Forward Note - 2024/10/27

VIX up and above 20 on a Friday?

Equity markets continued their upward march this week, inching closer each day to the main event of 2024.

Friday morning felt like we might close at an all-time high, as equities erased much of the midweek weakness from Wednesday and Thursday. But instead, they pulled back, with the SP500 ending a six-week streak, closing down 1%, and the Nasdaq finishing flat. Meanwhile, the VIX closed the week above 20, setting the tone for the next ten days, which promise to be particularly news-heavy.

No fewer than four stocks from the Mag 7 club report next week: GOOG on Monday, MSFT and META on Wednesday, and finally, AMZN on Thursday. If that’s not enough, we also have the October jobs report on Friday, all leading right into the Nov 5 election and the FOMC meeting on Nov 6.

As always, there’s no guarantee the market will make any dramatic moves. This past week, for example, was surprisingly calm, with realized volatility barely hitting 10%—and it wouldn’t be the first time we brace for action only to see none.

Yet, VIX closing at 20 on a Friday is not exactly routine, especially given that over the last 24 months, 67% of Fridays have seen implied volatility drop—that’s compared to the usual 55% drop on any given weekday.

But sitting above 20? That’s happened only three times in 2024. The first, unsurprisingly, was in early August on NFP day, right before the infamous VIX spike to 66.6.

Yes, we may sound a bit like CNBC trying to spook everyone (Halloween’s coming up, after all, so bear with us).

In all seriousness, though, if you’re not slowing down now from a trading perspective, when will you? If last week wasn’t a signal to trim risks, Friday’s VIX spike should serve as a good reminder: the next ten days may not be kind to anyone who’s slightly overleveraged.

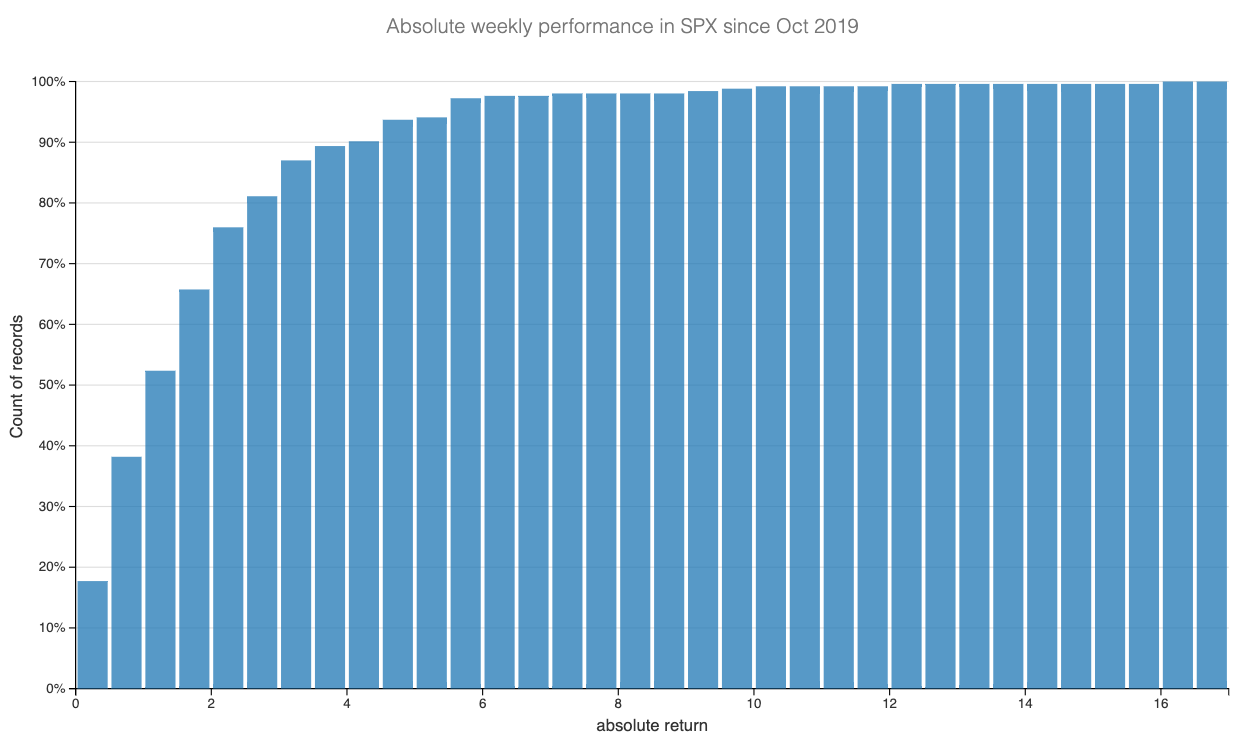

But let’s set the dramatics aside and get back to data. For context, let’s start with a simple statistic and examine the cumulative distribution of weekly returns in the SPX over the past five years.

Absolute weekly returns exceed 2% only about one-third of the time. But what happens when the VIX closes above 20 on a Friday? Looking at the past five years, a VIX spike above 20 on a Friday doesn’t strongly predict whether the following week will be positive or negative; the return profile remains fairly balanced, with a slight upside bias.

What it does indicate, however, is that there will be action. In fact, up or down, weekly returns exceed 2% a remarkable 67% of the time in the 45 instances since October 2019 where the VIX closed above 20 on a Friday. That’s starting to look statistically significant. With this week’s packed calendar, it’s fair to expect another move of around ±2%.

We may get our first hint right at Monday’s open. Early Saturday, reports emerged that Israel had responded to Iran by striking military targets, including some in Tehran. While official reports mention only minor damage, and it doesn’t appear Iran is ready to escalate, the market’s Monday reaction could set the tone for the rest of the week.

Now, before diving into long straddles on Monday just because you read it in a (highly suspect) options newsletter, remember that markets are often fairly efficient. With the VIX at 20, turning a profit from long volatility is tougher than ever—you’ll need a tidal wave of movement to justify the premium already baked in.

If anything, our advice from last week still stands: take some risk off, calmly and in an orderly fashion, as they love to say on CNBC when markets dip a mere 2% without any real drama (no hedge fund implosions, banks going under, or exchanges vanishing overnight).

Lean back, reduce exposure where it makes sense, and enjoy the show for a few days.

In other news

We briefly touched on Tesla’s earnings in Thursday’s note. You’d think the results were stellar, given the stock seemed to go on autopilot, reaching new heights at Thursday’s open. But once again, it’s all about perspective. They missed revenue—not by a landslide, but a miss is still a miss.

The stock’s rally seems to hinge on Elon’s latest promise: that next year will be "absolutely stunning," with a projected sales volume growth of 20-30%. Now, we’re far from being automotive experts—we don’t even own a car, let alone a driver’s license—but we really can’t quite wrap our heads around that target. Let’s assume, for argument’s sake, that Tesla does sell 20-30% more in 2025. Which market shares are they set to absorb?

And if they don’t hit that mark? It’s anyone’s guess where the stock will land. Needless to say, the volatility in Tesla isn’t set to calm down anytime soon.

Thank you for staying with us through the end. As usual, here are a couple of interesting reads from last week:

The FT is running a fantastic series, The Titans of Wall Street, spotlighting the secretive firms that have come to dominate trading. This week’s feature on Susquehanna is a must-read.

And it turns out the big whale betting on a Trump victory in the next election is... French? We’re a bit skeptical. The number of French investors with the liquidity to wager a casual $45 million on such a tight outcome is rather limited. Still, it’s an intriguing story worth exploring.

That’s it for us this week! Wishing you a wonderful week ahead and happy trading (in calm and orderly fashion).

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.