Forward Note - 2025/02/23

VRP - we are so back.

A shorter week and, overall, a quieter one—until patatra. A sudden 1.75% slide in the SP500, over 2% in the Nasdaq, and a sharp expansion in implied volatility, with the VIX closing at 18.21 and VVIX at 105.71.

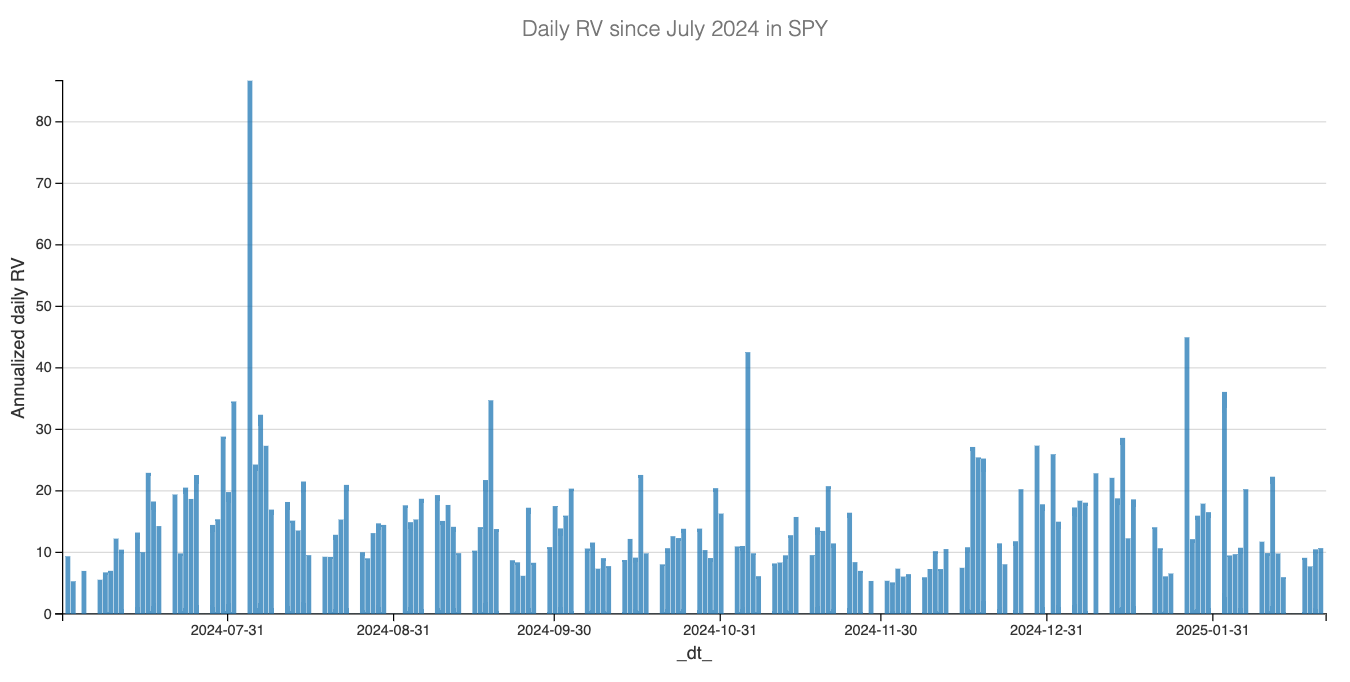

What happened, you ask? On the surface, nothing obvious. Even the realized volatility on Friday was relatively tame for such a significant move down.

At 10.7 for the day, it was the calmest drop we’ve seen in quite a while. There are, however, a few possible explanations—starting with the usual weird price action that tends to show up on monthly option expirations. And while we try not to give these flows more weight than they deserve, a mechanically driven move down without any panic does carry the fingerprints of a classic monthly expiry.

Yet, as comforting as that explanation might be, the financial press on Friday pointed to a more plausible culprit: the economy. Friday brought a series of moderately important economic indicators that painted a gloomier picture of the American powerhouse.

First, there was the PMI Services reading for January—49.7, well below the 53 average we saw throughout 2023 and 2024. Not exactly a sign of strength. Add to that the inflation expectations, which came in at a concerning 4.3%, and a drop in the consumer confidence index to a multi-month low of 63.4.

You don’t need a PhD in economics to connect the dots—things are slowing down. Could this be an early signal of the trouble ahead, driven by Trump’s policies? It’s starting to look that way.

Most likely. But this is where we hit the limit of our economic commentary—there are far more talented people (and sensationalists) out there to dissect the macro picture in detail. As for us, we’re much more comfortable going back to what matters most: market developments.

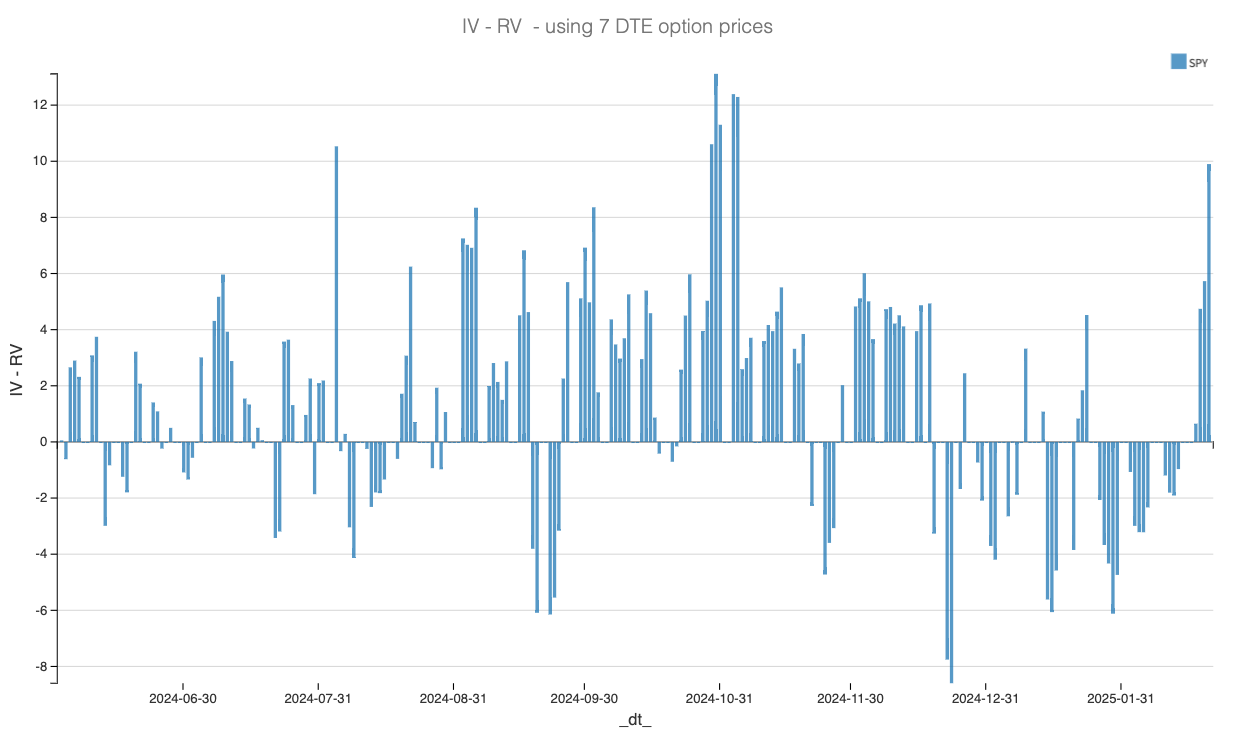

The first thing worth noting is the variance risk premium (VRP). January was frustrating for volatility sellers—VIX barely held above 16, while realized volatility hovered right at that same level. Not exactly the ideal environment for selling options on the S&P 500.

We briefly touched on this last week: thanks to the quirks of option pricing, you still could’ve made money from the path dependency of the index, simply because it didn’t go anywhere meaningful in the end.

This time, though, it’s a different story—the edge is back on the seller’s side.

As this chart shows, Friday’s close has opened the door for what could be a meaningful return of the VRP—at least, that’s what we hope. It’s still too early to tell whether we’ll see a resurgence on the same scale as what we experienced before the U.S. election. Back then, selling volatility was almost too easy: you could comfortably sell at 17–19% implied volatility while the realized volatility hovered closer to 10%. It was such smooth sailing that we managed a record streak—selling puts for over three months without a single loss.

Yet, 14% realized volatility isn’t 10%—and more importantly, it doesn’t look like we’re entering a regime where the volatility of volatility (VVIX) will just vanish overnight.

This means risk management needs to adapt. The days of selling naked options without a care might be behind us. Hedge your positions—whether through delta hedging, adding tail protection, or ideally both—because in this market, anything can happen.

This week, all eyes are on NVDA earnings. If you ask us, it’s far too early to expect any meaningful signs of DeepSeek’s impact showing up in this report. But, because markets thrive on irrationality, we wouldn’t be surprised to see the stock make one of its signature explosive moves to the upside—driven less by fundamentals and more by a mix of patriotic enthusiasm, a metaphorical middle finger to China, and a collective sigh of relief: “Our AI trade isn’t dead—thank you, market gods!”

From a volatility perspective, despite earnings being right around the corner, the implied volatility hasn’t returned to the highs we observed back in January after the DeepSeek headlines. The current distortion seems very much concentrated in the front week, suggesting that the market isn’t pricing in sustained turbulence beyond the immediate earnings window.

We closed at 64.5 on the 30-day VIX for NVDA, implying just under a 10% move between now and the close on Friday. The variance risk premium (VRP), using 7 DTE options, is trading at similar levels to previous earnings weeks over the last two years.

Let’s wrap this up by taking a look at our skew index, which compares the pricing of all out-of-the-money (OTM) puts to all OTM calls. This should help us gauge whether the market is favoring protection on one side or the other:

Currently sitting at 200, the index is sitting right in the middle of the range observed over the past 12 months. There’s no obvious dislocation between calls and puts. If you pressed us to suggest a trade, we’d lean toward a 25-delta strangle—a balanced way to express a view on volatility without taking a strong directional stance.

But hey, what do we know?

In other news

Alibaba is up 70% in just about a month, staging an impressive comeback after years of stagnation around the $80 mark. The stock now trades at $140—a clear sign of renewed focus on Chinese tech following the DeepSeek developments.

While much of the global spotlight tends to focus on U.S. tech giants, companies like Alibaba have been steadily advancing their AI capabilities in recent years. Recently, Alibaba has not only announced fresh investments but also unveiled models that rival some of DeepSeek’s most notable releases.

Perhaps the most symbolic shift lies in the political landscape: Xi Jinping has started receiving key figures from China’s tech industry, including the once-banned Jack Ma.

Thank you for staying with us until the end. As usual, here are a couple of interesting reads from last week:

The search for edge in trading is a crucial skill to master. Understanding why a trade could be profitable—or not—is often overlooked in favor of cryptic indicators and complex parametrics. This strong recap from pedma , heavily influenced by the legendary Robot James, is well worth studying for any retail trader aiming to sharpen their strategy.

You’d think that as crypto becomes more institutionalized, attacks and hacks would start to fade away. Well, think again. This week saw a spectacular hack on the Bybit exchange, with a staggering $1.5 billion USD lost. Here’s a solid breakdown from Liquidity Goblin on how it happened and what it means for the space moving forward.

That’s it for us this week. We wish you a wonderful week ahead and—of course—happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.