Digging into the overnight trade

VVIX or IV regime? Weekend or weekdays?

Since we published our article on how overnight volatility in 1 DTEs was overpriced when the market was rushing for hedges, VVIX has closed above 90 almost consistently.

As a result, we can already tell you this—out of the four opportunities presented to us, 100% were profitable. This piece of research is already a strong contender for our Best Finding award in 2024.

Admittedly, it's a spooky trade. You're expected to sell volatility overnight when markets are agitated, and headlines bring us one step closer to World War 3. What's not uncomfortable about that? It goes without saying that we were a bit on edge over the weekend and throughout Monday.

In situations like these, we have only two recommendations:

Don't read the headlines. Or maybe once a day, at the open or close, and that's it. Every trader understands the importance of protecting their capital at all costs. There's one type of capital we don't discuss much—the emotional/sanity/psychological kind. You have to manage that bankroll with the same ruthlessness as you manage your monetary one. If something pulls you away from staying rational and leads you to make an illogical decision, you should remove it from your setup: news services, social media timelines, charts, and anything that might cause you to deviate from an identified edge.

Go back to the data. Of course, data can lie. It can tell an incomplete story. In the case of this trade, for instance, we may not have encountered the situation that will completely wipe out the gains made from this strategy, rendering it useless. However, we must use the data to understand the exact results we should expect. That's pretty much the goal of this article. We'll dive into greater detail and analyze some statistics to build confidence in the trade and verify that what we observe in this period of heightened volatility aligns with what we've seen in the past.

Let’s get to it.

The Overnight Trade: the thesis

The thesis is fairly simple: fund managers have overnight hedging requirements. They must adhere to certain risk metrics, and 1 DTE option offers a flexible, low-cost tool. These options have the advantage of not fundamentally changing the portfolio, as they expire the next day.

When things get dicey, the demand for these products increases while the supply diminishes. This happens when things get spooky: you desperately want to hedge your risk, but sellers think twice before taking on that risk in their books. As a result, the price of 1 DTE becomes inflated, at least for the overnight period. We used VVIX as an indicator of "fear in the market," as it is a good proxy for the demand for OTM VIX options.

We made an important finding: the average profit grows almost linearly with VVIX.

Therefore, a position in 1 DTE ATM straddles when VVIX is around 90 (slightly above its long-term average, indicating that the market is buying more hedges than usual) leads to this PnL curve.

As a reminder, this assumes an execution at 3:50 PM the day before expiration and an exit at 9:35 AM. The list of tickers only includes assets with dailies (as opposed to weeklies): IWM, SPY, QQQ, GLD, SLV, UNG, USO, and TLT.

VVIX or IV regime? a comparison of two filtering methods

We can easily see the problem with using VVIX as a filter. VVIX is the VIX measure using 30-day forward VIX options. Therefore, it's a great filter for sentiment regarding the equity market. However, there's no guarantee that commodities or bonds will be overpriced when VVIX is high.

This graph clearly illustrates this point. As expected, the strategy works well for equities, but the effect is far less pronounced in USO, TLT, and UNG. We may need to find an alternative approach for these names.

To address this, we're going to switch our filtering method. Instead of using VVIX, we'll use the implied volatility regime for each name. We introduced our volatility regimes a few months back, and you can read more about the methodology here.

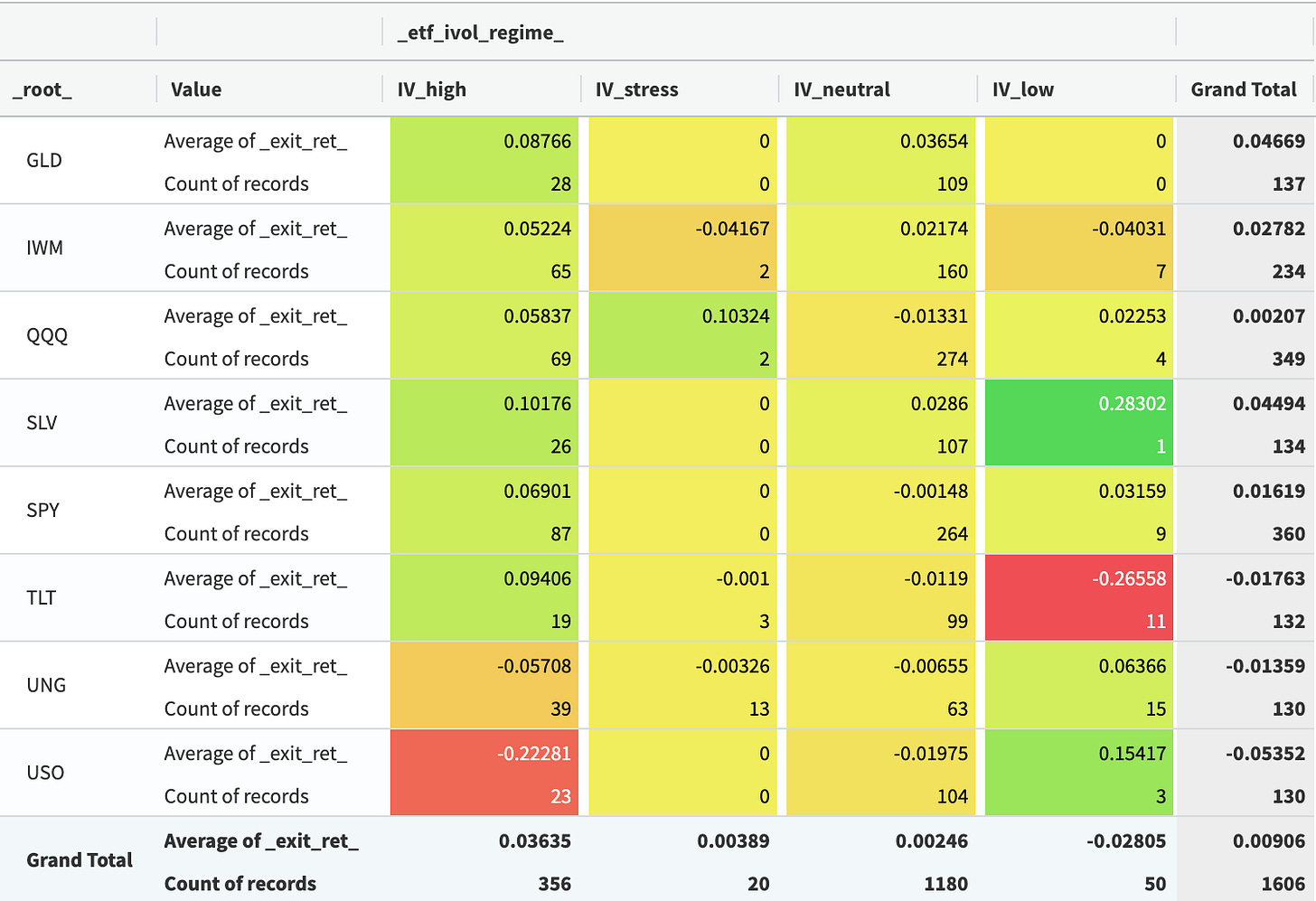

The key takeaway is that five regimes are derived through the price of options on the underlying asset. We use these regimes to build the following matrix.

What's quite apparent here is that a high volatility regime increases profitability for almost all assets except for UNG and USO. A high volatility regime implies ... some cheapness in the overnight volatility for these two names.

We don't have any solid explanations except that UNG and USO trade during US hours, and the main market movers lately have been geopolitical events in the Middle East and Russia, which occur when the US markets are closed.

Let's look at the cumulative returns.

Even though the dataset is still very limited (less than 40 trades since the introduction of dailies), we can see a trend emerging in USO. One could add a bit of long exposure in 1 DTEs when USO experiences heightened volatility or stay far away from the trade altogether.

GLD and SLV don't present great guarantees either when their IV is high.

The performance is slightly increasing, but the results are far less convincing than for equities. This filter seems a solid alternative to VVIX, as the cumulative performance across the three indices is highest in this setup.

Let’s now compare some statistics across the two approaches for the equities.

The number of trades and false positives significantly increases when we lower the threshold for VVIX. VVIX > 100 and the regime filtered on IV_high exhibit similar features, except that the losses tend to be slightly higher when we choose IV_high over VVIX > 100.

There's no definitive answer here. First, remember that the datasets are still relatively small, and we'll need to see if the data holds up in the coming months. Second, each trader will decide which guideline to follow based on their risk profile and tolerance.

What to do over the weekend?

A well-documented effect is the weekend trade, which suggests that volatility over the weekend tends to be overpriced. Euan Sinclair discusses this at length in his excellent book "Positional Option Trading," and we highly recommend our readers read it repeatedly.

We found results similar to his. Taking a trade right before the close on Friday and letting go of the position right at the open on Monday in equities yields this cumulative PnL curve over the past two years.

This has been a very appealing trade over the past two years. In his book, Euan argues it's not worth keeping the trade open over the weekend when VVIX is above 100. Until now, all our results have been presented regardless of the day of the week. However, it might be sensible to avoid keeping a trade open for an extended period over the weekend when there's plenty of time for scary headlines to cause significant market moves at the open on Monday.

Let's look at the performance of our IWM/SPY/QQQ combo by day of the week when VVIX is above 100.

When VVIX is above 100, and the market is experiencing heightened turbulence, it may be best to avoid opening a position over the weekend. However, the difference is far less pronounced when things are reasonably agitated and VVIX is above 90.

In this scenario, taking the overnight trade would have yielded positive results regardless of the day of the week.

In conclusion, overnight volatility in daily contracts is still a relatively new concept, and we'll need more data over time to assess the validity of the trade. However, one can already build some intuition around a few facts:

Trading over the weekend when things are very agitated may not be the best idea.

When there's moderate agitation (VVIX > 90), the overnight trade significantly outperforms periods of calm (VVIX < 90), regardless of the day of the week.

As always, remember to manage your risk carefully and be prepared to adapt your strategy as market conditions change. If you have any questions or would like to discuss this trade further, don't hesitate to reach out.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.