Forward Note - 20260125

Rupture.

In recent years, the World Economic Forum in Davos has become somewhat of an obligatory rite of passage on the geopolitical scene. While most discussions happen behind closed doors, important CEOs occasionally take the stage to get a message across. Last year, for instance, everyone at Davos was buzzing about the “DeepSeek moment” that shook Silicon Valley: the realization that OpenAI was not the only player capable of using transformers to build LLMs and that a Chinese competitor could do it at a fraction of the cost. The market took a beating that Monday in early 2025, spiking volatility right out of the gate.

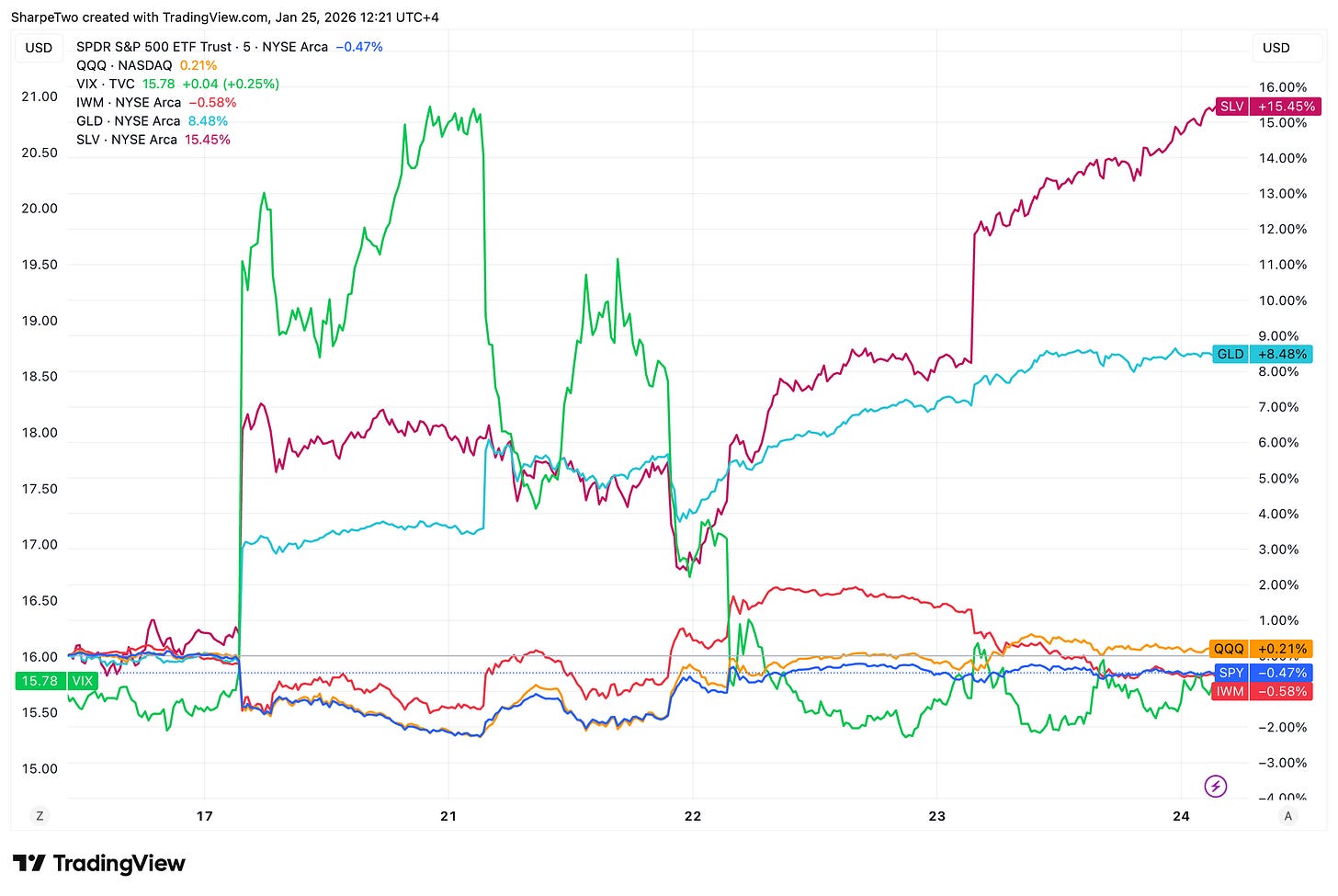

In 2026, however, there was no such beating in the stock market. The main indices were mostly flat, with the S&P 500 losing slightly less than half a percent and the Nasdaq gaining about the same. The VIX closed mostly unchanged, sitting right on the 16 handle.

The one notable shift at Davos this year was a change in the main characters. Jamie Dimon gave an interesting interview where he praised the President’s domestic performance while simultaneously casting doubt on his trade policies and influence over the Fed. But the real star was Mark Carney. Many analysts argued he gave a speech that will be remembered for a long time: the old world order “is not coming back,” he said in substance.

If you have any doubts about that statement, just look at the performance of precious metals this week: silver is up 15% and gold 8.5%. The last time we saw performance like this was back in the 1970s, right before the Bretton Woods system was thrown out the window.

This matters. If you weren’t paying attention before, you must now: the financial world is clearly positioning itself for the dedollarisation of the economy. Is this reaction excessive? Time will tell, as credible alternatives have yet to be brought to light. To paraphrase Winston Churchill: if democracy is the worst form of government except for all the others, the greenback remains the best of many bad options, except, perhaps, for precious metals.

Considering the geopolitical and economic instability stemming from the United States, it is possible that while the dollar remains the reserve currency for now, the performance of precious metals will accelerate.

In other words, one must pay close attention to geopolitical developments in 2026, probably even more so than in 2025. As Carney said, “there is no coming back.” If you ignore this, you may get caught on the wrong foot more often than not. Just look at the weekend’s salvo regarding Greenland ahead of the WEF: Trump’s comments were largely responsible for the spike in the VIX, which flirted with 20 on Tuesday before pulling back on Wednesday as he walked his comments back.

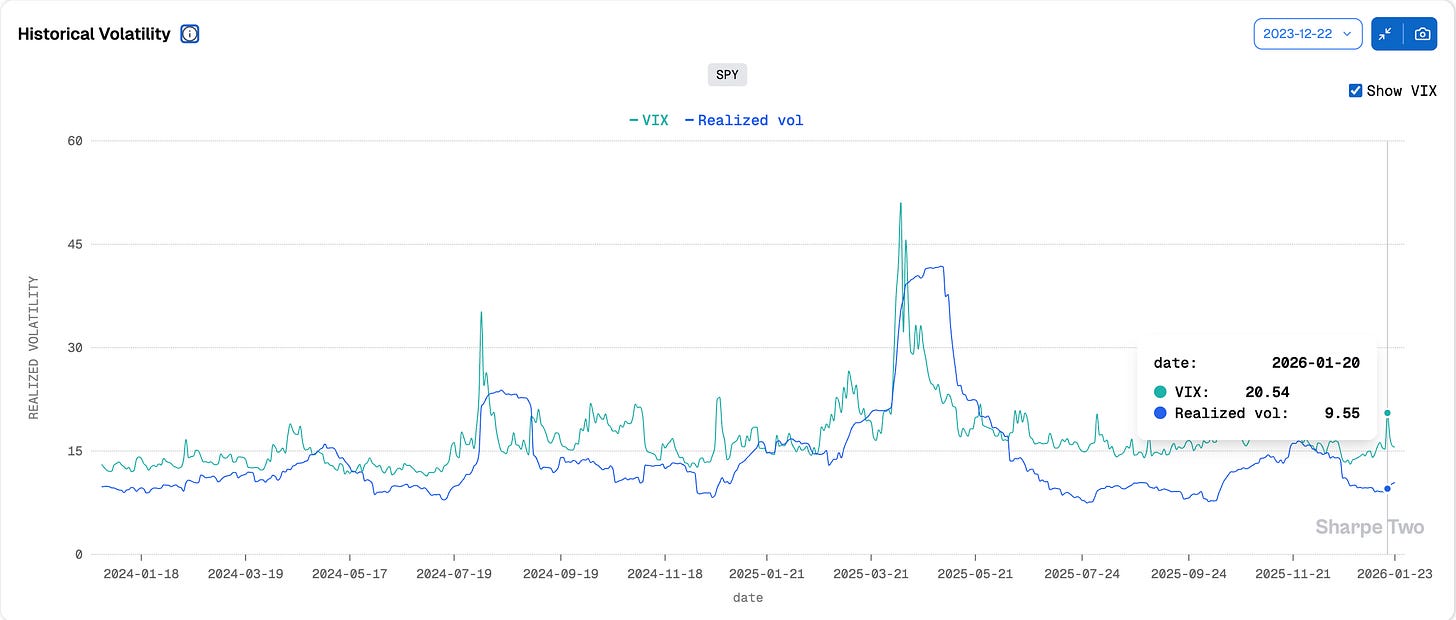

At that moment, the variance risk premium (VRP) was so pronounced, and the pattern of “escalation/de-escalation” so clear, that the trade was almost a no-brainer. Implied volatility came back to its senses throughout the rest of the week, helped by solid US economic data. The economy isn’t running hot, but it is robust, and we are now back to about 6 points of VRP in the SPY.

Let’s be rational for two seconds: this is more than enough to make money in a broadly diversified index that represents the US economy fairly well (yes, yes, we know tech stocks are heavy).

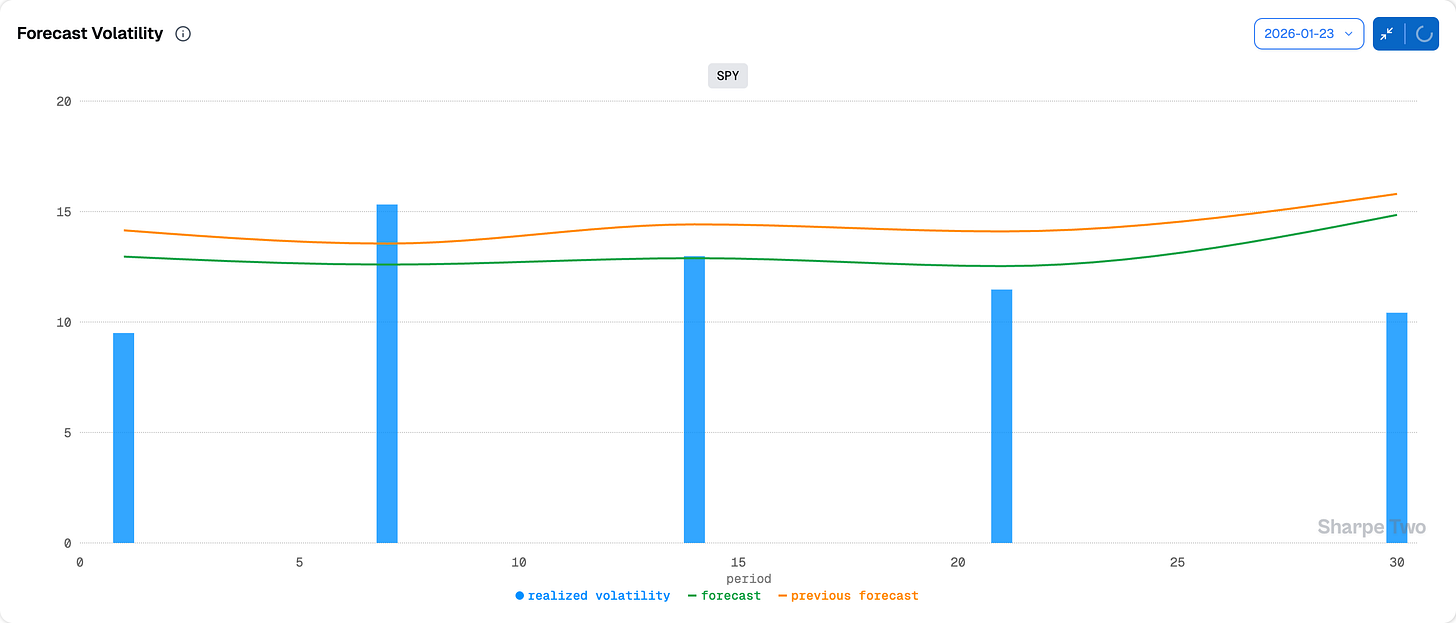

Is this VRP stable? On the surface, yes. Unless proven otherwise, realized volatility hasn’t given clear signs that things will accelerate just yet.

However, the data points to a slightly different picture: realized volatility is expected to rise over the next 30 days. Tech earnings and next week’s FOMC meeting could be catalysts, though the market reaction there is fairly anticipated: “wait and see” until May and the new Chair.

What is not anticipated is the next geopolitical catalyst. The White House seems to have a rotating agenda between different blocs. After some silence on China and Ukraine, one should almost expect a headline and a potential knee-jerk market reaction soon.

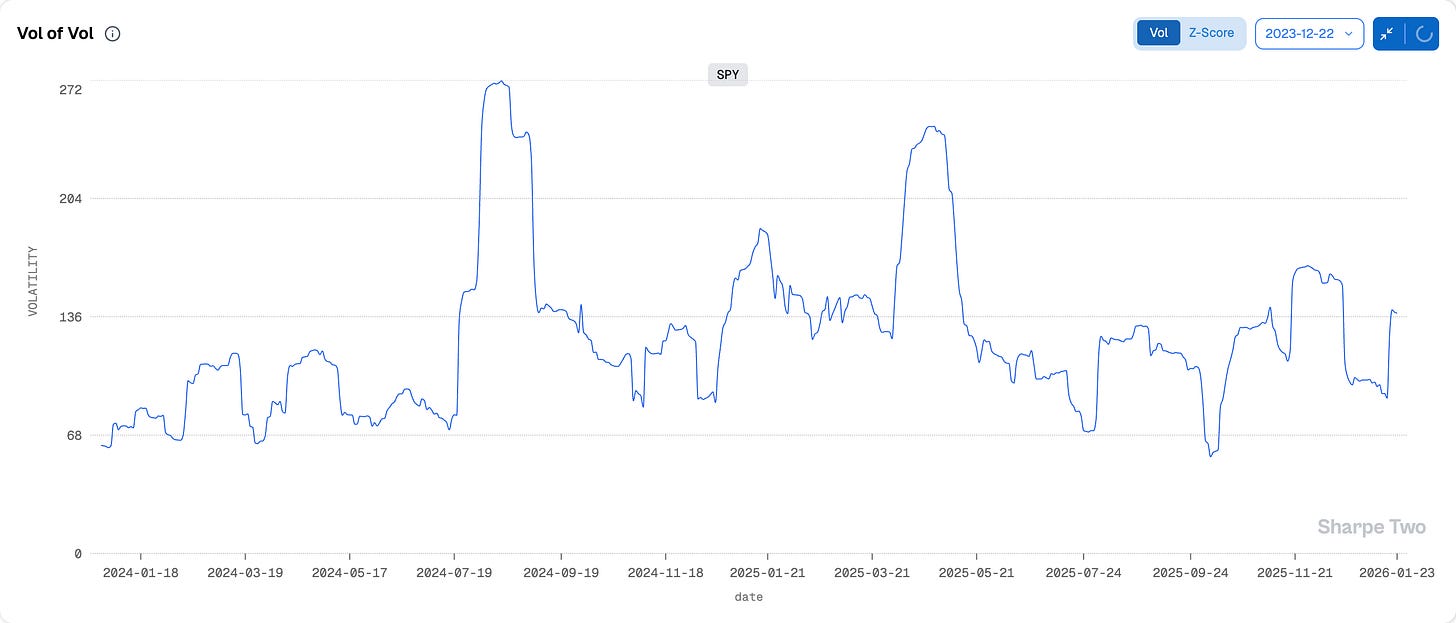

Let’s look at the volatility of volatility (vol-of-vol). It has climbed back to last October’s levels, and while still slightly under November’s highs, it is on the higher end of the range we’ve seen over the last two years. Until further notice, do not be surprised to see the VIX jump 3 or 4 points in a single session.

You see where we are going with this? If you plan to harvest the VRP in the US, keep some dry powder for potential hiccups. You want to avoid implied volatility dragging down your PnL even if realized volatility doesn’t meaningfully pick up.

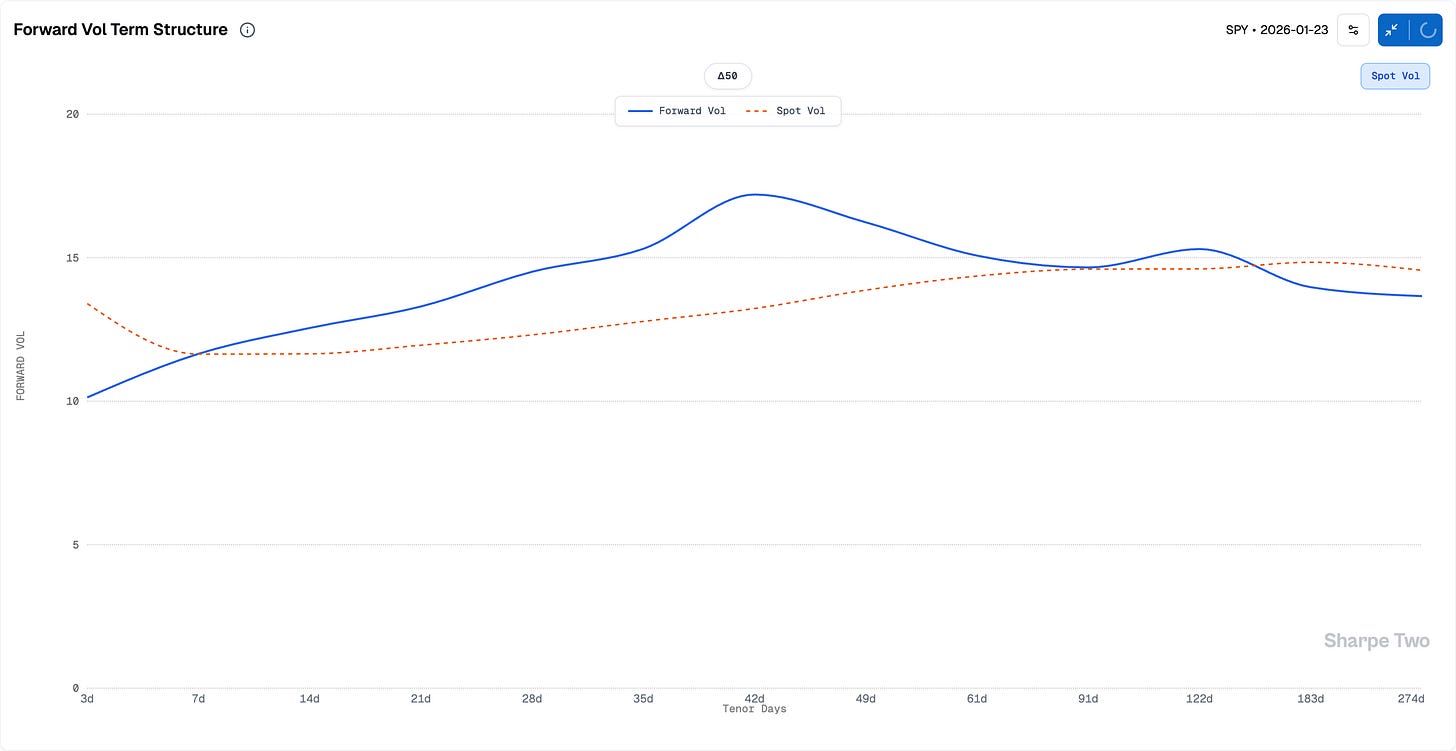

Looking at the forward volatility term structure, the market isn’t convinced anything serious will happen past the FOMC. Spot vol at 3 days shows a little less than 14% implied, while the 3-to-7-day slice shows 10%. But more than ever, you must be comfortable expecting the unexpected on the geopolitical front. Do not become complacent just because nothing happens for a few weeks.

Buying strips of cheap options to hedge the book makes sense, especially if you are harvesting VRP. As usual, there will be a moment where escalation is not immediately followed by the expected de-escalation, and being short volatility will be painful. In the meantime, let’s keep playing this game of musical chairs.

In other news

Just as Jamie Dimon’s name is being heard more frequently regarding a potential presidential run three years from now, he received a special gift from the White House on his way back from Davos. A lawsuit for $5 billion USD. President Trump seeks damages for having been “debanked” by JPM in 2021 following the events of January 6.

While JPM has acknowledged the complaint and intends to use all its might to “respond and defend itself,” a pattern is emerging: tariff threats on the geopolitical scene, and lawsuits on the domestic scene. Dimon joins a list of glamorous names targeted recently: Murdoch, the BBC, the Wall Street Journal, and of course, Powell. Not bad company at all.

We do not doubt that Jamie will find comfort in his newly found situation via his last paycheck: a nice 10% bump to a whopping $43 million USD. Most of his wealth is tied to JPM stock, and his fortune is estimated to be around $3 billion USD after more than 20 years at the helm.

Thank you for staying with us until the end. As usual, here are two good reads from last week.

It is the end of January, usually the moment where many resolutions made four weeks earlier go to die. So, here is a little pep talk to get you back on track: despite all the uncertainty, there is no better time to be alive and do what you dream of doing than now.

It is no surprise that the author of this newsletter is a big fan of Euan Sinclair. I learned so many tricks from him over the course of my options career that it is fair to say this newsletter wouldn’t be here today if it wasn’t for his book, Volatility Trading. Long story short, here is an interview with yours truly, hosted by Euan Sinclair for Robot Wealth, and needless to say, a proud moment.

That is it for us this week, we wish you a great FOMC week and as usual, happy trading.

Ksander