Forward Note - 20260222

The late night hedger

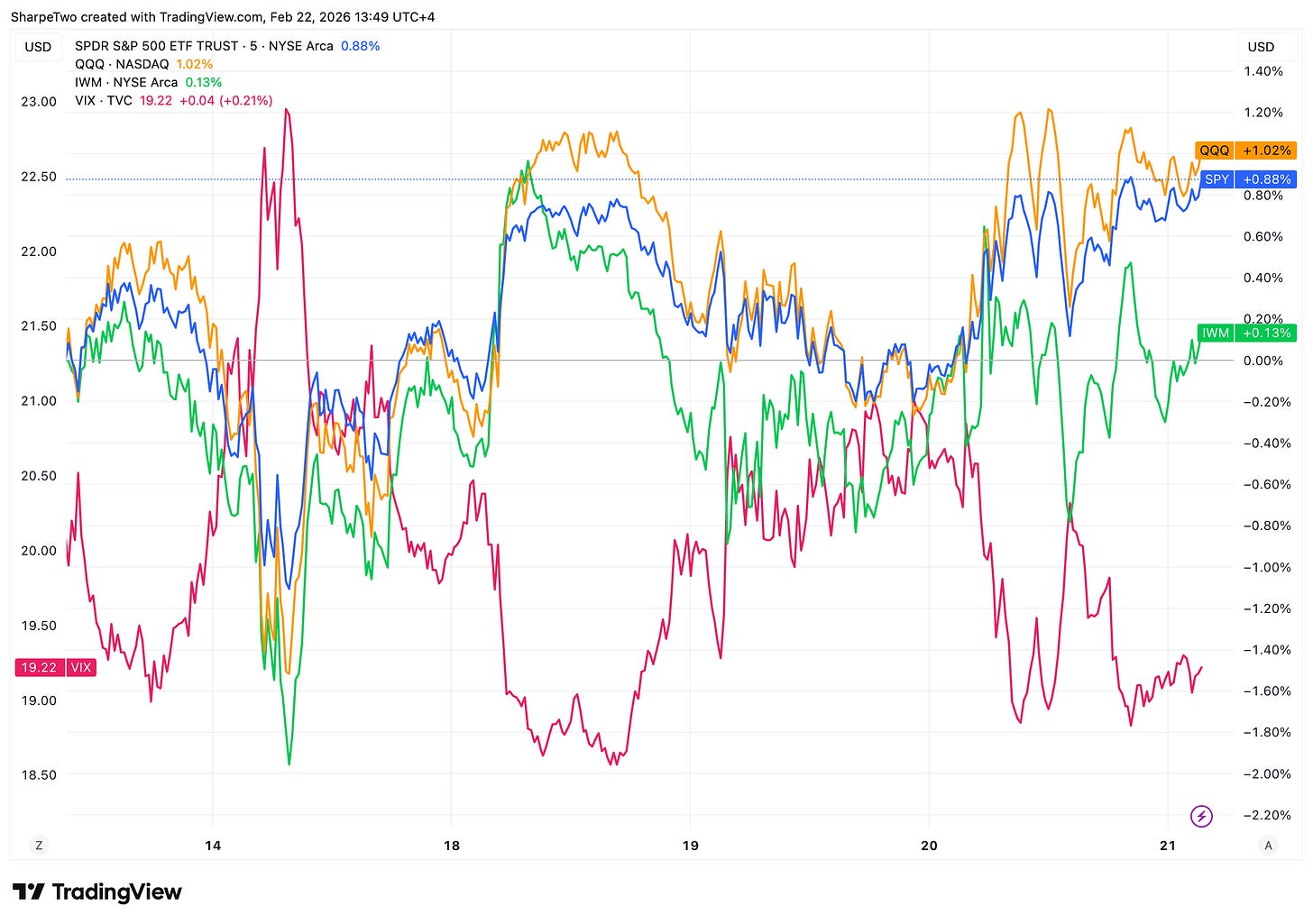

Another week of discomfort in the US equities market but another week where from a pure rational standpoint, nothing much happened. Sure the market closed up for a little bit more than 1% for both the Nasdaq and the SP500, but over the last three months, both indices are pretty much flat. In the meantime, IWM continues its march forward, adding 1.5% last week and up about 10% over the last three months.

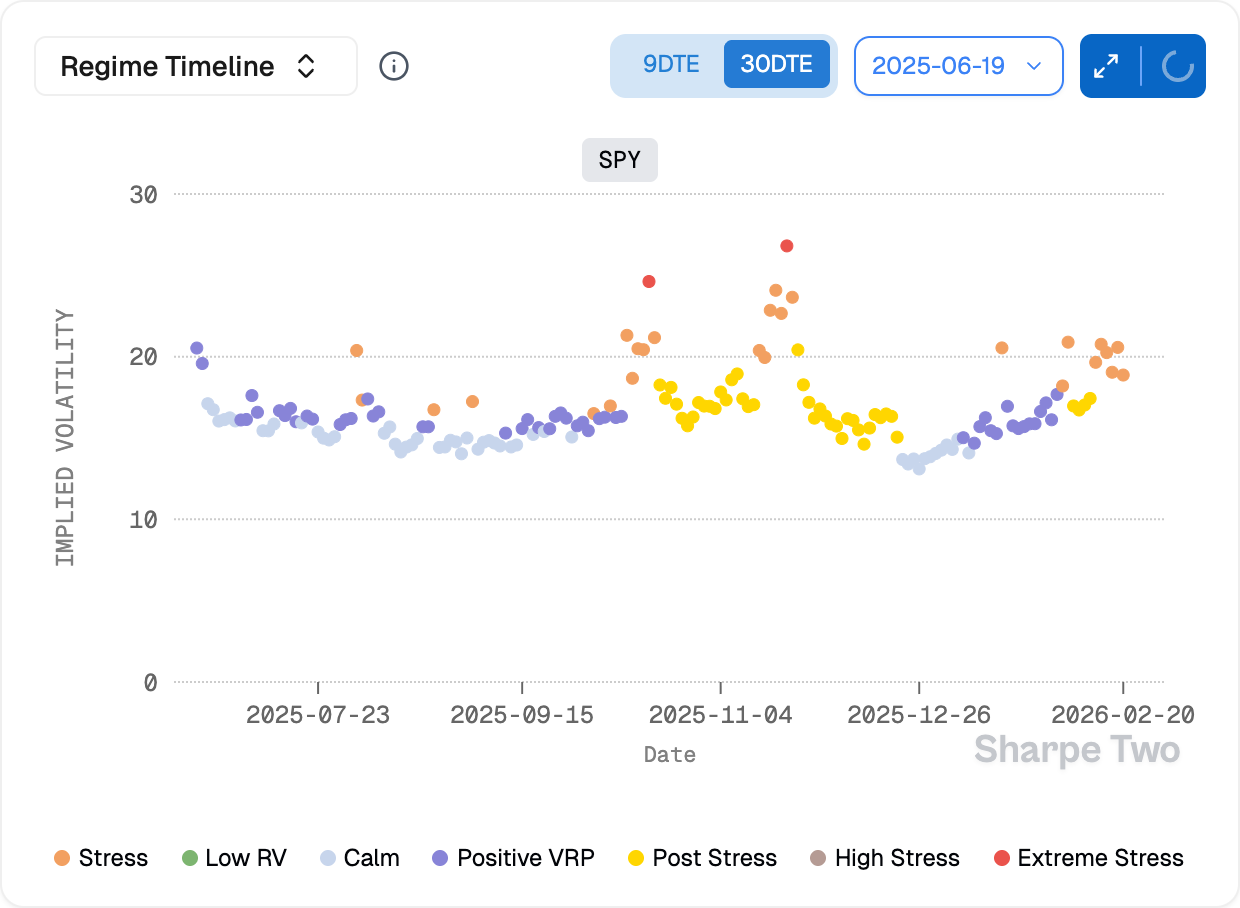

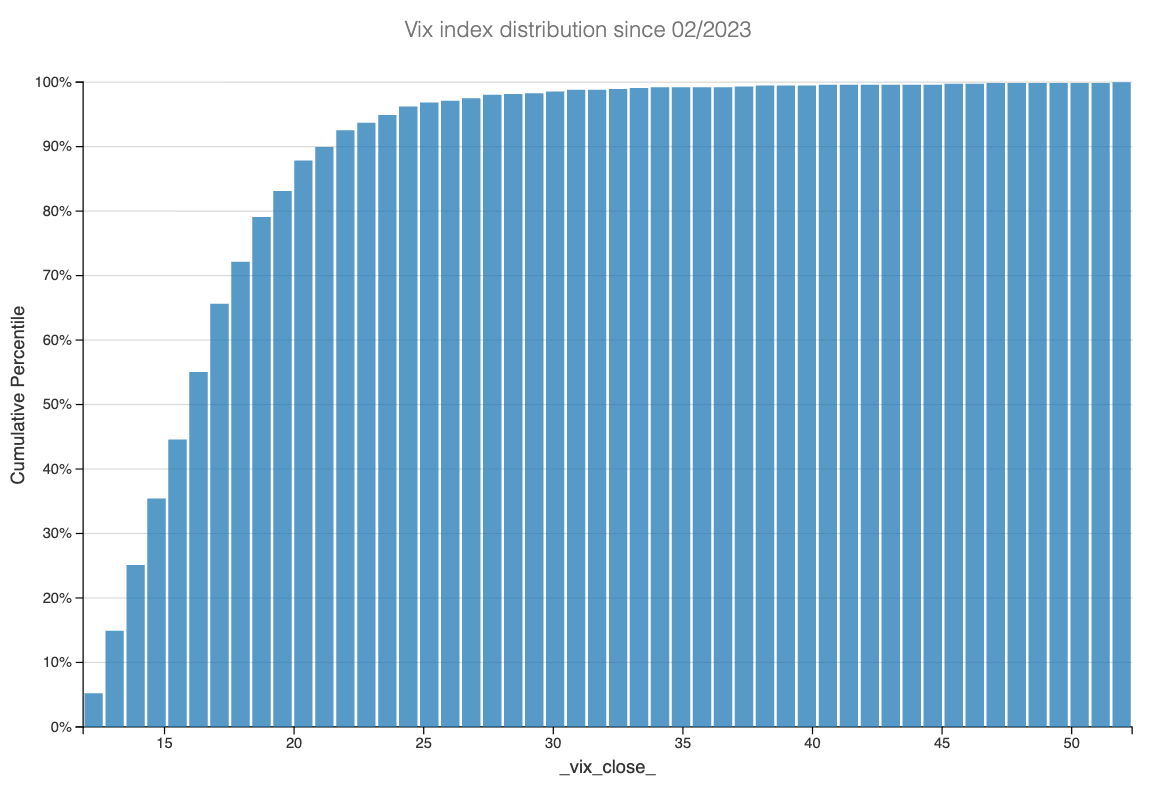

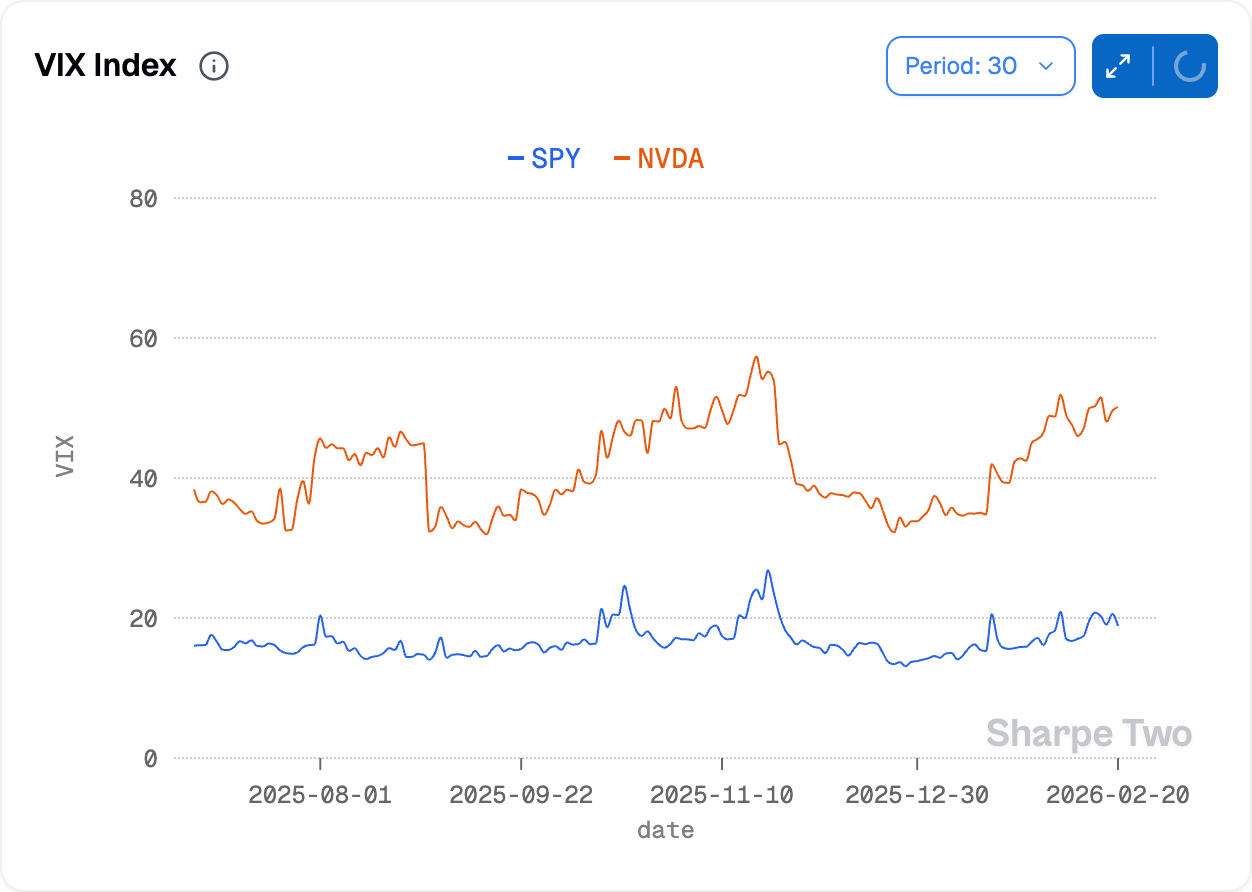

So why the discomfort? Well, because equities do not rise anymore. And for a market that has grown accustomed to adding percentage points every month like kids eat candy, the sudden diet feels odd. And this is perceptible in the level of implied volatility: the VIX closed on the 19 handle and while this in and of itself has nothing exceptional in the grand scheme of things, it didn’t happen too often over the last 3 years, where the regime has been geared towards lower readings.

Yes, a staggering 80% of the readings over the last three years have been below 19. When one considers that the long term average (and median) are roughly in the range between 18 and 19, this was an unusually calm market we just went through.

We can see eyebrows furrowing from where we are. Yes, it was, despite the tariff wars last year and August 2024, volatility in the market has been fairly contained: the fairly easy to read government policies and monetary policies were conducive to equity risk premium: rates would only go down from here, and the economy was resilient, why not buy stocks and why buy insurance?

That page has turned and uncertainty is now the dominant factor. Okay, let’s calm down for one second: not the kind of uncertainty you face when you are about to enter a recession. But the kind where the market has less visibility on the geopolitics: are/when the US going to intervene in Iran? With which consequences? Are the tariffs going to hold off or not? Where are the rates going to be at the end of the year? And … is NVDA going to deliver stellar results again?

That is a significantly denser agenda than what we had for most of 2023 and 2024 and as time passes and no clear answer arrives, well the market starts to hedge its bets. You can read much smarter analysis than this one, but in the end, it it all comes down to that. Because again in the grand scheme of things, the risk in the marketplace is still very manageable.

13% realized volatility over the last 30 days is in the grand scheme of things, fairly reasonable, especially when you factor in the wild move in commodities markets, the resurgence of worries around AI and the perpetual back and forth on the geopolitical scene.

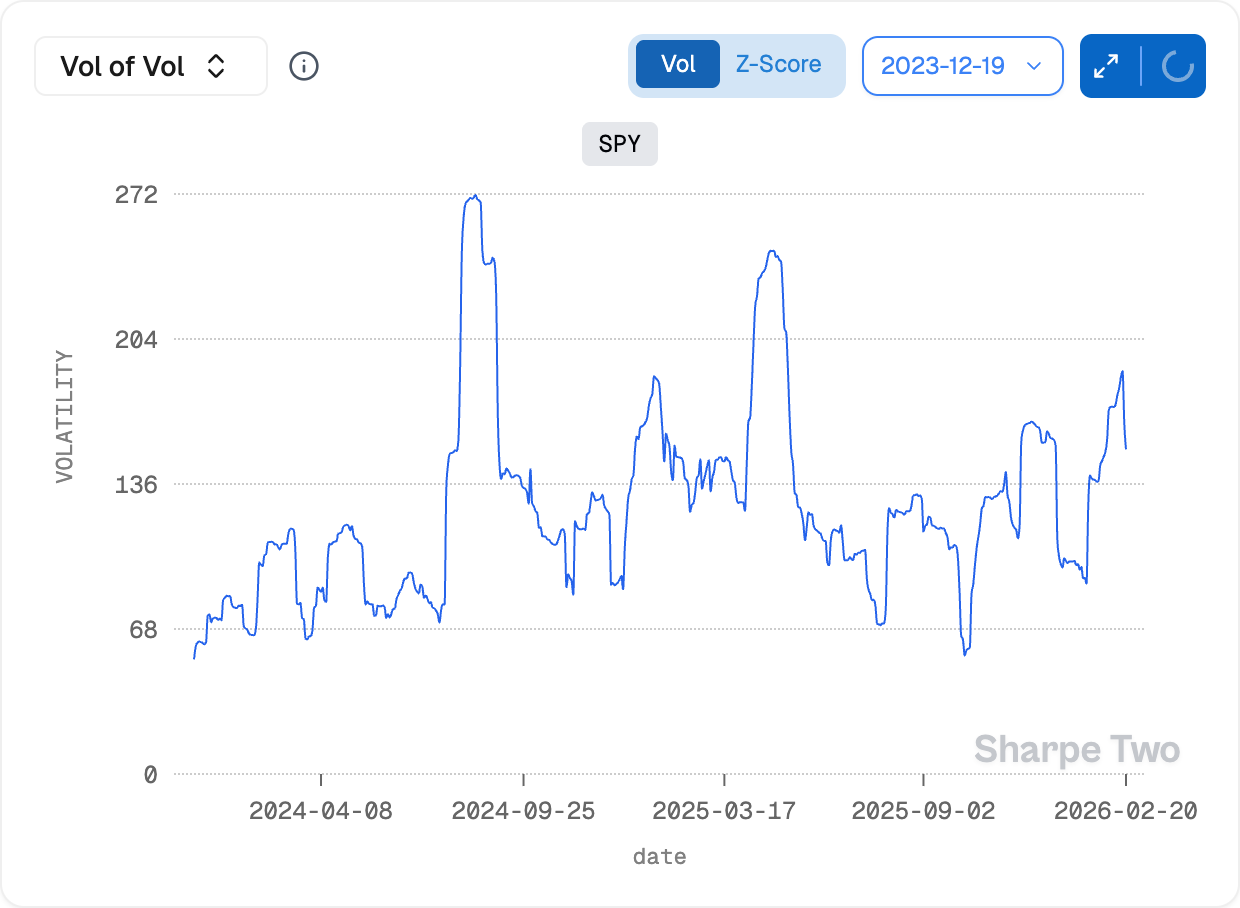

So yes, markets move, but they do not move that much. And market participants are increasingly worried and reactive, buying more hedges and selling them almost immediately which in turn, pushes vol of vol higher.

And while the metric came back from uncomfortable highs last week, it is still elevated; do not be surprised to see the VIX take 3 to 5 points in a session, to potentially lose them the next day. In that context, on the short side of volatility your customer base is well established: stressed market participants and in particular late hedgers, worry to see VIX getting a little too comfortable above 20 and unwilling to sell shares just yet (we would have lost a few percentage points otherwise) but quite interested in hedging. Or the purebred speculator thinking this time is the time.

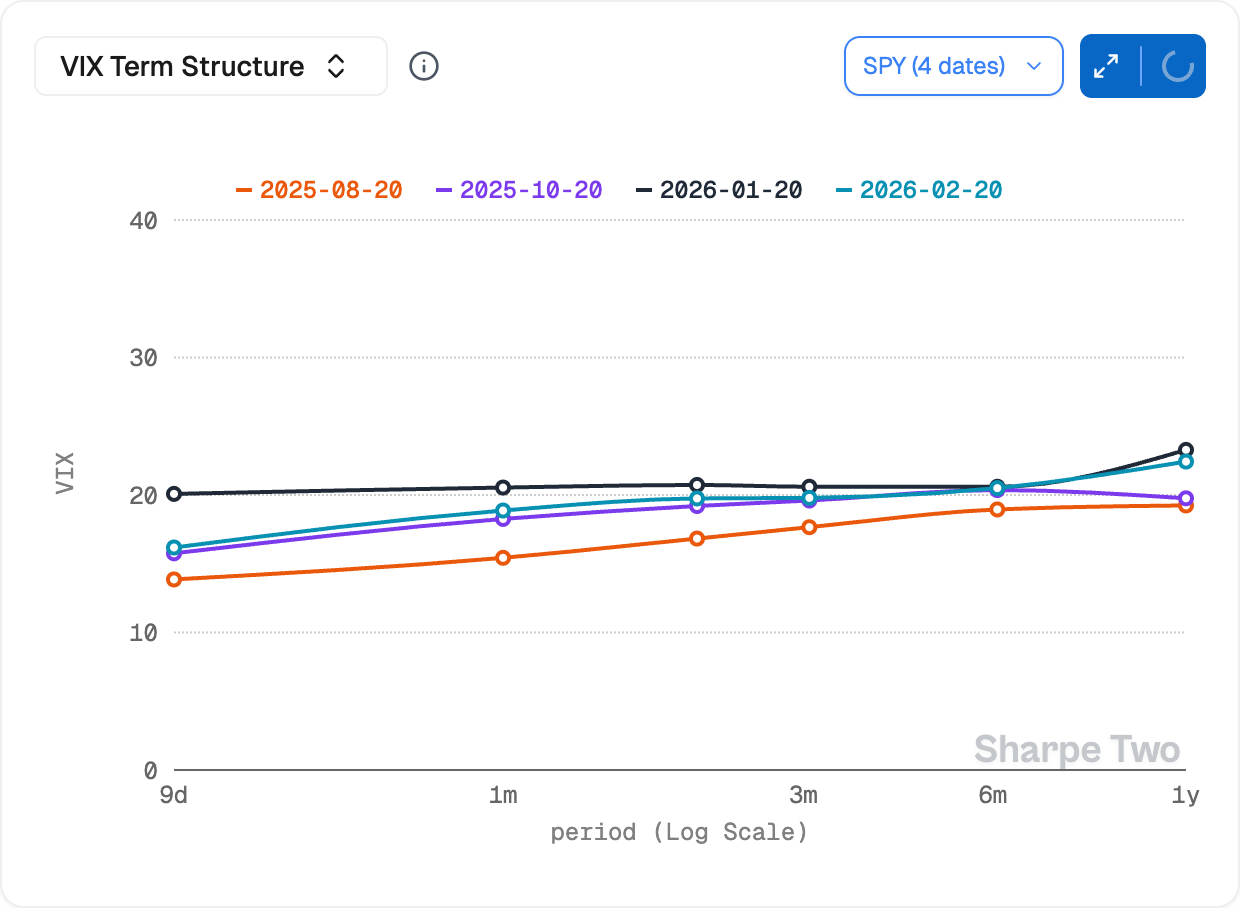

It is not terrible yet, and an environment where you will still make money more often than not selling expensive options, but one has to respect the data, even if so far everything is holding up. The term structure, while still in contango is becoming flatter by the day: tt is still driven by the activity in the front months, as the implied volatility in the back months hasn’t fundamentally recalibrated.

We will therefore give the same advice as last week: harvesting in the front months is okay, as long as you make sure to have some longer term options, filled with vega, and that will react very positively if/when the market decides that VIX 30 is worth paying. If you are a long term reader of Sharpe Two, you know that we don’t bother trying to predict these things. They do happen once in a while and often at the moment where nobody expected it. And while we may have been perfectly fine not wasting money on these in 2023 and early 2024, the regime has totally changed, and you should have them on, just to make sure the book is safe. NVDA earnings are next week, and while we suspect they will be good enough to not trigger a severe movement in the stock, and mechanically drag down a little the volatility in SPY, we never know: we still remember the feeling of a 25% overnight move in NVDA in May 2023. Just imagine what a down 10% would do to the market overall…?

But one can also look at the bright side: with NVDA earnings out of the way next week, that is a pretty big source of unknown out of the way. Do you think the VIX for NVDA will stay around 50? And considering the weight of NVDA in the index, do you think we will still be hovering around 20 on a regular basis? Maybe, if we find a new catalyst, and the busy agenda never fails to deliver a new one. Otherwise … all of that to say: resist being a late-night hedger.

In other news

What to do with the Trump tariffs? That is the question worth hundreds of billions of dollars. One cannot deny their effectiveness from a pure cash perspective: the US has replenished the treasury by almost 300 billions in one year. The only problem is that the Supreme Court has deemed them illegal. We have no clue what it means about the money collected, but we don’t think it will be handed back (cf the proper looting of Venezuela’s oil reserves on Jan 2nd). In the meantime, Trump is still very active on that front, signing an agreement with Indonesia to decrease it to 19% while at the same time, raising global tariffs by 15% over the weekend. It is tough for businesses to plan and anticipate their supply chain but also their pipeline of customers in such an environment and we are amazed so far that things hold up without breaking… How much longer? That is the other billion-dollar question and we wouldn’t bet on anytime soon either. The economy has proven it could adapt and is resilient to these shocks. At this point, this is more theatrics than anything (some very lucrative theatrics though, we give you that much).

Thank you for staying with us until the end, and as usual, here are two good reads from last week:

We have always said that trading solo is much harder than trading at an institutional desk: the level of schizophrenia needed to be risk manager, quant researcher and trader at the same time is unhealthy by any metric. Kris from Robot Wealth talks about it really well in this article.

And because risk management is often associated with iron condors, do not miss our latest article on our blog about them: you should trade them for what they are, a structure helping you manage margin requirements, but not a tool helping your trading over a long period of time.

That is it for us, we wish you a wonderful (NVDA) week ahead and as usual, happy trading.

Ksander