Forward Note - 2025/06/22

Putting emotions aside.

We learnt late last night that the United States has finally engaged in direct war with Iran, striking three nuclear sites in Fordow, Isfahan, and Natanz. President Trump is now calling for peace talks after declaring the program "obliterated," while warning that any form of retaliation would only bring further destruction to the country.

These are the facts.

Now comes the difficult exercise — what is next for the market? It will be interesting to see how futures open on Sunday. Yet, if we set aside emotions (and the tragic gamble hanging over thousands of human lives), we would anticipate a fairly quiet open on Monday and a moderate week overall.

Let us define quiet and moderate, shall we? Some volatility is to be expected, of course — particularly at the open, when speculators and larger hands with real interest will look to unwind positions. A mega crash? Only those sitting on an extensively short book could seriously entertain that outcome.

Most likely, something in between — and we can hear you from here: "Thank you, Ksander, that is not particularly useful." Fair enough. But let us again put emotion aside and think about what "something in between" really means. Is that not exactly what a VIX at 20 on Friday was already suggesting? And even then, the term structure was certainly less flat than what we saw when true uncertainty was hitting the market back in February, when no one quite knew where the disruption might come from.

So, some risks, potentially — yet very unlikely to lead us into severe or prolonged uncertainty. And because, at the end of the day, stock markets remain a signal of future economic health, this is certainly not the type of uncertainty that would trigger a massive recession in the United States.

Time will tell whether this assessment proves right. But the beauty of markets is that they digest news as it comes — and as we wrote a few weeks ago, you rarely go from VIX 17 to 45 without warning signs.

As far as we are concerned — and again, with emotion firmly aside — this is business as usual. We remain fully focused on operating within the neutral market regime that volatility still seems to be in.

Could we see VIX at 25? Certainly. It could even push toward 30. But meaningfully above that? We would need truly disruptive news — the kind that, at this stage, no one has yet priced in.

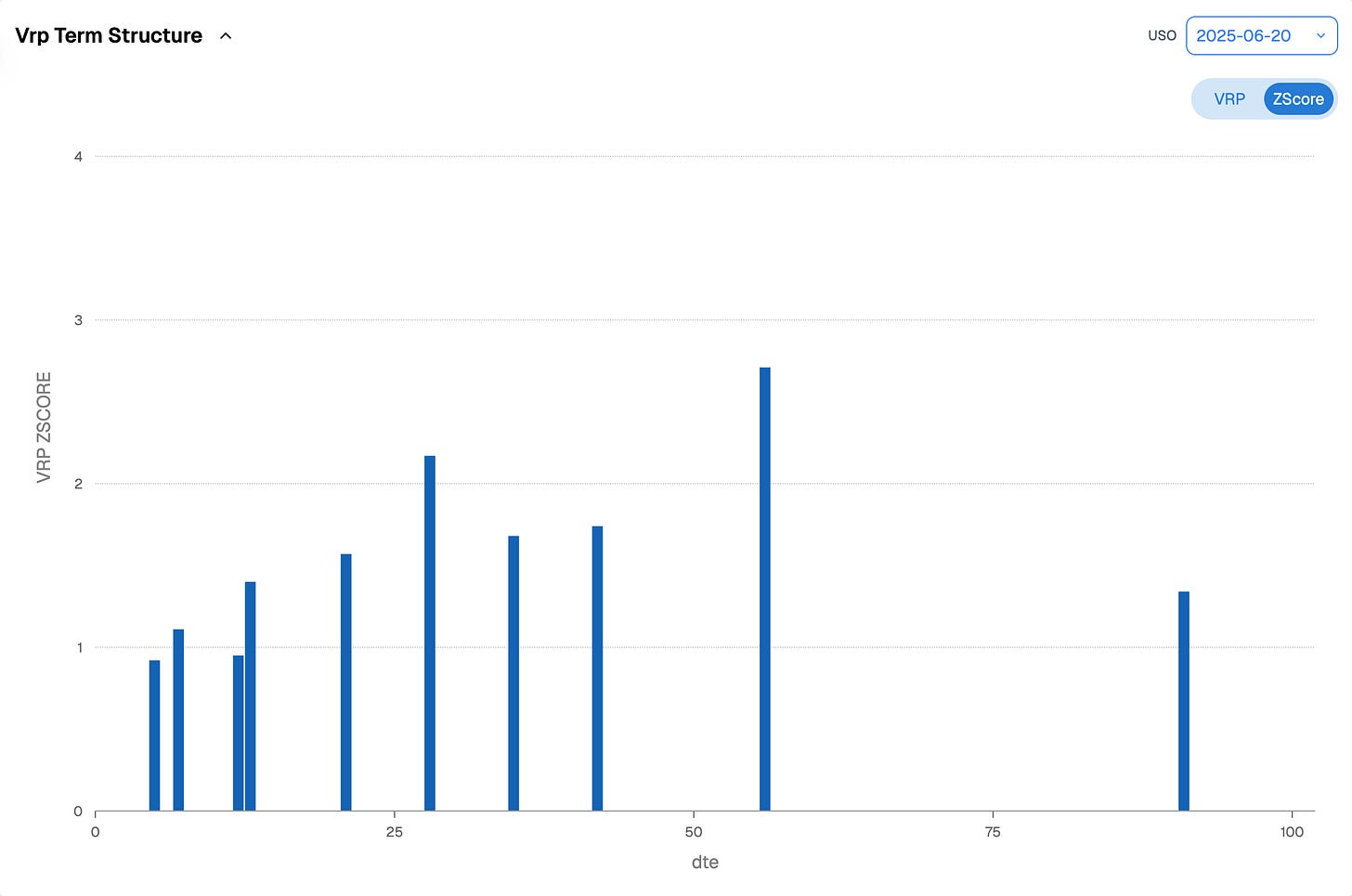

Before we dive into the very speculative exercise of imagining what that might be, let us focus on one metric that matters most to us in options trading: the VRP in U.S. equities is finally back in full force.

It is probably there for a reason, as usual — so one would want to size positions carefully, with an eye on potential disruptive factors.

What could those be? We would place the closing of the Strait of Hormuz at the top of that list. Such a move would send oil prices climbing dangerously high, threatening the "improvement" Powell pointed to in his press conference on Wednesday.

Because while the Middle East situation is still unfolding, the market will not linger long — it will soon refocus on the next story: two rate cuts before year-end were "almost" promised, and given Powell’s track record, that is still the most likely path.

So much so that we heard voices at the Fed calling for a rate cut as early as July. With oil on the rise — and until there is further clarity in the Middle East — that seems particularly unlikely. Post–Jackson Hole and September remain far more reasonable timelines.

We will insist on this point: if you do not trade commodities, do not get caught in the crossfire between the media, social media, and the occasional noise the market will inevitably react to as fresh headlines hit the tape. As much as these events may define the course of history, they still lack the truly disruptive catalyst that would warrant major positioning shifts. And if we lose 15% over the next three weeks, you are welcome to make fun of us.

But what if you trade oil? Let us start with the obvious — we are by no means commodity market specialists. While we did take a slight position last week, our assessment remains unchanged: favor the long-term relaxation of the term structure through calendar spreads, and avoid the short term.

The hardest part, as usual in situations like this, is to wait for the situation to settle — or even to be sure that they are truly over. Once again, the most likely scenario right now remains some form of retaliation from Iran.

Setting aside the Strait of Hormuz, we find it difficult to imagine Iran attacking neighboring countries — as that would almost certainly trigger a direct U.S. intervention, with troops on the ground and potential regime change. But that is pure speculation — and very much a personal view.

Now, something a little more data-centric to follow: realised volatility.

First, the obvious: realised volatility jumped from 27 to 35. And while this level is high, it is not exactly off-the-charts. There is definitely room for more panic — and your job here is to ask what could trigger it. Because otherwise, much of the potential disruption appears to be fairly well priced, given that the market has not (yet) chosen to deliver a bigger reaction.

Still, we will stress patience here. Developments are coming by the day, and there is little point in trading full size just yet. One key metric we will be watching this week is the spread between upside and downside semi-variance — it is extremely wide at the moment, and we would want to see some normalization before considering adding meaningful size to a variance risk premium that promises to pay handsomely in H2.

In other news

We heard the wildest rumors about Meta this week — from a potential buyout of Perplexity before settling on Scale AI, to existential fears that Zuck might soon be irrelevant as X enjoys a renaissance and Instagram loses steam. Even Altman added his little grain of salt. In a podcast with his brother, he implied that Meta had tried to poach some of his top engineers — with offers reportedly around 100 million USD.

It is unclear whether that figure was total compensation or just a signing bonus, as he did not go into further detail in the episode. But numbers like that are enough to make anyone’s head spin. It was not unheard of to see multi-million dollar packages for top AI engineers at the best shops — but 100 million USD was typically reserved for CEOs of leading companies.

This begs a couple of questions — and the most obvious (or at least the most interesting to us, venal little traders): how much are these people at OpenAI actually being paid to decline such offers?

Because sure — loyalty, love of the culture and the company, total devotion to the mission — we get it. We worked in an AI startup for eight years, we know the script. But let us be honest: there is not enough love in the world to convince an engineer to turn down a 100 million dollar package. Nobody in their right mind would pass on that unless:

1/ the competitive edge at OpenAI is so overwhelming — through infrastructure, data, and models — that it is on the verge of total domination in the coming weeks, or

2/ the tech stack at Meta is simply not that appealing.

We have a hard time believing the second. And while OpenAI is clearly a step ahead (and Altman is promising GPT-5 over the summer), calling it "total domination" still feels far-fetched.

Or... how about a third option: yet another complete lie or some creative PR spin?

Thank you for staying with us until the end, and as usual, here are two interesting reads:

Can anyone really "be anything they want"? Not quite. This sharp piece breaks down why aligning with your natural strengths is far more effective — whether in sport, career, or entrepreneurship. A ruthless (and fun) guide to hacking your own comparative advantage.

Apple dropped a paper arguing today’s AIs cannot really “reason” — a week later, an AI researcher, literally, because its name is Claude Opus, wrote a full rebuttal pointing out how Apple rigged the test. Amusing? Yes. But the bigger tell: Apple looks increasingly off the pace in this AI race. The stock is now the worst Mag 7 this year, -18%, worst than TSLA.

That is it for us, we wish you a wonderful week ahead, and as usual, happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.