Forward Note - 2024/09/29

Breathe in .. breathe out.

If it weren’t for the rising tensions in the Middle East, we might have called this an uneventful week. And in many ways, it was, despite the two-year prison sentence for Caroline Ellison and the financial bazooka unleashed by China. With barely 9% over a week, the realized volatility was the lowest since early summer and we won’t lie: we did enjoy it.

As we mentioned in the intro, the big news was coming from China. Stocks rallied more than 15% in just four sessions after the PBoC announced a $120 billion injection into the economy. Is this a good thing? That depends on your perspective: a government that feels the need to print so much money is acknowledging that things are running too hot. However, as an investor, it’s also a sign that the government will do whatever it takes to prevent a collapse. A friendly reminder—never bet against a central bank unless your last name is Soros or Druckenmiller.

The macroeconomic data from the US continues to support the Fed’s favored narrative: the economy remains strong, as evidenced by the 3% GDP posted on Thursday, while inflation is cooling off. There’s no doubt that market participants will closely watch the upcoming jobs report to gauge how significant the next rate cut will be at the FOMC meeting on November 6th… the day after the election.

The truth is, Jay Powell has remained consistent since the pandemic, and there’s no reason to think that will change now. Our bet is on two more rate cuts of 25 bps at the final FOMC meetings of the year. That would bring the total to a full point down in 2024, which isn’t far off from the six cuts of 25 bps the market expected at the beginning of the year.

That said, the combination of Super Tuesday and the FOMC meeting right after will likely stir up some market turbulence in the coming weeks. A disappointing jobs report could trigger a spike in volatility sooner than we’ve been anticipating—possibly just a few weeks before the election, so watch out for the latter half of the month.

But who knows? With rising tensions in the Middle East, there’s a good chance we’ll see an early continuation of the momentum in the VIX that kicked off on Friday. The VIX jumped a full point, and VVIX is now above 100. The bombing in Beirut certainly played a role, but it’s also natural for the market to start buying hedges ahead of the next 30 to 45 days, when risks are high and could linger.

So, what should you do in this situation? Let’s have a quick glance at the term structure in options prices in SPY over the next 6 months.

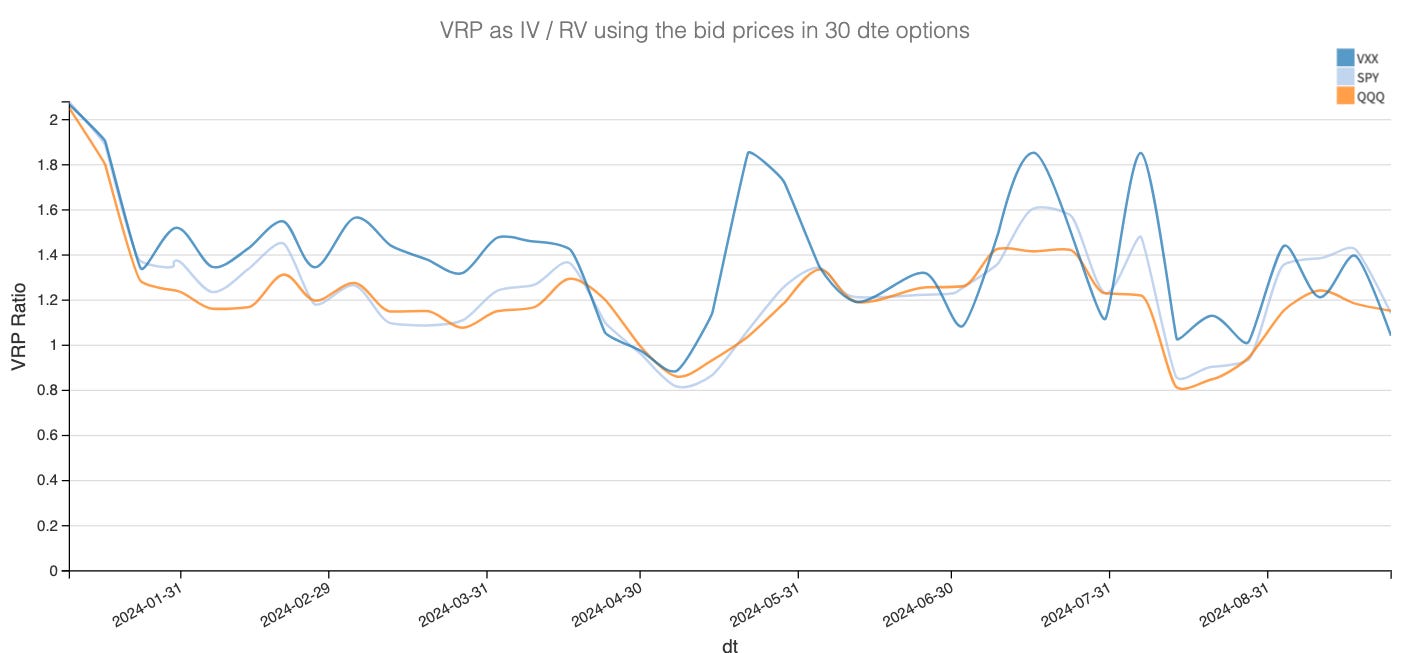

Yes the VIX curve did go up this week, but didn’t exactly flattened. And while the future may be telling a different story (You still have a bit of a backwardation in the future term structure), we’re currently in a neutral volatility regime, and the VRP is still there. Therefore for us, it’s business as usual.

And while we anticipate some spikes in implied volatility, we don’t expect them to be prolonged or extreme. Could we see a return to VIX 25? Possibly. However, for a sustained period of high volatility, we’d need catalysts beyond what we already know—like a full-scale war in the Middle East, a more significant economic slowdown, or a major shift in the presidential election race.

Buying hedges and insurance is a normal part of managing significant assets. The key for insurance sellers is to assess whether the premium justifies the risk. And right now, for many asset classes, the variance risk premium is there. So breathe in … breathe out.

In other news

What’s happening at OpenAI? We were quite shocked to learn about the abrupt (voluntary) departure of Mira Murati from the company. She’ll be off to explore her own ventures, and we have no doubt she’ll be back in the spotlight soon. During her tenure, OpenAI released several key iterations of their GPT models, notably the 4.0 (or Raspberry), which, despite being a bit verbose (pro tip: include in your prompt not to be so detailed or to answer like GPT-4.0), is truly impressive in reasoning.

This still begs the question of what’s happening behind the scenes at the company. We also learned, not without a smirk, that King Sam had awarded himself 7% of the company after candidly telling senators he wasn’t interested in making a dime from it. As we say in France, ‘Only fools never change their mind.’

Thank you for staying with us until the end. As usual, here are a few interesting reads from last week:

Yes, the Fed has started a cutting cycle, and we’ve seen suggestions everywhere to dump your dollars and pile into other currencies or asset classes. But is it really time? Here’s an interesting take from AlphaPicks .

Bye Bye, Professor McGonagall. Like many millennials, we spent hours reading the adventures of Harry Potter, and of all the faces that brought the characters to life on screen, Maggie Smith was the best. Little did we know about the life of that talented artist, perfectly narrated in this obituary from the FT.

That’s it for us. We wish you a wonderful week ahead and happy trading!

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.