Forward Note - 20260208

The price of anxiety

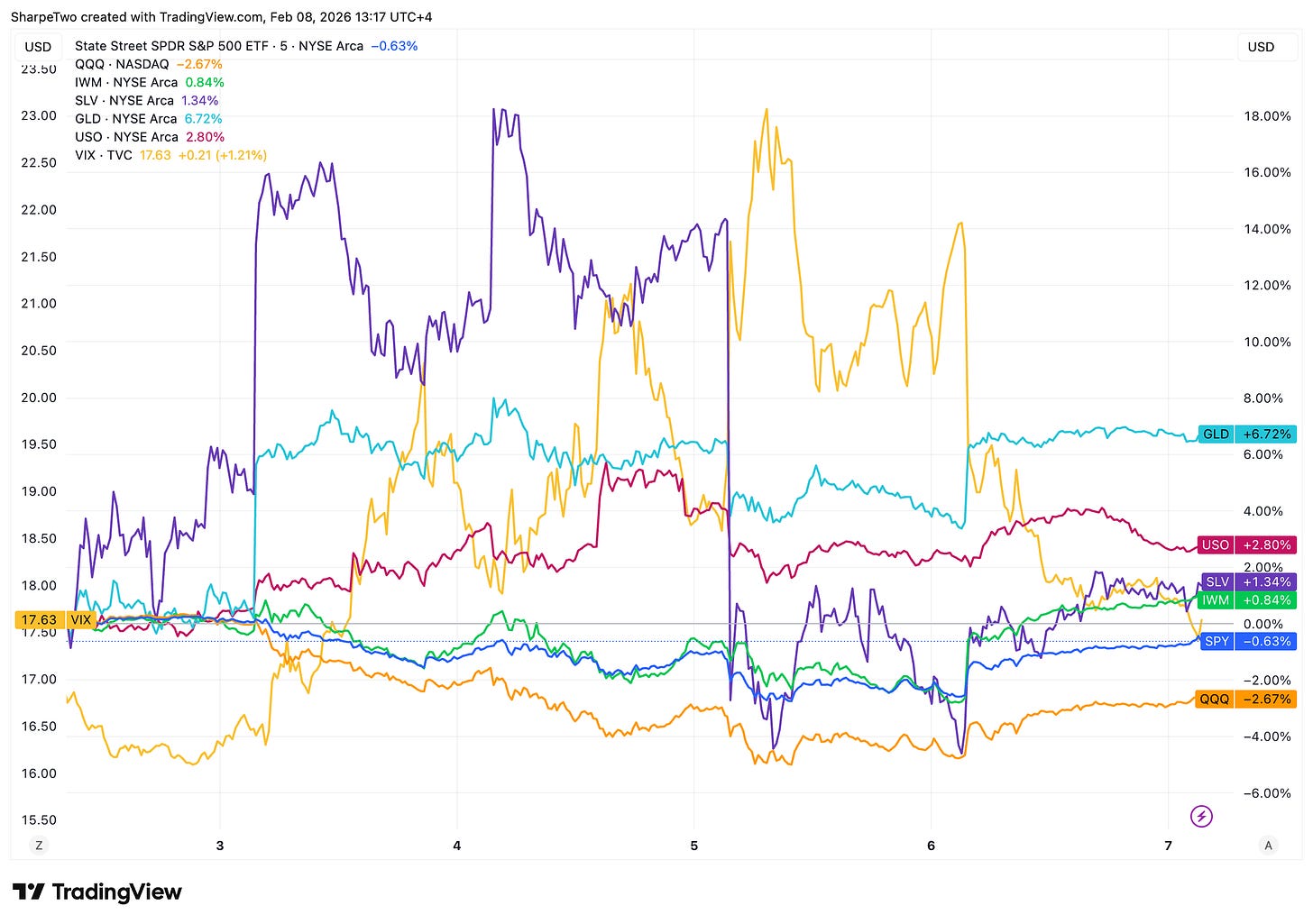

The markets were nervous this week, but they didn’t break. The S&P 500 ended the week mostly flat, but the great rotation out of technology and into companies that may benefit from looser monetary policies and AI automation, is continuing. As a result, the Nasdaq lost just under 2%, while the IWM added just under 2%.

SLV had another complicated week, losing more than 5%, while GLD rebounded by as much as 6%. The other big loser is Bitcoin, erasing most of the Trump-era rallies. Despite a significant rebound on Friday, investors will keep a close eye on it; there were fairly credible rumors about a large Asian fund, badly hit in October 2025, reaching its 90-day redemption limit, which could have accelerated the downward move last week.

The overall nervousness was highlighted by the VIX. Despite finishing the week comfortably on the 17 handle, it caused multiple cold sweats ahead of the next jobs report, especially when we learned from Wednesday’s ADP figures that job destruction was the highest since January 2009. Nothing more needed to be said for investors to pile into hedges, catapulting the VIX above 20 and flirting with 23 at times on Thursday.

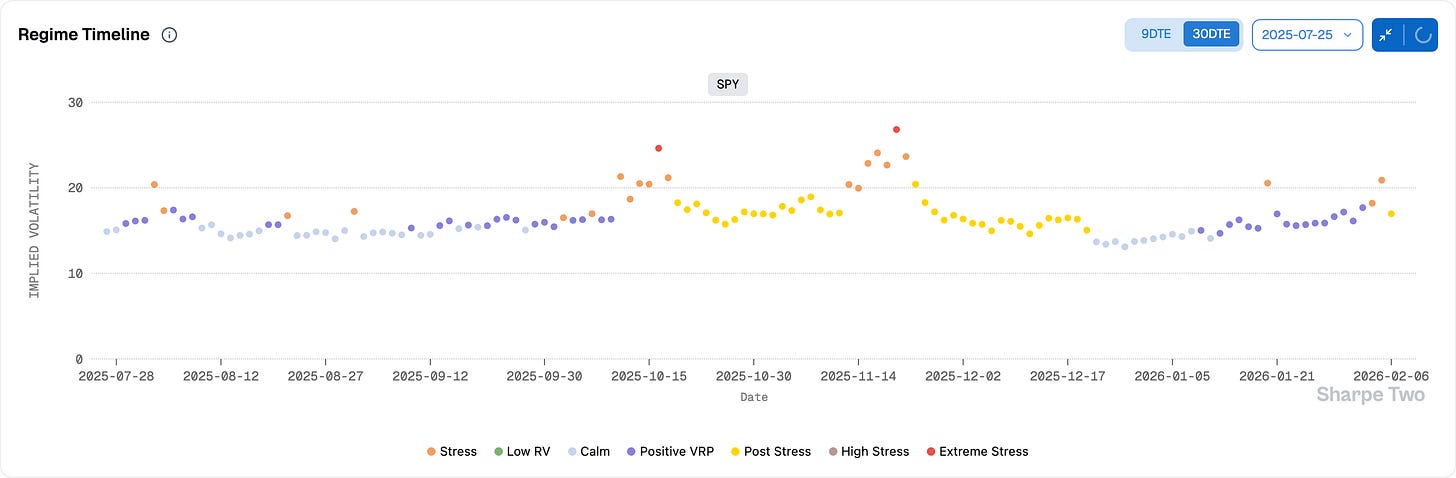

To be honest, this nervousness was the dominant regime for most of Q4 2025. After a well-deserved end-of-year break, it has returned in full force since mid-January.

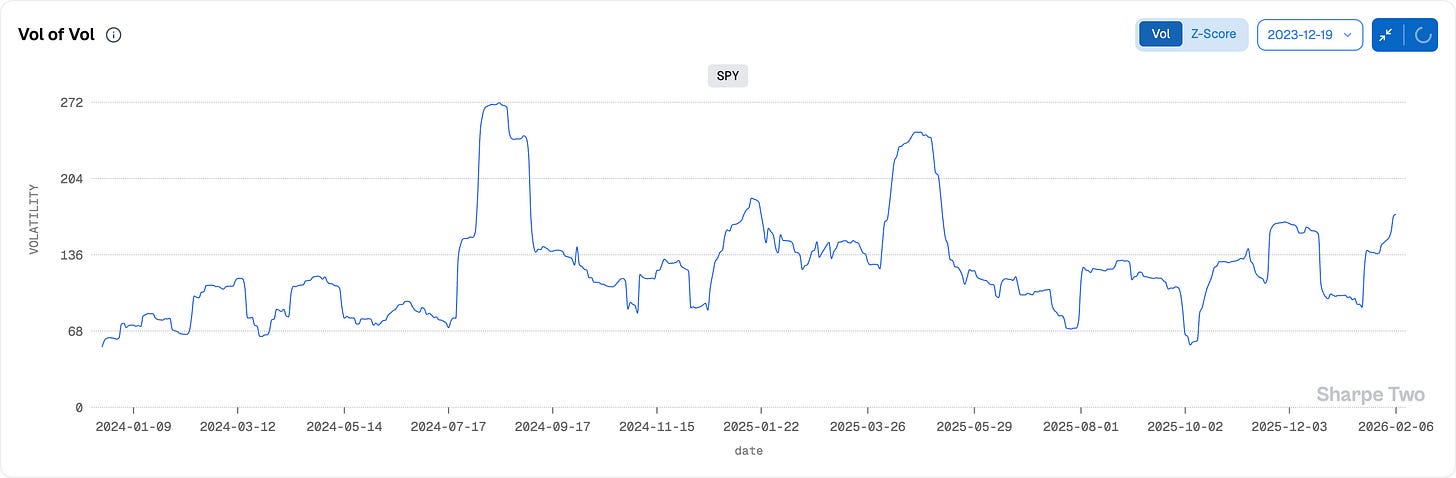

Sure, the VIX readings are not as bad as what we saw in October and November of last year, yet the feeling is very similar. Why is that? We’ve been hammering this point for a while, and it is worth repeating: as long as the volatility of volatility remains as high as it is right now, you should expect to see VIX readings moving multiple handles in a single day.

We are now at similar levels to those observed in November of last year, when the AI narrative dominated the marketplace. They are also similar to a year ago, when a mix of geopolitics (early signs of tariff wars on the horizon) and technology (the first DeepSeek moment) made investors quite angsty.

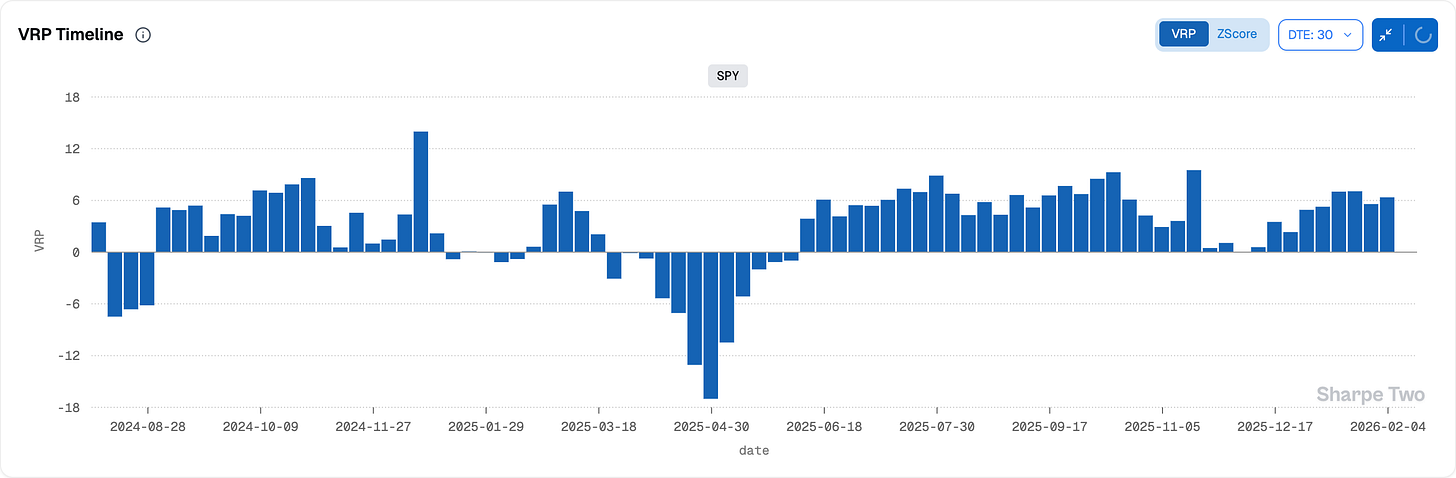

At that time, however, things were fundamentally different: the market was in denial, refusing to buy more hedges. Investors were betting that a Republican administration would bring the stock market to all-time highs and therefore, why pay for costly hedges?

This time, it is the other way around. Unable to trust the degree to which the current administration is willing to see how resilient the economy will be despite self-inflict wounds (often by torpedoing relationships with traditional trade partners) the market is consistently overpaying for insurance.

In the month leading up to the presidential election, you could sell options in SPY with your eyes closed. That changed when Trump was elected and the variance risk premium (VRP) disappeared. While realized volatility gradually increased during that period, the market never really accepted overpaying, except in March. Since then, with the rare exception of November, you can constantly extract 6 points of VRP on average from US equities.

So what to make of it? Sure, you should feel nervous and respect a market that collectively prices in a high chance of something happening over the next 30 days. But you have to bring nuance and wonder if this isn’t a little overpriced, especially considering where the risk (realized volatility) currently sits. In situations like this, we like to look at a sector that is often a bellwether for the entire marketplace and economy. XLI is a good candidate, but we prefer XLF, as banks remain the pillar of the modern Western liberal economy. At the moment, our signals show a high likelihood that the implied volatility you sell today will exceed realized volatility.

It reached a neat 75% on Thursday, with 6 points of VRP to harvest (unusually high for XLF). Here, you have two possible scenarios: either banks are on the verge of a collapse that no one saw coming, or, while it is fair to expect a little more movement, the cost of insurance is likely overdone.

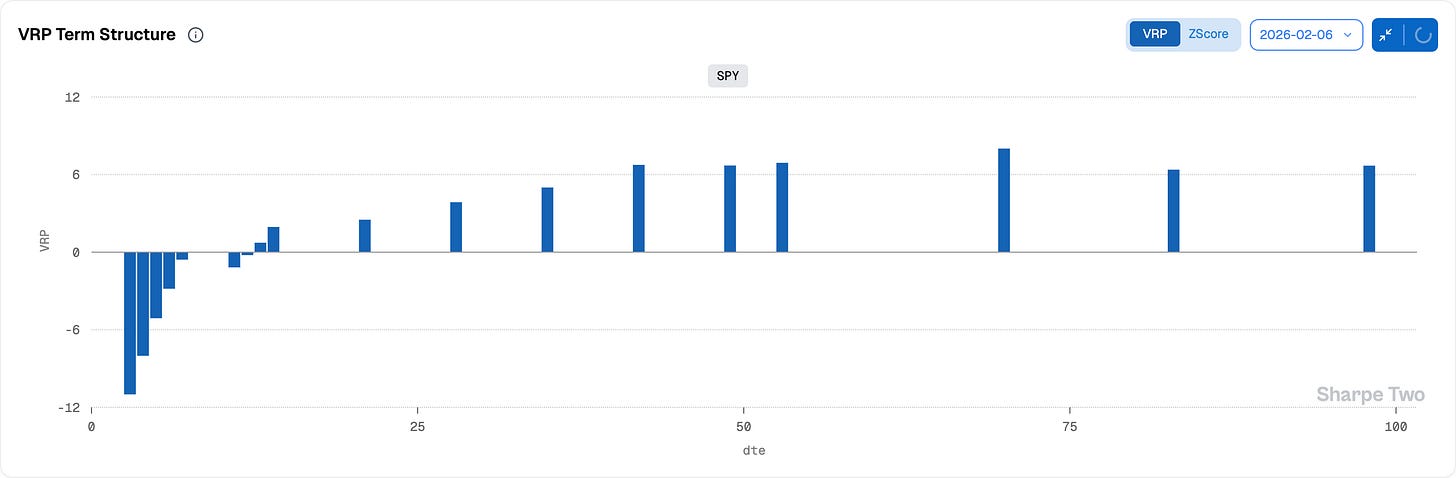

Nervousness in the market is often the mark of something brewing that we will only fully grasp later, or the ripple effects of a broken bone where the wound isn’t fully healed yet. Investors are ready to pile on Band-Aids, just in case the bleeding comes back in full force. We are in the camp of selling Band-Aids at the moment. We are not saying they are useless, simply that they are overpriced. Not all of them are, though: short-dated options are not particularly expensive by many accounts, especially in a regime where realized volatility is still climbing.

If anything, you may be better off on the long side of short-dated options right now, waiting for a surprise headline to push the market in your direction. 0DTE (zero days to expiration) options can be an effective and cheap risk management tool; they should never be considered a substitute for the long-dated options you buy on a regular basis. However, once in a while, buying cheap gamma ahead of a busy week is an interesting way of capping your risk, and your broker will thank you for it.

In other news

The technological sector is dead, apparently. This is the big theme of early this year, with many tech companies hit again by the “Claude Code” moment. 4% of commits on GitHub are now co-authored by Claude; this could be an early sign that many technology companies without strong moats could be disrupted over the next few months or weeks by much leaner, agentic companies. Essentially, SaaS disrupted heavy workflows—Excel and Word at worst, or physical applications installed on your machine. Now, SaaS could be disrupted by AaaS: Agentic as a Service.

Okay.

Despite being massive adopters of AI (100% of our commits in 2026 have been generated by Claude Code) since GPT-3, we view this with a mix of amusement and consternation. Do you really think AMZN or CRM, which lost 11% this week, is about to get disrupted by a bunch of kids writing code with an LLM in Antigravity and might make a cool video about it? We are definitely selling that put. That some companies may suffer (yes, Monday and Asana, we are looking at you) is obvious. But as usual, the market is throwing everything out without asking questions, leaving the answers for later. What does that leave you with? Understanding the space and looking for opportunities where the market sees only risks.

Thank you for staying with us until the end. As usual, here are two interesting reads from last week:

Thank you for staying with us until the end, as usual, here are two interesting reads from last week:

We are not entirely sure how this piece ended up on our feed, but boy, it took something out of us. Ever heard of free soloing? Probably not. It is the sport (and frankly, art) of climbing with no equipment—where a fall almost certainly means death. It is raw (due to the author’s personal experience with climbing) and quite philosophical. Many parallels with trading can be drawn, especially on the retail front, where one bad trade especially in 0 dtes, can mean wiping out your account. That is why you should read it: lamenting that “it is not fair” is never a solution.

Finally, here is a deep and detailed piece of research getting into the details of what may be at play in the technology sector right now. LLMs have passed the chasm from “nice little pet toy” to something the enterprise will eventually start to consider in the next 2 or 3 years. Long, but definitely worth the read.

That is it for us this week, we wish you a wonderful (CPI) week ahead, and as usual, happy trading.

Ksander