Forward Note - 2024/11/03

This is it.

If you're fortunate—meaning if your trading career, whether as a retail or professional trader, lasts long enough—you’ll experience about 20 major events that leave a significant mark on the markets you trade.

The upcoming U.S. Election in 2024 is one of those moments, so congratulations in advance for adding this to your list of trading milestones.

But how do we measure that impact?

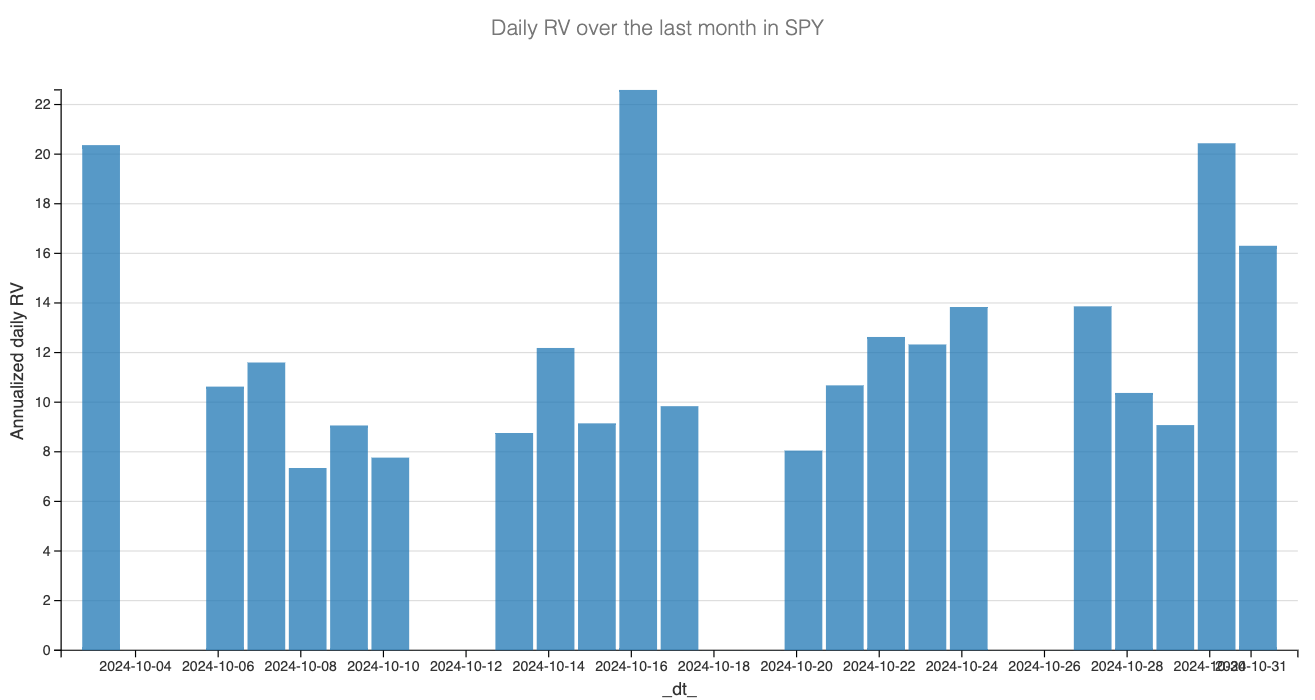

We anticipated last week would be quite turbulent as the election approached, especially with earnings reports from no fewer than five members of the Mag 7 club. Although we didn’t quite reach the 2% movement threshold we discussed in our last Forward Note, the SP500 still ended the week down 1.4%, and the Nasdaq lost 1.6%. Most of the action was concentrated on Thursday and Friday, as realized volatility was relatively absent earlier in the week.

In fact, Thursday and Friday were among the most volatile days we've seen in the past month. Without them, you might even question whether there’s an election just 48 hours away.

So, what triggered the move down? The main culprit seemed to be Microsoft's earnings report. Despite beating expectations, the company provided a cautious outlook for its cloud division, which cast a shadow over investor sentiment regarding the AI cycle—more on this later.

In addition, we saw mixed economic data. The preliminary GDP reading came in lower at 2.8%, and the job report revealed that the U.S. added only 12,000 jobs in October. While these figures didn’t appear to spook market participants—no significant extra selling pressure followed—this was somewhat anticipated. Strikes across the U.S. and Hurricane Milton's impact on Florida were likely factored in. As a result, most market activity on Friday was erratic, clearly influenced by the final stretch before Super Tuesday.

The election is also affecting markets beyond the U.S. Let’s take a look at the “VIX equivalent” metrics on some key geographical ETFs, each designed to replicate the performance of their local markets. We’ll examine Japan, India, Europe, Mexico, and Brazil to offer a balanced view of major global markets.

With the notable exception of Europe (FEZ), which seems to be following its own path, most of the ETFs on this chart have shown a strong upward trend in volatility since the end of September, mirroring the rise in U.S. volatility (SPY).

A closer look at VTI (Vanguard Total International Stock ETF) reveals a significant jump—from below 10 at the end of September to above 15 last week. For an ETF that hovers below 12 nearly 80% of the time when there are no global crises, such as war, a pandemic, or an inflation spike, this is no small feat.

So, regardless of which market you’re trading, even if it seems disconnected from the drama between Trump and Harris, it’s likely feeling some indirect impact.

Now, let’s turn our attention to different asset classes.

Setting aside USO, which has been on its own volatile journey amidst escalating tensions between Israel and Iran, implied volatility across the main asset classes has also been trending upward since the end of September.

Is this surprising? Not really. This phenomenon is well-documented: with markets more interconnected than ever and information traveling faster, even a subtle shift or an eyebrow-raising comment at a Trump rally can ripple across global markets.

So, what does this mean for us now? Think of implied volatility as the market’s breathing—it rises as we brace for impact and falls as we exhale in relief. That’s the most probable scenario, and it’s likely to leave a mark in various corners of the market, not just U.S. equities. So, regardless of what you’re trading, it would be wise to consider the impact of this “extra breath” on your respective markets in the coming days.

Of course, this is all assuming the election unfolds in a calm and orderly manner—a scenario some might argue is still up for debate.

But, even with the uncertainty, we’re holding steady.

Lately, we've seen a slew of social media posts from high-following accounts—ones that might make us jealous if we cared about vanity metrics—encouraging people to go long on volatility here.

Our advice? Don’t do it.

Yes, if something catastrophic were to unfold in the next seven days, that trade would pay off handsomely. But think about the cost of betting on such an unlikely (and let’s be real, undesirable) scenario. With the VIX at 23, volatility is moderately expensive under any conditions. In light of the past three months—where realized volatility has barely ticked above 13% despite all the Middle East tensions, recession chatter, the AI bubble-that-wasn’t, China’s turbulence, hurricanes, and even an assassination attempt on Trump—it’s astonishingly overpriced.

We feel the buzz of the main event just as much as anyone else, watching our screens as Election Day inches closer. But we’ve been through these cycles enough to resist the rookie mistake of believing “this time is different.”

And if it is? Well, let us assure you, you’ll have more to worry about than reminding us of a miscall on this particular trade.

In other news

The Mag 7 club had a mixed week. Microsoft took a hit due to concerns over Azure's growth trajectory, while Meta also saw declines after informing investors it would ramp up spending on data centers to stay competitive in AI.

It’s amusing how Meta is often cast as the market’s “troublemaker,” chastised for its spending habits, while others seem to get a pass. Take Amazon, for instance—despite also announcing rising expenses in hardware, its stock jumped 6%. But because it’s Amazon, it seems…acceptable.

The real spotlight will come on November 20, when NVDA reports after hours.

Thank you for staying with us until the end. As always, here are some interesting reads we found from last week:

We weren’t too fazed by the recent jobs report. Why? Because we keep up with Claudia Sahm’s insights, and once again, she was right on the mark a few days before the data dropped.

We’ve mentioned the FT’s series on the new trading houses shaping Wall Street. The latest episode focused on Kenny G and his Citadel empire—definitely worth a read.

That’s it from us. Wishing you a smooth election week and, as always, happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.