Forward Note - 2024/11/17

Unfortunate insurance claim.

First off, apologies for the Signal du Jour’s absence on Thursday. What started as a casual dinner downtown turned into a late-night adventure when a leak in the ceiling transformed the bathroom into a tropical rainforest. Needless to say, it disrupted our writing schedule.

The irony isn’t lost on us. As someone who’s often likened trading volatility to selling insurance, this was a real-world reminder: it’s good business, in theory at least, because people on the other side of the trade aren’t price-sensitive. When a situation becomes disruptive enough, peace of mind outweighs cost—knowing the issue will be handled lets you finally sleep at night.

Speaking of disruption, the markets weren’t exactly serene on Friday. The VIX spiked nearly 3 points at one point during the session, as the monthly options expiration for November seemed to trigger some unwelcome action. For those hoping for a quiet end to the year—or perhaps a Santa Claus rally—this may have been a gentle reminder that the road ahead could still be bumpy.

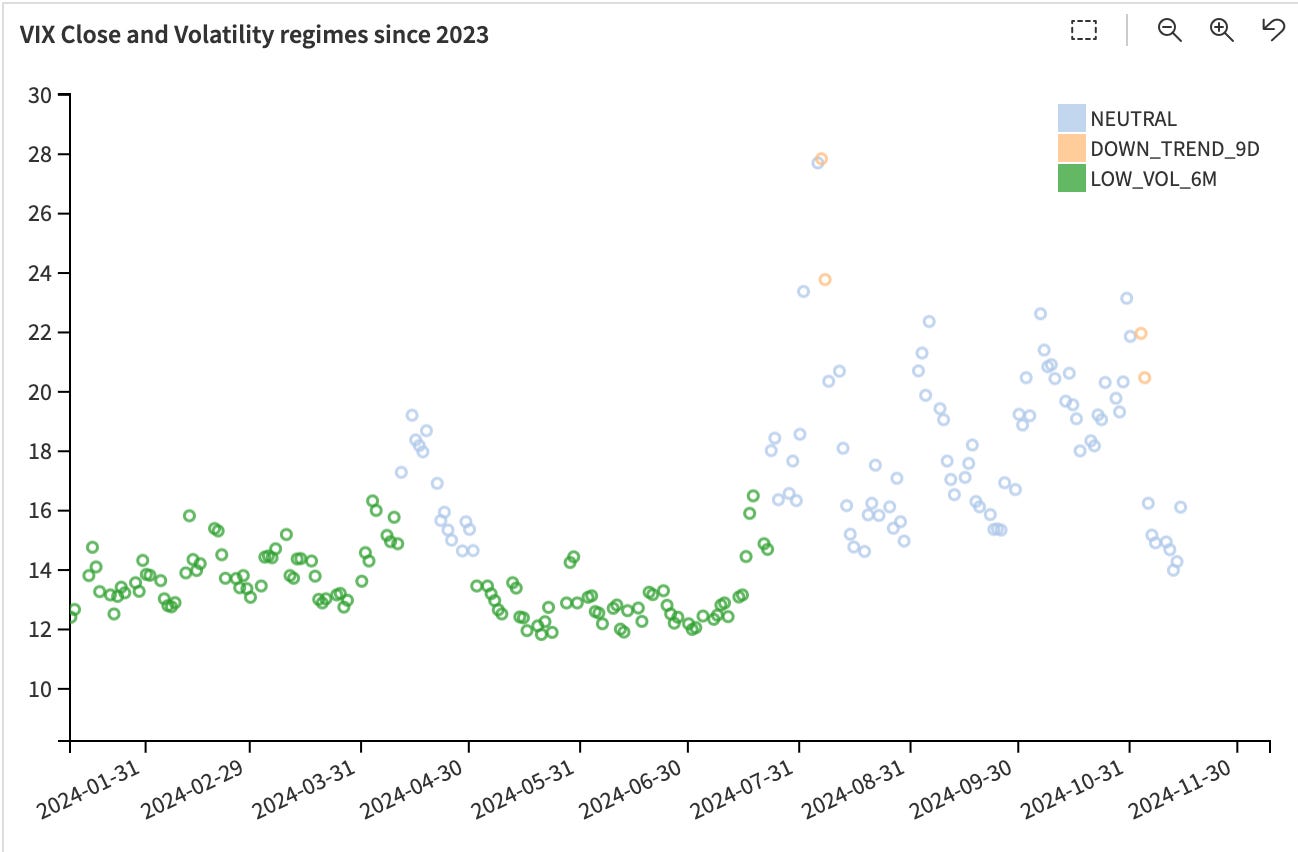

While Friday's session eventually calmed down, with the VIX closing at 16.01 and the SP500 losing only 1.5% on the week, it served as a sharp reminder: we remain in a neutral volatility regime, and these spikes are par for the course.

Earlier in the week, however, things were much quieter. Realized daily volatility was below 10%, creating prime conditions for harvesting premiums in short-dated equity options. It might even have been tempting to believe we were on the brink of revisiting the "quiet days" of 2024 when the VIX hovered at 12 on slow days and edged up to 13.5 on the busier ones.

Are those days coming back? Maybe. The honest answer: we don’t know. But that’s precisely why we’ll keep leaning on a mantra you’re likely familiar with if you’ve been reading Sharpe Two for a while: trade the regime you’re in—not the regime you hope, fear, or predict will come next.

Of course, nothing quite beats the "easy money" period when volatility trends downward for extended stretches (captured as the regime down_trend_9D in the matrix below). Yet, neutral periods of volatility remain among our favorite trading conditions. Sure, you’ll occasionally get caught on the wrong side of a sudden inhale, but when the market exhales in relief, your PnL often more than makes up for it.

The matrix above illustrates the average PnL of shorting ATM straddles in SPY across various volatility regimes over the past five years. When volatility is climbing—as described in regimes 4 and 5, not the spike we had on Friday—it can be counterintuitive, but shorting volatility is inherently riskier. Why? because the market is (almost) efficient and likely priced in the risks ahead; an unhedged straddle will face serious challenges when those risks materialize.

On the other hand, periods of reversion—when volatility trends downward—are ideal for harvesting the market's premium. Neutral regimes (like the one we are in right now), while less forgiving than outright downtrending ones, are still profitable on average. The trick lies in precision: forecasting realized volatility and comparing it to current implied volatility makes all the difference. Selling straddles indiscriminately during a neutral regime still yields gains, but it’s far from optimal.

Days like Friday often provide an excellent entry point, even if the setup feels uncomfortable. By adopting a data-driven approach, we can make these situations more manageable: in a neutral volatility regime, a realized volatility forecast becomes an essential tool—not only to predict where volatility might go but also to identify where it’s unlikely to be.

Take Friday’s spike as an example. Given the current regime, should it prompt a re-evaluation of the short volatility trade over the next 30 days? Looking at the numbers, realized volatility over the past 30 days has been approximately 11%, while our forecast for the next 30 days is around 14%. At VIX 17, like we saw at one point on Friday, this suggests there’s sufficient room for insurance sellers to extract value from the current premium levels.

Of course, this assumes no major geopolitical or economic shocks disrupt the landscape. But barring any such surprises, the potential reward from this setup is worth considering—especially when coupled with disciplined risk management and precise execution.

Let’s circle back to the matrix above, as we’re sure the Red Sea in the low-volatility regime caught your eye. This is the quintessential example of the equity risk premium at work: when there’s no significant risk in the market, equities tend to rise. In such an environment, selling puts is a lucrative strategy, but selling calls? Not so much. The neutral payoff structure of a straddle is suboptimal here. Instead, switching to a risk reversal—short puts, long calls—yields a much better value proposition.

How do we know this? We’ve been trading these structures consistently throughout the year, and the results speak for themselves. In our small Discord group, we’ve meticulously logged every trade, and since June 1st, we’ve been up 25%. That’s despite VIX hitting 65 in August (yes, we took a hit), the geopolitical tensions in the Middle East in early October, the wild swings in Chinese equities (our worst trade in 2024), and even Friday’s spike.

Such is the life of an insurance seller: every so often, you have to pay out claims for the risk you sell products against. And sometimes, those claims may involve something as mundane as a leaky roof.

In other news

How’s good old Europe faring? Bracing for yet another winter, as always. Despite the resounding success of the French Olympic Games and Bernard Arnault’s rivalry with Musk and Bezos for the WPP belt (wealthiest person on the planet), these headline grabbers can’t distract from the continent’s harsh reality: Europe is becoming increasingly irrelevant on the global stage.

It’s painful to write this as a European, but data doesn’t lie. The euro sits at its lowest level in two years, and the Eurostoxx 50 is up a mere 8% while the SP500 has surged an impressive 25% in 2024.

Europeans could point to the dominance of the Mag7 to explain the American market’s stellar performance. Still, the real issue is closer to home: the absence of comparable companies driving growth and innovation on this side of the Atlantic. Draghi and Lagarde have repeatedly sounded the alarm this year, urging action to prevent a deeper erosion of competitiveness.

And with American tariffs looming, the prospects look anything but encouraging.

Thank you for staying with us until the end. As always, here are two interesting reads we recommend from last week:

Katie Martin’s Opinion in the Financial Times dives deep into why Europe lags behind the US, shedding light on the structural shifts investors are waiting for and the remaining hurdles.

While Trump’s election and his tariff policies carry inflationary risks, the nuances are crucial. Who better than Claudia Sahm to explain it all? Her latest piece offers a thoughtful take on the potential implications for markets and the economy.

That’s it for us this week. Wishing you a fantastic week ahead and happy (NVDA earnings) trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.