Forward Note - 2026/01/18

Rotation.

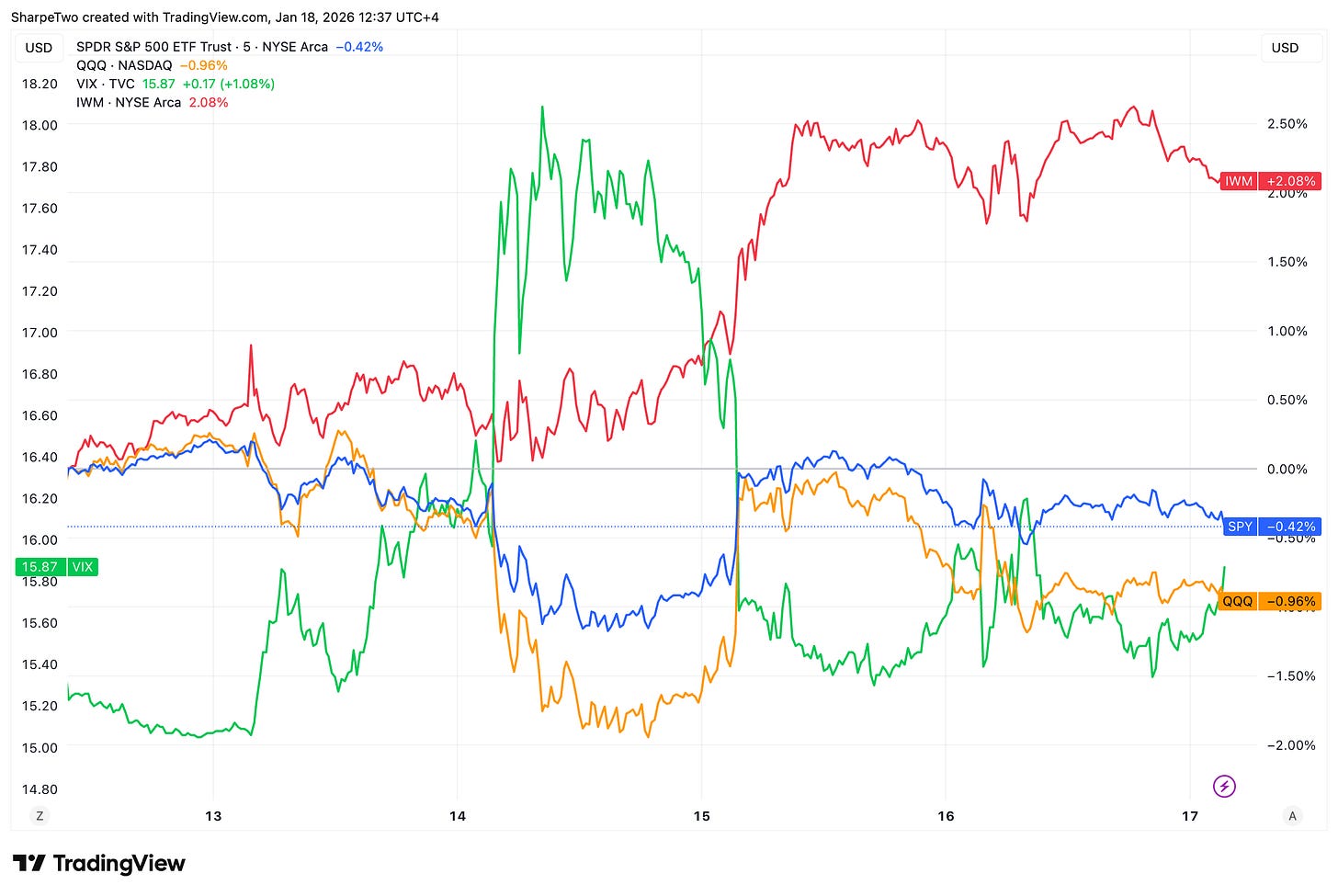

Another fairly quiet week when it comes to equities price action. Despite the major indices finishing in the red, with the S&P 500 losing a little less than half a percent and the Nasdaq Composite a little less than 1%, trading was fairly muted for the second week of the year. The main driver was rotation, with the Russell 2000 up two percent, as the market broadly anticipates a more accommodative monetary policy over the next twelve months.

This should not really come as a surprise. President Donald Trump is due to announce the next Fed president anytime now, but could not resist one last blow at Chairman Jerome Powell, whom he nominated in November 2017. During his eight years at the helm, Powell is widely regarded as one of the most effective chairmen the institution has seen. Yet the criminal investigation launched against him tells you everything you need to know about the level of connivance expected between the White House and the Federal Reserve once Powell leaves his seat four months from now.

Markets are cynical, yes, and if this comes as a surprise, you ought to do a few good reads from Michael Lewis. The Russell 2000 up two percent is a good reminder that money has no smell. At the end of the day, a dollar is a dollar. That being said, the very strong reaction from Jerome Powell himself, from central bankers around the world, and from some important figures in the US financial kingdom, starting with the king himself, Jamie Dimon, also tells you everything you need to know: at a time when the US is due for heavy debt-refinancing, it would be a shame to see rate cuts having the opposite effect on long-term bonds. Be careful what you wish for has rarely felt more apropos.

But in the meantime, this is still not enough to agitate markets, which seem more busy catching up on a backlog of deals, according to the Financial Times, than focusing on recreating the ingredients of a genuinely scary situation.

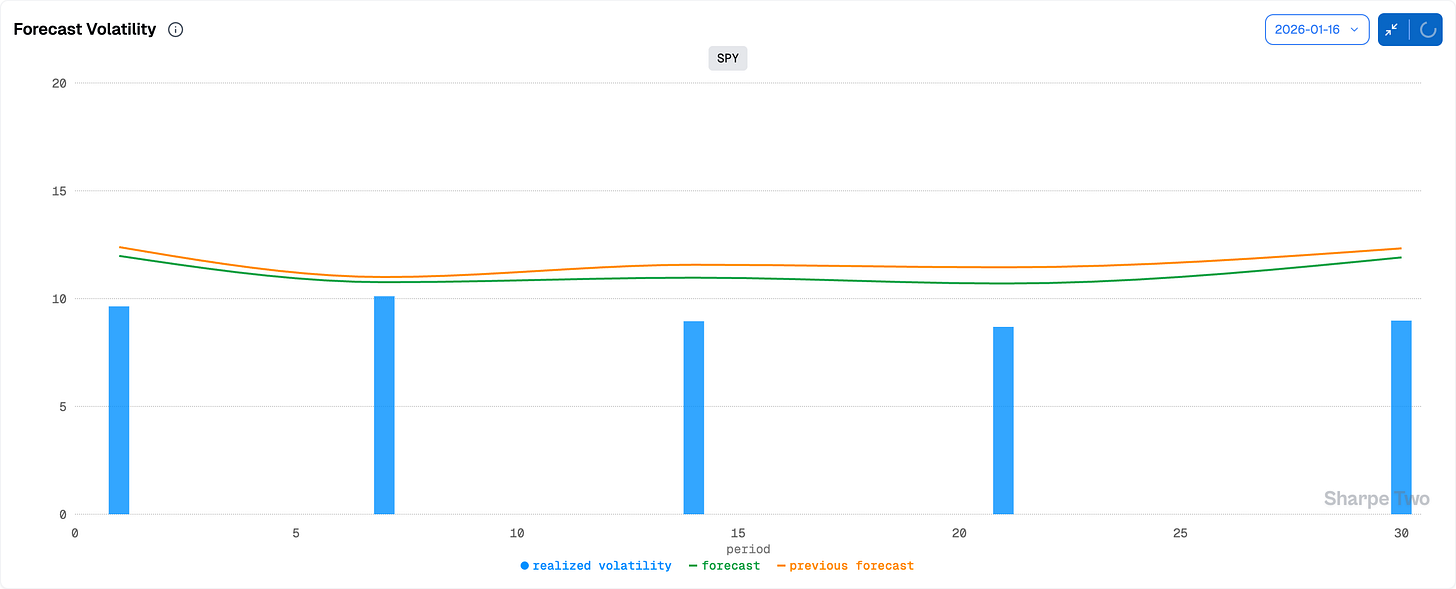

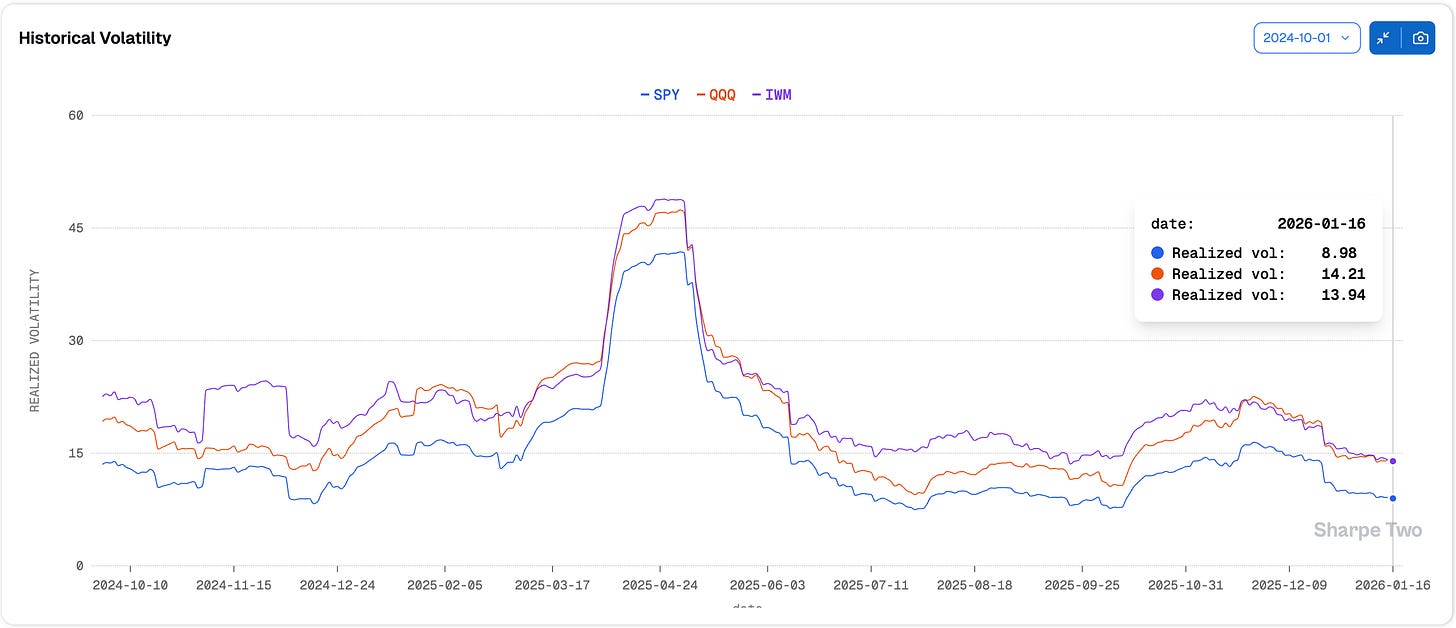

Realized volatility is still melting, currently sitting below 9%, right where it spent most of Q3 2025. As a reminder, that is roughly six points below where we started 2025. Remember the bad days of October and November 2025? That was the starting point of January 2025, and things never really got much quieter until the big fireworks of April.

One never wants to overfit the past. It is the quickest way to miss the next corner. But as things stand, it would take serious catalysts and renewed uncertainty for the market to switch gears..

Yes, our models do anticipate realized volatility to potentially go up and resettle somewhere around 11 or 12%, but as it stands, nowhere near 15%, let alone 20%. Once again, it does not mean it cannot happen. During a call with one of our platform subscribers, we were reminded of a day in April 2011 when we had to rush back to the office because of an earthquake followed by a tsunami in Japan, threatening a nuclear plant. The very definition of a black swan is something you cannot predict.

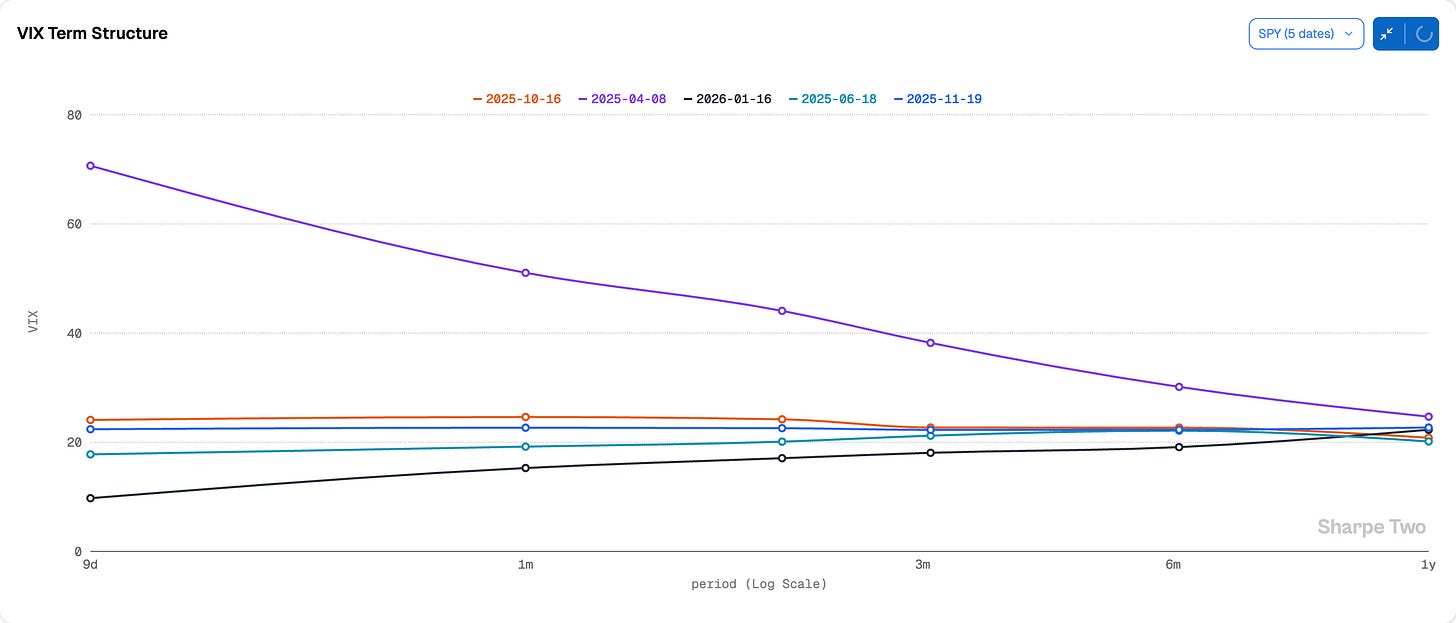

The best way to prepare for that is to routinely buy longer-dated options (three to six months out, or even one year if you see them cheap), to make sure the money-generative part of the book, the options you usually sell between 10 and 45 DTE, is hedged in case of an accident. Once that is done, selling volatility becomes similar to playing musical chairs. Is the music playing? Yes. Then keep walking.

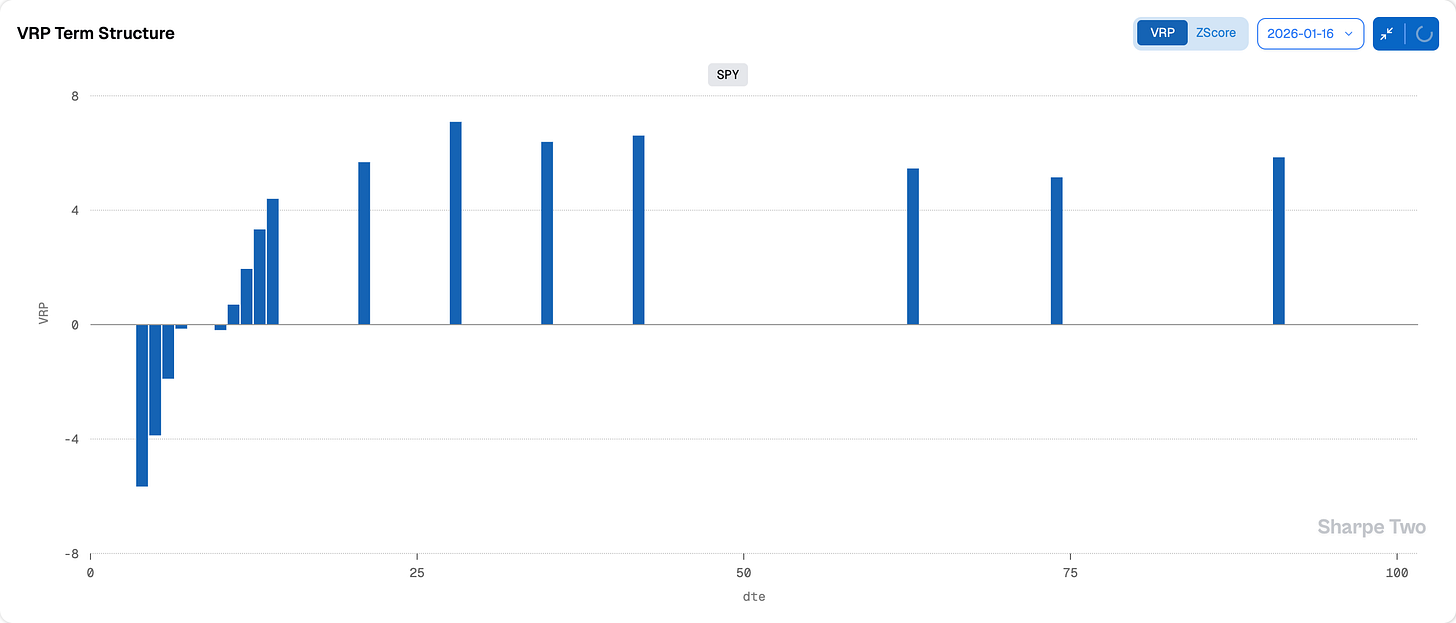

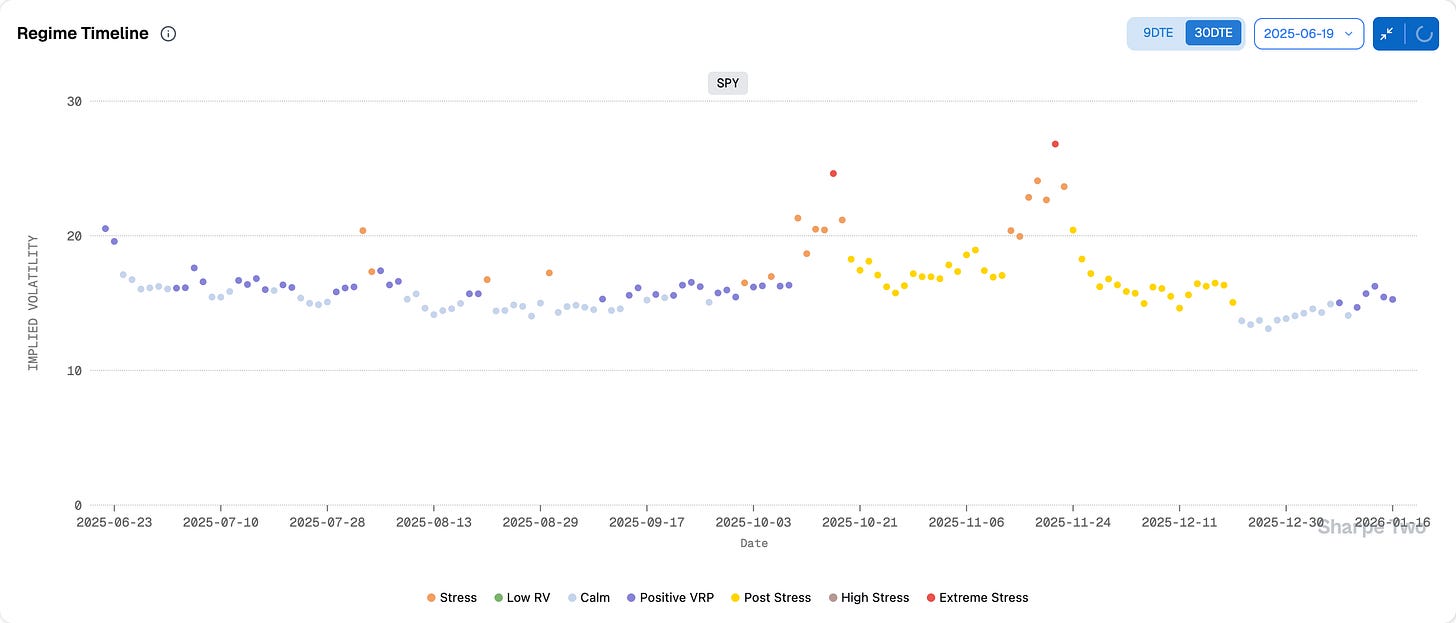

The S&P 500, as it stands, is back in our positive VRP regime, characterized by, well, as you guessed, a strong VRP, fairly low realized volatility, and low vol-of-vol. These are usually better conditions to harvest premium and sell options. And what is not to like about the VRP these days?

You still get about six points of premium in the 28 to 45 DTE range, which should give you enough room to work in an environment where realized volatility gradually picks up over the next few weeks, without any unanticipated black swan. That said, there is no need to jump on price. Sometimes the best thing to do is to wait for the moment when IV is on its way up, but unlikely to break unless there is a regime change, to really maximize your chances of landing on the right side of the coin.

Now, we hear a lot about geopolitics these days, and therefore some are quick to discount this as a black swan. Let us be precise. Yes, if the US and the EU were to go at it over Greenland, we would not bet on volatility staying at 9. But for it to jump to 20, you would need a severe and sudden escalation, with no clear and immediate path to resolution. As it stands, we are far from there, despite France and the European Union sending troops for military exercises on the island, and President Donald Trump arguing he really wants Greenland.

The same goes for Iran, which, by the way, has largely disappeared from the headlines after a de-escalation between the US and the regime in place was noted by countries in the region.

All of this to say, do not hang on to the news for too long. The market does not. Once something is out, it is incorporated into prices, and price action moves on until the next piece of information.

As it stands, this is not a market showing any real signs of anxiety just yet. Contango is pronounced and well in place. Sure, once in a while the curve will lift a bit, but avoid getting caught in the details. When we switch regime, because we will, there will be very little doubt in anyone’s mind.

In other news

“Absolutely, positively, no chance, no way, no how, for any reason.” Any idea who this is from? Jamie Dimon, in his usual direct and unapologetic tone, when asked whether he would take the job of Chairman of the Federal Reserve if asked by the President.

The truth is, the President would not ask Dimon in the first place. As the Chairman of JPMorgan Chase made pretty clear, “everyone believes in the independence of the Fed.” At least on paper. The problem is that the investigation by the Department of Justice into Jerome Powell is a rather damning signal that Fed independence is very much in jeopardy right now.

So far, markets have not shown any particularly worrying signs about the months ahead. But the next Chairman will have a much tougher job than he or she likely realizes. If rates do not go down, the probability of getting fired six months into the job is not trivial. But if they do go down, and a little too much, markets may react quite negatively, and the probability of getting fired after six months is, again, not trivial.

Another reason why we are not surprised to see Scott Bessent in no rush to jump on the job. From our perspective, this thing looks like a time bomb. As for Dimon, whose own succession at JPM is still not settled, we have heard he may have his eyes on a much bigger prize anyway. The next POTUS? Time will tell.

Thank you for staying with us until the end. As usual, here are two interesting reads from last week:

Prediction markets are all the rage. There is not a day on social media without someone showing how they are somehow milking an arbitrage out of them, either through high frequency tricks or by simply copying a successful account. That does not mean they are without issues. Here is an excellent article laying out the many ways, non-exhaustive, they could be improved.

You find fewer and fewer AI naysayers as adoption keeps climbing, from GPT-3.5 to what we use today. It is almost funny to remember we once thought GPT-3.5 was “smart.” Yet the bubble debate is still everywhere. What is rare is a piece that does not pick a team. One that stays balanced, forces a few uncomfortable valuation paradoxes, and makes you look at unit economics instead of the hype. Enjoy this long form. It is worth every minute of your time (and no, do not ask ChatGPT for a summary, that would defeat the purpose).

That is it for us. We wish you a wonderful week ahead, and as usual, happy trading.

Ksander