Forward Note - 2025/09/28

A very particular set of skills.

Just a few days left in September. Hard to believe how fast it went—ironical, really, given how little has actually moved.

A month ago we were bracing for something. We could not—or did not want to—put a name on it: a rising tide, a comeback in realized volatility, some justification for buying hedges and keeping insurance on the portfolio. That is how you survive in the money management business.

Instead, nothing. The grand nada.

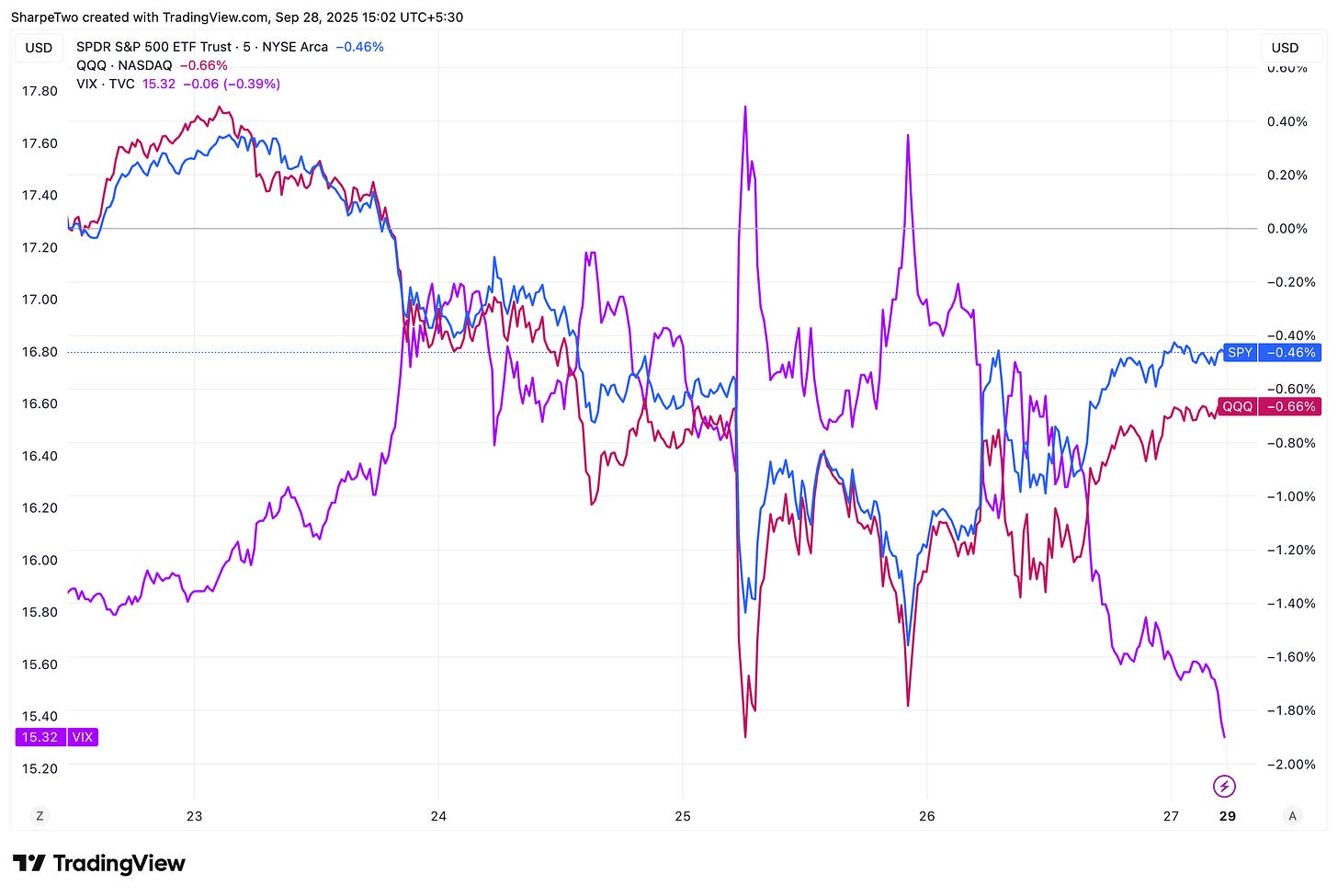

The S&P 500 closed the week flat (-0.1%), the Nasdaq slipped 0.5%. The VIX also bled out, dropping half a point to end just above 15, at 15.29.

We insist on the also: early in the week, we lost count of the messages pointing out “VIX up and stocks up”—the ultimate sign, apparently, that something was brewing and this time would be different.

If that was it… well. Yes, the S&P 500 did back off about 2% from its all-time high on Monday, and it did accelerate lower on Thursday after a supposedly bullish datapoint for US growth—GDP up 3.8% versus expectations of 3.3%.

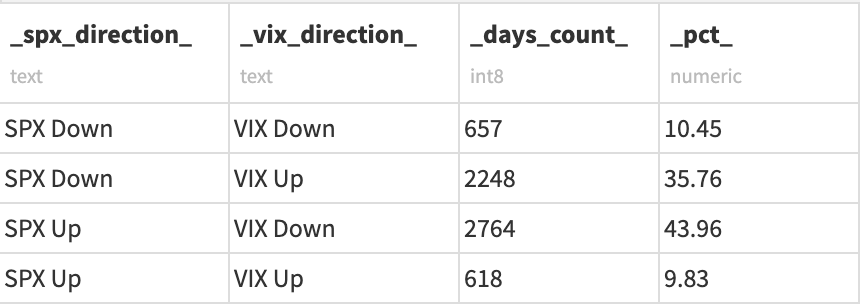

Those messages made us smile. “VIX up and stocks up” happens far more often than people care to admit.

About 20% of the time, VIX and SPX move in the same direction—which is not all that surprising. With a long-term correlation of roughly -80%, there is still plenty of room for returns to wander off on their own.

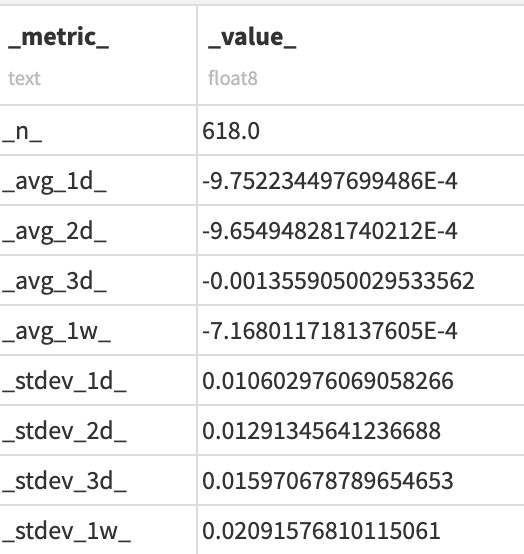

The better question: does a “VIX up, SPX up” day have any predictive power for SPX over the next few sessions? Let us see what the data say:

Here we computed the average one-day, two-day, three-day, and one-week return following such instances. The results are consistent across horizons: the average return comes in at less than -0.1%. Considering that the daily drift is close to zero anyway, that points to a tiny little something—but hardly anything predictive.

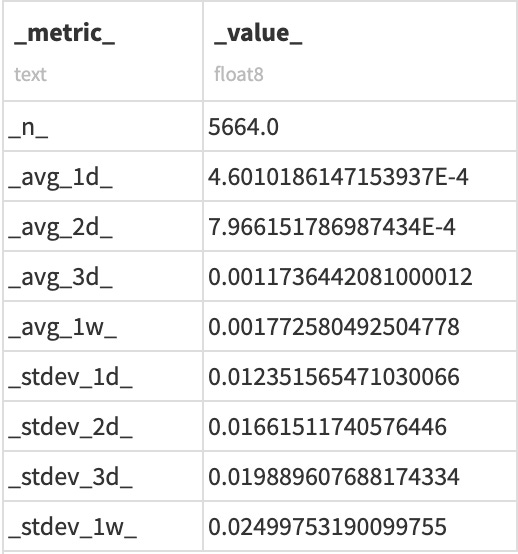

For a full picture, let us compare this to all other instances, where VIX is not up and SPX is not up (the complement, in probability terms).

As one would expect, the returns are again very close to zero, this time tilted slightly to the positive side. One is free to decide whether that is worth acting on.

Our take? “VIX up, SPX up” may be a flag that something is brewing, but it is certainly not a screaming short signal. At best, it can serve as a filter for entries over the next few days—not as a reason to exit, especially in the regime we have been in for months.

We know this conclusion may disappoint day traders, so let us add one thing: extracting an edge of 0.1% demands a very particular set of skills. Skills acquired over a long career. Skills that turn you into a quiet nightmare for every uninformed participant in the marketplace.

We do not know who you are, but you certainly fall into the category of extremely fast and proficient quant traders—usually at HFT firms, hoodies on, quietly racking up millions from the less informed.

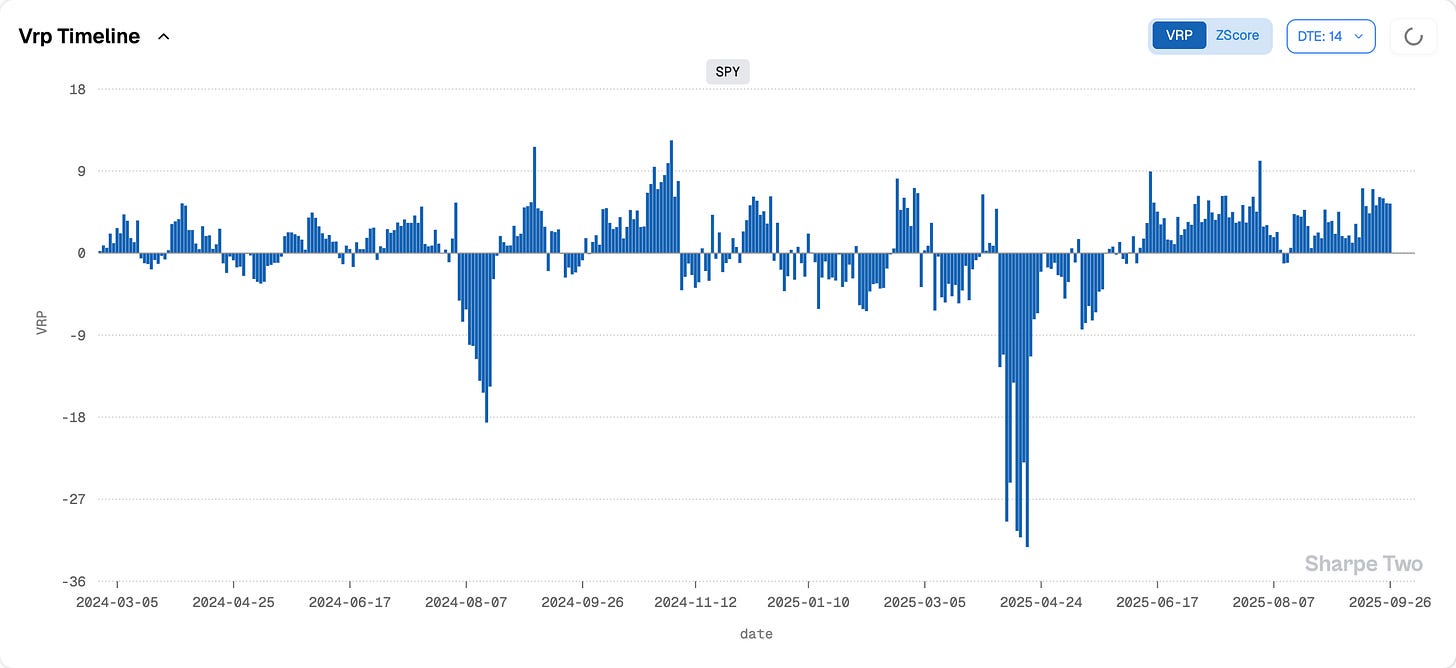

Why a nightmare? Because it pulls attention away from the much easier trades available to the layman. Trades that do not require looking at market prices with a scalpel and the precision of a surgeon. We have lost count of how many times we have shown this chart since June, but here it is again:

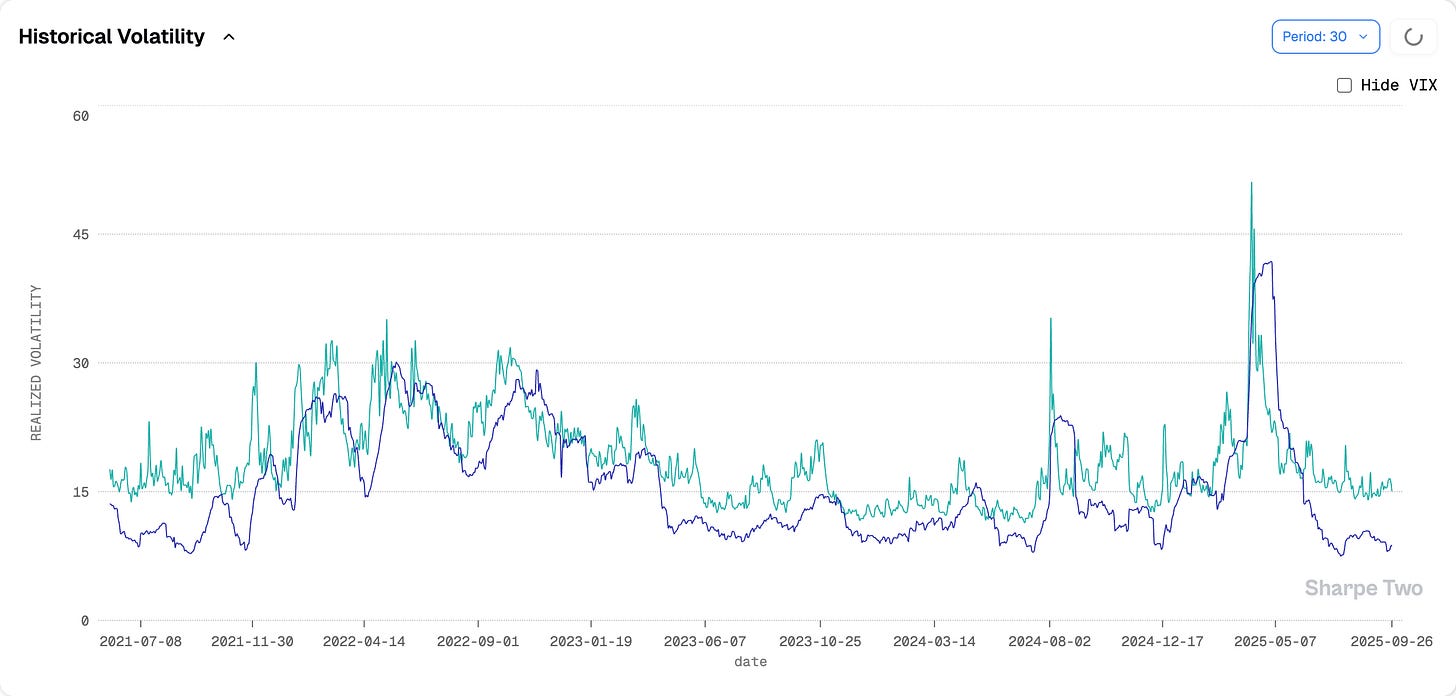

Six points of variance risk premium in the S&P 500 does not take much skill to monetize these days. Selling puts—and lately even calls—more often than not lands on the right side of the coin. And yes, it always feels scary to sell options (as it should; they are complex instruments that can punish the uninformed), but with realized volatility this low, it is a prime environment to harvest premium.

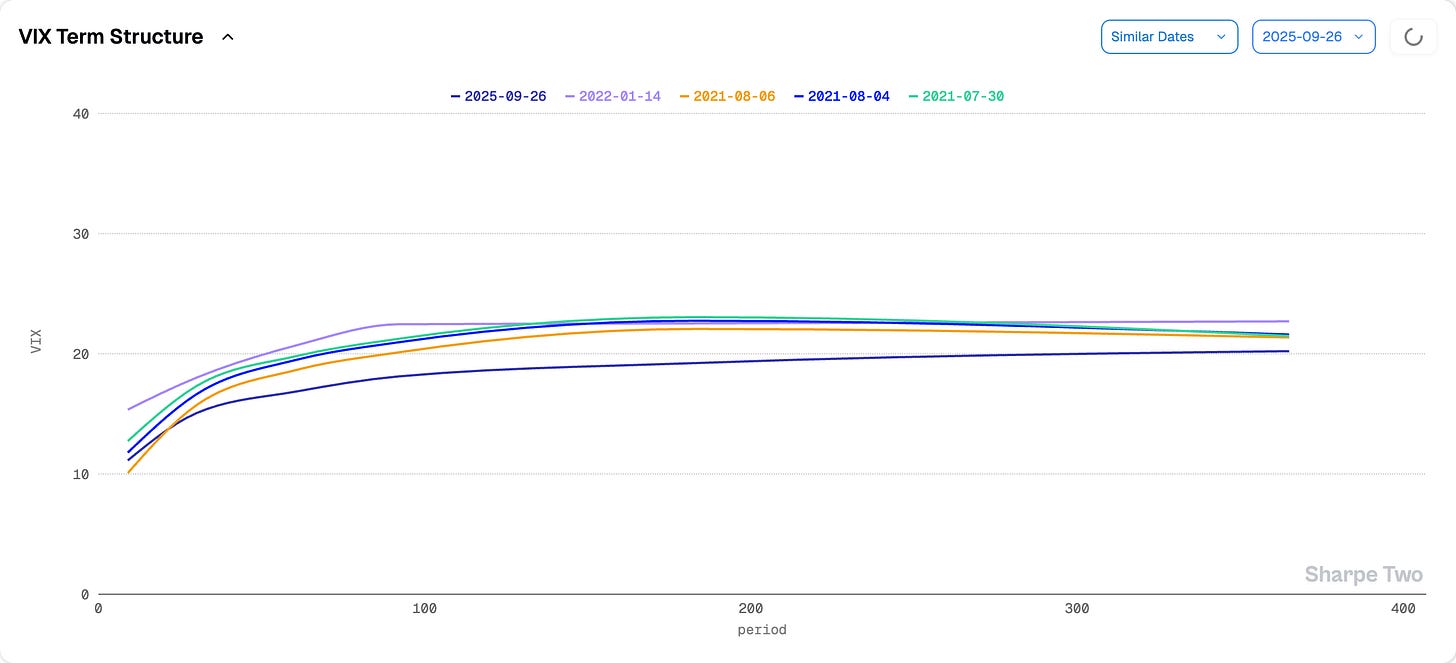

Do we expect realized vol to come back? At some point, yes. But for now, the catalysts are absent, and the contango in the VIX term structure says most of what needs to be said.

We ran a similarity screen on the VIX term structure as of Friday’s close. What came up was the stretch right before the Ukraine war and the rapid rise in rates—or, further back, the summer of 2021. Both analogs are telling.

In January 2022, inflation was already running hot (well above 4%), and by every standard the Fed was late to act. The Ukraine war only worsened matters by propelling oil prices higher. Yet the market were chilling. One if also free to find some parallels, but we still do not see the catalysts. Maybe on Friday after the next job report? It is a possibility. If we learn that the job market is not doing well and already destroying payrolls, this could deter the market a bit.

But summer 2021? Contango stayed steep, realized volatility stayed low, and conditions were prime for put selling and volatility premium harvesting. In fact, the last time VRP sat consistently at six points was precisely then. Also worth noting: Biden was in power, which dents the “Trump risk premium” narrative a bit.

That period was also a grand nada: for months, realized volatility sat below 10, until grim economic data finally dragged markets back to reality. The culprit? Inflation brewing under the label “transitory”—arguably Powell’s one only true blunder at the helm of the Fed, with consequences we all know too well.

As a retail trader, you can choose to be the Liam Neeson of the order book (and we hope many caught the paraphrase from Taken) or simply accept your fate as a layman. There is no prize for making money the hard way.

In other news

A page turned this Thursday when Tom Sosnoff rather abruptly announced his departure from TastyTrade. He had hinted at it for months, but this time it is official. TastyTrade, sold to IG Group in 2021, will now be run under “a new vision” from its owners.

We will not lie—we felt something watching the grim video. The financial circus he built was loud, distracting, and often on in the background these past years. It helped fight the isolation of working alone, writing SQL and Python pipelines, then placing orders… at another broker.

We salute Tom Sosnoff’s entrepreneurial spirit. Building one successful brokerage is already hard enough. Building two within 25 years is almost unheard of. He is proof that whole segments of finance were—and still are—ripe for disruption. And while so many bright minds choose to work at Citadel, one cannot help but imagine what finance would look like if more of those engineers were building better, more robust infrastructure instead.

We also salute the fact that, for years, the Tasty network democratized access to options trading for countless retail traders. And while we often disagreed with their data and research, it was undeniably a step in the right direction: little to no technical analysis (outside of the rare skilled day trader, there is no edge there), data-driven trading, and a focus on selling what is overpriced.

We doubt Tom will launch another company. When we met him a few years ago on a panel in London, he already looked exhausted. But then again… he has hinted at new beginnings. Whatever he chooses, we extend our sympathy—and wish him success in whatever comes next.

Thank you for staying with us until the end. As usual, here are two interesting reads from last week.

First, a rather provocative piece—one that should nudge you to look for corners of the market where edge may actually hide. It is rarely found in charts, and when it does appear there, it is usually the symptom of something bigger happening elsewhere. Reading the fine print is often the better place to look.

Second, at Sharpe Two we lean heavily on machine learning pipelines to generate explainable, tradable forecasts. Here is an article that digs into why this matters—especially when applied to the right datasets and the right problems.

That is it from us. We wish you a great week ahead (yes, NFP already!)—and as always, happy trading.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you’re uncertain about an investment’s suitability.