Forward Note - 2025/06/01

Normalization.

Sell in May and go away got peppered up pretty nicely. Equities ended the month higher—with no end-of-month rally fireworks this time. The S&P 500 added a solid 5.5%, and the Nasdaq almost 8%, in a stark recovery from the gates of hell opened in April.

As two-thirds of Q2 is now behind us and we edge closer to the mid-point of the year, we’re right back where it all started: the S&P 500 is just 5% off all-time highs, and the VIX is hanging under the 20-handle. This week it did not even flirt with it, despite last week’s tariff “alert.” The threat against the EU got lifted over the weekend after a “good call” between President Trump and Ursula von der Leyen, and traders coming back from Memorial Day weekend barely had time to get worried before volatility vanished again.

On Wednesday, Nvidia posted yet another round of astonishing results—70% year-on-year growth—despite the China curb and heightened scrutiny on demand. There are still lingering questions after the release of DeepSeek earlier this year, but also: who exactly are the Asian buyers of all these Nvidia chips?

While the stock popped 5% on the day—dragging part of the Nasdaq with it—it was another overnight shock that propelled the S&P 500 just a few points shy of the 6000 mark: the U.S. Court of International Trade invalidated the reciprocal tariffs imposed by the Trump administration, ruling that the legislation used was not appropriate.

The move retraced somewhat as the week wore on, once Wall Street unearthed a curious clause buried in the Big Beautiful Bill—one that might allow Uncle Sam to tax any foreigner holding American assets and diminish greatly the appeal of holding american assets. But even with that twist, the mood by Friday’s close remained one of cautious optimism.

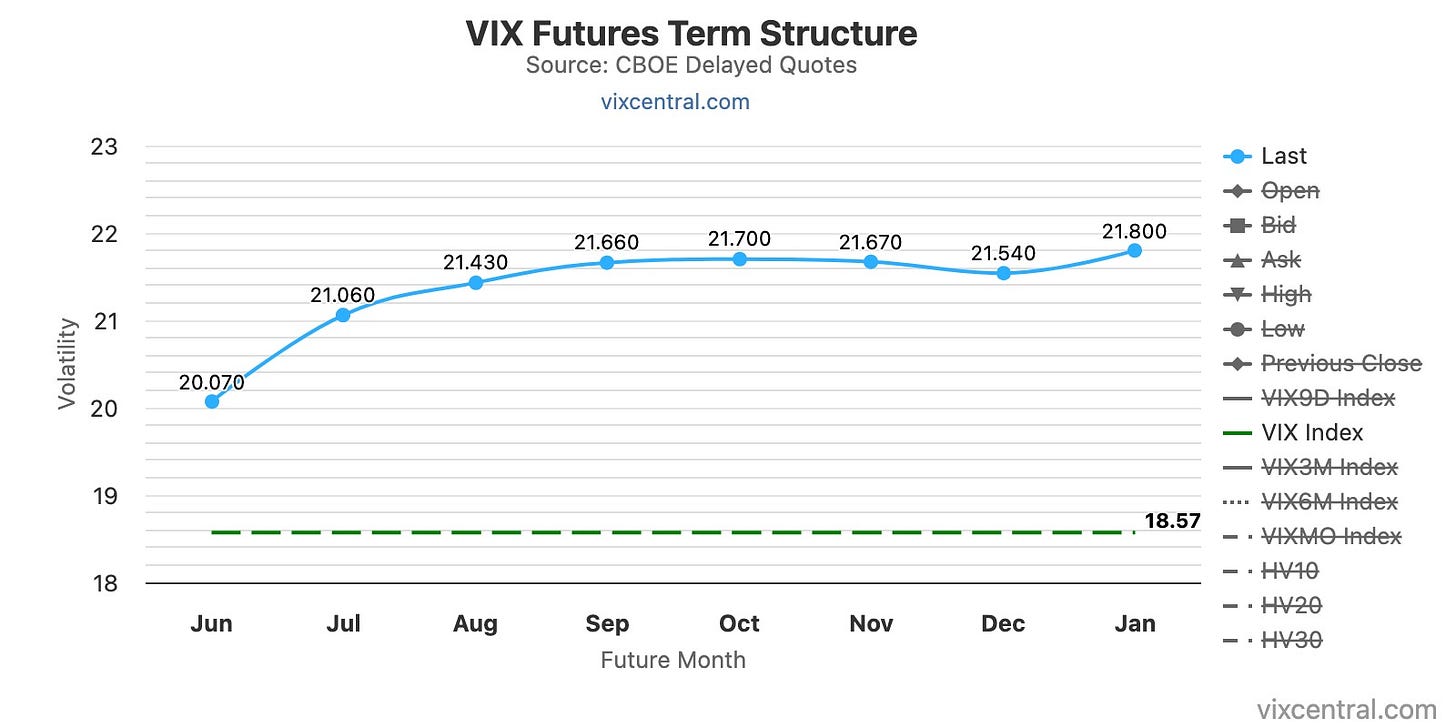

We’ve been talking quite a bit about the term structure lately, and that is once again where we will start. Do you remember what it felt like a year ago—before the Yen dislocation trade, before the August 2024 spike that arguably kicked off a yearlong stretch of agitation?

Back then: a pretty steep contango and, overall, a low-volatility regime. Now? Let’s state the obvious—we are not in a low-vol regime. And frankly, we do not think we will be for quite a while. But that is beside the point. Over the last three days, our similarity metric—designed to look beyond just the levels and focus on the shape of the curve—flagged the highest match with early July of last year.

That does not mean it is time to throw your hands in the air and pretend it is 2023 all over again. The market evolves constantly, and your job is to stay sharp and adapt your positioning to the regime you are in—not the one you wish you were in.

We began this year with a much flatter curve and a recurring hedging narrative. While we are not saying to scrap your hedges altogether, there is a growing case for dialing them back—or at least being more selective and paying less for them.

First of all, you may have noticed that over the past few months, we’ve largely favored calendar spreads—selling an ATM put in the 30 DTE and buying the same strike in the 60 DTE—over our traditional short straddle setups from 2024. While we are still not entirely comfortable letting hedges go, we are increasingly open to pushing protection further out in time and being a bit less ATM. In essence, shifting from a pure calendar to a structure that shorts vol in the front and buys some tail—just in case.

That is not a recommendation to copy-paste our book, but a reflection of what the data is currently telling us.

Even the VIX futures term structure is starting to clean up. We’re seeing a more classic contango now—much clearer than the flattish, indecisive shape that dominated the past 10 months. Back in Q1, we noted several times that the spot-vol surface and the VIX futures curve were often out of sync, which was its own kind of warning sign. Now that they are more aligned, it feels like an invitation to tune our instruments to the music currently being played.

The very obvious trade that did not work for much of the past year—but now deserves another look—is the classic short in VXX, UVXY, and the like. With the term structure stuck in a flattish grind, the natural drag in these products failed to deliver, and the sharp spikes along the way likely torched a good number of retail traders betting on these “guaranteed money-making strategies.”

The signals are looking much greener now. But if there’s one lesson from the last 10 months, it’s this: check your sizing. These things can spike—and wipe out an account in days.

And what about the VRP? With realized volatility drifting back to normal levels over the past few weeks, is this finally a green light?

Well… it depends on how you look at it.

Let’s start with the obvious—we are definitely not back to anything resembling the glory days of Q3/Q4 last year, when you could reliably harvest 3 to 5 points of vol in 7 DTE. In 2025, selling very short-dated options has been painful. And while the environment is now better than it was six weeks ago, timing still matters. If the VIX is not comfortably above 20—and if realized vol has not settled down—it may be presumptuous to aggressively sell vol in the front.

But if we do get a pop into the 20–25 zone, like we saw at the end of last week during the “EU tariffs threat,” it may feel uncomfortable—but that discomfort might be your cue to step in.

Zooming out from the data for a second, the playbook is almost boring in its simplicity: sell the headlines, bank on the resolution. April reminded us that the current cast of characters—whatever their firestarter instincts—are not quite ready to torch the global order just yet. They will likely do what it takes to keep the system from slipping into chaos.

That, at least, is what the market seems to believe. And it is what leaks through the timid contango and soft VRP we are now observing.

If you want to bet against that view—do it at your own risk.

In other news

Tariffs? No tariffs?

Who actually knows at this point what will end up being implemented. While the administration insists the tariffs are here to stay, the U.S. Court of Trade has, for now, deemed them invalid.

We would not bet on Trump letting this slide. Tariffs are a headline electoral promise, and the new world order likely includes a baseline where trading with the U.S. is simply more expensive than it used to be. There are about 30 days left before the 90-day pause expires—expect a bit of volatility as we get closer.

But panic? We are struggling to buy into that narrative.

A quiet but telling signal this week came buried in a tiny Bloomberg piece: someone—still unidentified—was bidding nearly $3 billion worth of long-dated call options set to expire about a year from now. We typically avoid flow analysis (there are simpler and cleaner things to track), but let’s be honest: very few players buy that much upside exposure, that far out, without some serious conviction—and hopefully a thesis to back it up.

Then again, maybe the only thesis needed is what we concluded last week:

Stocks go up over time. Not down.

Thank you for staying with us until the end, as usual, here are two interesting reads from last week

The first one comes from Quantitativo , and shows that if you have to do flow analysis, as much things in trading, the edge often lies in the very simple strategies, easily explained by big predictable flow of money showing up at repeatable period. Very interesting paper, and very straightforward to implement.

This long-form piece explores the rise of Generative Engine Optimization (GEO)—a new frontier emerging as AI assistants like ChatGPT, Claude, and Perplexity become the default entry point to the web. Traditional SEO rewarded visibility; GEO rewards reference. It’s not about ranking on Google’s page one—it’s about being included in the AI’s synthesized answer.

That is it for us, as usual, we wish you a wonderful (NFP and unemployment rate) week ahead and happy trading.

Ksander