Forward Note - 2024/10/13

It's all about communication.

The US equity indices continue their relentless march toward new highs. This week, both the S&P 500 and the Nasdaq 100 added just over 1%, with the S&P 500 inching ever closer to the 6000 mark. We tend to avoid making subjective calls, but… isn't that the unofficial target for year-end?

Yet, the week didn’t start so smoothly. On Monday, the VIX opened above 21 for mechanical reasons. This was mainly due to the VIX being calculated with options around 30 days to expiration, and on Monday, 30 DTE happened to coincide with the election week. This period also includes an FOMC meeting and a Non-Farm Payroll (NFP) report the Friday just before. This triggered a mechanical response and caused a slight sell-off in equities. Throw in the ongoing tensions in the Middle East and growing concerns about disruptions caused by Milton in the US; many were already bracing for impact.

But that impact never came. Gradually, the tension in the options market eased while weekly realized volatility was the lowest observed in H2 2024 so far, largely due to the absence of any major catalysts from the Middle East.

In the end, the biggest whipsaw of the week came from China.

Boosted ahead of China’s Golden Week holiday by promises of new spending and fiscal stimulus to revive the economy, investors went on a buying spree in Chinese equities. The main indices were up over 30% by Tuesday. And then… the plunge. Disappointment set in quickly when there was no clear direction on what the stimulus would entail—where was the number? The Chinese CSI 300 (ASHR on this graph) deflated even faster than they had surged, losing nearly 20% in just two sessions.

We’re getting used to seeing these incredible swings, though we’re unsure whether that’s a good or bad thing. The recent wild swings in NVDA have made us more immune to these daily fluctuations, but we can’t help thinking: it’s best if this doesn’t happen too often. Catastrophes strike when overleveraged players are suddenly forced to deleverage.

There’s plenty to criticize about the Fed, though we don’t have many complaints. Still, one thing we can applaud, especially after this week, is their consistency and ability to provide clear direction and signals to the market ahead of time. Even when, just a few months ago, the message was “we’re not sure yet and need more time,” it was clear and straightforward.

In an era where information flows almost instantaneously, policymakers can't afford to play guessing games with the market. Want another example? Look at Japan in early August when the BoJ hinted at more rate cuts but failed to clarify how many or how long they would last. The result? The carry trade in yen unraveled, and the same central bank had to step in just days later to clean up the mess, clarifying that nothing would change until at least the end of 2024.

So, why do US markets keep rising? Well, why wouldn’t they?

While not as robust as last year, the economy is still creating jobs, inflation is under control, and growth is clocking in at a solid 3%. The Fed has made it clear that monetary policy will loosen over the next six months, with a likely 25 bps reduction at the last two meetings of 2024. This clarity is incredibly reassuring for market participants who no longer have to guess—they can anticipate what’s coming. And with easier financial conditions on the horizon, corporate balance sheets will likely strengthen over the next few months, paving the way for more positivity.

And yes, the media will churn out sensational headlines about inflation "heating up" this week. But in reality, it hasn’t. At 2.4% instead of 2.3%, we’re far from the start of a new inflation cycle. Once again, Powell has made it clear that “one data point won’t change our course.” As an investor, you can cross that off your list of concerns. Isn’t it nice sometimes to be a US fund manager? Seriously, think about it—no massive real estate overhang crippling the financial sector, no aging population causing policy headaches, and a younger generation that remains optimistic and spends.

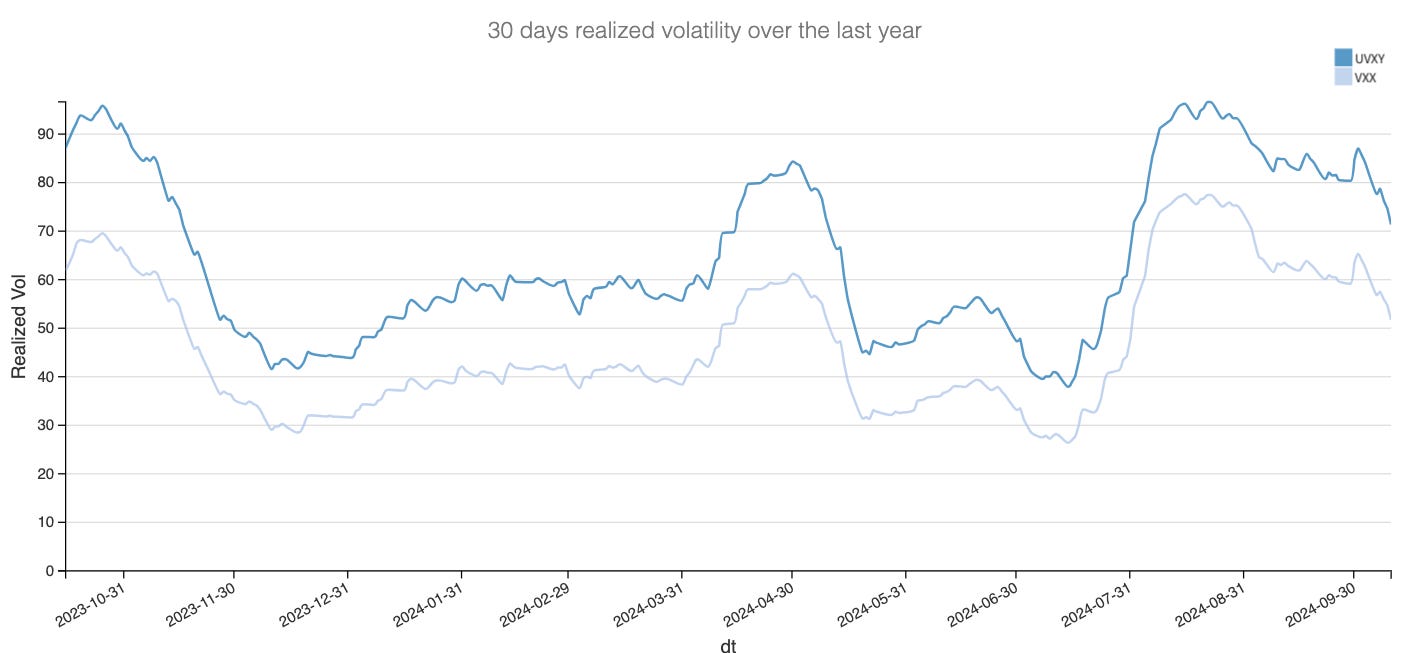

So, why would you sell? Or, at the very least, why would you be long volatility? Sure, plenty can happen in the coming weeks—a geopolitical misstep could easily trigger another spike in volatility. But the burden of proof lies squarely on the risk side. As we’ve seen, realized volatility in VXX has steadily declined over the past few weeks. If nothing significant shakes the market soon, the premium on these options will struggle to justify their hedging value. The market knows this well, especially as we edge closer to the 6000 mark.

In other news

Tesla dropped 8% on Thursday despite an impressive live demo featuring talking robots. These robots are designed to seamlessly integrate into modern life, handling daily tasks like grocery shopping and mixing drinks so we can spend more time on Netflix and Instagram. Exciting stuff, right?

So, why the punishment? Lack of clarity and poor communication. We’ll set aside the claims that humans remotely controlled these robots (it’s the first iteration, people—think about where we’ll be in five years). What matters is the numbers: timelines, sales expectations, and projections. None of that was addressed, and investors simply walked away.

In 2025, don’t be like the BoJ, the PBoC, or Musk. Be straightforward, clear, and intelligible. Like Powell.

Thank you for staying with us until the end. As usual, here are a few interesting reads from last week:

You know we’re avid readers of Claudia Sahm , the economist who kept her cool while everyone else was crying wolf over the past 12 months. Here’s her latest piece on the dangers looming over the job market, and we also wish her all the best in her recovery.

It’s Nobel Prize week, and this year, the groundbreaking work by Google DeepMind and AlphaFold to solve the structure of 99% of proteins has been awarded the highest distinction. Here’s an interesting article from the MIT review about how that feat was achieved.

That’s it from us. We wish you a wonderful week ahead and, as always, happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.