Forward Note - 2025/12/07

Front running Santa is not without risk.

This week was fairly uneventful as the marketplace is cautiously waiting for the last FOMC of the year mid next week, acting potentially as the kick off signal for the Santa Rallye. The SP500 added a little less than a percent while the Nasdaq 100 advanced a little less than 2%. That is nothing less than 5.5% and 7.5% in two weeks for the main indices; while many wait for the Santa rallye, it may very well have been front run during the .. Advent rallye?

The VIX gave everyone a good rest after a few cold sweats in October and November and spent the vast majority of the week in the 16 handle before closing at 15.28. While we welcome the first week of calm since Thanksgiving, we do not think we are completely out of the woods yet. As we said a few lines above, the main catalyst for the end of the year is now only 72 hours away and will most certainly drive a lot of the positioning for the next few weeks.

The Fed is due to give its decision about maintaining or cutting rates for December but most importantly it should update the expected rate trajectory for 2026. And while these projections will obviously be taken with a grain of salt considering that Jay Powell will only remain Chair until May 2026, they will still matter in how investors position their portfolios over the next few months.

As is, uncertainty is at maximum considering how divided the Committee was in October, combined with a few important missing data points that prevent a fully informed decision. And while the prediction markets (more on that in a second) give it an 80 percent plus chance of a cut, there is no clear consensus in the marketplace.

And therefore we are facing a paradox going into this event: a lack of consensus is usually a strong feature of heightened implied volatility as investors hedge their bets one way or another. Yet what to make of the calm in the options market and how to potentially trade it?

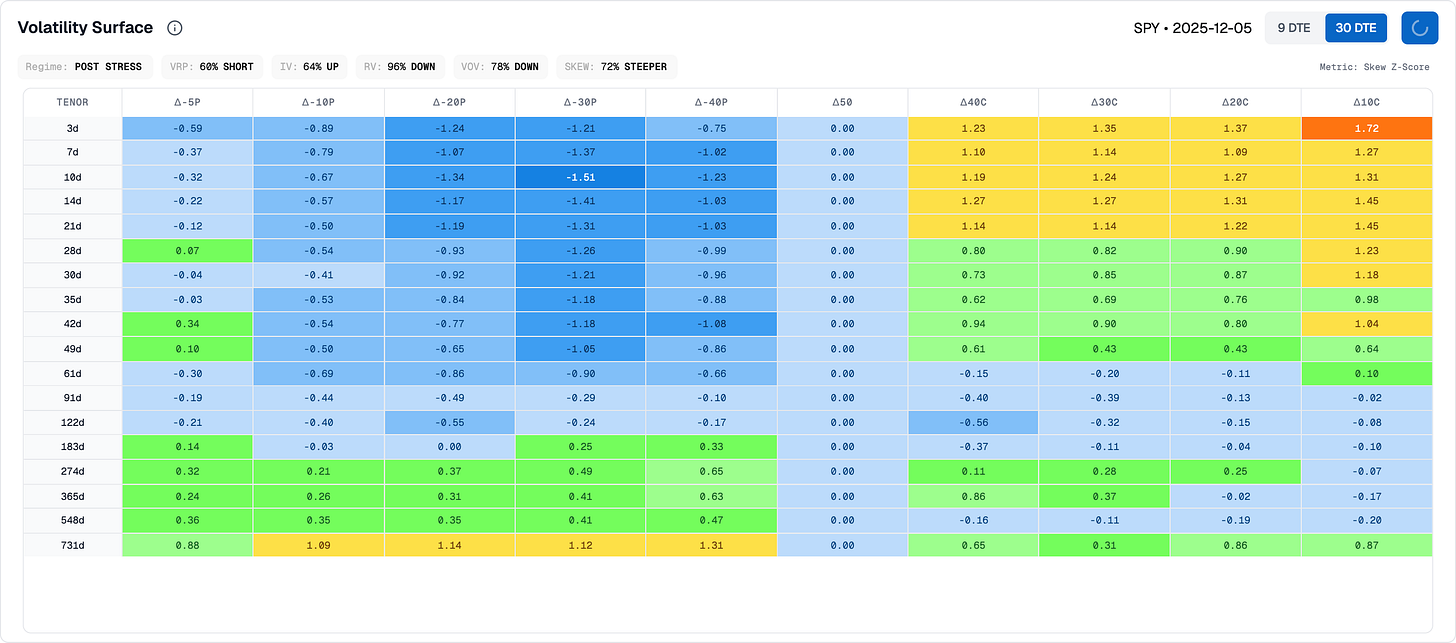

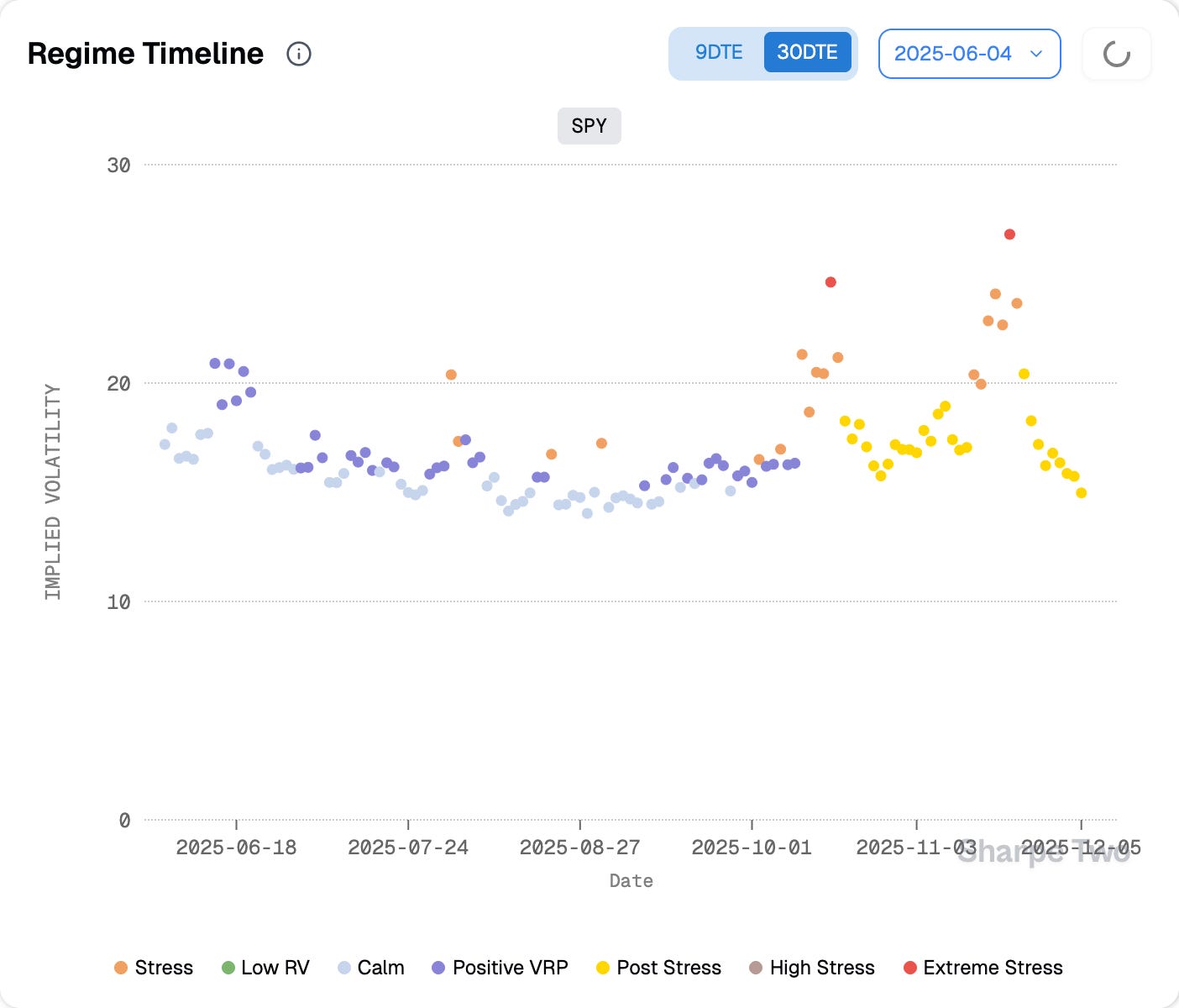

Let us start by rewinding what happened over the last two months and look at the regime we are in. One could decide to view the two relative spikes observed in October and November as bugs: nothing actually broke and while the market may have gone a little ahead of itself around the AI trade, the AI bubble talk may also have been a little overdone. The reality is probably somewhere in the middle, offering good reason to think the market will keep grinding higher and volatility stay compressed.

However, another view is to consider those spikes not as bugs but as features of the current regime and to see them as early signs of what could unfold over the next few weeks and months. Until there is further clarification on how cheap money will be, the bond market and AI valuation will remain at the center of attention, generating bouts of volatility that shake the most leveraged investors.

In other words, despite the calm going into this week, one could expect more of the latter rather than a clean return to a super quiet regime. Especially when one factors in that whatever comes out of the FOMC next week may alleviate the market only a little. Powell, whose influence is already diminished, is due to leave his post in May 2026 and Trump has already announced a new Chair for early next year. So the probability that the rate trajectory presented on Friday sparks more debate than consensus is fairly high.

Whatever side of the coin you sit on, the data invites some caution.

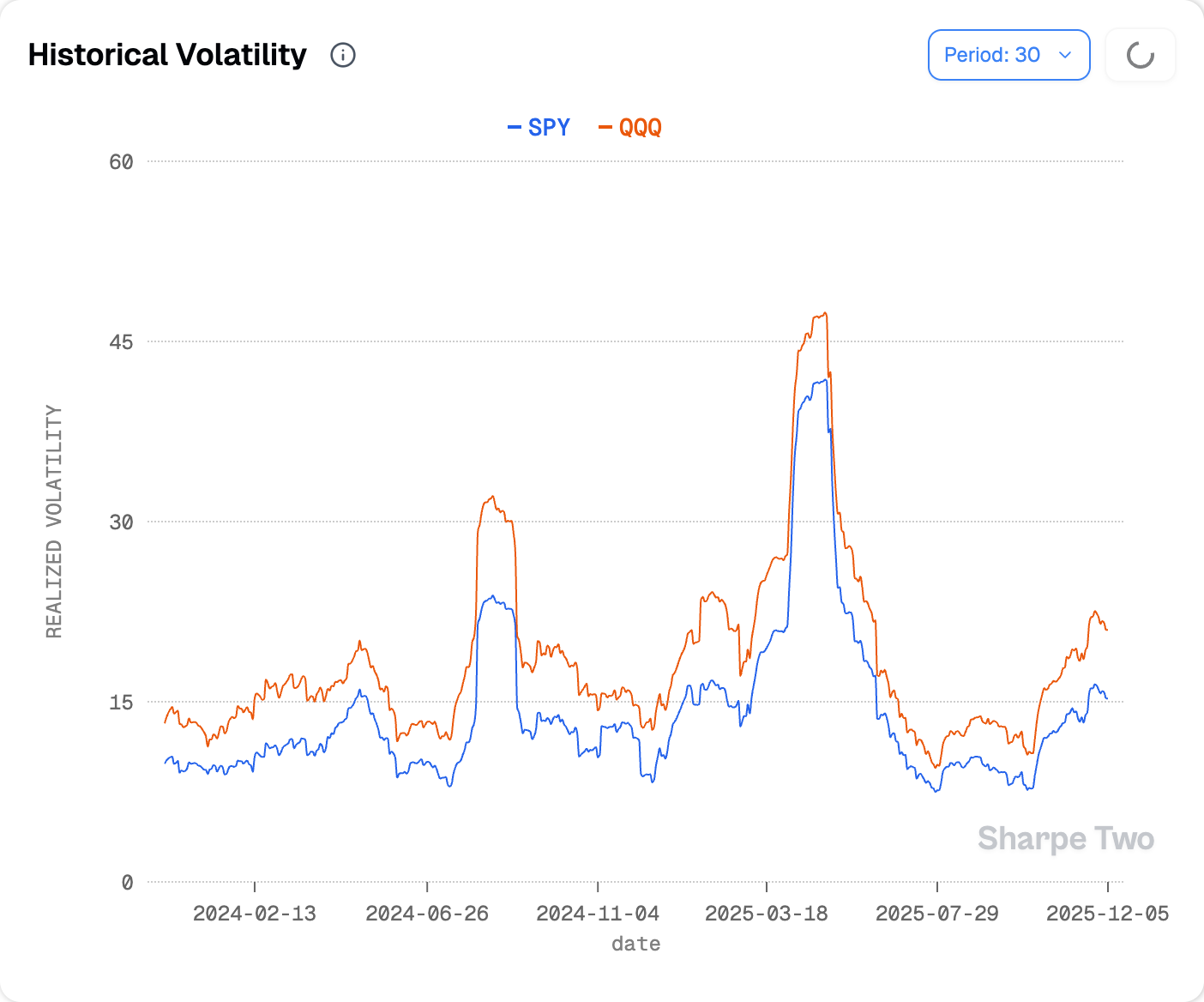

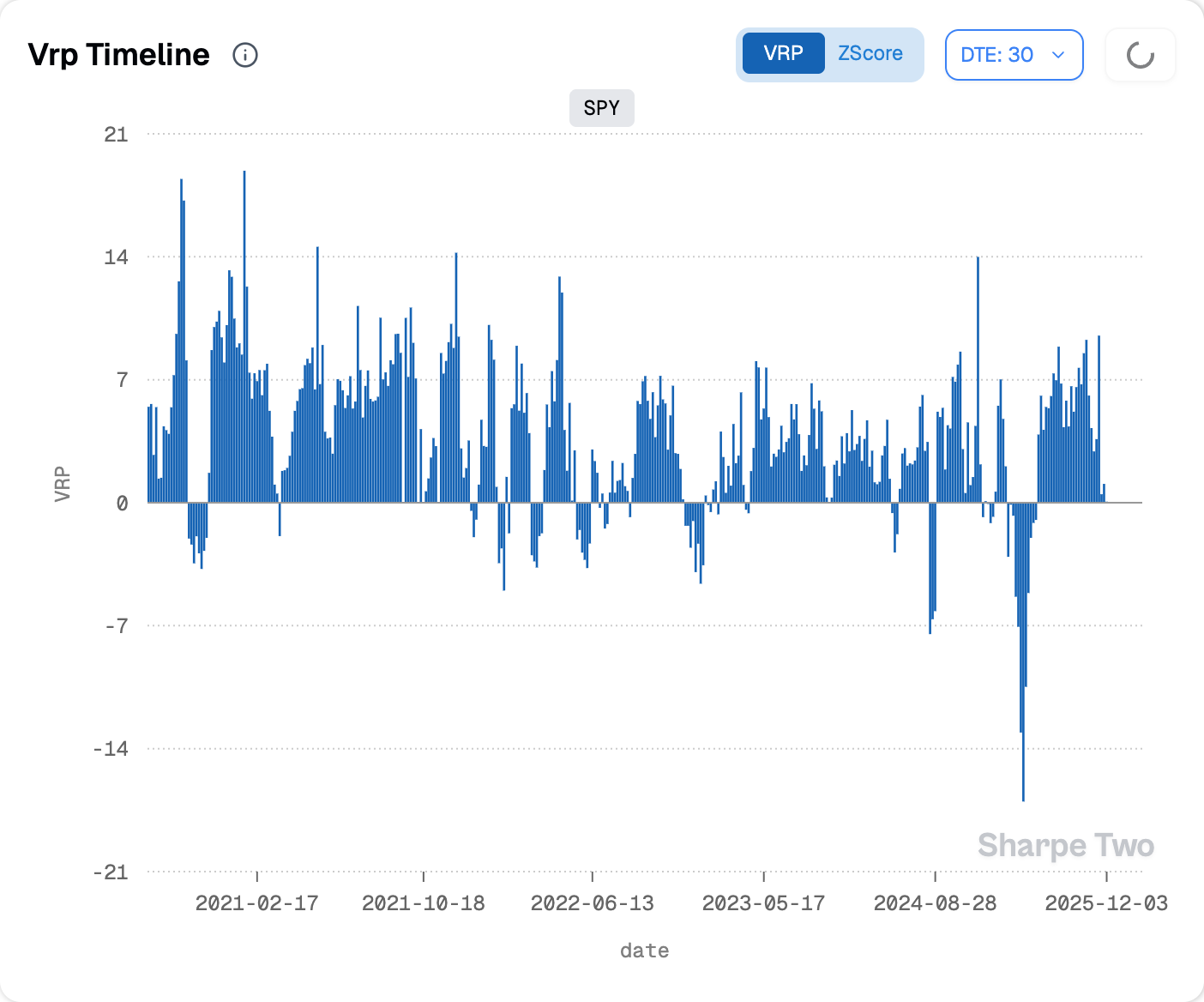

While realized volatility has started to retract, it is still on the elevated side, currently hovering around 15, which makes any sale of implied volatility prohibitive at this level. The edge is simply not there, to our biggest regret, as we already miss the glorious and productive period of the last six months when a pronounced and constant premium on the sell side of volatility offered the best environment since the post Covid year in 2021.

We insist on this; you can scout social media these days and everybody was a genius because a lot of “little strategy that works for me” actually delivered. Structurally the edge was there, meaning that even if you went at it randomly, there was a decent chance you made money selling puts and covered calls to a certain extent.

With VRP this low and vol of vol on par with pre tariff levels, we now enter a phase where many accounts will bleed simply because conditions have changed and adaptation was not fast enough.

Vol of vol has started retracting from its highs observed last month but still remains elevated. At these levels, it would not take much to see the VIX go from 16 to 21 in a couple of hours with the right headline. And many of you certainly have not forgotten how the last FOMC of the year went twelve months ago, when a seemingly innocuous question and a slightly more hawkish Powell sent the market into a tailspin and arguably marked the start of the wild bout of volatility observed throughout Q1 2025, culminating with the grand finale on liberation day.

Especially because as is, the market may already be a little overly confident about the year end rallye:

When measuring each node of the surface against its respective ATM node to extract a measure of skew, we can see that puts are on the cheaper side of where they have traded over the last three years, while calls are slightly richer. It is not necessarily the case for tails, a sign that the market is still aware that as long as Trump is in power anything can happen, but the region between 20 and 30 deltas does not seem to have the favour of investors at the moment.

Once again, we are not calling for an immediate and substantial crash, but if you were tempted to sell these puts, they are not particularly expensive at the moment and if volatility were to come back on the back of last week, they would be in a lot of trouble very fast.

In other news

Prediction markets are all the rage. A year after their meteoric rise with the US election, there is not a single bet you cannot make or a platform shying away from it. Robinhood is talking about a significant partnership to bring its user base one step closer to gambling in the comfort and privacy of their phone. Google has already announced that it will incorporate odds when it answers queries.

And speaking of Google, some may have found a neat way to double their salary in a few clicks. The AlphaRaccoon account on Polymarket was at the centre of some (unwanted?) attention after making extraordinary calls on who would top worldwide Google search. Everyone can get lucky once, even a couple of times; but a 92 percent hit rate on such a sparse event has obviously raised a few eyebrows, starting with ours.

Many now suspect that alphaRaccoon may be working on the search team at Google and cleverly used information from his job to rack up some juicy profit. Are you really that surprised? Should we really do something about it? Can we actually do something about it? The term insider trading is nowhere to be found in the platform rules and while the move is obviously legally risky, it seems that all you really risk is a ban from the exchange.

Now let us go one step further down the rabbit hole: considering the trove of creativity investors, Fed governors, politicians and other public servants display to bet in markets where insider trading is actually forbidden, how long until they translate these skills to the non regulated market?

Thank you for staying with us until the end, as usual, here are two great reads from last week.

A lot has been said about the main buyers of gold this year, with every sign pointing to central bankers planning for a potential de dollarisation of the economy. But not much has been said about a quiet and private actor, also important in an economy turning digital and helping bridge the path from fiat to crypto. If you do not know anything about Tether, you can get up to speed with this excellent piece.

Last month when many social media observers were quick to point to gamma flow (sic) to explain the weird moves in the market (think Thursday 11/20 post NVDA + NFP), we were alerting you about the rumors of multi funds rotating or simply .. liquidating. We heard and read about RenTech in October, here is a story about the misfortune of Millenium and their index rebalance trade.

That is it for us, we wish you an excellent FOMC week ahead and as usual, happy trading.

Ksander