6000 it is then.

Exactly 43 sessions after the biggest SPX drop in over four years. A VIX that flirted with 60? Now back to 16, as the June quarterly expiration effects start to kick in. After all, who wants to keep paying for overpriced insurance that expires in a few weeks—especially when recent events have tested the appetite of world leaders to shake things up, and their response was loud and clear: status quo is just fine, thank you very much.

As it turns out, lows are great to buy from weaker hands… and when that’s done, most seem to prefer chasing all-time highs.

Friday's jobs print beat expectations—again—and it didn’t take much to shift the narrative from “the mother of all recessions is coming” to “it’s actually not that bad.”

Assuming tariffs are suspended by July 9—either through a deal or via the courts—what’s really left on the risk menu?

Of course, of course—we can already hear the chorus: “But the rates! The deficit! The BBB! Russia! China will never let go!”

We’re not ignoring any of it. We’re just looking at the odds the market is giving you. And as we said back in late 2023 when we launched this newsletter—and all through H1 2024—VIX 16 is all you need to know.

Yes, yes, but “the market can be wrong—look at April!”

Fair. April was a wake-up call. But here’s the nuance—one that’s worth revisiting.

That spike hurt, no question. But we didn’t go from 16 to 40 in a straight line. We hovered above 20 for a while, with that classic flat term structure that screams no one knows anything.

Then came the headline. Then came the panic.

Another thing you’ve heard us say many times - trade the regime you are in and not the one you may eventually be in. Last week, we’ve had the first glimpse of a come back in a neutral regime, where most of the risks in the marketplace are usually labelled as business as usual from an option pricing perspective. Once again, there is indeed no guarantee that we do not wake up early July to no trade deal announced and tensions on the rise. But it is more likely that the market will give us warnings signs of discomfort than a sudden jump from 16 to 30. In other words, we should have time to see it coming in the data and a change in the mood in the marketplace.

It’s always tempting to do some very clever analysis and uncover hidden risks.

In fact, a whole chunk of the finance industry is built—and handsomely rewarded—for exactly that.

The line between asset manager and risk manager is thin. But in the institutional world, those roles are usually distinct. For the retail trader, though, all the hats land on the same head—softly or not.

Rewiring your narrative is hard when your nervous system is still fried from a VIX 60 print. So how do you soothe it? You remember one thing: volatility clusters—upside or downside.

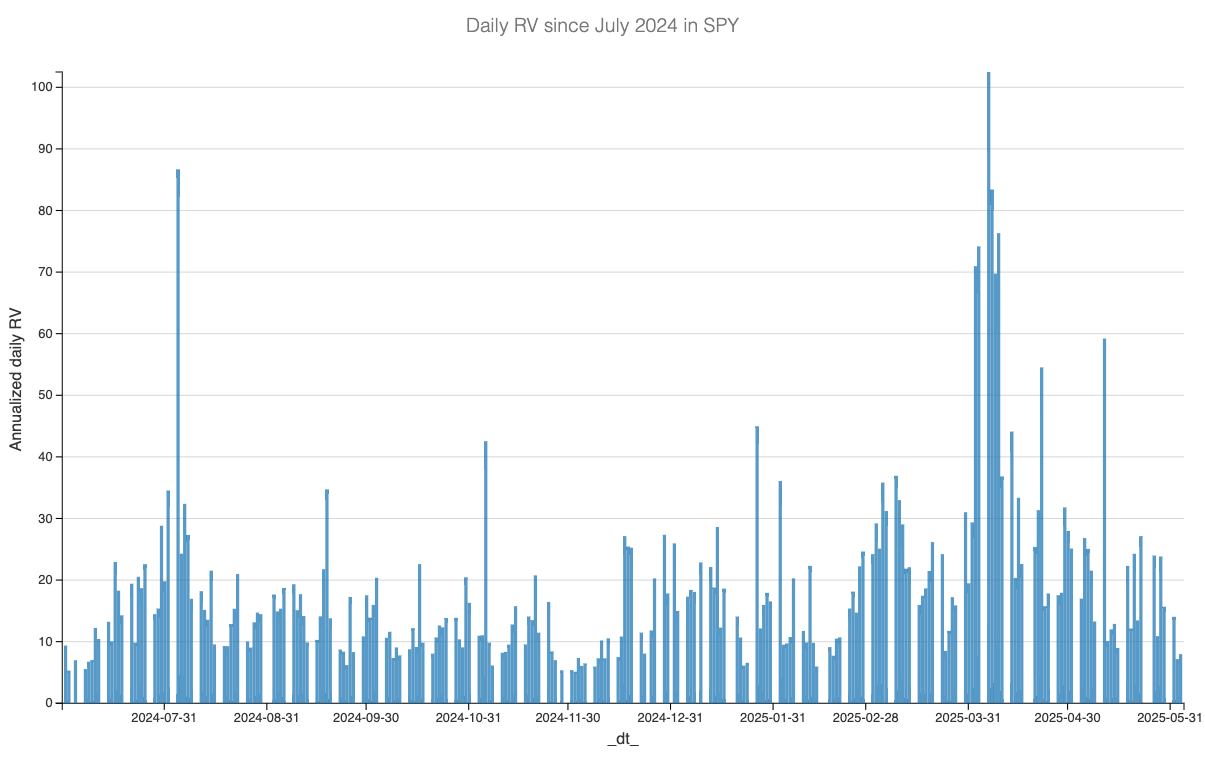

Let’s take a look at realized daily volatility over the past three months:

The build up of Q1 2025 and the fireworks of April? That chapter has passed. The market has moved on—and it keeps moving quickly. Most of last week was spent below 10 in daily realized volatility. For the last 6 weeks now, we’ve only had 5 occurences of daily realized volatility clinging above 20. This period has nothing to do in comparison with the build up we could observe in February and March.

We’ve spent most of the last four weeks selling puts and buying calls—classic risk reversal setups. And while early this week we had enough reason to hedge with some downside, just in case a headline blew up the calm, thursday night confirmed our current assumption that uncertainty is far more contained now.

And despite all the noise and gesticulation, nobody seems eager to hold expensive insurance for a risk that—yes—could materialize, but almost certainly not to the extent that financial commentators (and participants—more on that later) are suggesting.

So, what’s left to do?

We opened the door to relaxing hedges last week. At VIX 16, that’s entirely justified—premiums are thinning out fast, and the cost of insurance starts dragging on performance. The downside is clear: If, for whatever reason, the market flips again and VIX shoots back to 24, it’s going to sting.

In other news

We have no words.

We went to bed Thursday after yet another lazy session drifting between 5900 and 6000 on the SPX…

Only to wake up to TSLA down 15%, a florilège of tweets destined for the history books, and half the financial press munching popcorn—while the other half… well, felt a bit like us.

No words.

Is this what we’ve become? A full-blown meme economy—where the stock market, by extension, becomes a farce? Where only the naive and the overleveraged suffer on days like this, while the rest—brothers and partners in particular—profit from their confusion? We won’t comment on the “feud.” But we will leave you with a few facts from the last ten years:

Dogecoin. “Funding secured.” Surely, those ring a bell.

One that may have slipped from collective memory—less meme-y, but just as absurd: Remember that “great” call between Putin, MBS, and (then ex-President) Trump that led to the biggest single-day rally in crude—+25%—on vague headlines that ultimately amounted to nothing?

And we will not dwell too much on the perfectly timed, $200 million stock sale—just one week before this circus kicked off (Yes, Kimbal Musk, we are looking right at you). How convenient.

We wrote a few months ago about prestidigitation:

The magician’s first job is to make sure the audience still enjoys the show.

Not to leave them with a bitter aftertaste—figuring out the trick, realizing the cost of admission, and wondering whether the spectacle was worth it at all.

And as if that wasn’t enough, we also learned—on the same day—that Trump Media is planning to launch a Bitcoin ETF. Because clearly, there’s zero conflict of interest here. And yes, the U.S.—and the world, by extension—have absolutely nothing more pressing to focus on right now.

A quick side note :

We obviously have no proof of what we’re—strongly—implying in this piece.

And while we sincerely hope the relevant authorities might take a look at this in the foreseeable future, the cynic in us is just bracing for the next 3 million HUF USD insider trading fine handed to Goldman or JPM.

Thank you for staying with us until the end. As usual, here are two reads we found particularly interesting last week:

First, a piece on options pricing—a topic close to our hearts.

Options may be one of the few truly forward-looking metrics in the market. And while interpreting them as odds is not a new idea, this article does a solid job of bridging that gap with precision.Second, as ex-UK residents (and Revolut users for almost a decade—yes, really), we appreciated this sharp breakdown of Revolut’s push into rewards-based credit cards. Spoiler: it’s not about beating Amex at its own game, but about spinning the fintech flywheel harder.

If you’re a credit card geek, this one’s worth the read.

That’s it from us.

Wishing you a wonderful (CPI) week ahead—and, as always, happy trading.

Ksander

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.