Forward Note - 2024/08/18

A blink of an eye

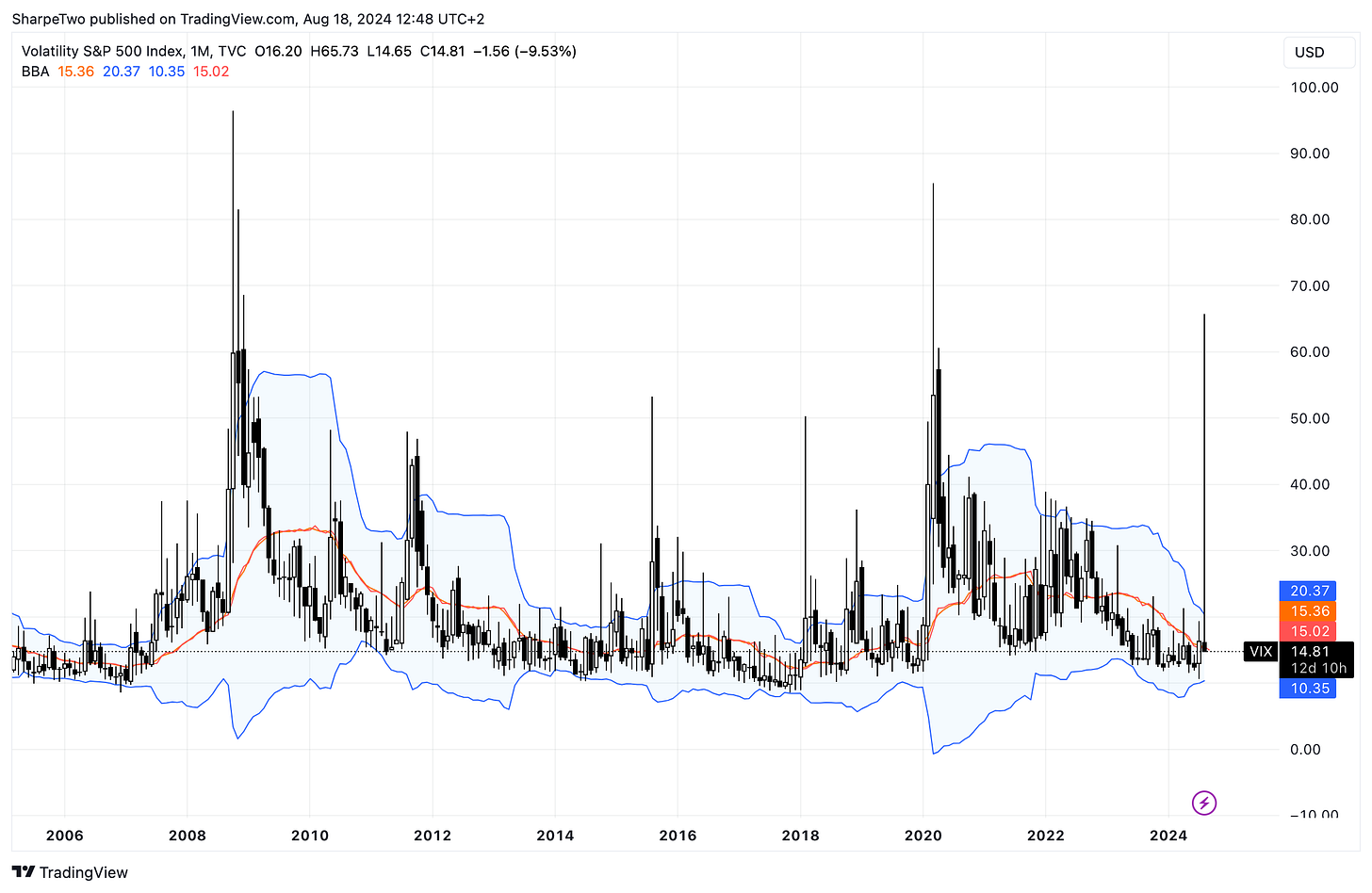

14 - 3 - 65 - 9 - 14

These aren't the numbers of a winning lottery ticket, though depending on how you navigated that sequence, they could very well represent a make-or-break moment for your yearly P&L.

In just three sessions, volatility spiked from 16 to 65. Then, it took only nine sessions to drop back down to 15. We had barely issued a volatility warning two weeks ago while enjoying the sunny coastline of France when all the agitation dissipated—vanishing like a nightmare as soon as you open your eyes.

Volatility spikes are a known feature of the markets—an essential part of the game. Since 2008, the chart above shows at least five significant surges above the 50 threshold on the VIX. What we hadn't seen before, however, was the speed of this mean reversion. In the past, it took weeks or even months for the market to calm down and revert to a normal state. This time, it took just nine days.

We're not alone in being baffled by the extremes of these moves—first and foremost, on the way up, as recession fears resurfaced and accelerated the equity repricing that began early in July.

Yet, as quickly as recession fears surfaced, they were sidelined. Strong retail sales data on Thursday highlighted robust consumer spending, which was further reinforced by better-than-expected consumer confidence figures on Friday. Additionally, the job data for the second week in a row exceeded expectations, suggesting that the earlier concerns sparked by the Sahm rule and the latest NFP report were likely overblown.

Couple that with encouraging inflation numbers, now back under 3%, which bolstered the likelihood of a rate cut in September, and you had the perfect recipe for a VIX crush and a rally in the equity markets.

However, it's premature to conclude that the markets have fully stabilized and that we’re in for smooth sailing between now and the election.

Firstly, when examining the current VIX term structure and the recent market movements, it’s evident that we’re in a neutral volatility regime—not a low-volatility one, like what characterized much of the first half of the year.

Could we return to a low-volatility regime in a few weeks? It’s possible, but we believe it’s unlikely. The calendar ahead is packed, and things are set to accelerate with Jackson Hole, the NVDA report, and, more importantly, increased scrutiny on macroeconomic data. Given the sharp reactions we've seen to the most recent economic releases, it’s reasonable to expect that any slight disappointment—or worse, data hinting at a potential recession in the U.S. economy—could easily spark another wave of volatility.

It's tempting to embrace the calm and relief from last week and assume it will be the new norm. However, if we delve deeper into the data, last week's realized volatility over seven days in the SP500 remains significantly higher than what we've seen throughout 2024.

With that in mind, it’s crucial to hedge your directional bets or, at the very least, be mindful of their size.

At this stage, this is the best course of action: unless you possess some extraordinary skills to decipher—or better yet, forecast—the actual state of the economy over the next 90 days, you have to accept that this will be the new market narrative for the coming months, driving the market’s ebbs and flows. Just as a year ago, the focus was entirely on inflation; the new narrative may very well center on the potential for a recession.

You should also exercise caution when considering selling volatility at any price. Pure market mechanics show that the current level of implied volatility is well below the most recent realized volatility. In simpler terms, the variance risk premium in equities is … negative.

We’ve always been skeptical about long volatility trades—it’s much harder to time a spike and profit from it. However, this situation at least encourages a more cautious approach, prompting us to be more selective about the asset classes and opportunities we consider.

And that’s for the better: as extreme as the latest spike and subsequent crush were, they are a stark reminder of the dangers inherent in active volatility trading. All it takes is a blink of an eye to get wiped out.

In other news

Remember the major tech outage from last July? While it may now be behind us, the cyber insurance sector is the clear winner in its aftermath. According to a recent report from the Financial Times, this sector has been growing steadily, with projections showing it will collect around $25 billion in premiums by 2025—a threefold increase from 2020. Cyber insurance is not for the faint of heart, given the difficulty in quantifying risks beforehand. However, the rewards can be substantial. The same article reveals that Beazley’s cyber division retains about 31% of its premiums, which is 8 points higher than the group average.

Thank you for staying with us until the end. As usual, here are a few interesting reads from last week:

With the election drawing nearer, the campaign has significantly intensified recently. As the fight against inflation seems to be winding down, Quoth the Raven argues that the measures proposed by the Democratic Party could do more harm than good to the economy.

Investing is often about making sound decisions, but it's easy to second-guess ourselves. When it comes time to pull the trigger, we sometimes mimic what our neighbor did. Sound familiar? AlphaPicks offers some tips to avoid the herd mentality.

That’s it from us. We wish you a wonderful week ahead and happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.

Appreciate the feature 🙌