Forward Note - 20260215

Two propositions can be true at the same time

Another week is down for the US equity markets, with the SP500 losing a little more than 1% while the Nasdaq100 lost slightly less than 1%. This has been a recurring theme so far in 2026: big indices stumble, hurt by AI bubble concerns, while the smaller IWM thrives on the benefits of AI and automation for small businesses. Two propositions can be true at the same time, and so far, the great rotation continues.

Over the last three months, IWM is up nearly 10%, while SPY and QQQ are pretty much flat or slightly negative. The other interesting piece is the rally in the bond market since the beginning of the month. Rates in the US market keep falling, most likely in anticipation of more rate cuts to come in 2026. This is especially true following inflation reports suggesting prices are not growing anymore, alongside conflicting data in the job report. While we apparently added more than 130k jobs in January, the downward revision of more than 800k entries for the entire year of 2025 puts the growth at… zero.

The Volatility Regime

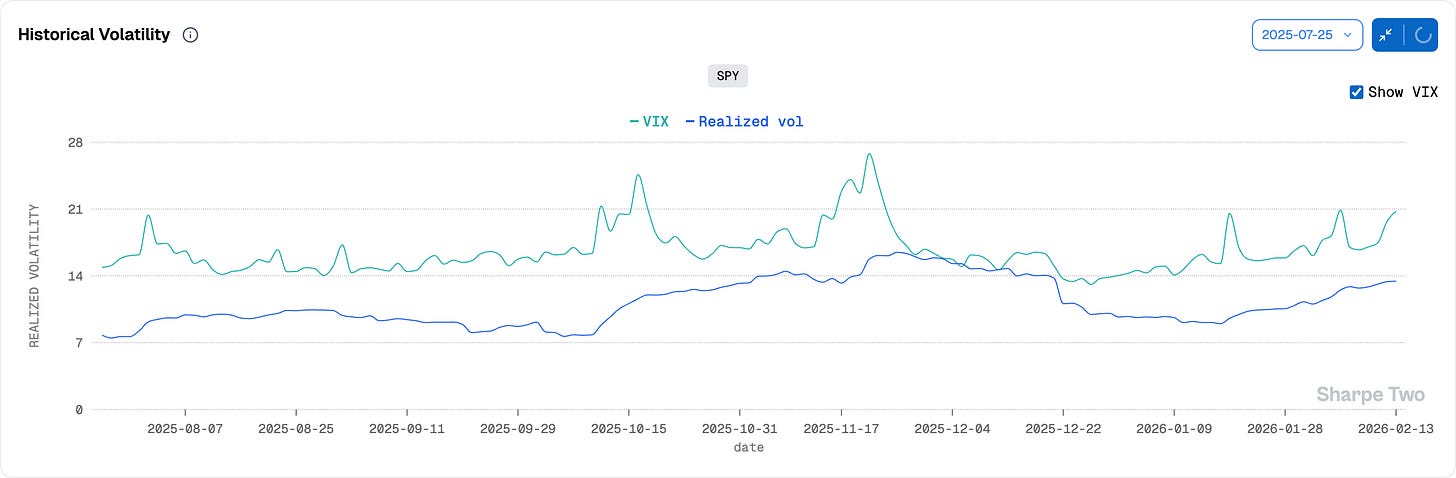

The VIX was also uneasy this week, climbing steadily in the second part of the week. While we haven’t had one of those spectacular spikes yet, the tension is palpable. “Vol of vol” is now at the same level as January 2025 and does not show any signs of cooling off.

We are now in territory that has been crossed only six times in the last four years: at the beginning of 2022 when the market was grappling with very high inflation (remember those 8% YoY readings?) and the Fed’s secular rate hike cycle; then August 2024; January 2025 with the early warnings of the tariff war; and then April 2025. While November already felt slippery, we now have sessions where a 3-point swing up and then down happens casually (this was the case again on Friday), right before a long weekend, mind you.

Of course, the fact that Trump has a habit of making announcements over the weekend, and that President’s Day is on Monday, may have something to do with it. The fact that another government shutdown is looming on the horizon does also. To add to that already volatile political landscape in the US, you indeed have to consider the latest tremor sent through the AI narrative. Anthropic products are good. Really good. So good that many businesses are starting to adopt them, and that poses some serious questions about a decoupling between the macro economy (what becomes of the job market?) and the micro economy (earnings may significantly improve).

7 points VRP in SPY: No big deal? Yes and no.

We talked macro a little longer than usual because one has to respect a high volatility regime and its evil twin, the often hidden “high vol of vol” regime. You open social media these days, and while people can feel that something is brewing, nobody can exactly pinpoint what it is.

The temptation here would be to keep doing the same thing, hoping that things won’t be different, after all you are still paid more often than not by selling options in SPY at the moment by the look at the VRP. But they are. Once again, we are at a level of vol-of-vol that has happened only six times in the last four years.

Could that be a passing phase? We would prefer it strictly: we would happily go back to a 6 or 7-point VRP market with low vol of vol and realized volatility not climbing anymore. Because this is the other story in the market these days: from 9% to 14% in a matter of a few weeks, here is another sign that the mood has drastically changed.

Now, realized volatility at 14% in the SP500 is still very much contained and could revert back to lower levels over the next few weeks without throwing a fit. Yet, with NVDA’s earnings around the corner and the next headline never too far off, it’s time to tread with caution: you will probably still be good selling the reading of VIX above 20. Make sure, though, that you let vol expand a few points before putting a trade on. With the current regime now firmly under stress, one has to do things differently to not get wiped out.

Hedging

We will assume that you bought some hedges in January when vol was relatively cheaper and there was no obvious sign that the picture would look like this a month later. If you haven’t done so, it will stink, but it is never too late to buy long-term hedges (3 to 12 months out), especially because while the term structure is flatter, the move has been mostly concentrated in the front for now.

While the 20-delta put at 1 month has repriced from roughly 11% to 17%, the climb is only from 15% to 17% at 6 months. If you feel uneasy about your risk profile, that is the first thing you ought to do on Tuesday morning while these wings at 6 months are still relatively cheap.

When looking at the forward volatility term structure, we are slowly heading towards what the market expects to be the most volatile period of the next six months: the last two weeks of March. There we will see another FOMC meeting, the quarterly expiration, and in the meantime, whichever political or AI-related news may hit the newswire.

It is still harvesting season until proven otherwise; just make sure you have a raincoat and an umbrella.

In other news

There was a somewhat stunning piece of information this week that almost went under the radar. A leaked memo from the Kremlin considered a potential return to using the US dollar for international settlements as part of a broader economic deal with President Trump. So much for the “unlimited friendship” with China, considering the week prior President Xi clearly unveiled his intention to make the Renminbi the new world reserve currency!

Well, both things can be true at the same time: if a deal with the US could allow some sanction relief or at least no extra pressure on the burning Ukrainian question, that would obviously be a win for the Russians. Once again, the geopolitical strategy from the US is as murky as ever. While they didn’t comment on the leak, Rubio just skipped another meeting with the Europeans on the future of Ukraine… while reaffirming the day before that the US did not see a future without “our dear friends from Europe”.

Exactly the kind of sentence the popular college kids in American series use before dumping their not-so-popular friends or romantic partner. It’s been a month since Davos and the Greenland escalation, and a year since JD Vance’s lecture at the European Security Summit. Yet, Europe still feels like it’s lagging by three or four moves…

Thank you for staying with us until the end. As usual, here are two interesting reads from last week:

We won’t lie: we’ve had a few existential crises while using Claude Code the last two weeks. Yes, it is that good, and we are slowly starting to see a path where token consumption is going to skyrocket in the enterprise over the next few years, as well as in the consumer space. You may think we are insane? It’s okay, you won’t be the first. And we are not the only technologists having to grapple with these feelings. Here is an excellent piece from Matt Schumer, infinitely more eloquent than us at describing the big things that are happening.

We usually steer clear of risk management questions at Sharpe Two. However, after a few heated conversations about the need for wings in our Discord channel, we thought we would at least provide a full view of what a forward-looking approach (the industry standard Monte Carlo) would say over a simple backtest (only good at telling what happened in a not so distant past and offering no glimpse on what the future could have been). TL;DR: Unless trading is a hobby and swimming in the adrenaline of an overnight gap while blaming the market makers is what makes you happy, buy these 20-to-1 delta strips of options at 6 months.

That is it for us this week, we wish you a happy (short) week ahead, and as usual, happy trading.

Ksander