Forward Note - 2025/08/10

The lazy summer is coming to an end.

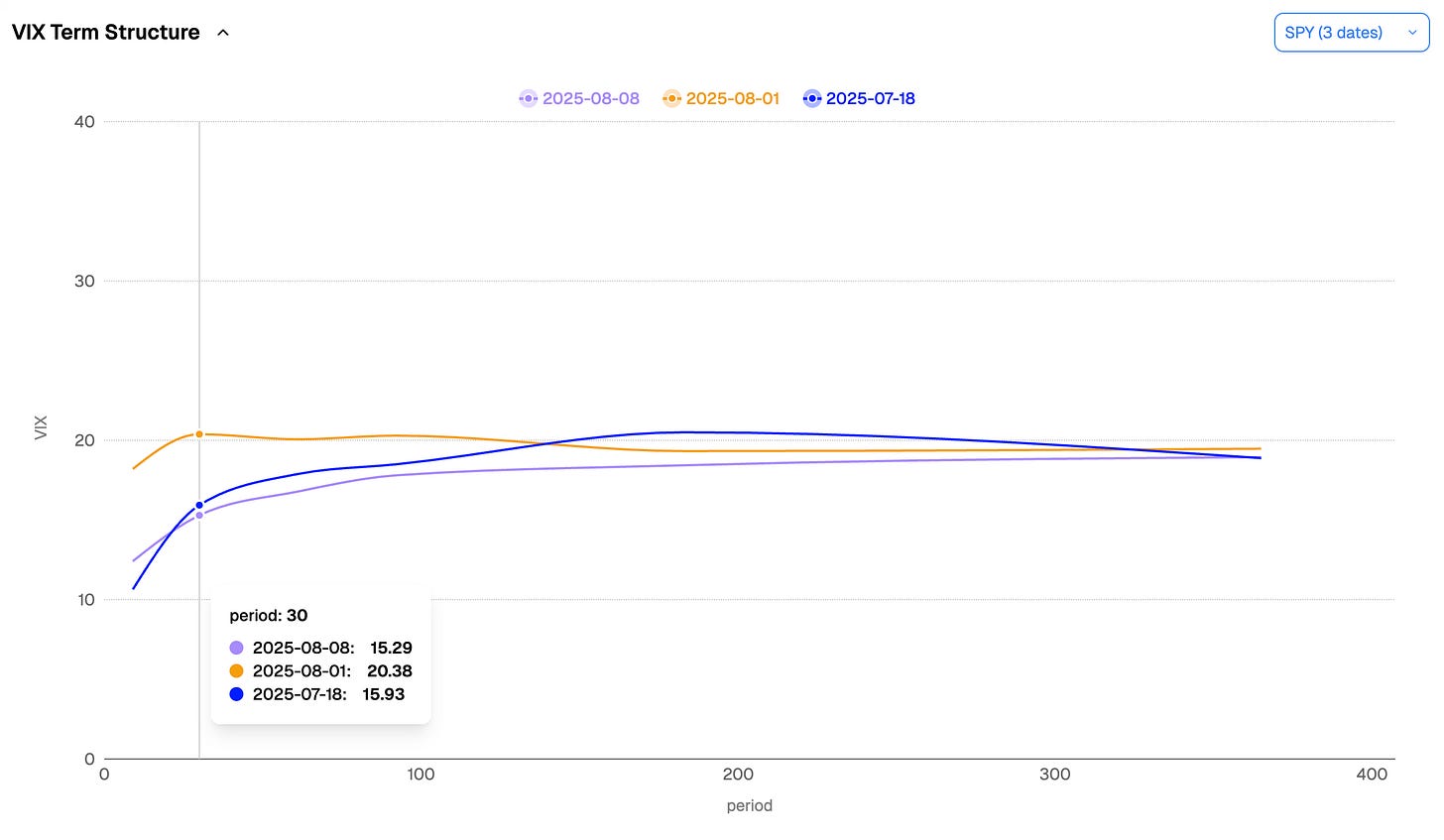

After zee spike in early August, we just had a fairly quiet, uneventful week—if we put aside the rather astonishing geopolitical developments (more on that in a second). The S&P 500 clawed back most of last week’s losses to trade near all-time highs again at 6,389, while the Nasdaq added just under 3% to, unsurprisingly, sit at fresh all-time highs. As you would expect in such conditions, the VIX was crushed mercilessly, closing right on the 15 handle.

What happened? Nothing. Literally. No major economic data, no big earnings, no headlines worth the ink. And because it is still August and trading remains light—well, that is all there was to it.

Last week we were celebrating better prices in volatility — with a caveat: you rarely get a spike in realized vol without some sort of second wave later on. This week offers a few catalysts, starting with CPI.

Even if the market is relaxed about a September rate cut — and last week’s jobs data fully supports a softer Powell at the next FOMC — a resurgence in inflation could shake that certainty. A weaker print, on the other hand, would almost seal the deal… and with it, maybe a rally well past all-time highs.

We have no idea which way it breaks, but we are prepping the terrain. Expect some movement this week, and do not feel obliged to sell VIX at 15. And if nothing happens? Holidays are nearly over anyway. The following week brings the Jackson Hole conference, where Powell is expected to speak on the economy. His last symposium — and you can be sure every word will be dissected.

Five days later, NVDA reports earnings. The stock sits at all-time highs and carries 8% of the index’s weight. Any real movement there could ripple through the entire market.

What else could stir things up? President Trump, of course. We never know what cards he will play week to week. A meeting with Putin in Alaska next Friday is already a tour de force — but who knows what will actually come out of it. Markets usually shrug off geopolitical theatre, but the unpredictability of the U.S. president bends every rule of “business as usual.”

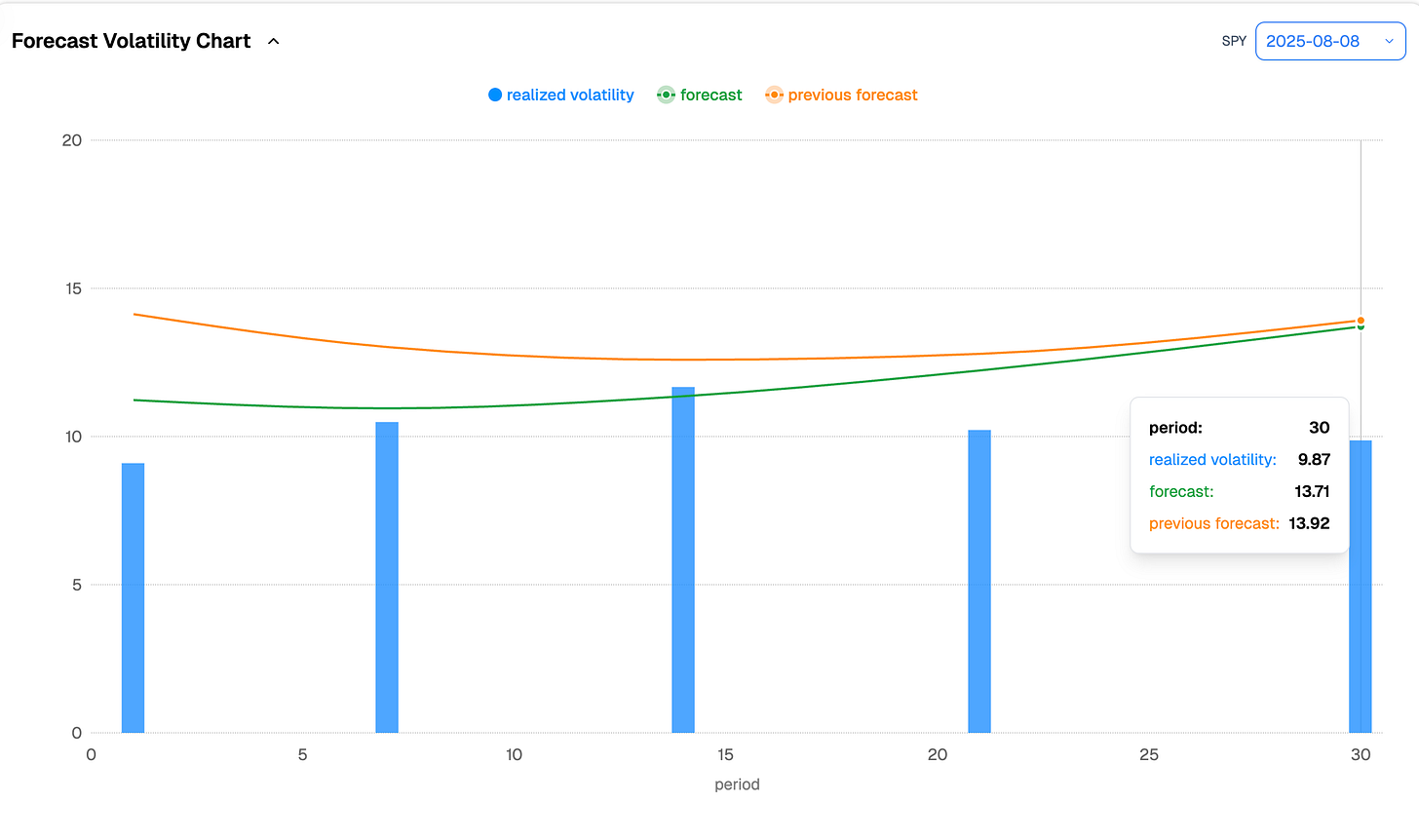

That is the context and the conjecture. From the data side, even after another quiet week, our models still see realized volatility settling around 14 over the next 30 days.

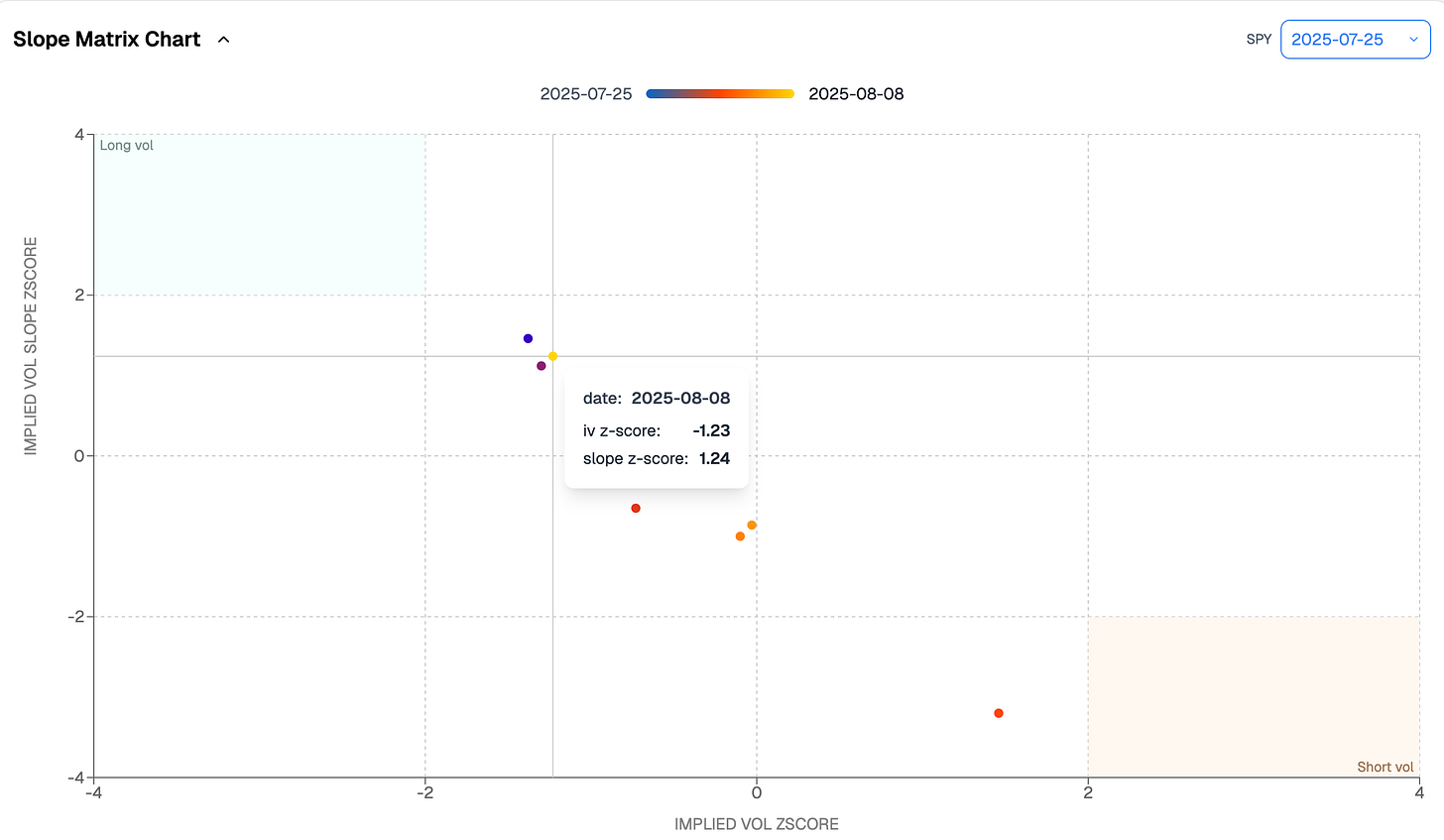

Needless to say, selling VIX at 15 — or even 16 — is no longer much of an idea. All good things come to an end, and the lazy summer is no exception.

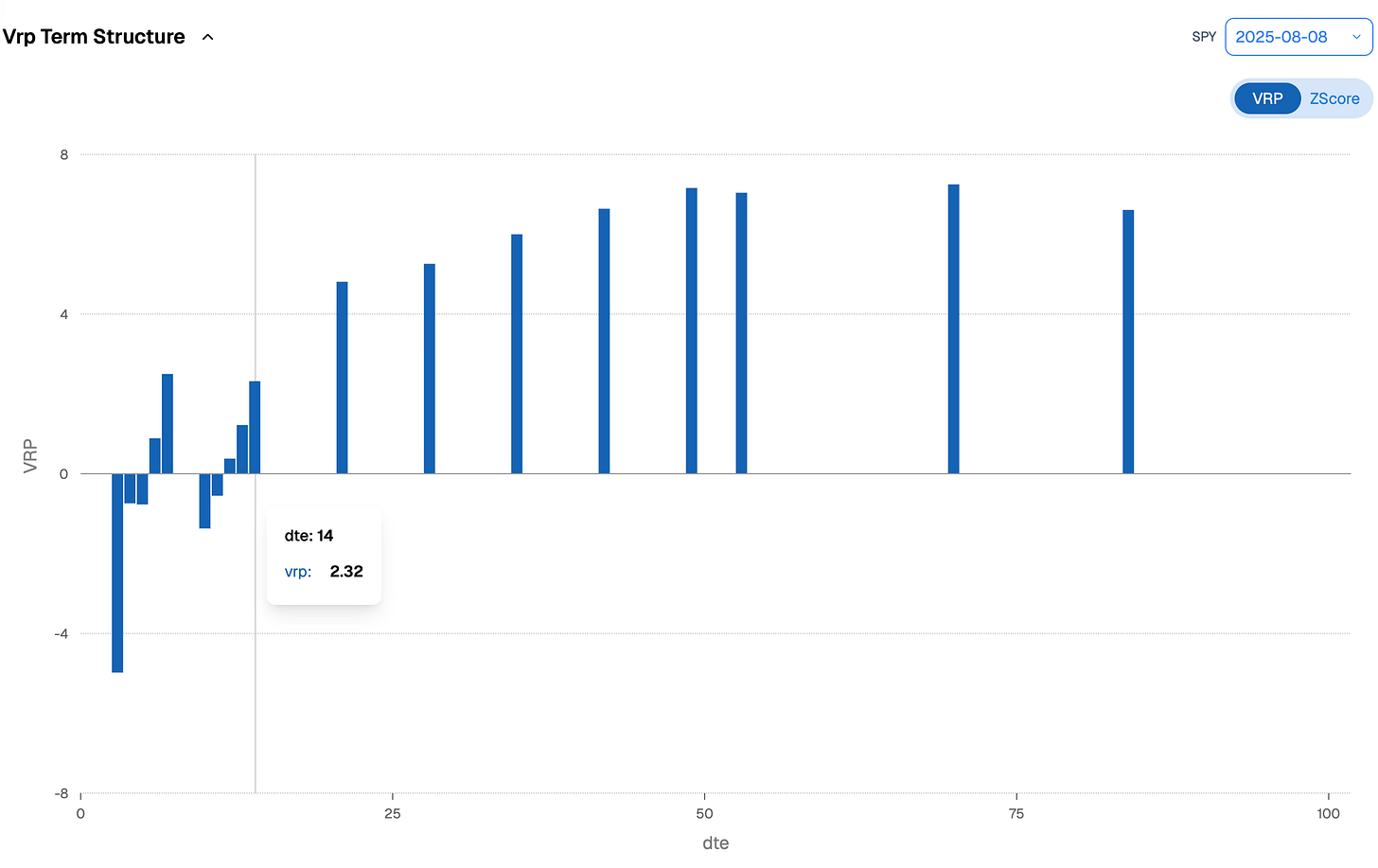

The VRP is virtually gone from the first two weeks. In other words, your edge there is getting thinner, and extracting vol without doing much (starting with delta hedging) will be harder. Even the back weeks, around 30 days out, look far less attractive than the almost guaranteed 8 points we had a month ago.

To be clear — the data are far from dramatic, and we are not calling for a blowout. But it may be worth waiting for better prices. We would go one step further: get a feel for the mood over the next few weeks. Nobody likes to get caught in a spike or a regime shift. For now, the light is still gre

The contango in SPY options is pronounced — hard to look at this and think the market is worried. But when you put that steepness in the context of how low volatility is, we are not in long-vol territory yet… still, it is worth watching for complacency early this week, and maybe picking up a few long-term hedges while they are cheap.

One last point, if you needed another reason to take some risk off and get the book ready: the (realized) volatility of (implied) volatility has been rising steadily for two weeks. That is rarely a sign things will stay quiet. We are not yet at a level where you can say the “worst” is behind us.

Better safe than sorry — being long theta only works when you know the market is overpaying for what you sold. That evidence is getting thinner by the day. A timely reminder of one of the simplest, yet most effective, rules in risk management: you do not have to trade.

In other news

A French rap song goes something like: “The winners write it while the losers narrate history.” It is hard not to draw a parallel with what is unfolding before our eyes. While Europe is busy issuing statements that the Ukrainian conflict cannot end without Ukraine’s consent, Putin and Trump will meet to discuss exactly that. And it is difficult to imagine the outcome being anything other than a piece of paper asking Zelenskyi to concede territory — terms unacceptable to him, and to the fighters who gave their lives to defend their land.

The cynical observer might immediately follow with: “Or else what?” Russia holds the upper hand, advancing slowly but steadily, and without U.S. support the Europeans are hardly in a position to take decisive action against Putin — yet, at least. Whatever comes of Friday’s meeting, the lesson for Europe is already clear: its diplomatic weight has eroded badly and flirts with an all time low.

And at a time when other blocs are investing heavily in the technologies of tomorrow, Europe should treat this as another wake-up call. Having a tech scene in Paris, London, Berlin, and Stockholm is nice — but is it enough to secure a seat at the table of those, litteraly, writing the future?

The cynical observer would probably answer in no more than two letters.

Thank you for staying with us until the end, as usual here are a few very interesting read from last week:

Two giants, same pod shop model — yet Citadel and Millennium could not be playing the game more differently. From pass-through economics to commodity powerhouses and contrasting approaches to autonomy, the piece dives into what really sets them apart beneath the surface. If you think all multi-manager funds are just crowded trades in disguise, this will make you think again.

If you think the next cultural frontier is in LA or Silicon Valley, this essay will challenge your perspective. It’s a sweeping, story-rich case for why the “Middle Places” — forgotten towns, overlooked communities — might be the true Florence of our time. Equal parts memoir, philosophy, and call to arms, it’s about stealing fire from the gods, mastering new tools, and building something timeless where no one is looking.

That is it for us this week, we wish you a great (CPI) week and as usual, happy trading.

Ksander

Charts, and analysis are powered by Sharpe Two Insights.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.