Forward Note - 2024/09/08

Caught in the headlights.

After a positive end to August, driven by end-of-month flows, worries have hit the market again.

It started on Tuesday afternoon with a downbeat ISM manufacturing report, indicating contraction and reigniting recession fears. The SP500 took a hit, dropping about 2% that day. The market then moved without clear direction on Wednesday and Thursday as tension built ahead of the jobs report on Friday.

The report came out mixed: the unemployment rate was 4.2%, matching expectations and easing some of the concerns triggered by the Sahm Rule in August. However, job creation fell short at 142,000 versus the 165,000 expected by economists. Not terrible, in our view, but it was enough to trigger another wave of selling in the stock market. As a result, the SP500 closed the week down 4.28%, and the Nasdaq fell nearly 6%. It was the worst week since 2022 when recession fears last shook the market.

Markets are fascinating—on the way up, their optimism can be almost irritating as they brush off any bad news and keep pushing to new highs. But on the way down, they can drown in a glass of water, as we say in France. Convinced that something terrible is just around the corner, it's hard to get them to see the bigger picture until something—usually a shot of free money from the Central Bank—snaps them out.

It's important to monitor the recession narrative: a slowing economy isn't good for stocks, and fund managers have been pricing this perspective over the past two months. However, you must avoid paralysis when time feels compressed and volatility spikes.

This is tougher after six months of a low-volatility regime: VIX at 22 suddenly feels unsettling, especially when the memory of 65 from just a month ago is still fresh in everyone’s mind.

Before diving into trade opportunities, let's start with some key risk management guidelines.

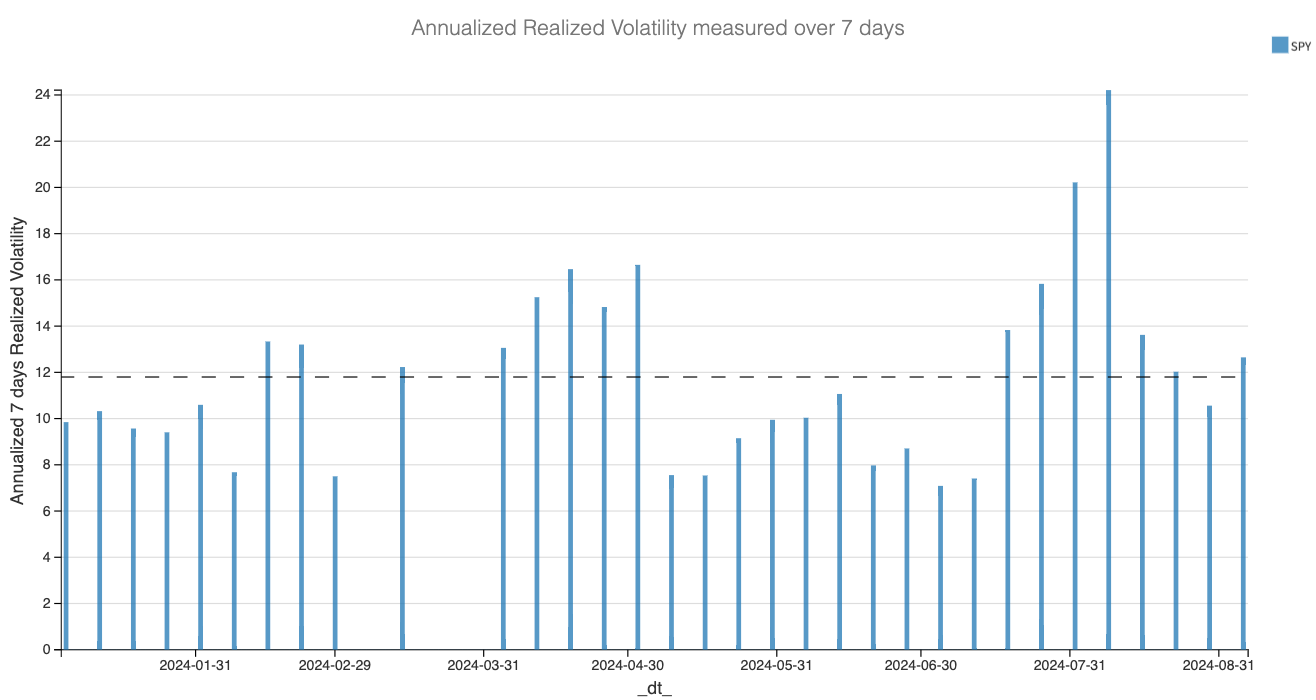

First, while the weekly realized volatility in the SPY reached 12.56 this week —certainly high—it’s still nothing compared to the frenzy we saw a month ago.

The massive underperformance in the realized skew, which measures the volatility linked to weekly performance, is more interesting. If you managed to come through relatively unscathed (perhaps because you sold very far out-of-the-money straddles a while back) or if you ended up deep in the red due to over-exposition to directional movement and not even volatility, now is the time to reassess some key risk metrics and make necessary adjustments. Next time, we might not be so un-lucky.

Now, let’s get into the trade opportunities. Over the past few weeks, we've advocated caution when selling volatility in the equity complex due to the lack of a solid VRP. The good news? It's back. But should you dive in just yet? There might be areas where the mispricings are even more apparent, like in the VIX complex.

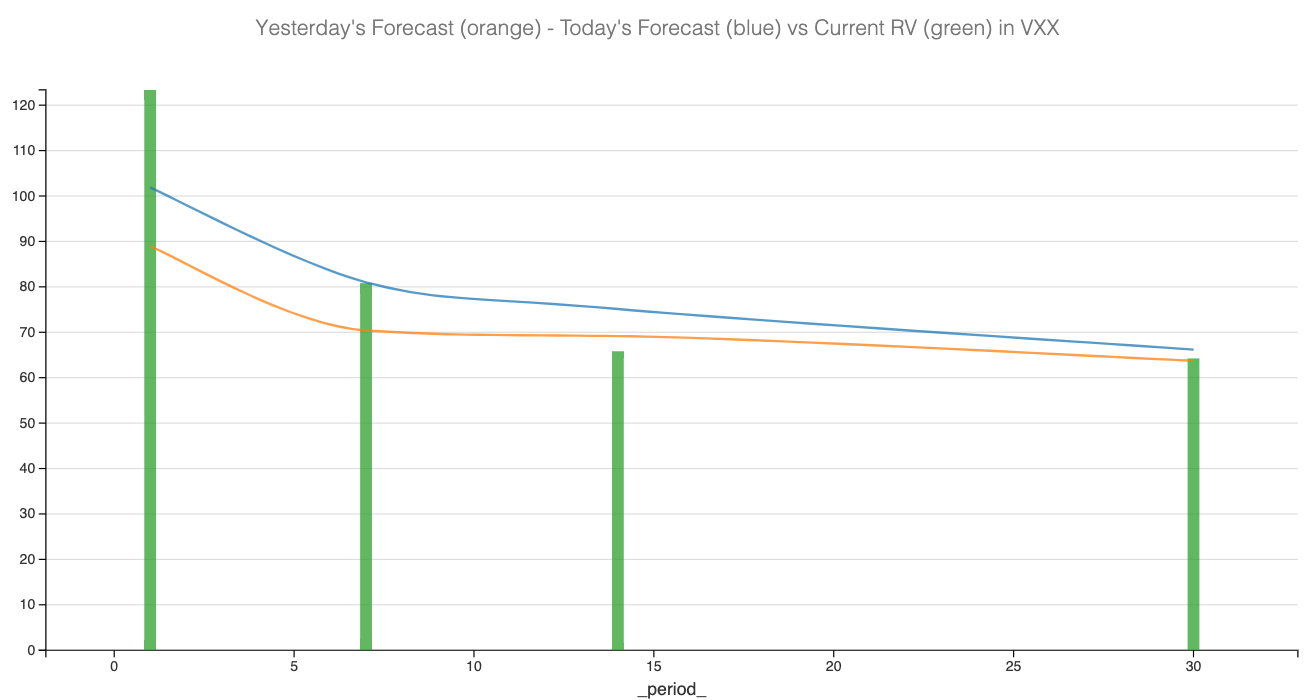

Yesterday, before the close, you could sell a 125% implied volatility on the Sep 20 ATM straddle in VXX. Considering that the realized volatility is barely at 65% and is projected to approach 75%, these are excellent prices.

Of course, our forecasts could be off, and there’s always a risk—another VIX spike could put this position under pressure. But from a rational perspective, there's a lot more room for error when forecasting between 125 and 75 than between 22 and 16 (the current spread between realized and implied volatility in SPY options expiring in 30 days).

Let’s talk numbers. You could sell the ATM straddle in VXX for $11.5 on Friday. What are the chances of seeing VIX between 45 and 69 over the next two weeks? The burden of proof is on realized volatility, and you don’t even have to hold the position until expiration.

If you manage your risk properly, these situations can be highly lucrative… but don’t last long.

We scratched our heads over those prices for 30 minutes, and then—just like that—they were gone. When we checked again, you could only sell at $10.5 (and it took more effort as the spread widened toward the end of the session). Still, it’s a decent price, but it shows just how much of a gift $11.5 was from the market gods.

For retail traders, selling straddles can be margin-intensive and, understandably, a bit scary. But remember, it's a neutral play on where volatility is headed: you're betting that it won't move as much as the market currently expects.

If you want to limit your risk, buying the wings in the back months can cap your downside while leaving you room to profit from the front weeks.

In short, monitor the recession narrative closely, manage your risk carefully, and don’t let these prices slip through your fingers.

In other news

A week without NVDA in the headlines seems impossible.

After navigating its earnings week relatively unharmed, news broke on Tuesday that the Department of Justice had subpoenaed the company over antitrust concerns. The market reaction was predictably brutal, with the stock dropping 10%. Despite denying any claims of receiving such a subpoena, it shed another 5% throughout the rest of the week. Who is telling the truth isn’t our concern. But this sudden drop is another example of why we steer clear of volatility trading in single names: even a seemingly minor event can blow up a position, and there’s often little you can do to mitigate the damage.

Thank you for staying with us until the end. Here are a couple of good reads from last week:

We’ve been discussing the shift from inflation concerns to recession fears since mid-summer, and now it’s in every media outlet. Here's an interesting viewpoint from the FT on why you should prepare for a recession, even with potential Fed intervention. While we don’t agree with everything, understanding how market participants think is helpful.

Corey Hopstein's recent interview with Gappy is another must-listen. If you're short on time, pedma offers an excellent summary.

That’s it from us this week. We wish you a pleasant week ahead and, hopefully, some relief in the volatility market.

Happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.