Forward Note - 2024/04/14

Back to school.

Here we are—a regime change.

This week ended on a tense note as a flight from risk to quality shook the market throughout Friday. The main focus was on reports of Iran preparing a retaliation against Israel after it targeted an embassy in Syria, killing several high-ranking military officials.

The S&P 500 ended the week down 1.5%, while the Nasdaq retreated by half a percent. However, the VIX closed above 17 for the first time since November 2023, and the VVIX ventured into the 110 territories before retreating and finishing the session at 103. Even though we've seen much more panicky situations in the markets before, the mood heading into the weekend was apprehensive, to say the least.

Iranian authorities claimed on Friday evening that their response would be calibrated to avoid escalating the conflict. On Saturday morning, we learned they had captured a vessel in the Strait of Hormuz, and we thought the worst might still be avoided.

However, as we write these lines, some drones are en route to Israel, and the situation is growing cloudier by the minute.

This is a lot of geopolitical commentary for a trading publication, probably the most we've ever written. Are we overthinking this, like most market commentators? Will everything return to normal as quickly as possible?

That's all we wish for: the best we can do is stay calm and rational while waiting for more (peaceful) information.

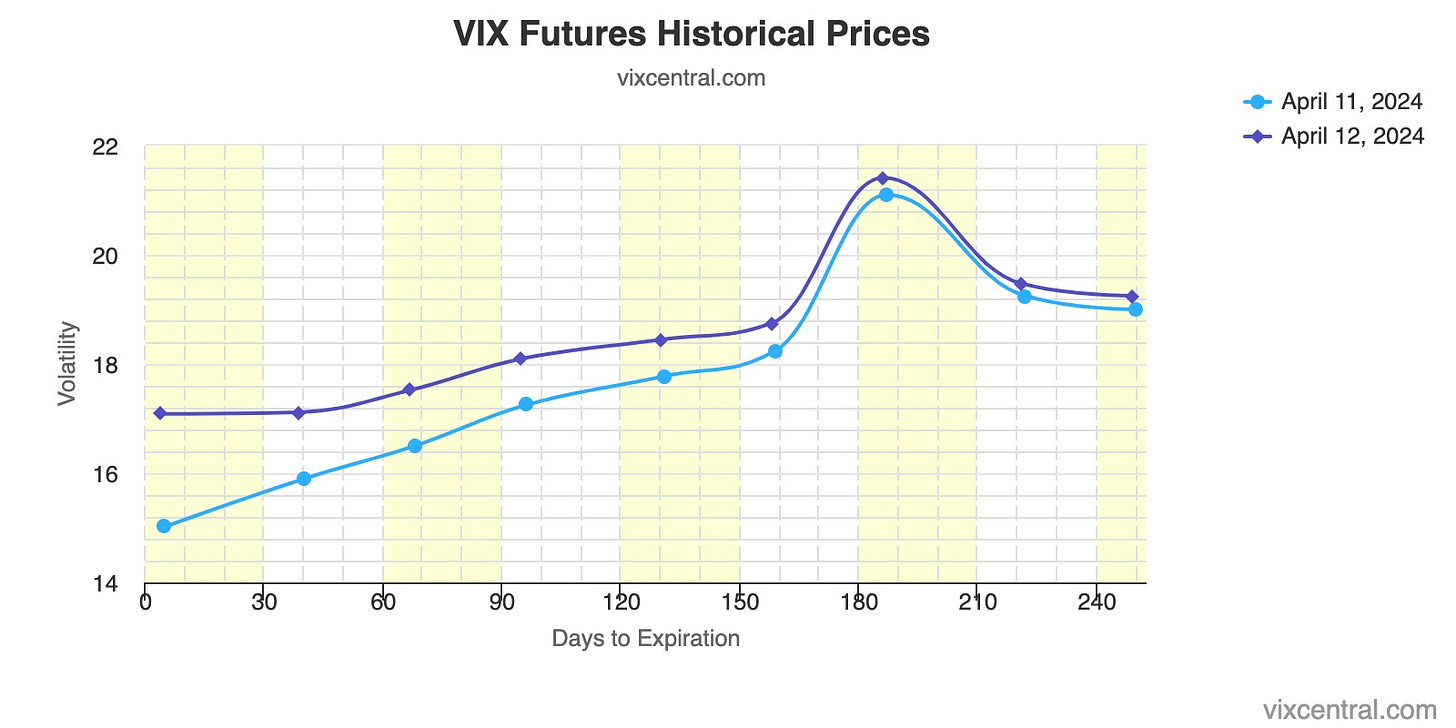

So, let's return to the VIX—we went from 13 to above 17 in two weeks, and our models switched from a long-term low volatility regime to a more neutral stance.

The move was rapid, and after six months of euphoria, the sudden change in tone must have been a shock for some. While a reading of 17 is still very manageable in the grand scheme of things, if the geopolitical climate continues to deteriorate, that 17 could become 35 in a matter of days, as it did at the onset of the war in Ukraine in February 2022.

That being said, we'll stick to our mantra: "Trade the regime you're in, not the one you might be in." Of course, one has to monitor the developments in the Middle East before putting any positions on. However, trading as if a nuclear conflict is already a given may be presumptuous.

The regime says you should be neutral and nothing more. As we shared on Discord on Friday, it's probably best to be delta-neutral in the next few days until there's more clarity on the latest developments. However, being short seems reckless and leaves the door open to massive relief swings if the situation improves.

Now, the tough question—should one short volatility at this level? We'll take a risk because that's what trading is all about: yes, but certainly not like a degenerate gambler.

The biggest risk for volatility traders is when volatility spikes, and even though we're still in contango, the VIX futures term structure flattened and got higher at a pace that deserves some attention.

Shorting too soon and aggressively can only end in disaster if the markets decide to take another leg down as the situation deteriorates. Being neutral means being prudent, not oblivious to the situation, or assuming that the newswire is crying wolf once more and that everything will be settled in a week.

This is especially true because geopolitics isn't the only market mover: interest rate cuts are still a significant driver, as proven by the rapid decline observed on Wednesday after data showed that inflation was still above 3.5% and had deviated from its steady decline trajectory observed over the past year.

As the earnings season has just started, the sudden change in mood could be far less forgiving and bring back some scrutiny on how resilient some of these corporations would be if rates were to stay higher for longer.

All that to say, risks are back on the table; the holidays are over, and it is time to go back to school.

In other news

This week also marked the start of the Q1 2024 earnings season. The least we can say is that considering how JPM was punished after its poor guidance on earnings from an interest in 2024, investors could be much tougher on regional banks than in the last cycle.

From JPM's struggles to the resurgence of a potential bank crisis, there was only one step, which the market took in no time. While KRE, the ETF tracking the regional banking sector, was down only 0.9% on Friday, it closed at 46.52, almost 15% below its January 29 mark.

As usual, we'll refrain from commenting on the direction but reiterate our stance on being more neutral. We went from expecting seven rate cuts in 2024 to possibly none. This will certainly have some consequences for weaker balance sheets in the banking index.

Thank you for staying with us until the end. As usual, you'll find a couple of interesting (and more entertaining) reads than what was available this weekend on every newswire:

This week, StreetSmarts addressed an interesting question for every sports fan: Is owning a sports team profitable?

We love a good Italian story (we're French). So when it includes a bank and how it got taken offline because of its own maintenance system, we couldn't resist pouring a mega pint of coffee and reading the detailed report from The Pragmatic Engineer about the outage.

This week at Sharpe Two, we presented some results on how overnight volatility in 0 DTEs was often overpriced when demand was higher than usual. This seems timely, considering the state of the market. You can read more about it here.

That's it for us this week. We wish you a wonderful week ahead and happy (neutral) trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.