially higher.

The volatility performance matrix

After analyzing the performance of short volatility strategies along each axis separately, let's examine how they fare when we consider both realized and implied volatility together.

Our matrix analysis reveals a standout anomaly: combining extreme implied volatility (IV_extreme) with extreme historical volatility expansion (hv_expansion_extreme) results in an average net gain of 46%.

The dilemma, however, lies in identifying the peak during a market stress period. Pinpointing the precise moment when the worst has passed to enter a short-term position confidently can be mentally challenging, even when we rely on data. Furthermore, these periods of stress, while potentially lucrative on average, are infrequent, offering fewer trading opportunities, and could see profitability erode as new data comes in.

A regime of particular interest arises when historical volatility expansion (HV expansion) appears to be peaking while implied volatility is high but not at stress levels. This scenario has yielded an average return of nearly 8% across our ETFs. Below is what the cumulative PnL curve for this regime looks like.

This performance is commendable; however, the frequency of trading opportunities is limited by the relative rarity of this regime combination.

An even more compelling scenario unfolds when both implied volatility is high and realized volatility is expanding. Over the past 18 months, this condition has offered an average return of 7%. Below is the cumulative performance for this particular setup.

Now, we're looking at a strategy that appears to be consistently effective across a diverse range of asset classes and geographies. What we like about it is that it survived the difficult part of 2022 before finding its rhythm. Selling in the back month helps to reduce the variance in returns, and we reach Sharpe 2+ throughout the period. If you are trying to optimize for PNL, selling in the front month is acceptable, but the swings in PNL may be difficult to deal with.

In conclusion, by targeting moments when implied volatility is high and realized volatility is expanding, traders can capitalize on market conditions that are ripe for short volatility strategies. Given the robust performance demonstrated in our analysis, it's clear that such a strategy not only navigates through the nuanced dynamics of the market but also leverages volatility to generate favorable returns. This approach, grounded in a comprehensive understanding of volatility regimes, offers a pragmatic pathway for traders aiming to optimize their portfolios in a varied trading landscape.

Be sure to follow us on Twitter @Sharpe__Two for more of our insights. If our work resonates with you, don't hesitate to share it with others who might find it helpful.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.