Forward Note - 2025/08/31

Let's dance until the summer stops.

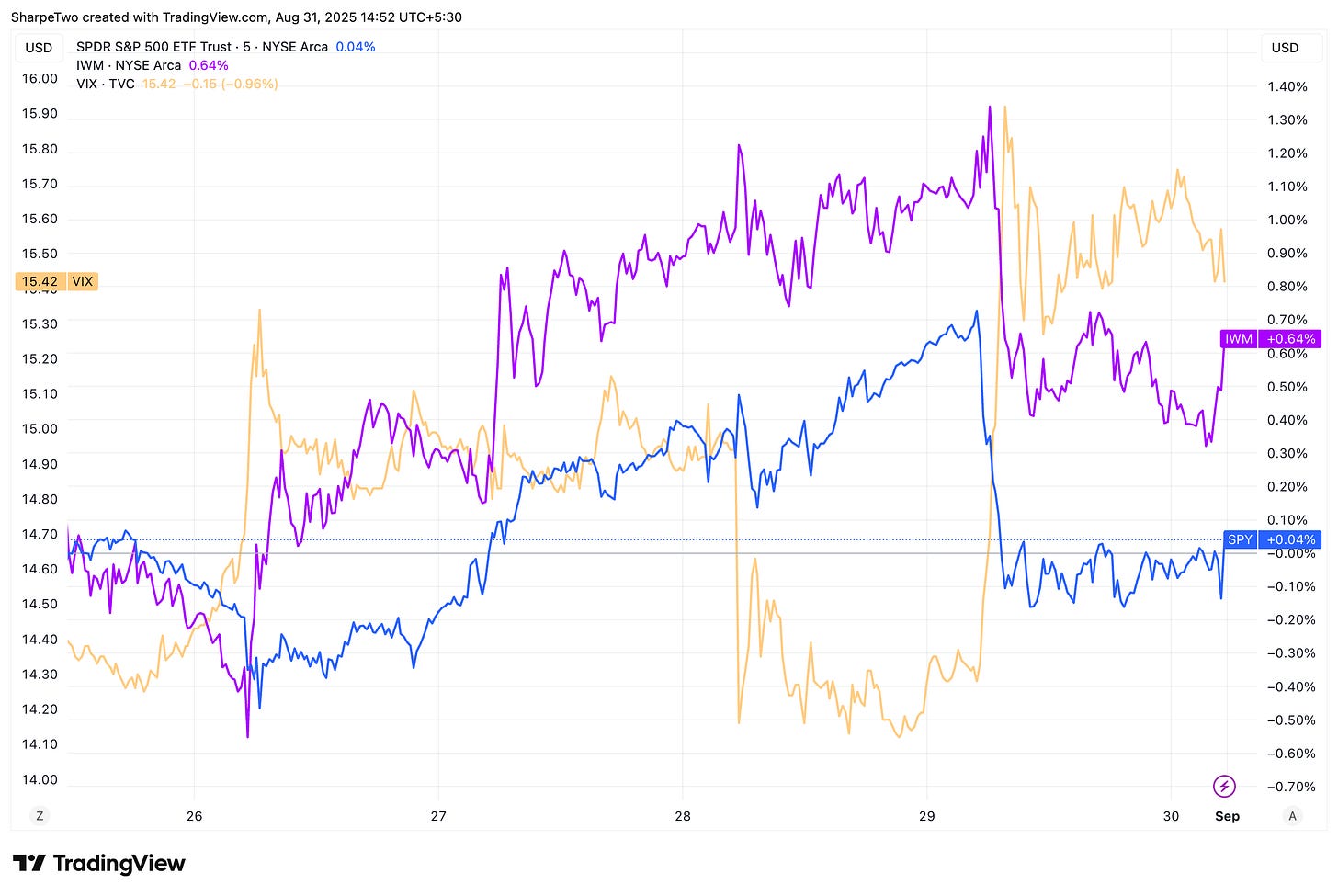

NVDA did not break the market, and month-end flows did not deliver the moonshot either. What is happening? Traders still seem to prefer the newly found privacy at Monte Carlo casino to the 0DTE slot machines. And frankly, it is time for the holidays to end so gambling-as-trading can resume. SPY and QQQ finished flat, while the Russell managed a painful half-percent gain. The VIX added a point to close at 15.42. In other words, not enough concern to spark panic heading into the long Labor Day weekend.

So what should we expect in September? More of the same? Or something sharper?

This week brings two catalysts worth watching: Thursday’s inflation print and Friday’s jobs report. Both will shape expectations for monetary policy.

Let us not kid ourselves: the market mood is dictated by monetary policy. That has been true forever, but the past three years have made it glaringly obvious. Risk appetite is just the expectation of money’s cost, dressed up in different narratives.

Most of what fills the front pages today is just noise to kill time. If traders are bored, imagine the journalists.

Could Powell hold steady if this week’s data go the “wrong” way? The awkward spot is this: a weak NFP would almost certainly lock in a September rate cut, even if inflation ticks modestly higher. After all, the Fed likes to remind us of its dual mandate. But if the jobs report is truly ugly, the promise of a cut may not be enough to offset the shift in perception ie from “the economy is resilient” to “the economy is cracking” and the markets may not be giving Trumponomics the benefit of the doubt.

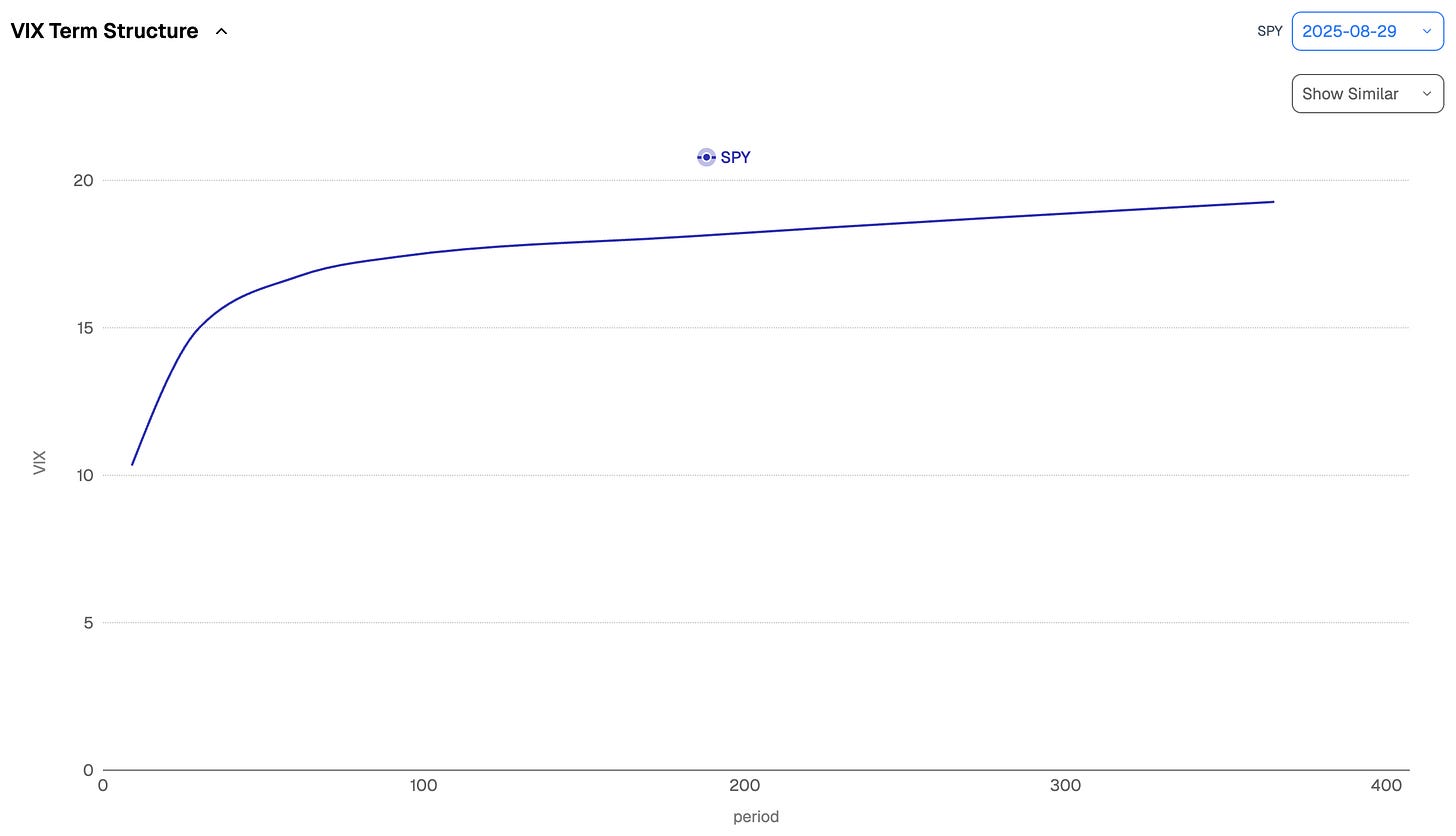

That said, the VIX 6M and the term structure still tell you most of what matters: the market is not pricing that scenario. Important caveat: that does not mean it cannot happen, or that the market is always right. What it means is simple—the cost of being wrong is not high. The collective view of funds and retail alike is embedded in these curves, and the read is clear: nobody is paying up to hedge for a storm over the next three to six months.

But if inflation prints north of 3% and jobs roll over this week, regime change comes fast. Realized volatility would return, and the cost of insurance would climb sharply. Extreme scenario, yes but putting this aside, the forecast picture still does not point there yet.

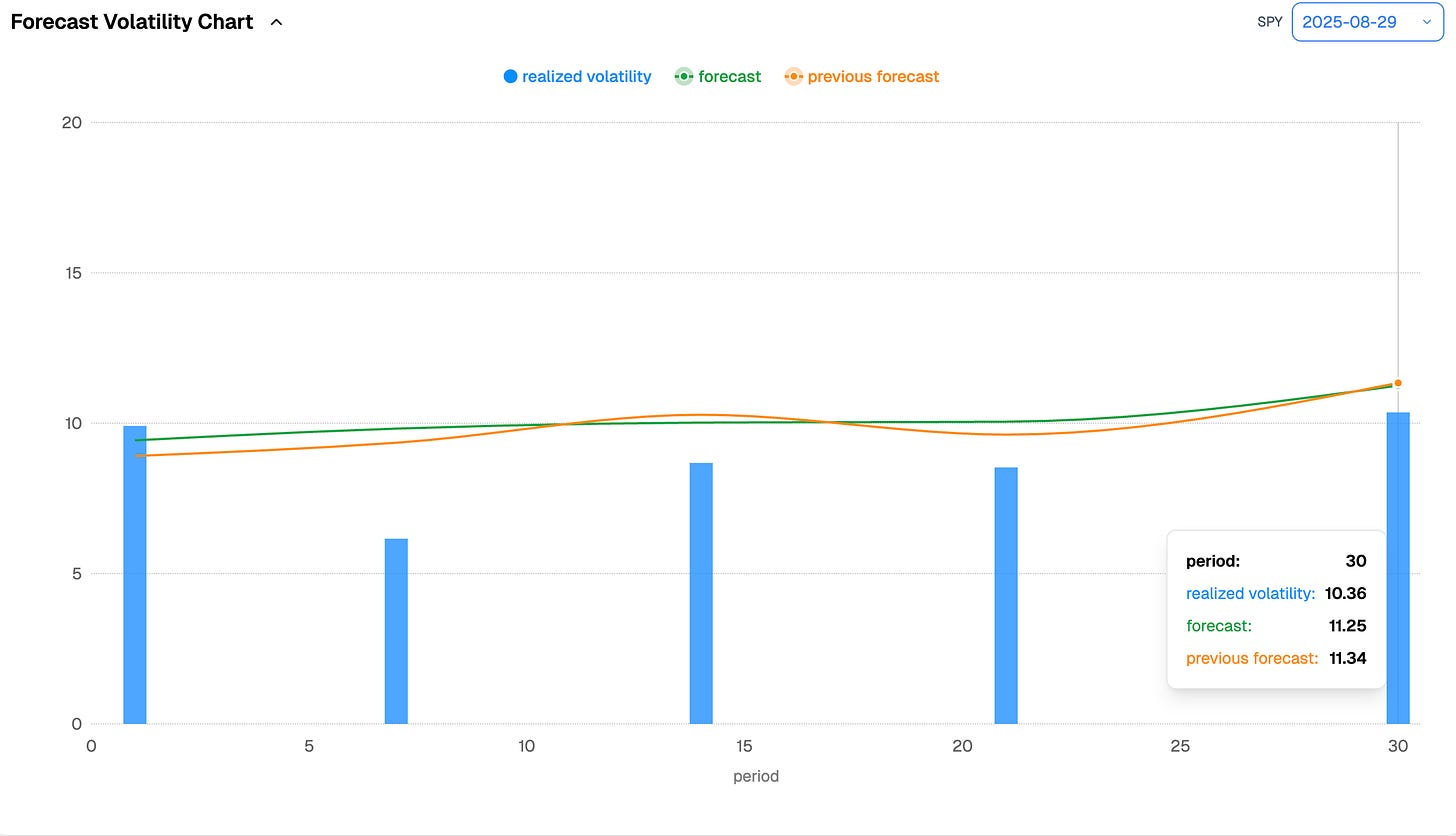

After this very quiet last week of August (only beaten by the already very quiet last week of July and the lowest levels observed since early December 2024), is it reasonable to still expect 11% over the next 30 days? Probably not.

People will come back to their desks, trading should happen again and at a relatively faster pace than what we saw during this lazy summer. But to see 15%+ realized, you need the kind of catalysts we mentioned above. Otherwise, with volatility’s strong clustering properties, that 10 to 13 range can linger for quite a while. How long? Well, again—until we get some meaningful new information that can actually move the lines. And after a year of nonstop uncertainty (US elections, policy expectations, monetary course, geopolitics, tensions between blocs), many of these themes are, if not resolved, at least very dormant for now.

The trap for retail is to believe there is a strong causal link between macro headlines and market reaction. The link exists, yes—but not as neatly as people wish. And the old line, “the market can stay irrational longer than your portfolio can survive,” is one nobody can afford to ignore. Finance is built on deploying capital, not sitting on the sidelines. Even if VIX were back at 18 by month-end, it would hardly qualify as panic in the bigger picture.

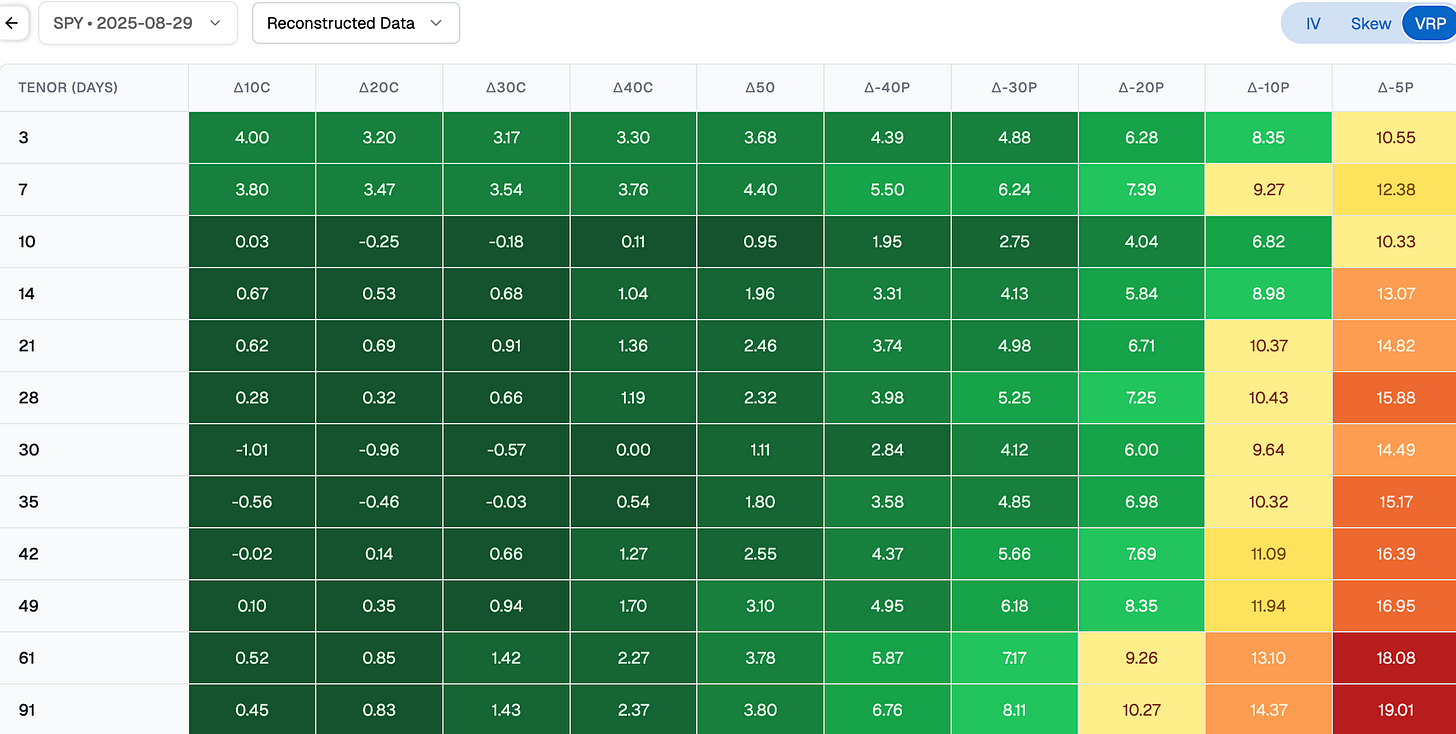

So is this just a buy and never think about it again type of advice? If you do not want to over-manage a book, then yes: buying the dip and dollar-cost averaging, despite the online mockery, is still a solid strategy, especially when implied volatility is this low. In the options world, that translates into selling some 20-delta puts 30 days out—and maybe buying a few calls against them.

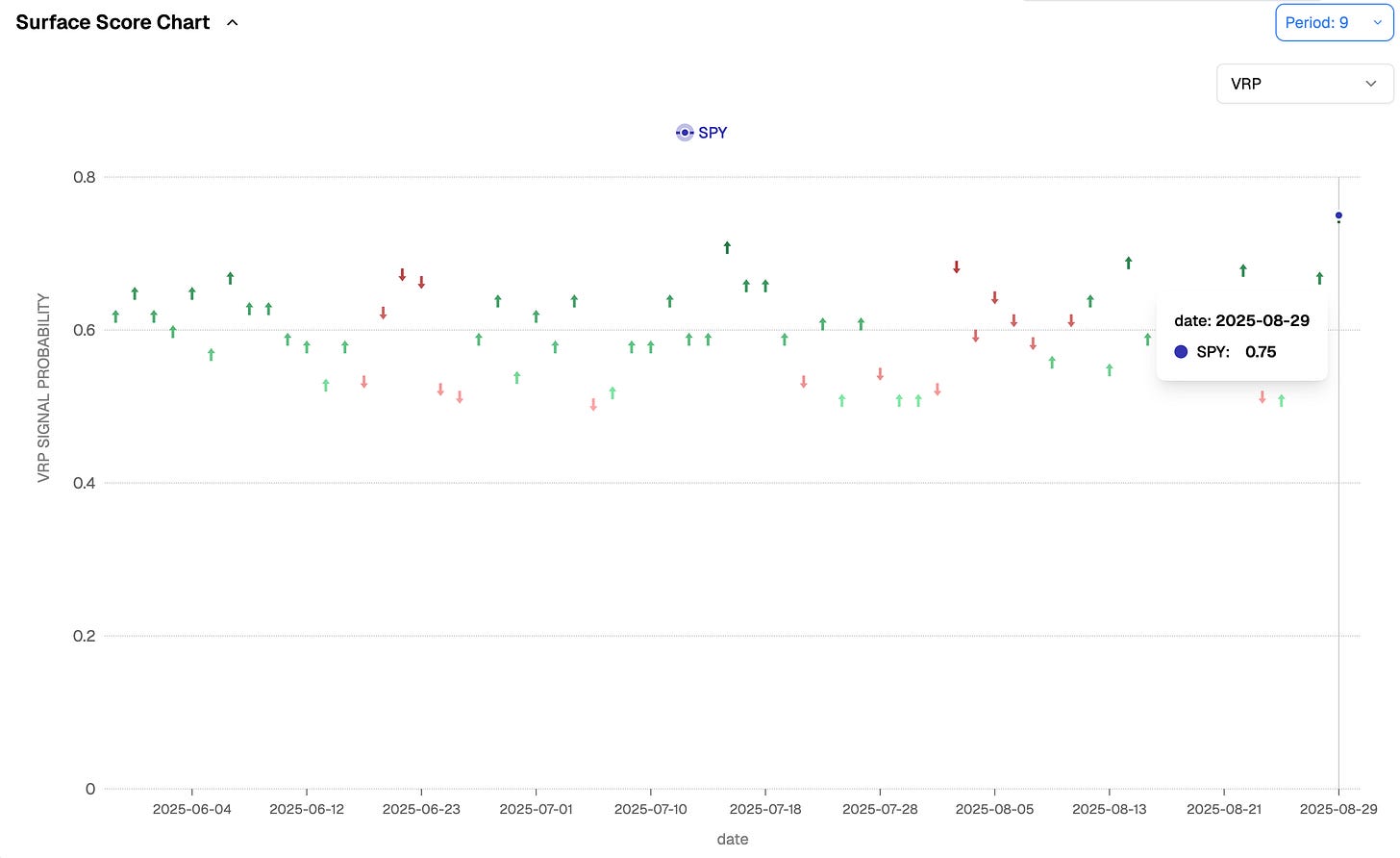

This chart shows the smooth, reconstructed volatility surface for SPY adjusted for realized volatility—in other words, the VRP at each node (delta, DTE). Selling 20-delta puts at 28 days on Friday gave you 7 points of VRP. That leaves plenty of margin for error if September turns wavy. Go out to October and you get 9 points and now we are talking about something quite attractive.

Selling calls, though? As usual with indices, the pain is mostly on the upside. With negative VRP there, the edge sits in buying what the market does not want.

Of course, this is not a magical position. A 20-delta put / 10-delta call risk reversal still carries directional risk. But it is almost certainly better than selling four VRP points on a 7-day straddle. Why? Because everything comes down to forecast. If the market moves hard next week, those four points will almost never cover the cost of gamma and the risk of an explosive move either way.

Right now, our forecasting tools are clear: the IV you sell in the very short end of the curve (options expiring in about 9 days) is worth roughly 10.33, and is almost certainly going to come in below what will be realized over that period.

We are not predicting magnitude here. We are simply saying there is a 75% chance that IV sold on Aug 29 ends up below realized between Aug 29 and Sept 8. With that in mind, the better scenario for us remains the same one we have traded throughout August: wait for the big moves, confirm they are not tied to true macro worst-case scenarios or signaling regime change, and then sell comfortable longer expiries.

In other news

Markets are cynical masters of musical chairs—we dance until the music stops. And while we can write at length about their refusal to stay on the sidelines, they are not blind to risk. American debt keeps getting a free pass, but the same may not be said for France and a few other European problem children in the months ahead. Are we heading for a repeat of September 2010 to March 2012, right up until Draghi’s famous “whatever it takes”? Not impossible. France is almost certainly staring at another political crisis when a crucial confidence vote lands on September 9.

The government is expected to fall again, and what comes next is anyone’s guess. Without a clear plan for servicing debt—either through growth, painful budget cuts, or a messy mix of both—the Eurozone could face pressure. At best, a challenge. At worst, something more serious. Could that then ripple across the Atlantic? We doubt it because America still has robust growth, but earthquakes thousands of miles away can still send tsunamis. Better to watch the warning signs and for now, keeping an eye on the euro is a must.

As for France, the Finance Minister claimed last week he does not believe the country is “on the verge of a financial crisis.” Famous last words, the kind that usually age badly in politics and business alike.

We are only joking, France—you know we still love you.

Thank you for staying with us until the end, as usual, here are a couple of good reads from last week.

The Goblin is back this week with a sharp reminder: 20% of the effort often gets you 80% of the way, courtesy of Pareto’s law. The same goes for trading, life, and yes, building tools or data pipelines. Next time you find yourself trying to reinvent the wheel, ask whether it might be smarter to just use one that already rolls.

A fascinating new study looks at how psychopathy, narcissism, and fear of missing out drive online political participation across eight countries. The findings are both unsettling and revealing: psychopathy is a consistent predictor of digital political engagement, while higher cognitive ability actually suppresses it. If you want to understand who really fuels the political noise onlineand why, it is a read worth your time.

That is it for us, we wish you a wonderful labor day weekend and a great (CPI+NFP) week ahead. And as usual, happy trading.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.