Forward Note - 2025/06/15

Fireworks, VRP and patience.

The good thing about a data-driven approach is that, once in a while, it stops you from doing something stupid. We felt slightly odd writing "stay put" on Thursday—pointing to the lack of opportunity across most corners of the market—only to feel much better about it a few hours later, when the latest geopolitical twist in the Middle East validated the call.

While we obviously hope for a peaceful resolution to this never-ending conflict, the Israel–Iran tit-for-tat jolted a market that had been dozing off for nearly three weeks.

Late Thursday night, reports emerged that Israel had struck military targets in Iran, killing three top commanders and at least 78 civilians. The market spun on the news, with VIX spiking to 21 in pre-market trading. But true to form, the "buy the dip" mood that dominated the last few weeks returned—VIX quickly sank back to 18. That was until Iran retaliated just before Friday’s close, sending a visible chill through the tape.

As a result, the market closed down 1.2% on the day, wiping out the week’s gains and dragging the S&P 500 back below the 6000 mark. VIX ended the week above 20 for the first time in nearly two months.

There’s little doubt the latest developments over the weekend will heighten concerns and keep equity markets agitated for a while. For how long? That’s hard to say. But it is worth remembering: while markets dislike uncertainty, they’re surprisingly adept at digesting it—and lately, they’ve been doing so faster than most expected, ourselves included.

That said, one does not want to be early in fading a disruptive catalyst. Until we get some indication of where world leaders are drawing the line, it feels premature to step in. Still, it is hard to ignore the inevitability of “old news” rhetoric taking over, especially if the conflict stabilizes into a new status quo (Ukraine comes to mind).

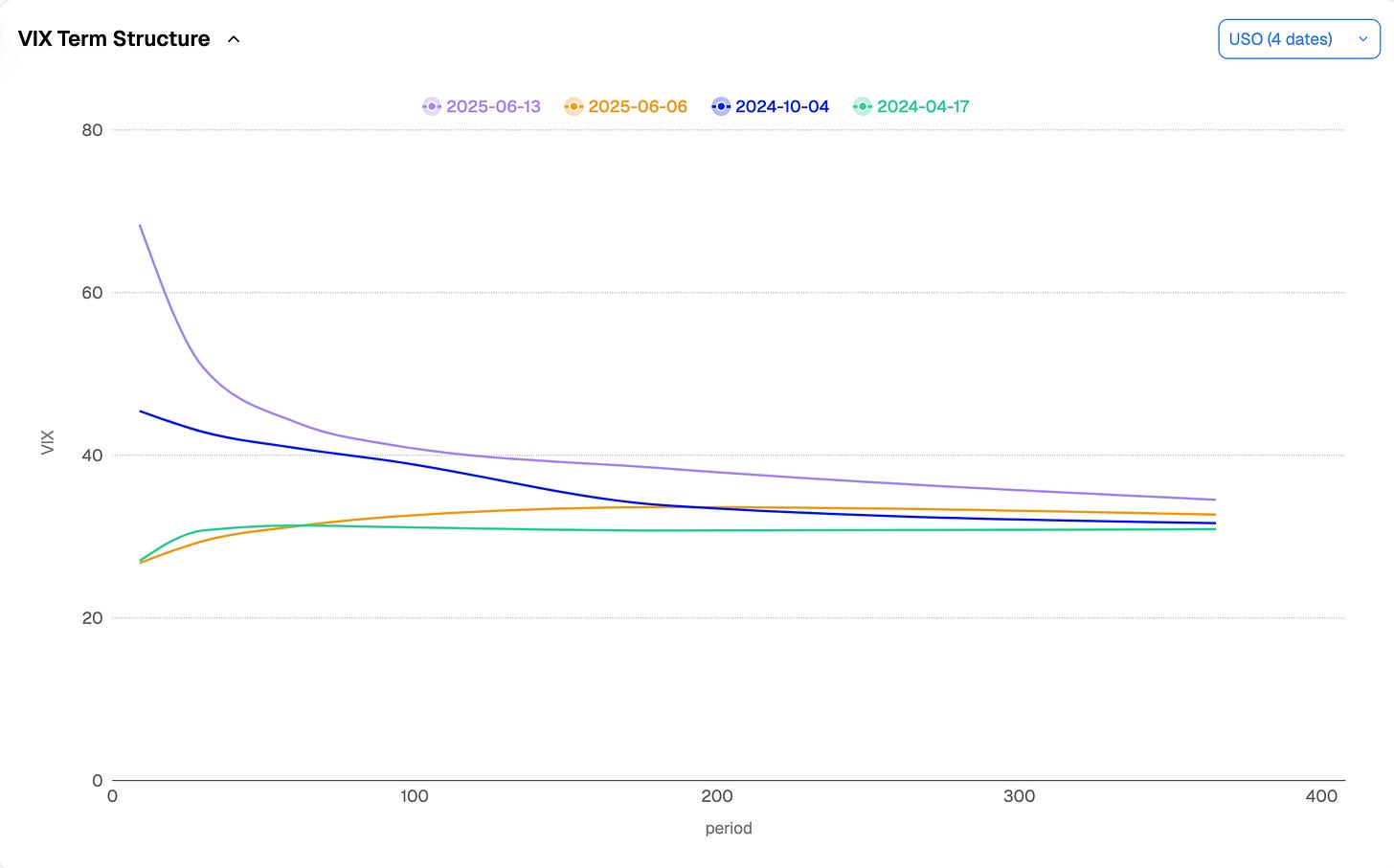

Oil surged nearly 7% on the news, and it is likely volatility will linger longer in energy-related assets than in traditional equities. Looking at the term structure in USO, it inverted sharply—unsurprisingly—on the back of the headlines.

While we had a pretty well defined contango at the close of last week, and an IV at 9 day somewhere below the 30%, we closed the week at 70% on Friday, as market participants felt uneasy going unhedged into the weekend, and supply of insurance dried up throughout the day.

But as we mentioned a few paragraphs above—until we reach some sort of threshold, it may be presumptuous to start selling vol. Any new development could trigger wild swings, punishing short-tenor insurance sellers in an already compressed maturity cycle.

So what sort of signals should we be watching?

The first—and most obvious—is a stabilization in the newsflow. Without some clear indication that a resolution or a stalemate is soon, it is unlikely to observe any form of cooldown in the market. From a data standpoint, we want to see signs that realized volatility is no longer in explosive mode, particularly on the short end.

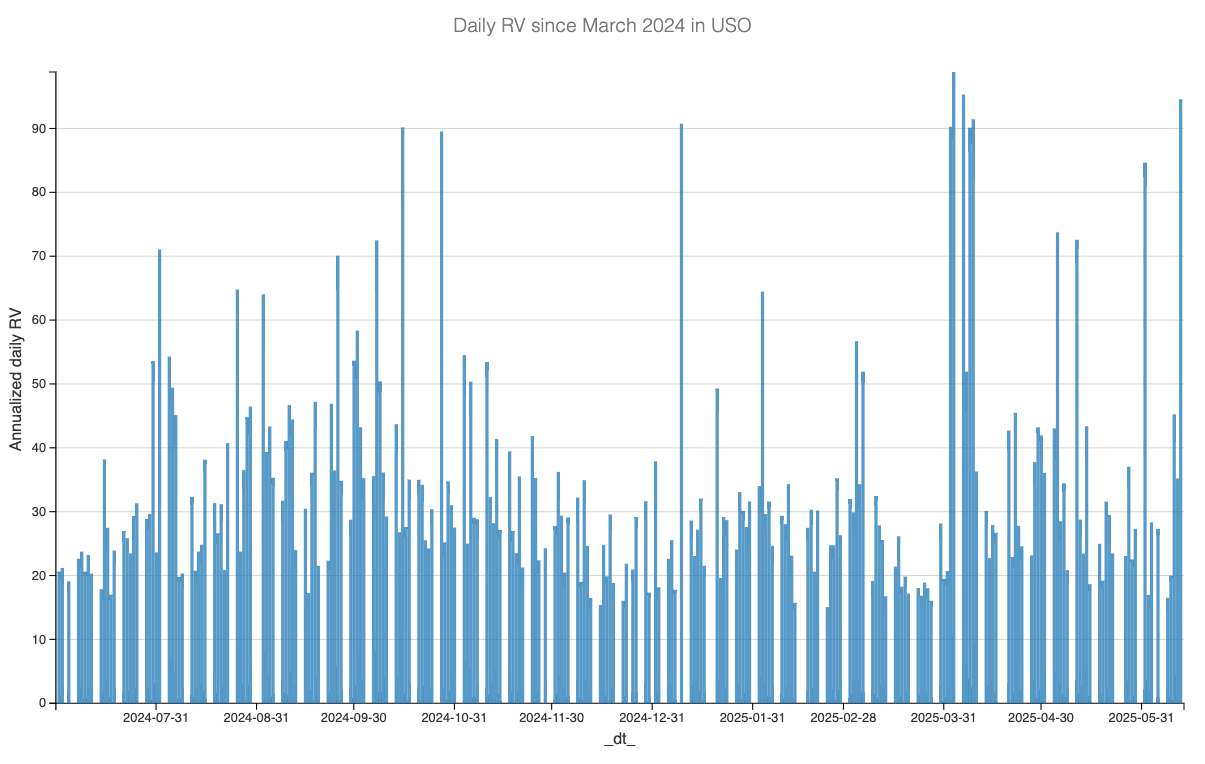

With the gap overnight and the pretty dense session, the realized volatility at 1 day measured in USO reached above 90, levels seen only in April during the trade war, and at the worst of the tension between the two countries in October 2024.

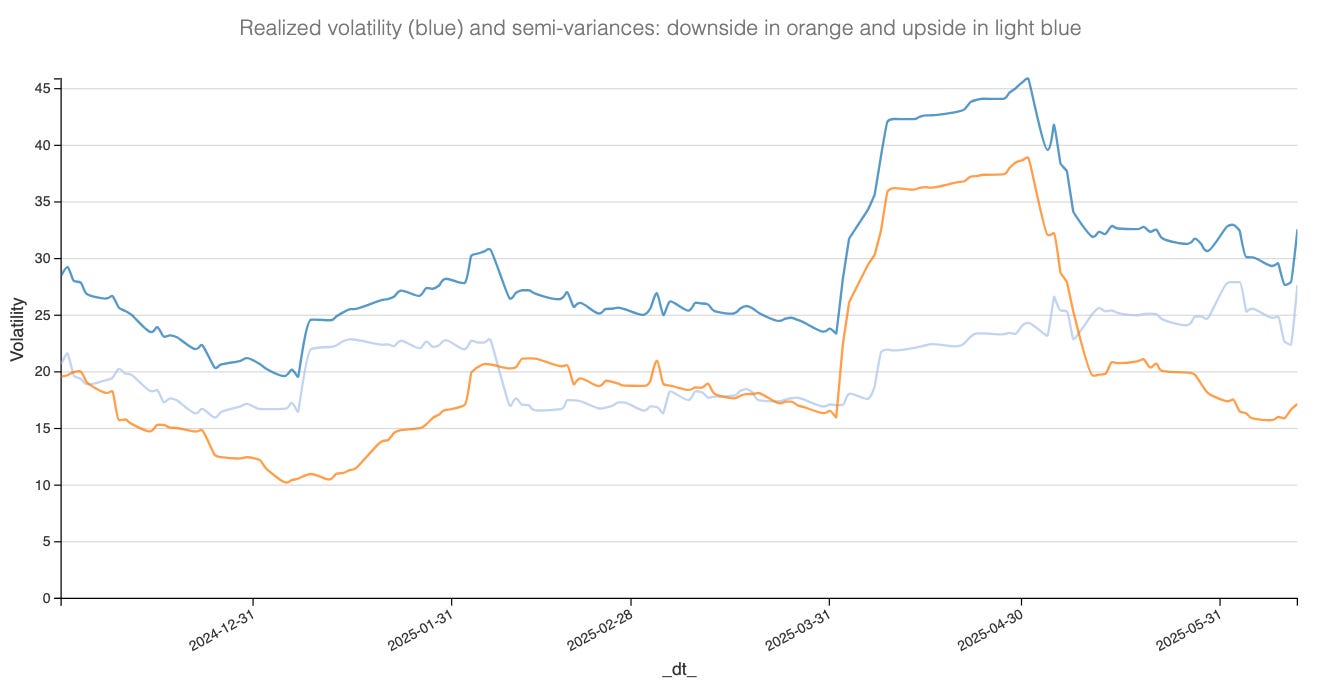

And remember last week’s note on volatility clustering? It is plausible we remain elevated for a while before short-term realized vol begins to cool off. Another signal worth tracking: realized skew, and the divergence between upside and downside semivariance.

What’s immediately apparent is that realized volatility is being driven by upside moves—and until a slowdown, stepping in to sell implied volatility may still be premature. Semi-variance is useful for identifying past trends, but its forward-looking value is limited compared to the information embedded in option prices.

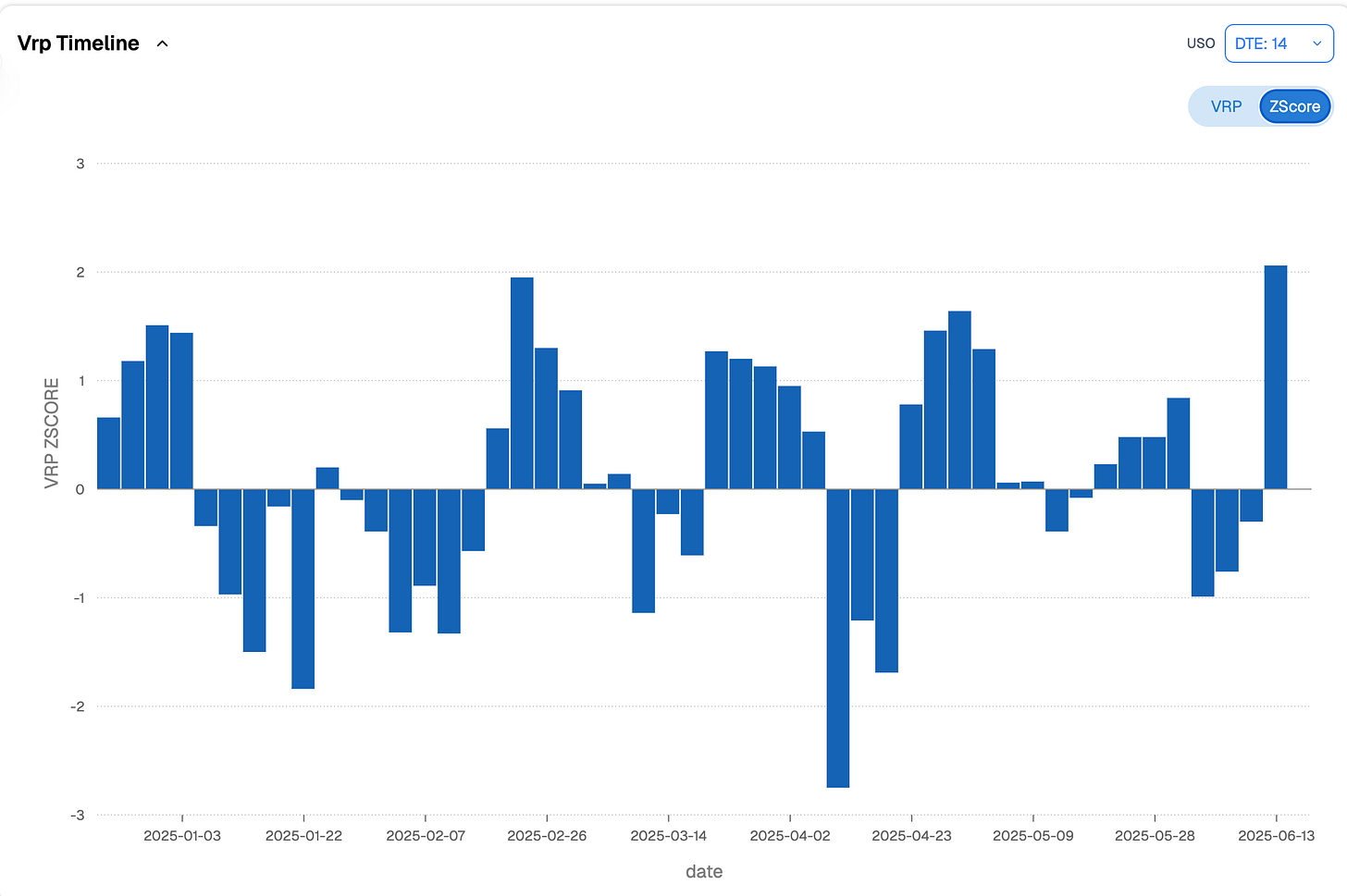

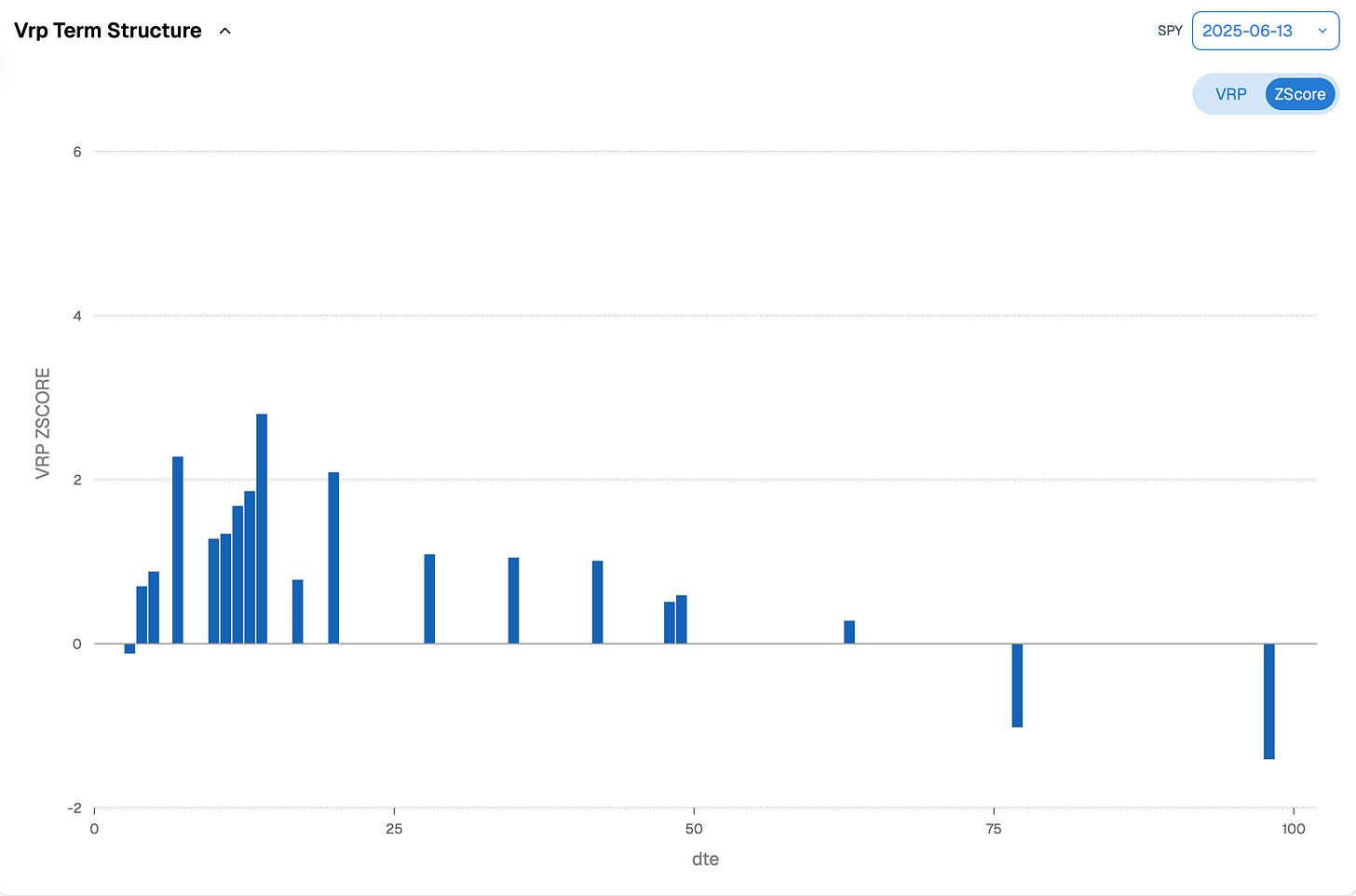

Therefore, let’s have a look at the VRP to get an idea of how demand for protection is currently overstating the risk observed in the underlying.

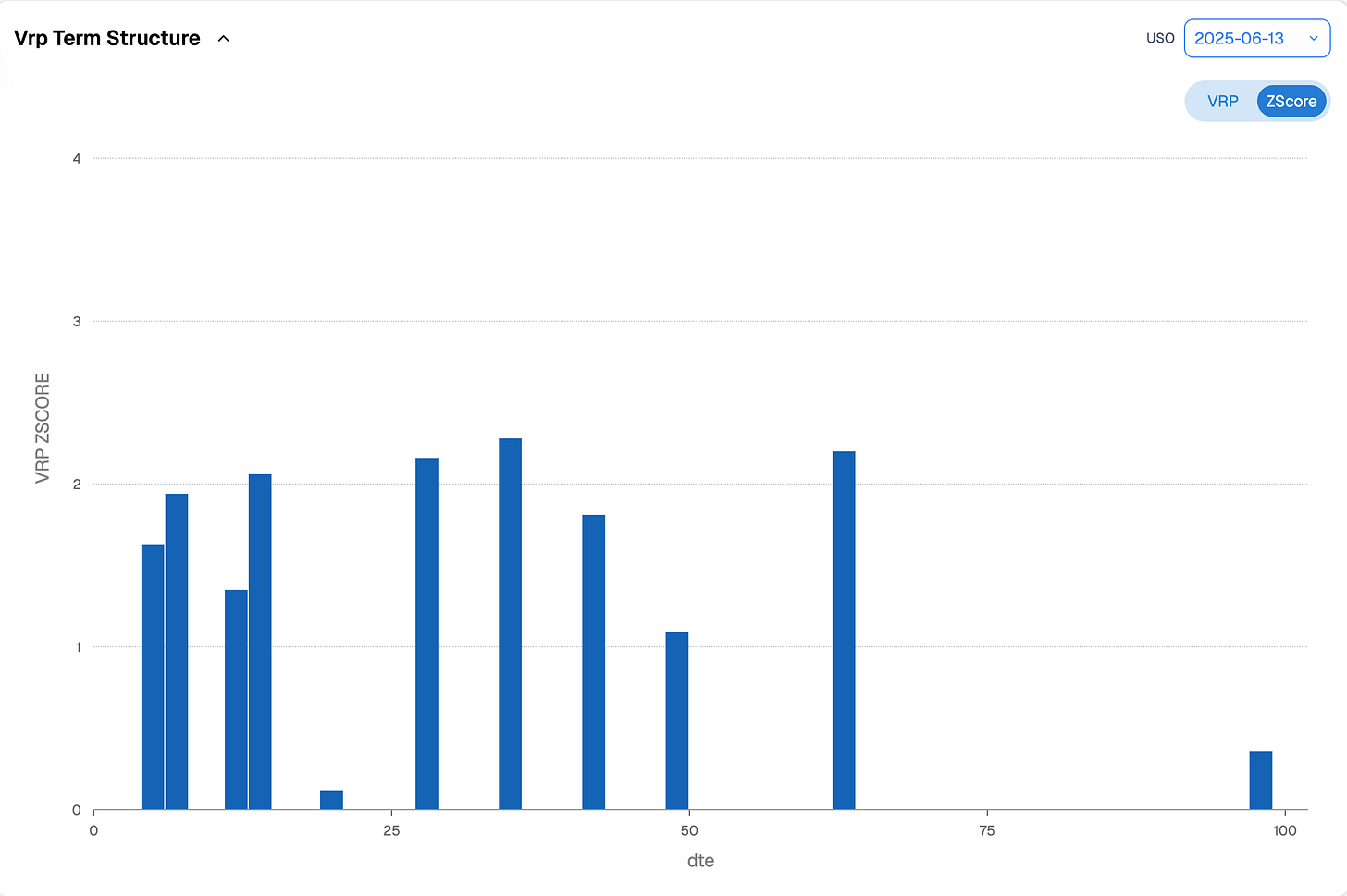

As expected, the variance risk premium is completely distorted with traders piling into protection and a very clear signal in the VRP computed with 2 options prices. It is, once again, tempting to lean into these distortions and harvest what looks like obvious mispricing. But patience remains key. First of all, at the present, the entire term structure has been lifted and the VRP is quite pronounced even in longer maturities.

As long as news is hot, the premium is probably here for a reason and far more likely to persist once the situation finds a new equilibrium.

And if you really cannot wait to get involved, favor short volatility in longer expirations—and pair it with hedges. You’re essentially building calendar spreads, betting on some relaxation of the term structure. But anything leaning too heavily into the short term leaves you unnecessarily exposed to gamma risk.

Your call, obviously.

While we’ve focused mostly on oil, it is worth remembering that Iran is also a major gas producer. The latest Israeli strike will likely ripple through related ETFs like UNG and the ever-explosive BOIL. The same logic applies: if you feel compelled to take action now, favor calendar structures—and ideally, in the back months.

And what about equities? In the short term, it is tough to say. We are monitoring developments carefully, of course. Yet, the VRP is back in most part of the term structure and will present interesting opportunities for traders if the news stay contain. In any case, it still feels like it would take a truly catastrophic escalation to derail the broader optimism that has defined the last few weeks. And therefore, anything past 30 days, again in some calendar structure, looks like a decent opportunity.

In other news

The conflict in the Middle East may be putting the Fed in an even tighter spot than it was already in. This week, we learned that inflation is cooling faster than economists expected, and GDP came in below forecasts—a near-perfect recipe for the Fed to justify a sooner-than-expected rate cut. Traders promptly revised their expectations from one cut to two.

Yet with oil spiking to levels not seen since late 2024—and likely staying elevated for a while—that disinflation narrative may get complicated. Even a modest energy-driven rebound in inflation could be enough to delay action from the Fed. No more rate cuts under Jay Powell? Still feels far-fetched, but it is a scenario the market may need to start grappling with.

What would come next? No one truly knows. But recent surveys of foreign investors flagged Fed credibility and U.S. fiscal policy as top risks—recurring themes in strategy reviews and investment committee debates.

Needless to say, everyone will be watching the summer data prints closely—nobody wants to be caught offside by September.

Thank you for staying with us until the end. As usual, here are a couple of interesting reads from last week:

As crypto treasury strategies gain traction, this study shows that BTC prices exert a dominant, one-way influence on the equity of firms like MSTR.

Using Transfer Entropy, the authors reveal bursts of directional dependency—interspersed with long stretches of noise.Think fine-tuning is the go-to method for updating your LLM? Think again.

This piece breaks down why tuning advanced models often does more harm than good—and what smarter alternatives like RAG and adapters can offer instead.

That is it for us this week. We wish you a (peaceful) week ahead and as usual, happy trading.

Ksander

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.