Forward Note - 2025/07/27

Beware of the week ahead.

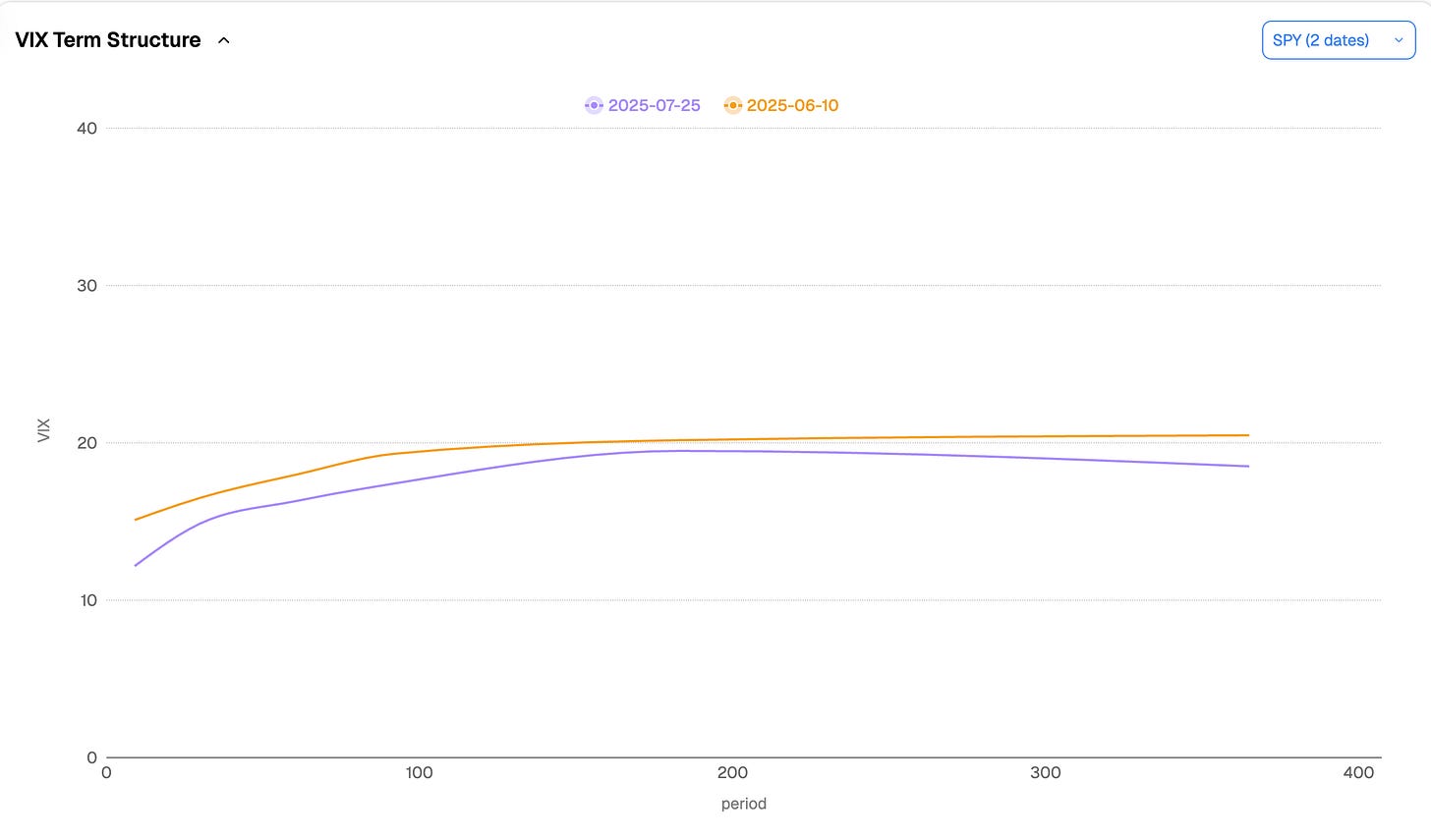

Weeks pass and start to look awfully similar: this week, the S&P 500 added a little over 1%, while the Nasdaq rose about 0.5%—a perfect mirror of last week’s performance. In the same vein, the VIX keeps grinding lower and just closed below 15 for the first time since February.

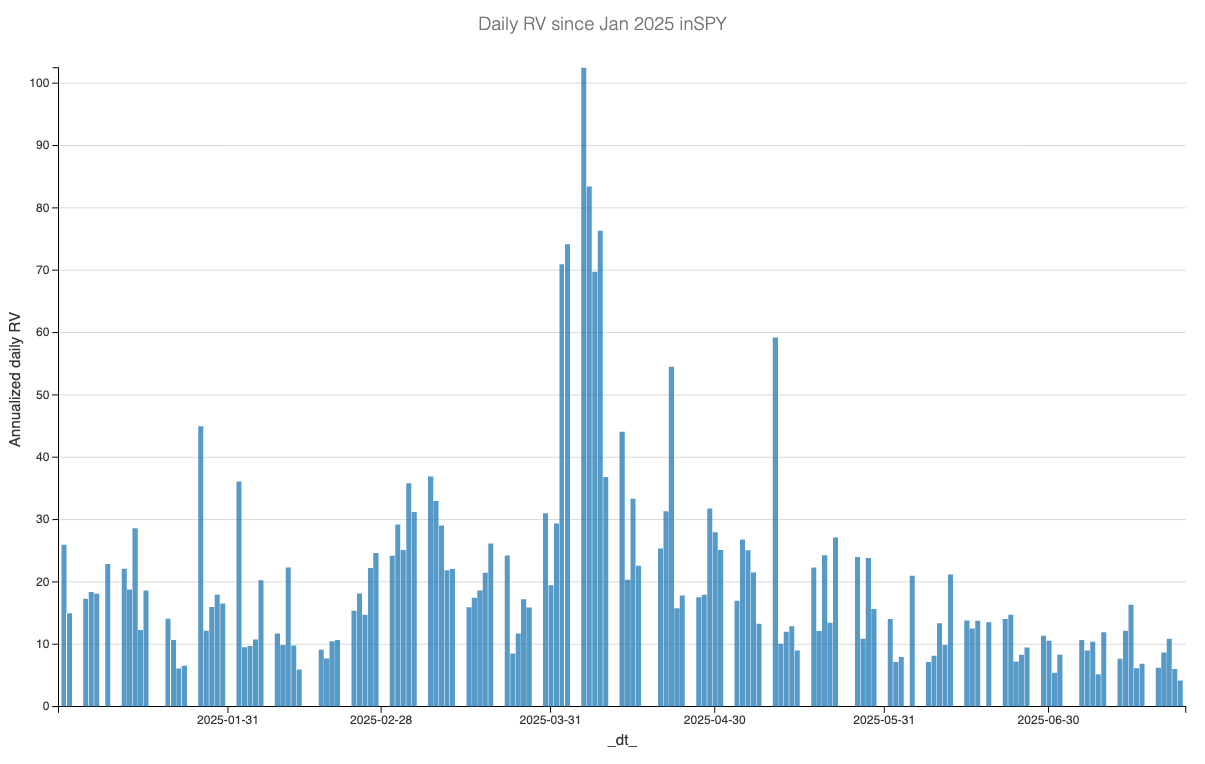

If you're the kind who reads the past to divine the future, you might say the VIX will be back above 20 within a month—just like it did during that mad Q2 we all remember. But, as usual, we prefer a bit more nuance. For starters, daily realized volatility has stayed low for quite some time now.

Nothing has managed to disrupt this quiet, lazy summer. And sure, there's a good case to be made that all the major macro narratives—US debt, trade wars, and the broader health of the US economy—are just waiting to return in September. That said, a few important events are lined up for next week that could, at the very least, stir the pot a little.

First up: the next FOMC meeting. While we’ve said repeatedly that we do not expect any major announcements, nothing is ever truly off the table. And with President Trump slowly turning up the pressure on Powell, this decision will be more scrutinized than ever. The market’s real question is simple: does Powell still have a grip on the board, or should we start pricing in a looser Fed sooner than expected?

Be aware: even if the rate decision remains unchanged, any hint of friction—whether in the statement or the press conference—could trigger a meaningful market reaction.

Then on Friday, we’ll get the Non-Farm Payrolls report. And depending on what the Fed signals about the economy earlier in the week, this number could carry more weight than usual.

Finally, throw in a few major tech earnings, and you’ve got the recipe for some “fireworks” in the middle of the summer torpeur. MSFT, META, QCOM, and ARM are all set to report on Wednesday, followed by AAPL and AWS on Thursday.

Still want more? Thursday also marks the last day of a month in which the S&P 500 has already added about 3%. Could we see an extra percent tacked on thanks to month-end flows?

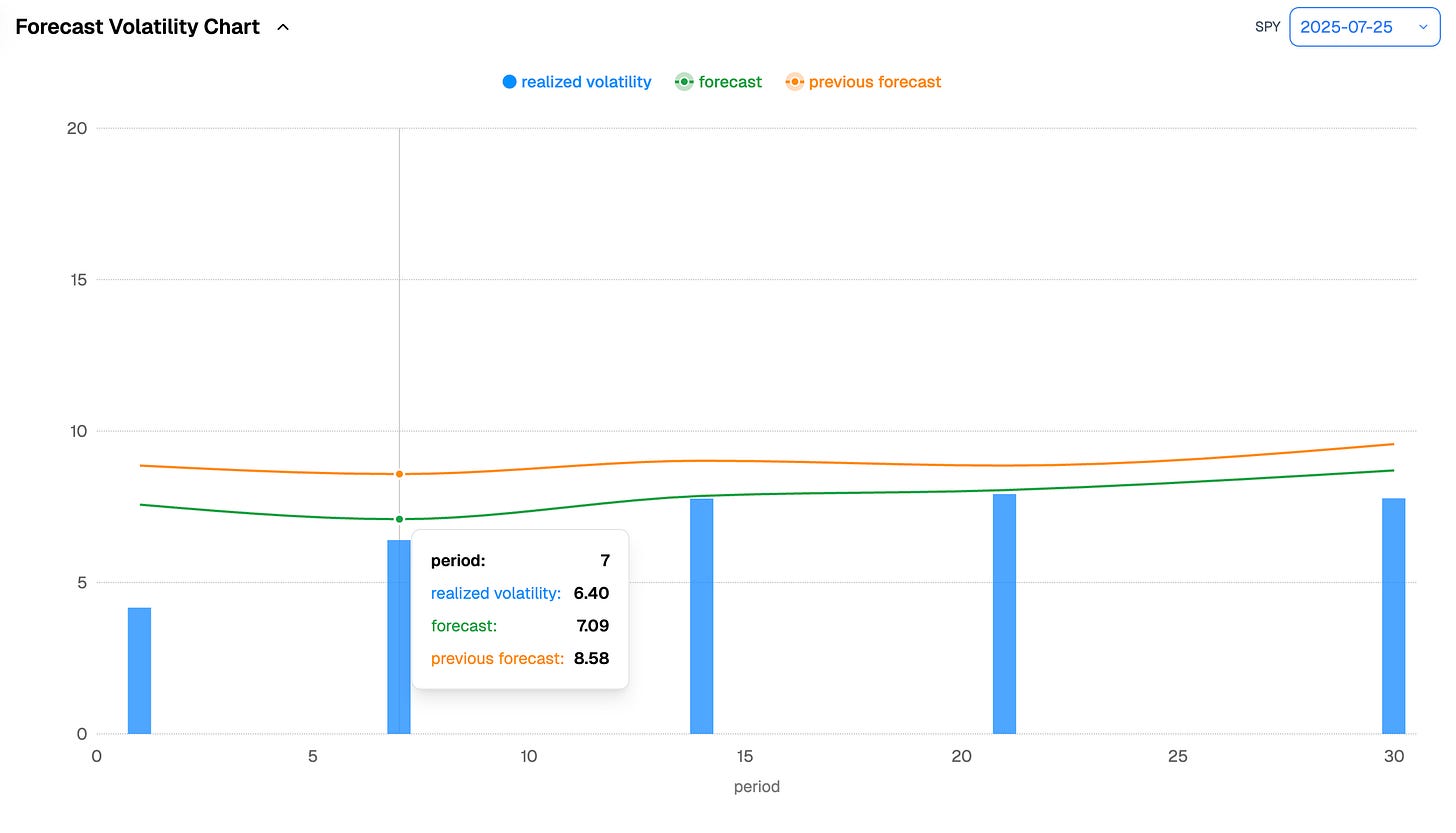

Needless to say, relying purely on a realized volatility forecast this week—without factoring in what’s coming—has its limitations.

Expecting realized vol to print a 7 in the coming days might be a stretch given how packed the agenda is. That said, the broader takeaway remains: it is extremely unlikely that you will see realized volatility stay at 15 over the next 30 days. A print of 11 would already be impressive—and would require a meaningful jolt from the sluggish tape we’ve been riding lately.

In any case, while we remain confident in the current neutral-to-low volatility regime, gamma might be looking a little cheap right now. Let’s start with the contango in the SPY term structure:

Not only has the overall level of volatility come down, but the short-to-medium-term steepness has become more pronounced. Too pronounced? That’s always a fair question when your last week with realized vol above 10 was over a month ago.

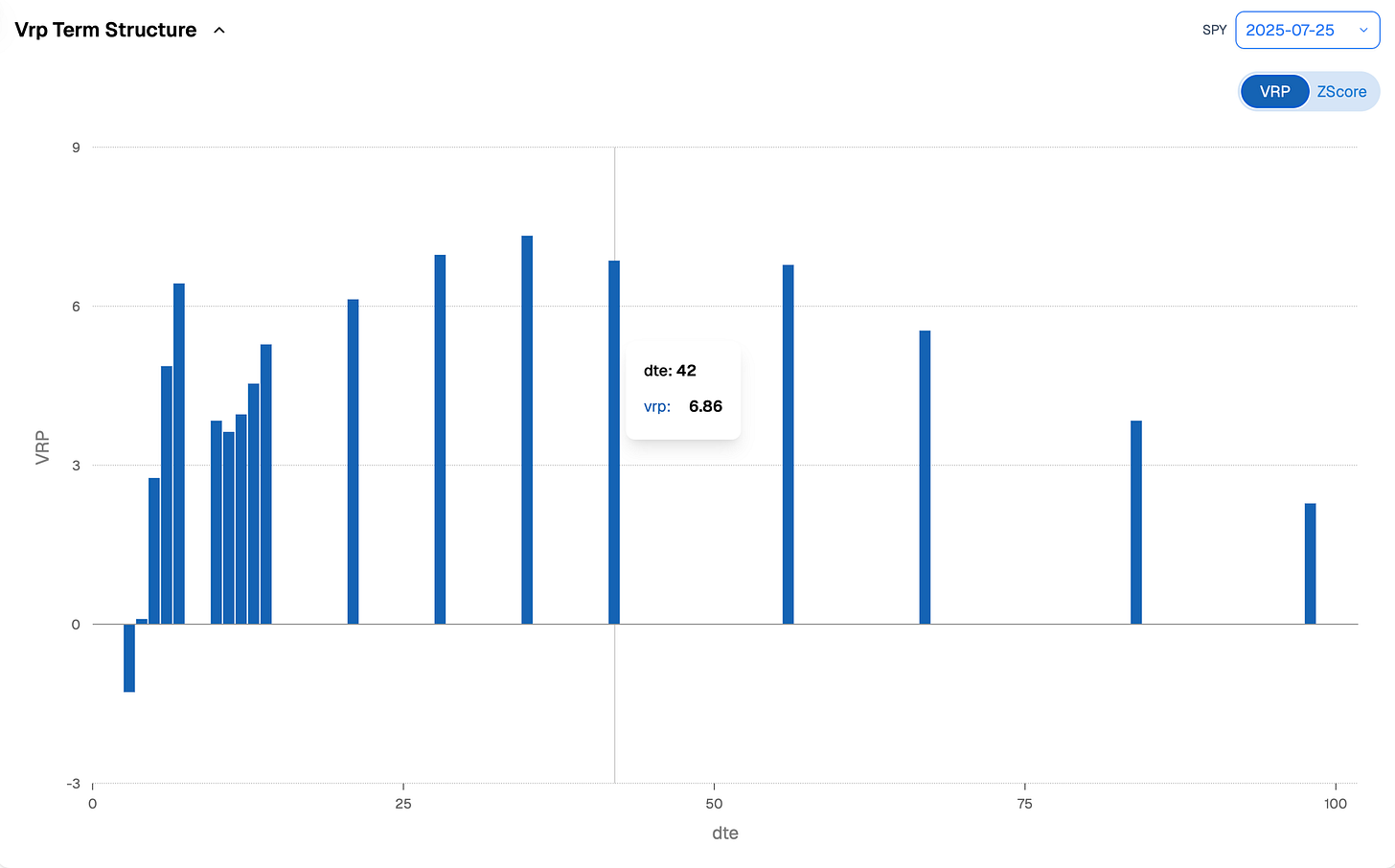

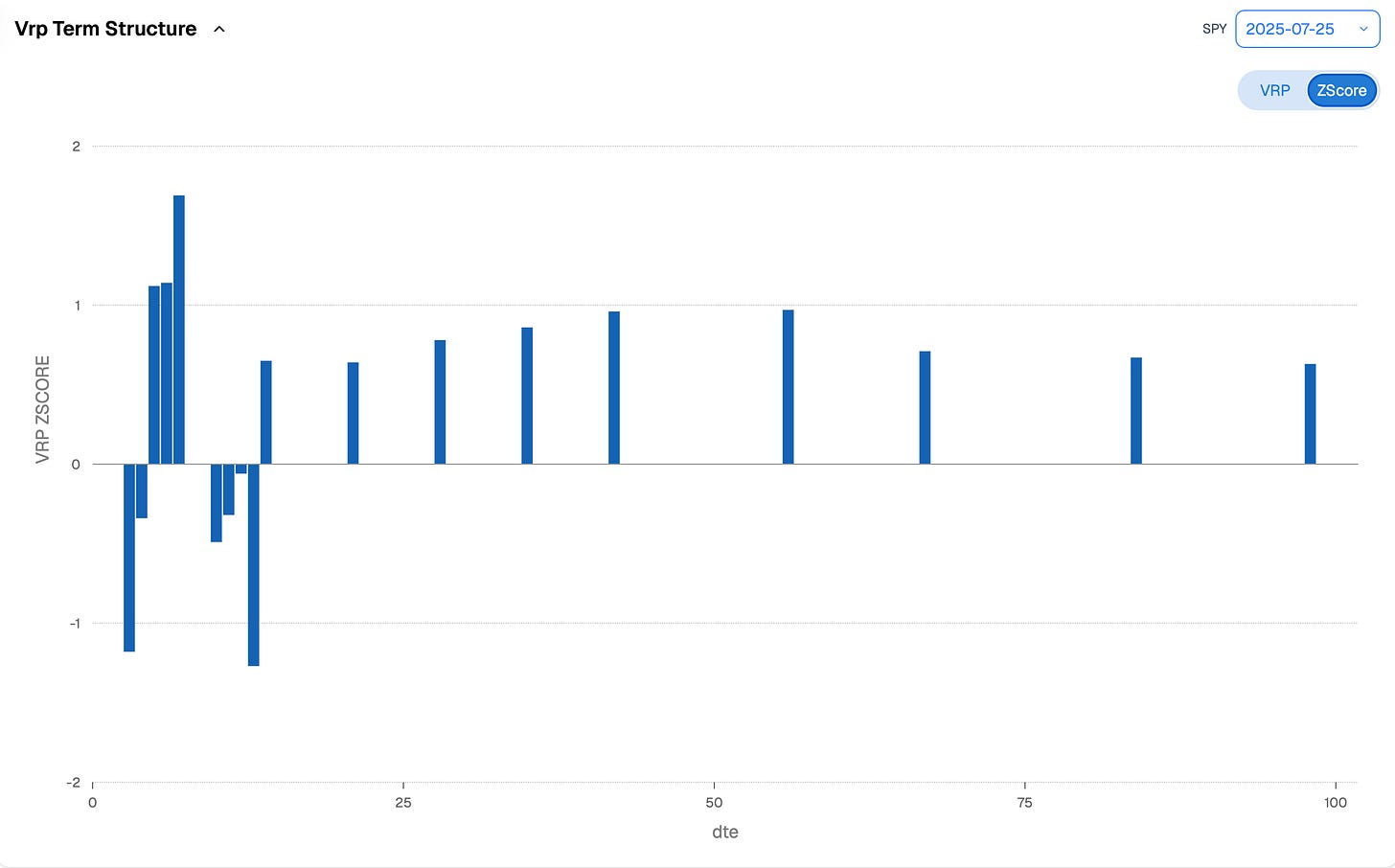

Now let’s take a look at the VRP term structure:

As of Friday’s close, you still had a decent 6-point VRP 30 days out. But in the super short-term, it turns negative. In other words, if you’ve been short 0DTE lately—capitalizing on relatively expensive short-term options—you may want to tread carefully next week. In fact, buying tails in that tenor might not be the worst idea.

How about selling VIX at 15 just because you’ve got 6 points of VRP? This is where trading gets nuanced. Given the potential “agitations” ahead, we are not exactly in a rush to jump on 15. If you build a z-score on the current term structure, it becomes clear that while pricing is still somewhat interesting, it has lost a good bit of its appeal.

With a z-score down here, there’s nothing wrong with waiting for the next wave of “problems” and letting VIX drift back toward the 17–18 region. So, similar to last week, we’re not adding new positions—we’ll wait for better opportunities, which we have no doubt will present themselves.

The z-score view also reinforces the need for caution in the front week. Monday and Tuesday options are cheap, yes—but the dynamic is clear: the market expects movement, just not yet. That does not mean you should be selling them. At least not now, especially when most of week 2 is showing a more compressed-than-usual VRP.

In short: be patient. Let the events of the week play out, and look for chances to reload in the back weeks. Unless something truly substantial drops at the press conference, odds are we still have another two weeks of boredom calm and laziness.

In other news

TSLA had a rough week—down 8% on Wednesday after disappointing sales and Musk admitting the company still faces a couple of rough quarters ahead. No need to be a rocket scientist to see the problems: Musk has severely dented the brand’s image (those “I bought this before Elon went crazy” stickers are now flourishing on the backs of Teslas), while the competition has not only caught up—they’ve surpassed in some areas.

Zoom out over a six-month window, and what was supposed to be a standout year for Tesla is morphing into a slow-motion train wreck. The stock is now down 16% year-to-date, well behind the rest of the Mag 7.

The bigger issue? TSLA has become a pure bet on Elon’s personal fortune—a pretty ironic outcome for someone who was once the poster child of decentralization and early crypto bets. Unfortunately, there is no liquid instrument to short Elon’s popularity… except the stock itself.

Could we still see a turnaround for Musk? Absolutely. Grok is quickly becoming a serious force in the AI world, and early benchmarks already rank it as one of the top models around. That is going to be hard to ignore.

Thank you for staying with us until the end. As usual, here are two interestnig reads:

Alphabet’s Q2 blew past expectations and crushed the “AI kills Search” narrative, with both Search and Cloud accelerating. The piece does a great job unpacking why monetizing AI Overviews could become Google’s next cash machine, and why $85B in capex is a feature—not a bug.

If you want a sharp, conviction-driven take on who’s really winning the hyperscaler war, this is your read.A French micro-cap with a national monopoly, high-ROCE model, and real operating leverage finally kicking in. This deep dive lays out why recent contracts with Carrefour and Leclerc could unlock years of profitable growth—and why the market is still ignoring it.

If you’re into asymmetric bets with low liquidity and high upside, this is the kind of idea you want to catch before it trades 10x volume on results day.

That is it for us, we wish you a wonderful (FOMC+NFP) week ahead and as usual, happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.