Forward Note - 20240714

Bringing back some perspective.

What exactly happened on Thursday?

The Nasdaq experienced a significant drop of over 2% on Thursday, breaking a nearly three-month streak without such a move since the peak of tensions between Israel and Iran. To put this in perspective, it's only the sixth time in the past 12 months that we've seen a drop of more than 2%—a mere 2.4% of all trading days.

This unusual streak has been a hot topic on social media, with many arguing that it indicates an impending market explosion. However, we prefer to stay grounded and rely on data.

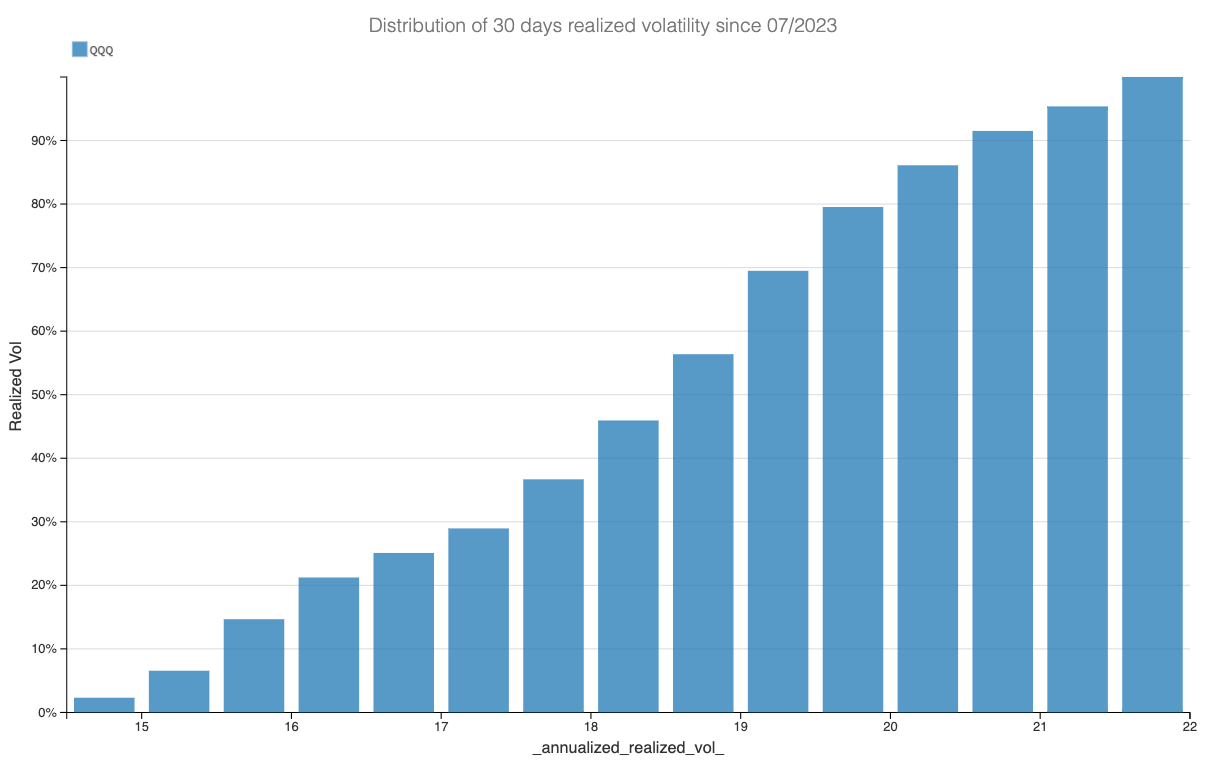

Assuming stock market returns follow a normal distribution (a widely accepted, albeit imperfect, notion), we can calculate the probability of a 2% move on any given day using the average realized volatility in QQQ. The chart below shows that the average and median annualized realized volatility hover around 18.5%.

Assuming there are 252 trading days in a year (although one could argue there are effectively 241 trading days when holidays are excluded), that average annualized volatility of 18% translates to approximately 1.13% daily volatility. This figure is crucial because, under our assumption, about 66% of daily moves should fall within this range. Using the standard normal distribution, we can calculate that the probability of a 2% down move is around 3.89%.

Some might point out that this estimate has a significant error margin (about 50% between the actual and expected values). Fair enough—this discrepancy suggests we should have seen three more down moves over the past 12 months.

Another way to look at this is by recognizing that equations can't perfectly explain markets. Things appear more aligned with expectations when factoring in assumption errors (for instance, considering the solid positive drift in the QQQ this year). While the low realized volatility context might be frustrating, the numbers we see are perfectly justified.

Using the same reasoning, let's examine the "amazing" streak of 352 trading days without a move of more than 2% in the SP500. With an average annualized realized volatility of about 13.5%, the daily probability of not seeing a 2% move down is 99%. Assuming daily returns are independent, the probability of not seeing a 2% move down over 352 trading days (since February 2023) is about 3.6%.

Does that seem very small? When put into perspective (something we humans often struggle with), it is still higher than hitting your number at the casino (about 1 out of 49 or roughly 2%). The event's rarity shouldn’t make it suspicious, as if everything were automatically staged.

Great, but what exactly happened on Thursday? Well, once again, there are multiple ways of looking at it.

The most common explanation is that the soft CPI increased the likelihood of a rate cut in September. This triggered a significant rotation from tech into small and mid-caps, more impacted by tight monetary conditions. A rate cut would be a breath of fresh air for these sectors for their balance sheets. Could this movement continue? Potentially. It's early to tell, but it's something to watch as we approach the next FOMC meeting and the Jackson Hole Symposium in August, where the market will look for clues about that September rate cut.

Another perspective is to look at implied volatility. That 2% drop in the Nasdaq certainly didn’t trigger a reaction in the options market, with the VIX closing the week down at 12.46.

Does this mean we can’t see another 10% drop while IWM keeps rising? Absolutely not. However, if the market isn’t buying protection against the downside, why should you? You could argue that the market is wrong and has a very poor understanding of macro risk, and with this earnings season and everything priced for perfection, this time, it is different.

And maybe you will be correct. But let’s finish with some perspective: there was only one Michael Burry in 2005, and even he has sounded like a broken record lately.

In other news

The terrible news this morning, as we finish this note, is the assassination attempt on former President Trump. As usual, we will refrain from political commentary, simply reiterating that violence is never the solution.

Now, the big question is how the markets will react. Our guess—nothing much. He survived, which will certainly not deter him from continuing his campaign—quite the opposite. One can argue that after such a dramatic incident, his odds of winning have seriously improved almost overnight, and it will be interesting to keep an eye on the polls in the next week or so.

Remember that the market under Trump did exceptionally well, and despite all the fears around his character, four years of his presidency did not plunge the world into a nuclear war. Once again, one can argue that this time, it is different, but as usual with the market, the burden of proof will be on the accusation. Until proven otherwise, his relatively smooth track record as president should play a big role in how markets react in the next few weeks.

Thank you for staying with us until the end, and as usual, here are a few good reads from last week:

While significant spending is being made on AI, its economic benefits and long-term return on investment remain uncertain. Experts are mixed in their skepticism and optimism regarding AI's future impact on productivity, economic growth, and corporate profitability. This report by Goldman Sachs provides some perspective.

Sharpe Two is now on the sunny Azure Coast for the summer, but we truly enjoyed our time in Mexico this year. Despite being a country of 128 million people, here is an excellent article by Tomas Pueyo of why 80% of it is empty.

That’s it for us—we wish you an excellent week ahead, especially if you are on holiday. Happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.