Forward Note - 2024/06/30

What happen in H2 when you take 15% in H1?

This is officially the end of Q2, and despite high expectations of closing at an all-time high, the markets didn't deliver (for once) and closed broadly flat: the SPY and the QQQ lost 0.05%, while IWM was up about 1.25%.

That being said, half the year is done, and as we head into the summer, we are already up a whopping 15% for the SP500 and almost 20% in the Nasdaq. Does that seem like a lot? Maybe even too much? We checked what has happened over the last ten years.

What’s interesting about this chart is that since 2017, we have managed to have one key index above 15% at the halfway mark five times. This is quite impressive, considering that 2020 and 2022 were crisis years, along with the Volmaggedon event in 2018. You could almost conclude that if no major market event shakes things up, the likelihood of printing 10%+ at the end of the first semester is pretty high. This is yet another sign that stocks tend to go up, and despite the temptation to be smarter than the rest and call the tops, the better position might be to stay long and forget about it.

Interestingly, when we reached 15% at the halfway mark, only the IWM in 2021 posted a negative performance in H2 of -3%. Even more intriguing is that this performance was consistently about half of what we delivered the previous semester.

Once again, at Sharpe Two, we like to maintain a neutral view of the market and focus on volatility. However, one can’t completely ignore these statistics, particularly when the VIX has been this low for an extended period.

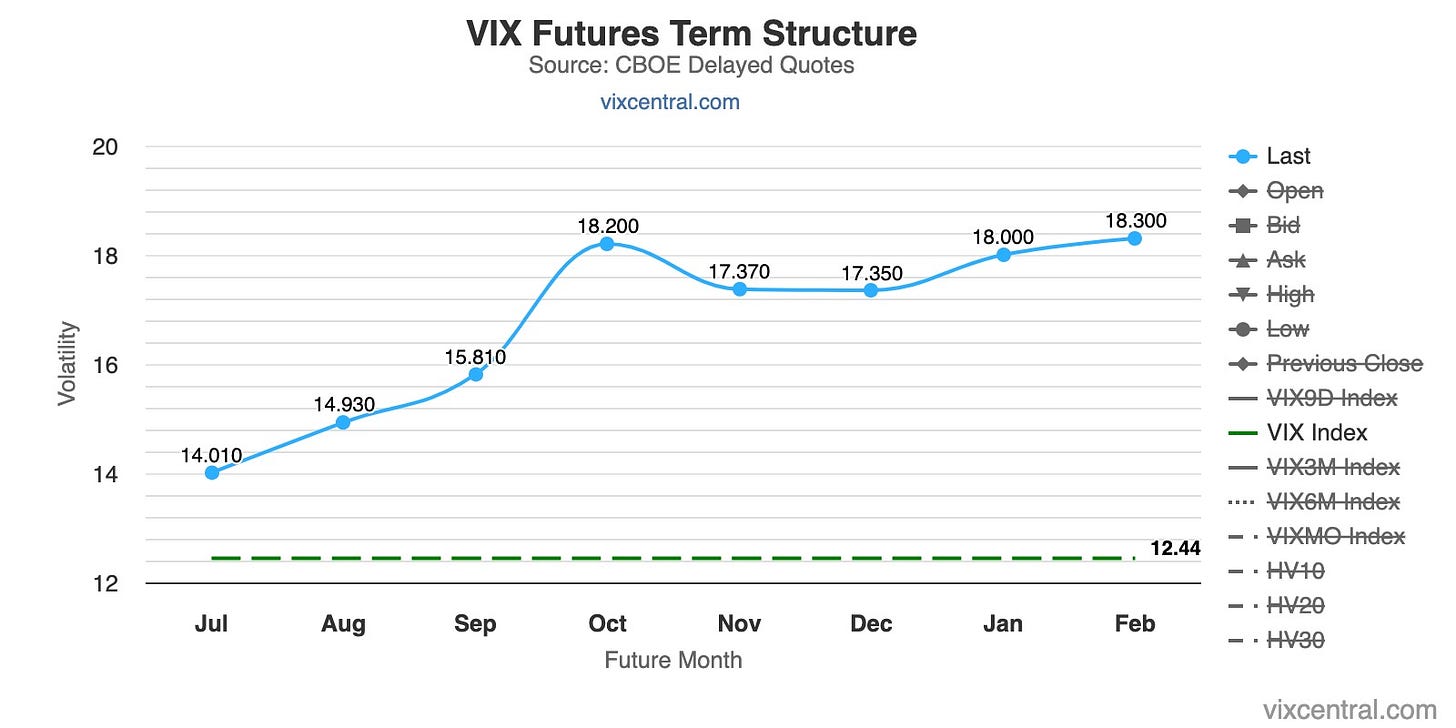

With yet another close below the 13 handle at 12.44 and despite being a couple of handles away from the all-time lows (almost a surprise, to be honest), we have been in a low volatility regime for more than 50% of the past 12 months, and it is unlikely to shift fundamentally during the summer.

Is this normal? That's not really for us to say. But as we’ve mentioned multiple times, volatility tends to exhibit three distinct regimes:

One where it’s relatively low and giggles around its long-term average.

One where it’s spiking up to what can seem like infinity.

One where it comes back down.

The last two regimes, particularly the second, are the most exciting. But they are rare and often come out of nowhere, and trying to time them is a foolish game.

Since 2006, we’ve spent over two-thirds of the time in a neutral or low volatility regime. Therefore, when we step back, the last 12 months aren’t particularly calmer than usual. And to be honest, we gladly trade the fun and excitement of going through a great historical moment (just read some of the articles during COVID describing the new world ahead of us - they are quite funny in retrospect) for the calm and boring of a PnL slowly going up.

The second part of the year is packed with some interesting economic developments: will the Fed finally cut the rates? Will the US economy continue to slow down and potentially enter a recession? The GDP this week came in line with expectations at 1.4%, while the latest PCE number came in at 2.6%. Yes, the growth is not as strong as it was six months ago, but inflation is substantially lower, and there are no major obvious signs that things will blow up on the economic front.

Finally, the main event will be the US presidential election, but even that isn’t deterring market participants much.

We’ve seen much scarier bumps in the future term structure. Although remarkable, the premium in October compared to September is only 1.5 vol above 16.8—the value we could infer in the term structure (with a normal linear interpolation) had there been no election.

It may be early to conclude that the market isn’t too concerned about the election either. However, it is something to remember as we get deeper into the summer and the noise-to-signal ratio increases: right now, the VIX futures for October are not even above 20, the key psychological level for most participants.

So, is everything good in the best of worlds? We wouldn’t want to become complacent and will stay vigilant to any development this summer. That said, the market gives a very low probability of any major event happening in the next few weeks/months; you can bet against that view, but you are essentially backing a weak underdog.

As far as we are concerned, we will stick to our favorite mantra, and if you had to take only one thing from this publication, let it be this: trade the regime you are in, not the regime you will potentially be in. It’s been working well so far.

In other news

We usually distance ourselves from politics, but it is hard not to mention what happened this week in the presidential race: Joe Biden had an extremely difficult moment against his opponent, Trump, during the first presidential debate. While he admitted that he wasn’t debating as well as he did in the past, the front-page news of the Wall Street Journal on Friday was clear—will the Democrats try to replace him before the ballot?

If Trump believes that isn’t the case and that Biden will still be his opponent in five months, many observers aren’t certain. Does that matter to us traders? It does a little bit. We suspect the market isn’t concerned about Biden or Trump being president … again. You may like or hate them; they have experience in the job and do not present a substantial risk when it comes to economic policies. However, should a new candidate enter the ballot with a view radically different from what’s been presented so far and with significant chances to win, the aforementioned election risks may start to be priced differently.

Thank you for staying with us until the end. As usual, here are a couple of interesting reads from the past week:

Does Being President Actually Matter? This provocative piece from BowTied Bull helps refocus on what really matters: yourself.

Predicting Trends and Prices: It isn’t easy, but that doesn’t mean it's impossible. In this piece, Samuel Brodsky, CMT applies techniques from the book Advances in financial Machine Learning to outperform the buy-and-hold strategy.

That’s it for us. We wish you an excellent week ahead. And if you are French, go vote—it does matter.

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.