Forward Note - 2024/11/24

Even money trees can catch fire.

Last week brought relief to US equities, wiping away most of the previous week's losses. The S&P 500 jumped 1.65%, pushing back toward the 6000 mark, with the Nasdaq 100 right behind it, climbing nearly 2%. The VIX settled at 15 – comfortably in neutral territory and well below its recent peaks above 18.

But beneath the surface, things weren't exactly smooth sailing. Seven-day realized volatility shot up to levels we haven't seen in two months, not since the Israel-Iran tensions were at their peak. This time around, though, markets were dancing to a different tune: escalating tensions between Ukraine and Russia.

The big news? President Biden gave the green light for long-range missiles to target military sites deep in Russian territory. Moscow's response hit hard and fast. They streamlined their nuclear force protocols and fired back with a stark warning: any foreign missiles striking Russian soil would be treated as a direct act of war.

The news sent the VIX spiking several points before it cooled off. It settled at more reasonable levels as markets regained their composure after some rocky pre-market sessions.

On the macro front, things stayed relatively quiet. Services PMI showed continued expansion while manufacturing PMI was recorded at 48.8, still below the crucial 50 mark and signaling a slowdown for the fourth month in a row. Markets barely blinked at these numbers, which largely matched expectations.

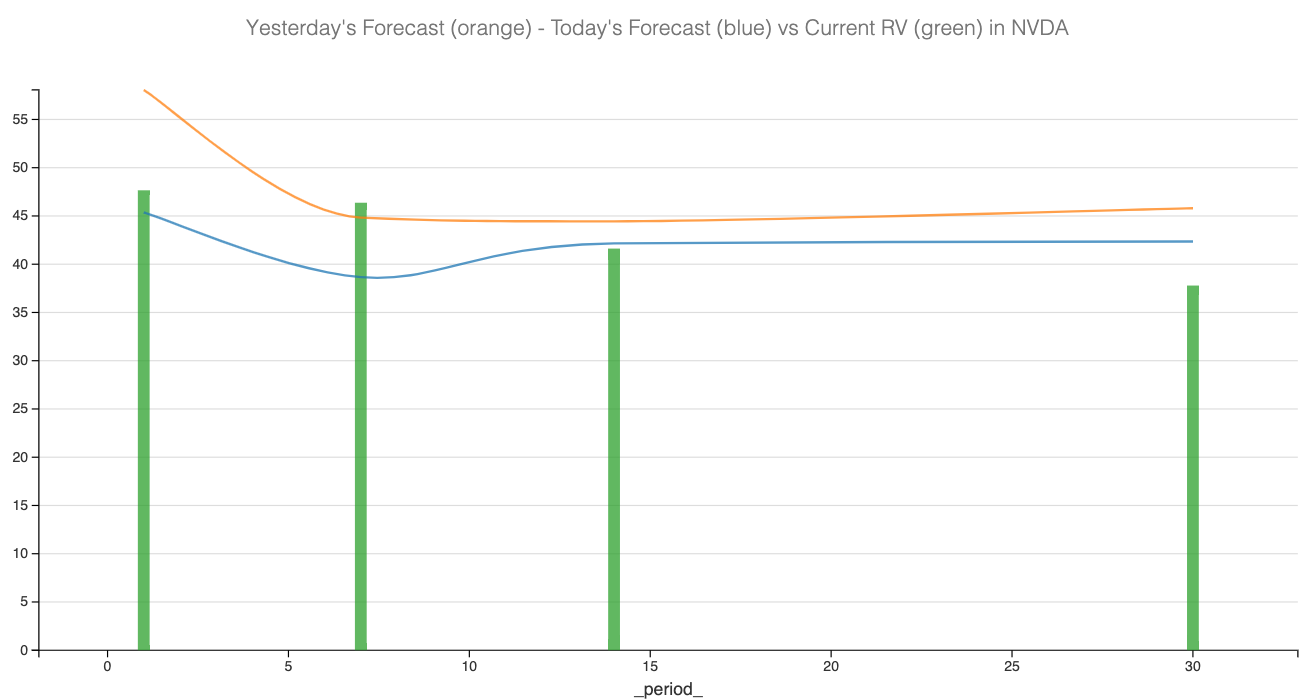

Then came the week's main event: Nvidia's earnings. Even stellar results drew a surprisingly tepid response for the second quarter running. Sure, the company doubled its revenue year-over-year and drummed up excitement about the demand for its latest chips, but investors seemed to shrug it off. The stock actually dropped a few percentage points at first, only bouncing back the next day—much to the relief of anyone betting against post-earnings volatility.

Looking at pure volatility plays, the next 30 days should see realized vol hovering just above 40% - meaning current option prices might serve up some juicy opportunities for sellers. But here's the thing: Nvidia's already up a casual 200% in 2024, standing tall as one of the year's biggest success stories. Watch out for year-end portfolio reshuffling that could test those straddle levels. Bottom line? If you plan to harvest that variance risk premium, keep a tight grip on your delta exposure.

What's on deck for next week? More of the same, really. The big earnings rush is behind us, with no major market movers until the 2025 cycle kicks off. We'll get some economic data sprinkled in - preliminary GDP numbers and another inflation reading.

Then comes the Thanksgiving breather. Unless Russia and Ukraine throw us a curveball, don't hold your breath for any dramatic downside moves. Put-selling strategies in US indices cleaned up nicely last week, and without any compelling reason for markets to tank, this playbook should work right through year-end.

And we can't forget Bitcoin's wild ride. Since Trump's win, it's been on an absolute tear, eyeing that 100k USD milestone like it's destiny.

Speaking of wild, El Salvador's sitting pretty – up 300 million USD. Don't snicker – that's a solid 1% of their 2023 GDP (34 billion USD). Meanwhile, MSTR has morphed into the market's newest meme darling. Get this: they tank 10% after October earnings, then rocket up 100% in just four weeks. Options premiums are in the stratosphere, and the Reddit threads are pure comedy gold.

But here's a friendly warning: when trees try reaching for the sun, they tend to catch fire. Just saying.

In other news

Adani.

The name might not be familiar, but it belongs to arguably the most powerful figure in India and one of the world's most influential conglomerates. In January 2023, short-seller Hindenburg Research released a multi-year investigation that raised serious, well-documented concerns: allegations of fraud, conflicts of interest, and bribery as the driving forces behind the meteoric rise of a man who started with nothing. After initially dismissing these claims as baseless slander, the businessman now faces far more formidable opponents: U.S. federal prosecutors and the SEC.

While the group maintains its innocence and emphasizes that the investigation targets only Adani Green Energy, not the broader organization, the consequences are likely to be substantial. The conglomerate has already shed more than 25 billion dollars in market capitalization – though this pales compared to the 150 billion dollar drop that followed the Hindenburg report.

Thank you for staying with us up until the end; as usual, here are a couple of interesting reads from last week:

Another sector that did extremely well in 2024 was the defence sector. Amid geopolitical tensions and Trump's election, it is also expected to perform quite well in 2025. Here is a handy recap by AlphaPicks .

Is software back? After a rough couple of years for ex wall street darlings, it looks like corporate spending is finally back and therefore some of the valuations on the cheaper side. Here is a lay of the land by Clouded Judgement .

That is it for us this week. To our American readers, we wish you a wonderful Thanksgiving in advance. Enjoy your time with family – and know that we're grateful to have you as part of our readership.

Thank you, sincerely.

Ksander.