Forward Note - 2024/08/04

Recession

If you are a new reader of Sharpe Two, I’d rather warn you now: we suck. Here is an extract of our Forward Note from two weeks ago.

Yep—calling for no VIX above 30 and seeing at 29 on Friday made us laugh: You always get punished by the market Gods for making dubious calls like that. Predicting volatility spikes is as challenging as predicting an earthquake, and this serves as a good reminder that variance can hit at any time.

So what happened this Friday to trigger a 10-point volatility spike in a couple of hours and VVIX's move from 110 to 150?

The week started with Microsoft losing up to 8% post-market on Tuesday after missing cloud revenue expectations, heightening fears about the AI sector.

Then, a few alarming headlines from the Middle East added to the tension in the order books.

By Wednesday's close, though, things seemed to settle. Following a dovish FOMC meeting where Chairman Jay Powell confirmed a potential rate cut for September, a relief rally spread across the market. The Nasdaq was up over 3%, and NVDA closed nearly 15% higher in one day.

At that point, many of us thought we were back on a smooth ride until the election. But we were wrong. The disappointing ISM manufacturing report for July signaled an accelerating economic contraction, bringing the word "recession" back into market conversations.

The final blow came with Friday morning's job report. Initially, it didn’t look too bad: 110k jobs were created in July. But the worrying part was the unemployment rate, which came in at 4.3%. You might think this is still historically low, and you'd be right.

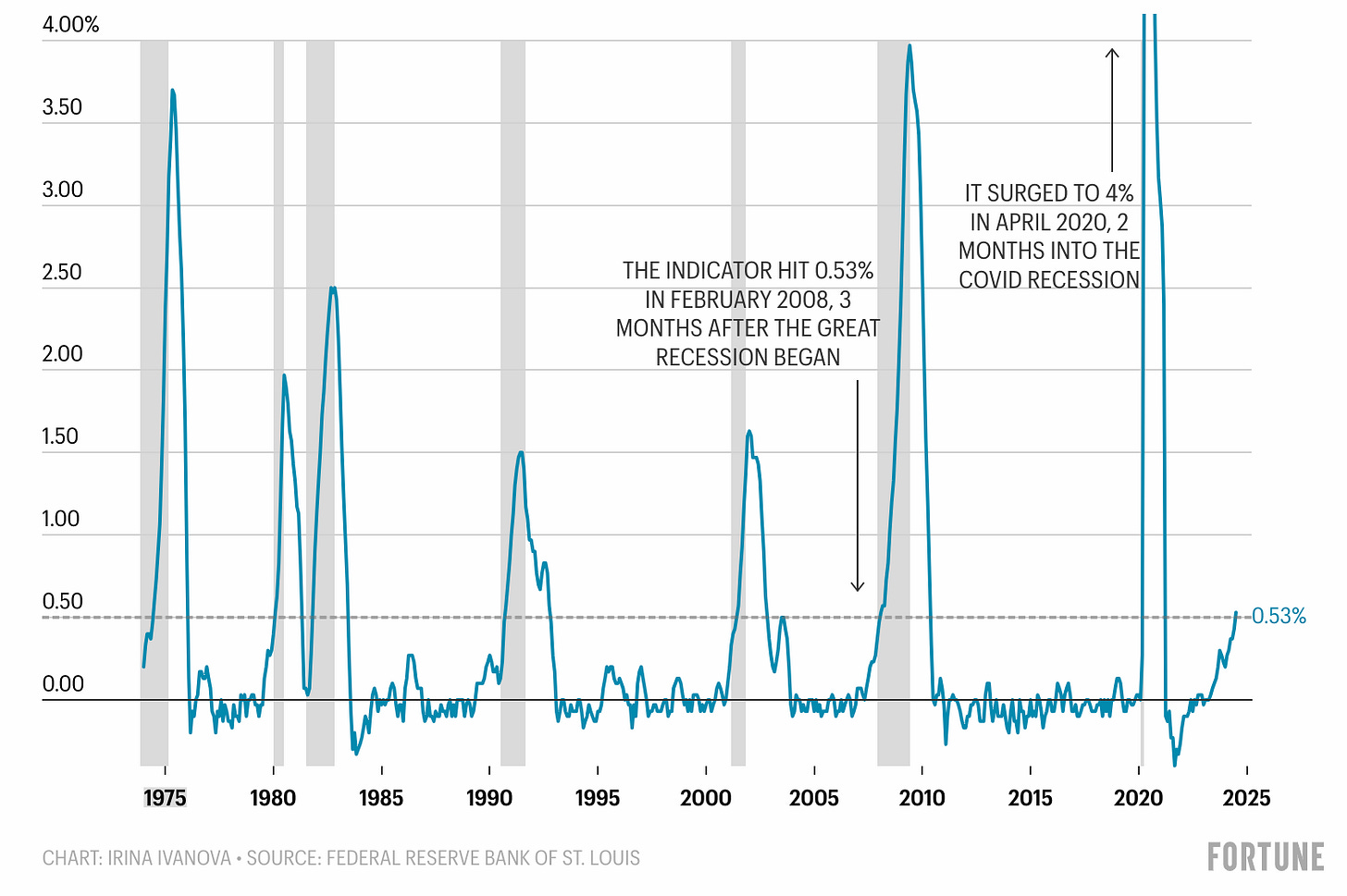

The concerns stemmed from the iconic Sahm rule, which states that the economy is already in a recession if the unemployment rate is above the average of the past three months by half a percentage point. And guess where the average is? 3.8%.

Even though Claudia Sahm explained why the rule might not apply this time, it was enough to spark concerns about the economy's actual state, trigger more selling pressure, and prompt a rush toward hedges.

Okay. But a VIX spike to 29, really? By the close, the market had calmed a bit, and the index closed at 23.63 —well below the session highs but now firmly in a neutral volatility regime.

To our merit, we suck, but we’ve also warned you it was very unlikely that volatility would come down to the lowest level and get used to this regime.

So what’s next? Expect plenty of macro commentary (and victory laps for those calling it out since September 2022); every economic data point will be scrutinized, causing significant whipsaws.

A neutral volatility regime means we must review and check our directional exposure. Big swings up and down happen more frequently in this market, adding unnecessary stress to a portfolio. As the chart above shows, the relative level of volatility observed this week was more than the average but still far from being an outlier. The market can swing much more to finish the week at -2%. If you day trade directionally, be cautious.

Shorting implied volatility in anticipation of a reversion to normal can be tempting. However, the current backwardation signals otherwise: the market will be tense for a while. Until there's clarity on the economy and confirmation that the spike is behind us, shorting with all your size is a sure way to endanger your capital.

As long as you check direction and volatility exposures, staying on the sidelines and observing is perfectly fine. For months, we've said, “Trade the regime you are in, not the one you will potentially be in.” That maxim holds whether the VIX is at 12 or 23. You risk blowing up on the next spike if you enter too strong and too soon. Not taking any trade isn’t the solution either—there will be plenty of asset classes where the variance risk premium will present much better risk-reward ratios; that is where your focus should be.

In other news

We’ve been readers of Claudia Sahm for a few years now: her macro commentary is often straightforward, less pessimistic, and fiercely data-driven. So when she wrote a few weeks ago that this time might be different, we paid attention.

Sure, the Sahm Rule indicates that the economy may be in recession because the current unemployment rate is higher than the 3-month moving average. However, household income is still growing, and consumer spending and business investment remain resilient. Obviously, these are lagging indicators, and we will have to monitor the next batches of data carefully.

In a macro world where participants are often driven by the desire to be right, it is refreshing to find an economist willing to argue against her own rule and stick to the facts in front of us.

Thank you for staying with us until the end. Here are a few good reads from last week:

While we are discussing Claudia Sahm, check out her latest article, where she explains why the Fed should cut rates sooner rather than later. Spoiler alert: she delves into unemployment quite a bit.

We haven’t published new research in a while but received many inquiries about this article. Note that this trade has performed extremely well, but VVIX was not flirting with 150 then. Stay safe.

Thank you for reading to the end. We wish you an excellent week ahead and happy trading.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.